2.7 How does the CRA assess residency?

Amrick Sidhu and Manisha Soorah

Residents of Canada are divided into three main categories: part-year residents, ordinary residents and deemed residents. We’ll address ordinary and deemed residents now (part-year residents will be addressed later in the textbook). Both ordinary residents and deemed residents are taxable in Canada on their worldwide income. Ordinary residents are assessed based on their Primary/Significant and Secondary residential ties in Canada, with more emphasis being placed on the Primary/Significant residential factors.

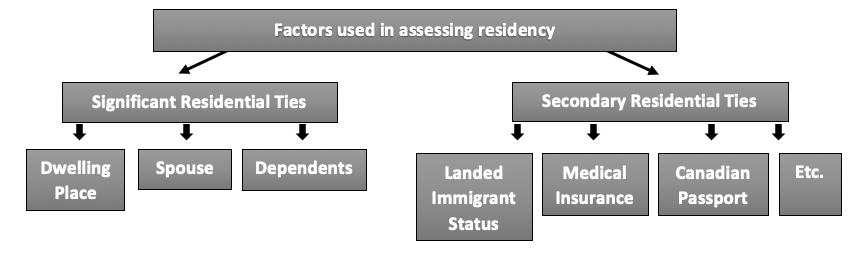

Primary/Significant residential ties include whether a dwelling place is available for an individual to use in Canada, and the location of that individual’s spouse and dependents.

There are lots of Secondary residential ties including Landed Immigrant Status, whether an individual has medical insurance, membership in local clubs, citizenship etc. Again, all these factors are considered as a whole – with Significant ties given more ‘weight’ – when assessing residency.

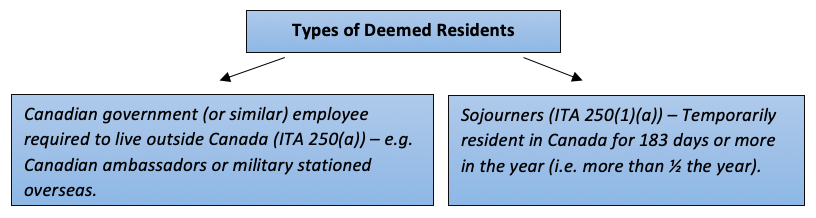

Some individuals are ‘deemed’ to be residents of Canada despite not meeting the requirements for ‘ordinary’ residents. These deemed residents are broken into two basic categories: Individuals required to live outside Canada by virtue or their employment with (or connected to) the Canadian government; and Sojourners, i.e. individuals who are temporarily resident in Canada for 183 days or more in the year.

Interactive Content

Author: Amrick Sidhu, June 2019

Interactive Content

Author: Arminder Sandhu, August 2019

References and Resources

Image Description

- Factors used in assessing residency: Factors used in assessing residency are significant factors like dwelling place, spouse and dependents, and secondary factors like landed immigrant status, medical insurances and memberships, medical insurance etc. [Return to Factors used in assessing residency]

- Types of deemed residents: A flowchart titled “Types of Deemed Residents” at the top. It has two branches. The left branch reads: “Canadian government (or similar) employee required to live outside Canada (ITA 250(a)) – e.g., Canadian ambassadors or military stationed overseas.” The right branch reads: “Sojourners (ITA 250(1)(a)) – Temporarily resident in Canada for 183 days or more in the year (i.e., more than ½ the year).” Each branch is represented with a connecting arrow from the main “Types of Deemed Residents” box at the top. [Return to Types of deemed residents]

“How does the CRA assess residency?” from Introductory Canadian Tax Copyright © 2021 by Amrick Sidhu and Manisha Soorah is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.