8.4 What are the ‘change in use’ rules? What are the tax implications?

Mariah Cawkell

The change in use rules are used when a property was originally purchased to generate income but is then used for some other reason or vice versa (i.e. from business/property to personal use or personal use to business/property use). ITA 45(1) says that for tax purposes, if a change in the use of property occurs, it is assumed the property is disposed of at fair market value (FMV), then immediately re-purchased at this same FMV. Any capital gains (losses) must be recorded in the year of the change in use. Some of the common changes in use (and their tax implications) are stated below.

Business Use to Personal Use

If the change in use is from business to personal use, proceeds from the deemed disposition of the asset will be equal to its FMV. This same FMV will also be equal to the assets re-acquisition capital cost for personal use. Any capital gains (losses), recapture, or terminal loss shall be recorded as normal. ITA 45(1)

Personal Use to Business Use

If the cost of the asset > FMV:

This is treated similarly to Business to Personal Use. According to ITA 45(1), the asset’s proceeds from the disposition and the capital cost of reacquisition will be equal to the asset’s FMV.

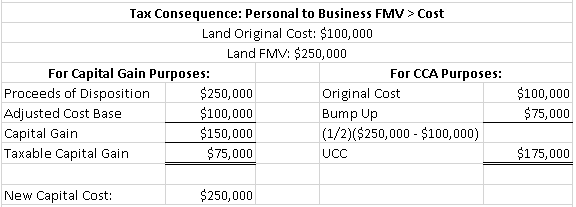

If the FMV > cost of the asset:

Proceeds from the deemed disposition will be equal to the FMV of the asset. The capital cost of the asset will also be equal to FMV when determining capital gain on the deemed disposition. However, ITA 13(7)(b) states that when calculating CCA, the UCC balance of the re-acquired asset will be equal to its original cost + ½ of the difference between its cost and the proceeds from the disposition (FMV). This calculation is to stop 100% of the capital gain from getting deducted as CCA. I.e. you are only taxed on the 50% taxable portion of the capital gain but – without this rule – you would be able to deduct 100% of the increased value as CCA over the life of the asset.

Principal Residence to Rental Property

This should be treated the same as Personal Use to Business Use. Deemed disposition at FMV and re-acquired at FMV. However, the taxpayer can elect that they have not changed the use of their principal residence to a rental property and therefore do not have to record any capital gains on the property for up to 4 years (and this can be extended further if certain criteria are met). If they elect to do this, they cannot claim any CCA on the property during this time. The rules regarding this election are explained in more detail in this document “Changing All your Principal Residence to a Rental or Business Property”.

Rental Property to Principal Residence

A deemed disposition at FMV may trigger capital gains, recapture, and terminal losses. However, ITA 45(3) states the taxpayer can elect out of this disposition as long as they have not taken any CCA on the property since 1984. If this election is made, the taxpayer can assign this property as their principal residence up to 4 years in advance, meaning they are not required to report any capital gains when the change in use occurs. See “Changing All your Rental or Business Property to a Principal Residence”.

Interactive Content

Author: Zaynab Rashid, January 2020

Interactive Content

Author: Elezer Joseph, January 2020

Interactive Content

Author: Taylor Chow, January 2020

Interactive Content

Author: Chris Rush, January 2020

References and Resources

- Income Tax Act, RSC 1985, c1, (5th Supp.) s 45(1)

- Article – “Changing all your rental or business property to a principal residence” (Author: Government of Canada)

Image Description

Tax Consequence: Personal to Business FMV > Cost: A spreadsheet titled “Tax Consequence: Personal to Business FMV > Cost” with details on land’s tax implications. The land’s original cost is $100,000, and the land FMV is $250,000. The table is divided into two sections: “For Capital Gain Purposes” and “For CCA Purposes.”

- For Capital Gain Purposes:

- Proceeds of Disposition: $250,000

- Adjusted Cost Base: $100,000

- Capital Gain: $150,000

- Taxable Capital Gain: $75,000

- For CCA Purposes:

- Original Cost: $100,000

- Bump Up: $75,000

- (1/2)($250,000 – $100,000): $75,000

- UCC: $175,000

The new capital cost is $250,000.

“What are the ‘change in use’ rules? What are the tax implications?” from Intermediate Canadian Tax Copyright © 2021 by Mariah Cawkell is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.