2.1 Who is liable to pay tax in Canada and on what sources of income?

Sam Newton

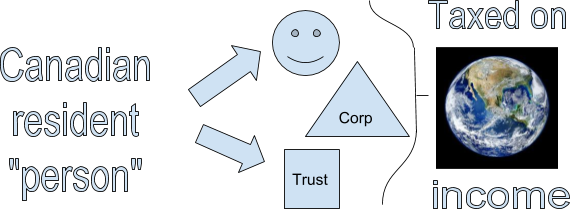

Basically, every person resident in Canada is required to pay income tax on their worldwide taxable income. A “Person” is defined in the Income Tax Act (“ITA”) as a corporation, individual or a trust. Here are some relevant sections from the ITA.

ITA 2(1) states that “An income tax shall be paid, as required by this Act, on the taxable income for each taxation year of every person resident in Canada at any time in the year.”

ITA 248(1) defines a “Person” as a corporation, individual or trust and ITA 3(a) states that a taxpayer’s income includes sources “inside or outside Canada”. Therefore, Canadian resident corporations, individuals and trusts are taxed on their worldwide income

“Persons” non-resident in Canada are required to pay tax on their Canadian source income, which is basically income earned/generated in Canada (See ITA 2(3) for further details).

Why are residents taxed on worldwide income and non-residents taxed only on Canadian sourced income?

Residents are taxed on worldwide income to discourage individuals and corporations from storing their assets and sourcing revenue in tax havens with low tax rates (like Switzerland or the Cayman Islands) to avoid tax. Since Canadian residents are taxed on worldwide income there may be no point in sourcing your income in a low tax country if you – as a resident of Canada – are still required to pay tax on the amount in Canada.

Non-residents are only taxed on their Canadian source income as it wouldn’t seem fair to tax someone on their worldwide income if they aren’t resident in Canada. For example, let’s say a software developer resident in Mexico temporarily moves to Canada for 2 months and takes a contract with Hootsuite. Although she would be taxed in Canada on her income earned in Canada for the 2 months, it wouldn’t make sense (or be fair) to tax her in Canada on her income earned in Mexico during the rest of the year.

Interactive Content

Author: Kokila Sharma, June 2019

References and Resources

- Income Tax Act, RSC 1985, c1, (5th Supp.) ss 2(1), 2(3), 3(a), 248(1)

- Chartered Professional Accountants. (2022). The Chartered Professional Accountant Competency Map. Part 1: The CPA Competency Map: 6.1.1

Image Description

The image is a diagram illustrating the tax implications for a Canadian resident “person.” In the middle of the image is a simple smiley face icon representing the “person.” Two arrows point from the smiley face to a triangle labeled “Corp” and a square labeled “Trust.” On the left side of the image, there is text reading “Canadian resident ‘person’.” On the right side, there is an image of the Earth with text above and below it saying “Taxed on income.” [Return to Figure]

“Who is liable to pay tax in Canada and on what sources of income?” from Introductory Canadian Tax Copyright © 2021 by Sam Newton is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.