3.7 What are Other Incomes and Other Deductions?

Jaydeep Shergill

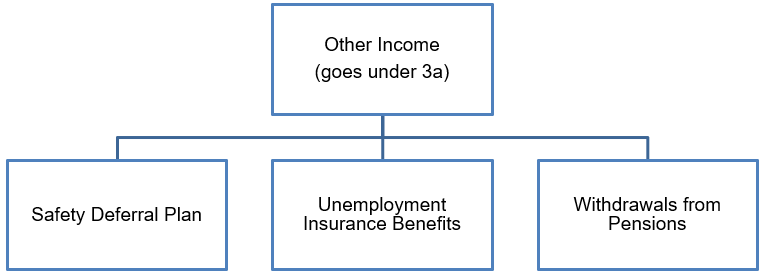

According to ITA 56(1), other income amounts to be included in the recording of income tax are amounts not obtained through employment, business, or property income such as: pension benefits (CPP, provincial pension plans, and private pension benefits), unemployment insurance benefits, parts of registered pension plans that are redeemed within a tax year, spousal support payments received, and salary deferral plans.

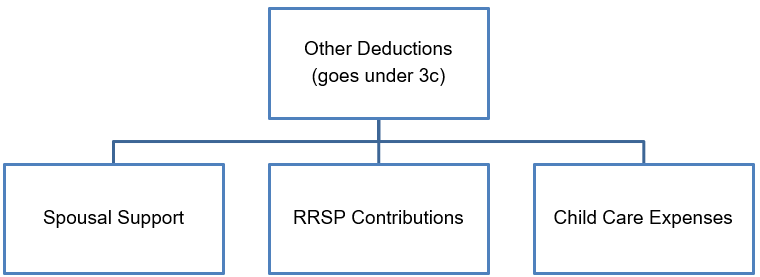

Other Deductions are similar to other income in that they do not originate from employment, business, or property income. ITA 60 states, “There may be deducted in computing a taxpayer’s income for a taxation year such of the following amounts as are applicable: Support payments made, Pension income reallocation, Repayment of support payments…”. Examples of these “Other Deductions” include childcare expenses, spousal support payments paid, moving expenses, and deducted RRSP contributions.

It is important to identify whether certain items represent income or a deduction. For example, spousal support payments received would be included as income in 3(a) whereas spousal support payments made would be deductible in 3(c).

Order of Other Income and Other Deductions in Calculating Net Income for Tax Purposes

Other Income amounts are included under ITA 3(a) in the calculation of Net Income for Tax Purposes. Other deductions are applied against the sum of ITA 3(a) and ITA 3(b). If the 3(c) exceeds the sum of 3(a) and 3(b) then the subtotal is $Nil. Although there are some exceptions most of the ITA 3(c) deductions are “use it or lose it” deductions meaning that they expire if they are not used within the year.

Interactive Content

Author: Jaydeep Shergill, January 2019

References and Resources

- Income Tax Act, RSC 1985, c1, (5th Supp.) ss 56, 56(1), 60, 248(1)

- Chartered Professional Accountants. (2022). The Chartered Professional Accountant Competency Map. Part 1: The CPA Competency Map: 6.3.2

Image Description

- Other income (3a): A flowchart titled “Other Income (goes under 3a)” at the top. It has three branches: Safety Deferral Plan, Unemployment Insurance Benefits, and Withdrawals from Pensions. Each branch is represented with a connecting line from the main “Other Income” box at the top. [Return to Other income (3a)]

- Other deductions (3c): A flowchart titled “Other Deductions (goes under 3c)” at the top. It has three branches: Spousal Support, RRSP Contributions, and Child Care Expenses. Each branch is connected by a line to the main “Other Deductions” box at the top.[Return to Other deductions (3c)]

“What are Other Incomes and Other Deductions?” from Introductory Canadian Tax Copyright © 2021 by Jaydeep Shergill is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.