4.3 What are the optimal kinds of employee benefits (for both the employer and the employee)?

Karn Josan

ITA 5(1) states that “Income from office or employment includes salary, wages and other remuneration that is received by the taxpayer during the year as a virtue of their employment.” Per ITA 6(1)(a) this includes the value of “benefits of any kind that is enjoyed by the taxpayer during the year as a virtue of their employment.” This section of the ITA also features an “except for” clause which documents numerous benefits which, although they provide a benefit, are not taxable. This includes items like some private health insurance plans, registered pension plans and group life insurance policies.

We can use these sections of the ITA (along with some ITA sections regarding deductibility of business expenses) to help find ‘optimal’ employee benefits, i.e. benefits that are non-taxable to the employee but still deductible to the employer.

In addition to the ITA guidance provided above we may need to determine who is the primary beneficiary of the benefit. Typically, if the employee is the primary beneficiary the benefit is taxable, but if the employer is the primary beneficiary it would not create a taxable benefit.

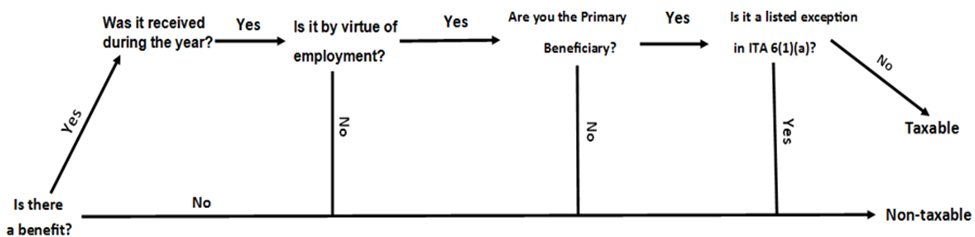

Ultimately, any benefit received in the year by virtue of your employment is taxable unless there is a specific exemption or the employer is the primary beneficiary. The taxable benefit would be added to your employment income and include in S3(a) when calculating Net Income for Tax Purposes. The following flowchart is a helpful guide to determining if a benefit is taxable:

In many situations, there isn’t a clear or distinct answer. For instance, if an employer provides payments to each employee to purchase a laptop, is this a taxable benefit? You could argue that the employee is the primary beneficiary as they receive a free laptop, but you could also argue that the employer has a greater benefit as this could increase productivity.

What are the optimal benefits?

Optimal benefits are essentially not taxable for employees, and deductible for employers. This means they aren’t included in the employee’s income, and according to ITA 18(1), can be deducted from the employers’ business income.

Interactive Content

Author: Karn Josan, January 2019

Interactive Content

Author: Natalie Haviland, January 2020

References and Resources

- Income Tax Act, RSC 1985, c1, (5th Supp.) ss (5)(1), (6)(1)(a), and (18)(1)

- Article – “T4130 Employers’ Guide – Taxable Benefits and Allowances” (Author: Government of Canada)

- Chartered Professional Accountants. (2022). The Chartered Professional Accountant Competency Map. Part 1: The CPA Competency Map: 6.3.2

Image Description

Flowchart for Determining the Taxability of a Benefit under ITA 6(1)(a): A flowchart for determining the taxability of a benefit. It starts with the question, “Is there a benefit?” If yes, an arrow leads to “Was it received during the year?” If yes, another arrow leads to “Is it by virtue of employment?” If yes, the next question is “Are you the Primary Beneficiary?” If yes, the final question is “Is it a listed exception in ITA 6(1)(a)?” If yes, the outcome is “Non-taxable.” If at any point the answer is no, the outcome is “Taxable.” Arrows guide the progression through each question with “Yes” or “No” branching paths. [Return to Flowchart for Determining the Taxability of a Benefit under ITA 6(1)(a)]

“What are the optimal kinds of employee benefits (for both the employer and the employee)?” from Introductory Canadian Tax Copyright © 2021 by Karn Josan is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.