2.13 What are Preparer Penalties?

Azhar Jaffari

Any person who helps, advises, or participates (voluntarily or paid), directly or indirectly, in any accounting or financial matter comes under the scrutiny of ITA 163.2(4). Despite the name “preparer penalties,” these penalties can also apply to any person who performs this act and is not limited to the tax return preparer. A person who gives tax advice to a specific person or any person preparing a tax return for a specific taxpayer can fall under this category and face these same penalties.

Example 2.13.1

According to ITA163.2(5) The penalties include the greater of $1,000 and the lesser of (i) a penalty equal to the penalty faced by the person who used the false statement or (ii) $100,000 and the person’s gross compensation.

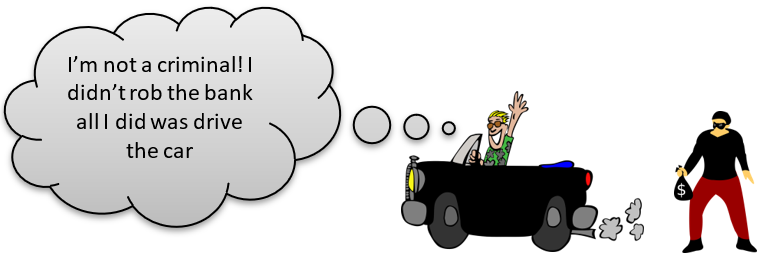

Sometimes people believe that if they were not the ones who directly committed a crime they are innocent. However, in the eyes of the CRA and the law anyone who assists knowingly in the breaking of a law in any way can face charges.

Why are there preparer penalties?

These penalties are placed as a discouragement for any person who participates in unlawful financial activities regardless of who benefits from them. These penalties make it so that individuals who have an influence on other people’s tax returns are less likely to engage in or knowingly participate in advising unlawful activities that would result in avoiding taxes in a prohibited manner. Tax preparers rely on the information given by their clients or the persons who need to pay taxes. However, as a tax professional it is vital for them to be vigilant and they are not supposed to give wrong advice to their clients. Any advice that helps a client save tax in an illegitimate manner is considered as an offence by the tax preparer and they can be prosecuted or penalized for the crime.

Interactive Content

Author: Azhar Jaffari, March 2019

Interactive Content

Author: Jas Sihota, June 2019

References and Resources

- Income Tax Act, RSC 1985, c1, (5th Supp.) ss 163.2(4),164.2(1)(a)(b),163.2(5)(a)(b)

- Chartered Professional Accountants. (2022). The Chartered Professional Accountant Competency Map. Part 1: The CPA Competency Map: 6.1.1

“What are Preparer Penalties?” from Introductory Canadian Tax Copyright © 2021 by Azhar Jaffari is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.