2.8 What are the tax differences between a full-year, part-year and deemed resident?

Gurprem Dhaliwal

Part-year residents: ITA 114 states that any person who establishes residential ties in Canada or leaves Canada with an intention to settle somewhere else during a calendar year is considered a part-year resident.

Part-year residents are taxed on their income both inside and outside Canada (“worldwide income”) for the portion of the year that they are residents of Canada. They are taxed on Canadian-source income only, during the period when they are non-residents of Canada (ITA 114). For example, if a person is a resident of Canada for eight months in a tax year, they are taxed in Canada on their worldwide income for eight months they are resident and taxed on their Canadian source income for the four months they are non-resident.

Deemed residents: It is mentioned in ITA 250(1)(a) that there are certain individuals who Canada says are residents of Canada regardless of typical residential rules (such as dwelling place, spouse, kids). This includes people like military stationed overseas, and Canadian ambassadors. Also, a person who sojourns (frequently moves between Canada and foreign countries) in Canada for a period of 183 days or more is considered a deemed resident.

Deemed residents are taxable in Canada on their worldwide income (ITA 250) for the year. Deemed residents are different from part-year residents because part-year residents leave or enter Canada permanently; whereas, deemed residents’ stay is temporary. For example, a person who lives in Bellingham, Washington but commutes to Surrey, B.C. for work 200 days in a year, is a deemed resident as they exceed the 183-day rule.

Full-year residents: According to Canadian Revenue Agency (“CRA”), full-year residents are those persons who have significant residential ties in Canada throughout the year.

Full-year residents are taxable in Canada on their worldwide income. For example, Daniel is a full-year resident of Canada and he lives in Vancouver. He makes $50,000 as an employee at Vancity Credit Union and has $15,000 in net rental income from a rental property in Seattle, USA. He will be taxed in Canada on his $50,000 of Canadian employment income and his $15,000 in U.S. rental income.

Interactive Content

Author: Gurprem Dhaliwal, March 2019

Interactive Content

Author: Yinzi Mao, June 2019

References and Resources

- Income Tax Act, RSC 1985, c1, (5th Supp.) ss 250, 250(1)

- Video- “Tax and Residency in Canada” (Author: John Mcllroy)

- Article-“Factual Residents- Temporarily outside of Canada” (Author: Canada Revenue Agency)

- Chartered Professional Accountants. (2022). The Chartered Professional Accountant Competency Map. Part 1: The CPA Competency Map: 6.5.1

Image Description

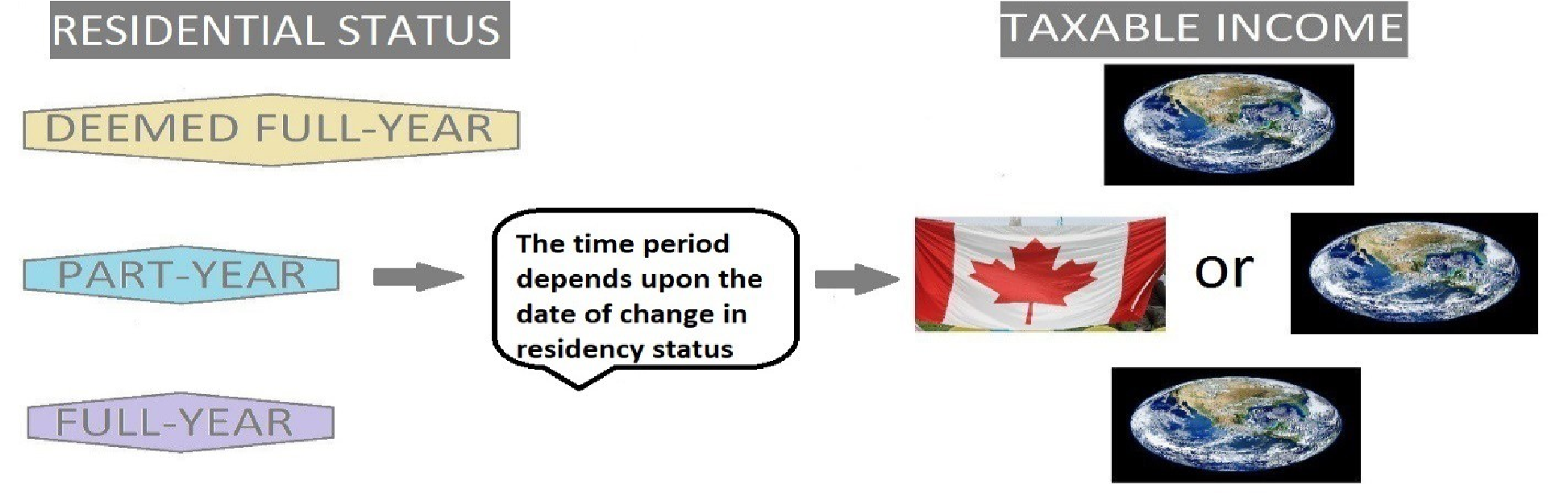

The image shows a diagram with the title “Residential Status” on the left and “Taxable Income” on the right. There are three sections under “Residential Status”: “Deemed Full-Year” in yellow, “Part-Year” in blue, and “Full-Year” in purple. Each section points to a central box that states, “The time period depends upon the date of change in residency status,” which has an arrow pointing to the Canadian flag. The Canadian flag is positioned between two sets of images of Earth, indicating that the taxable income status could be based on either Canadian or international residency. [Return to Residential Status and Taxable Income]

“What are the tax differences between a full-year, part-year and deemed resident?” from Introductory Canadian Tax Copyright © 2021 by Gurprem Dhaliwal is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.