9.1 Explain the tax concept of “integration”

Eva Viernes

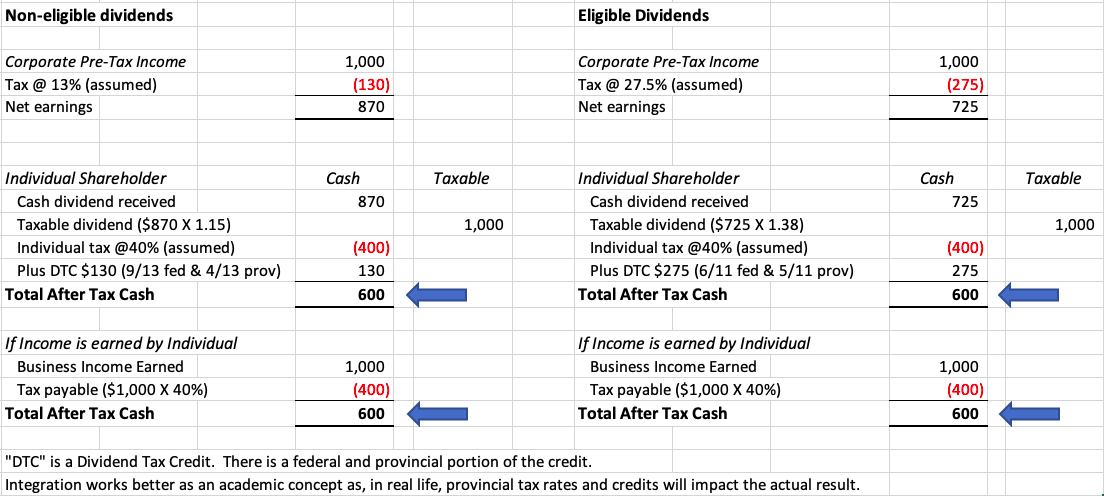

The concept of integration is intended to eliminate any advantages and disadvantages in the application of tax between individuals, corporations and trusts. Thus, the after-tax cash received by an individual should be the same regardless if it was generated directly (as salary) or paid out as dividends from a corporation.

To achieve integration and to avoid double taxation on dividends received from a corporation, an individual must:

• gross-up dividends received to reflect the corporate pre-tax income

• receive a dividend tax credit (DTC) for the tax deducted at the corporate level

The DTC is the sum of federal and provincial dividend tax credits, and the calculation varies depending on whether the corporation is issuing eligible or non-eligible dividends. Typically, public corporations issue eligible dividends while Canadian-Controlled Private Corporations (CCPCs) issue non-eligible dividends.

Eligible dividends are paid from income that is taxed at a higher corporate rate, while non-eligible dividends are paid from income that is taxed at a lower corporate rate. To offset this inequity (and to create integration) eligible dividends receive more favourable tax treatment than non-eligible dividends.

Here is an illustration showing how integration works for both types of dividends. Notice that the tax paid by the corporation is equal to the DTC that can be claimed by the individual shareholder. The computed tax payable amount and the total after tax cash is the same irrespective of whether it is paid through eligible dividends, non-eligible dividends or received directly as salary.

Interactive Content

Author: Eva Viernes, March 2019

Interactive Content

Author: Pooja Devi, June 2019

References and Resources

- Video – “Integration” (authors: Abjeet Khatra and Gursimran Kohli) – uses 2017 rates

- Chartered Professional Accountants. (2022). The Chartered Professional Accountant Competency Map. Part 1: The CPA Competency Map: 6.1.1

Image Description

Example of treatment of Non-eligible dividends and eligible dividends: A spreadsheet comparing the tax consequences of non-eligible dividends and eligible dividends, as well as income earned by an individual.

Non-Eligible Dividends:

- Corporate Pre-Tax Income: $1,000

- Tax @ 13% (assumed): ($130)

- Net Earnings: $870

Individual Shareholder (Non-Eligible Dividends):

- Cash dividend received: $870

- Taxable dividend ($870 x 1.15): $1,000

- Individual tax @ 40% (assumed): ($400)

- Plus Dividend Tax Credit (DTC): $130 (9/13 federal & 4/13 provincial)

- Total After Tax Cash: $600

If Income is Earned by Individual (Non-Eligible Dividends):

- Business Income Earned: $1,000

- Tax payable ($1,000 x 40%): ($400)

- Total After Tax Cash: $600

Eligible Dividends:

- Corporate Pre-Tax Income: $1,000

- Tax @ 27.5% (assumed): ($275)

- Net Earnings: $725

Individual Shareholder (Eligible Dividends):

- Cash dividend received: $725

- Taxable dividend ($725 x 1.38): $1,000

- Individual tax @ 40% (assumed): ($400)

- Plus Dividend Tax Credit (DTC): $275 (6/11 federal & 5/11 provincial)

- Total After Tax Cash: $600

If Income is Earned by Individual (Eligible Dividends):

- Business Income Earned: $1,000

- Tax payable ($1,000 x 40%): ($400)

- Total After Tax Cash: $600

The footnote at the bottom states: “‘DTC’ is a Dividend Tax Credit. There is a federal and provincial portion of the credit. Integration works better as an academic concept as, in real life, provincial tax rates and credits will impact the actual result.”

[Return to Example of treatment of Non-eligible dividends and eligible dividends]

“Explain the tax concept of “integration”” from Introductory Canadian Tax Copyright © 2021 by Eva Viernes is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.