Calculating the Rate, i

Note that due to the placement of ![]() in the PV & FV formulas for ordinary annuities, it is not possible to solve for

in the PV & FV formulas for ordinary annuities, it is not possible to solve for ![]() algebraically. Excel has a function we can use to solve for

algebraically. Excel has a function we can use to solve for ![]() .

.

where:

- Nper is the total number of payment periods in an annuity.

- Pmt is the payment made each period

- If pmt is omitted, you must include the fv argument.

- Pv is the present value

- Fv is the future value,

- If fv is omitted, it is assumed to be 0 and you must include the pmt argument.

- Type is the number 0 or 1 and indicates when payments are due.

- 0 indicates at the end of the period

- 1 indicates at the beginning of the period

- If type is omitted, it is assumed to be 0

Example 1

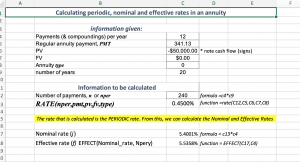

A life insurance company advertises that $50,000 will purchase a 20-year annuity paying $341.13 at the end of each month. What nominal rate of return and effective rate of return does the annuity investment earn? (Source: Jerome & Worswick, 2020, Example 12.3A).

For this example we are given:

- Compounding/payment frequency = 12

- PMT = $341.13

- PV = $50,000

- FV = 0

- Type = 0

- Number of years: 20

We can set up our spreadsheet to calculate the nominal and effective rates.

Try recreating the spreadsheet above on your own.

Click this link to see the completed spreadsheet: Calculating periodic, nominal and effective rates in an annuity – Template

For more information about using the RATE function, see Microsoft Support