1

Students can claim the eligible tuition fees paid to an accredited post-secondary institution in respect of a tax year on their personal tax return to reduce their federal taxes payable in the tax year.

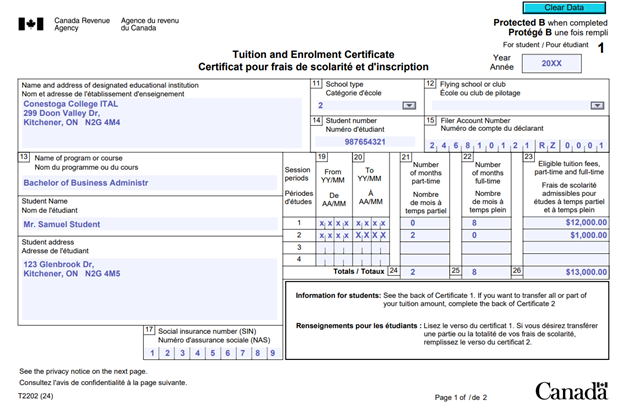

Eligible tuition fees paid and other relevant information is provided to the student on a T2202—Tuition and Enrolment Certificate issued to the student by their educational institution in the first two months of the subsequent tax year. The tax year in Canada corresponds to the calendar year. This information should be reported on the student’s personal tax return in the year in which the tuition amounts are paid in respect of, as noted on the top right corner of the T2202.

Eligible Tuition Fees

Eligible tuition fees are amounts paid by a student in respect of a tax year to an accredited post-secondary institution.

Eligible tuition fees include amounts paid for:

- Admission fees

- Exemption, examination and application fees

- Charges for use of library or other educational facilities

Eligible tuition fees do not include amounts paid for:

- Extracurricular activities

- Medical expenses

- Transportation, parking, board and lodging

Accredited Post-secondary Institution

Accredited post-secondary institutions include:

- Canadian Universities, colleges and certain other educational institutions

- Canadian educational institutions certified by Employment and Social Development Canada (ESDC)

- Certain universities outside of Canada for higher-educational degrees

T2202 — Tuition and Enrolment Certificate

The T2202—Tuition and Enrolment Certificate provides all relevant information required by the student to report and claim the tuition tax credit on their income tax return, including:

- The name of the post-secondary educational institution

- Box 24: Total part-time months of enrolment during the tax year

- Box 25: Total full-time months of enrolment during the tax year

- Box 26: Total eligible tuition fees paid in respect of the tax year

Figure 1 shows a typical T2202—Tuition and Enrolment Certificate issued to a student at Conestoga College.

Source: T2202—Tuition and Enrolment Certificate from the Canada Revenue Agency. Reproduced with permission of the Minister of National Revenue, 2025. All changes are the sole responsibility of the author.