3.1 Child Care expenses and how they are treated for tax purposes?

Bhavish Toor

Child care expenses are amounts you or your spouse or Common-law partner spend to have someone look after an eligible child so that you or the other person could work to generate income or handle business or attend school ITA 63 (3). An eligible child is

- Under the age of 16 at any time during the year (exceptions are made to the age limit if the child is mentally or physically infirm).

- You or your spouse’s or common-law partner’s child.

- Was dependent on you, your spouse or common-law partner in the taxation year.

Examples of child care expenses (“CCE”) are the amount paid to a child care provider, day care centers, day nursery school, nannies, day camps and overnight camps, not including fees paid for education, leisure or recreational activities, medical or hospital bills, clothing or transportation cost.

CCE is recorded as deductions in section 3(c) of the section 3 ordering rules, when calculating Net Income for Tax Purposes.

Ed.Note: Per ITA 63(2), for the higher income spouse to claim some of the childcare expenses, the lower income spouse must be attending school for a minimum of 3 weeks or in a hospital or imprisoned for a minimum of 2 weeks.

In order to understand it in much detail there is a good example in income tax folio S-1,F-3,C-1 on paragraph 1.44.

Example 3.1.1

Martina and Joe sent their kids Max, age 19, with a disability; Jax, age 6; and Rex, age 4, to a summer camp for 4 weeks. The total cost for the camp was $4,500. They also incurred $11,090 in regular childcare during the year. Martina has earned income of $55,000 and Joe has earned income of $61,000.

Calculate the deductible childcare costs to see which would be the least of the 3 methods. (Actual, 2/3, Annual)

ITA 63(3) Annual Child Care Expense Amount:

Max 19 with a disability = $11,000

Jax 6 =$8,000

Rex 4 =$8,000

To get the weekly eligible amount (Actual Amount) we divide the Annual Expense Amount by 40 to get the following:

Max 19 with a disability = $11,000 divided by 40 = $275

Jax 6 =$8,000 divided by 40 = $200

Rex 4 =$8,000 divided by 40 = $200

Martina is the lower income spouse and, since the exceptions in 63(2) don’t apply, she will be the one claiming the childcare expenses for the year. Here is the calculation.

2/3 method = $55,000 x 2/3 = $36,667

Annual Method =$8,000 + $8000 + $11,000 = $27,000

Actual Method = $11,090 + (($200 + $200 + $275) X 4 weeks) = $13,790

Since Martina is the Lower Income Spouse, her deduction will be $13,790 (the lesser of the three amounts calculated above).

(Example by: Priya Dhariwal)

Interactive Content

Author: Bhavish Toor, March 2019

Interactive Content

Author: Arminder Sandhu, June 2019

References and Resources

- Income Tax Act, RSC 1985, c1, (5th Supp.) ss 63(2), 63(3)

- Article – “Income Tax Folio S-1, F-3, C-1, Child Care Expense Deduction”, (Author- Government of Canada)

- Image – “family” by Bhavish Toor licensed under CC BY 4.0

- Chartered Professional Accountants. (2022). The Chartered Professional Accountant Competency Map. Part 1: The CPA Competency Map: 6.3.2

Image Description

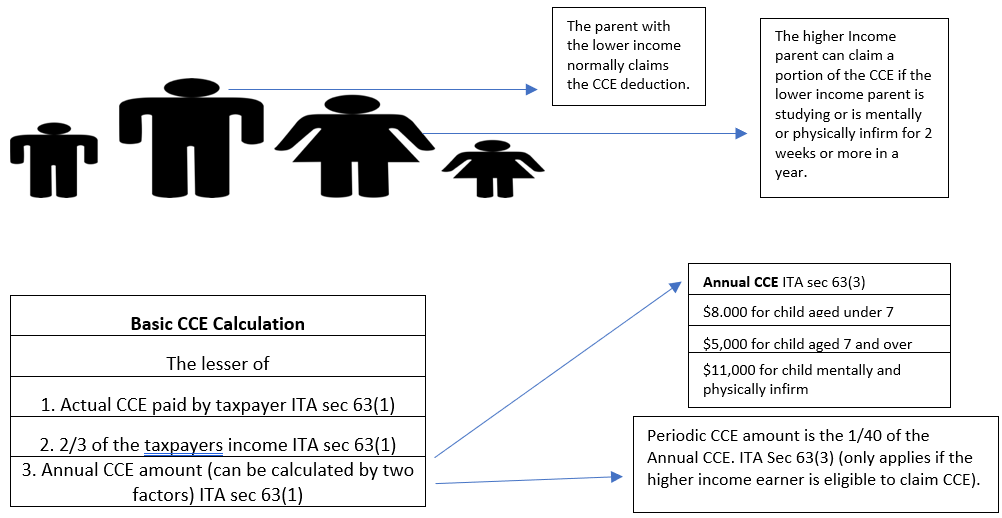

Who can claim the CCE?: A diagram illustrating the Child Care Expense (CCE) deduction process. At the top, there are icons of a family (two parents and two children). An arrow from the lower-income parent points to a box that reads, “The parent with the lower income normally claims the CCE deduction.” Another arrow from the higher-income parent points to a box that reads, “The higher income parent can claim a portion of the CCE if the lower income parent is studying or is mentally or physically infirm for 2 weeks or more in a year.”

Below the family icons, there is a box titled “Basic CCE Calculation” with three points:

- Actual CCE paid by taxpayer ITA sec 63(1)

- 2/3 of the taxpayer’s income ITA sec 63(1)

- Annual CCE amount (can be calculated by two factors) ITA sec 63(1)

To the right, another box titled “Annual CCE ITA sec 63(3)” lists the amounts:

- $8,000 for a child aged under 7

- $5,000 for a child aged 7 and over

- $11,000 for a child mentally and physically infirm

An arrow from “Basic CCE Calculation” points to “Annual CCE ITA sec 63(3),” and another arrow from “Annual CCE ITA sec 63(3)” points to a final box that reads, “Periodic CCE amount is the 1/40 of the Annual CCE. ITA Sec 63(3) (only applies if the higher income earner is eligible to claim CCE).” [Return to Who can claim the CCE?]

“Child Care expenses and how they are treated for tax purposes?” from Introductory Canadian Tax Copyright © 2021 by Bhavish Toor is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.