2.2 Risk Classification

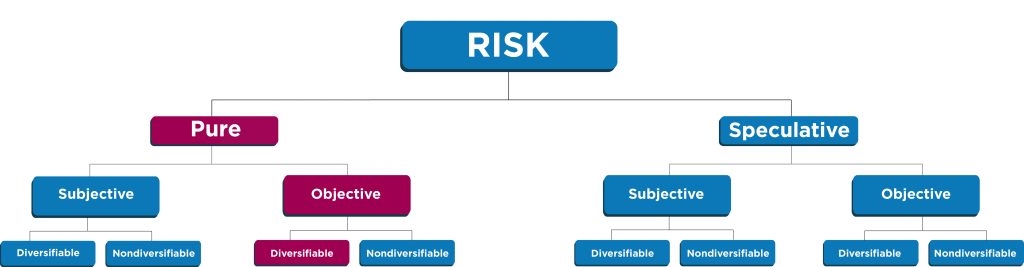

Risk can be classified in several ways, but the following classification has been used for clarity (Elliott, 2018):

- Speculative and pure risk

- Objective and subjective risk

- Diversifiable and non-diversifiable risk

- Quadrants of risk (Strategic, Financial, Operational, and Hazard)

Image Description

Classifications of Risk diagrams.

Risk box with two branches: Pure and Speculative. Each of those is divided with a branch into Subjective and Objective boxes. Each Subjective and Objective is branched into a Diversifiable and Nondiversifiable box. The Pure, Objective, Diversifiable line of boxes is coloured as insurable risks are generally classified as pure, objective, and diversifiable.

Speculative and Pure Risk

Pure Risk

Pure risk is a category of risk that cannot be controlled and has two outcomes: complete loss or no loss at all, but no gain can be realized.

Pure Risk Examples

- Natural Disasters: Events like earthquakes, floods, hurricanes, and wildfires fall under pure risk. These disasters can cause significant damage or loss without any chance of gain.

- Death: The risk of losing a loved one due to illness, accidents, or other unforeseen circumstances is a pure risk.

- Theft: When the property is stolen, it results in a complete loss for the owner.

- Liability Risks: Legal situations where someone may sue for damages (e.g., slip and fall accidents) are also examples of pure risk

Although pure risks cannot be avoided, insurance can mitigate them. Insurance companies offer policies to transfer pure risk from individuals to themselves. For example, auto owners purchase auto insurance to protect against any damage to their vehicle and/or liability for damages.

Speculative Risk

Speculative risk refers to a category of risk where the outcome is uncertain and can result in either gains or losses. Unlike pure risk, which only involves the possibility of loss, speculative risk involves conscious choices made by individuals. Here are some key points about speculative risk:

- Speculative risk is the possibility that an investment will not appreciate in value. It arises from situations where the outcome is uncertain, and there is a chance of both gain and loss.

- Speculative risks are voluntary and not solely a result of uncontrollable circumstances.

Spectulitive Risk Examples

- Investing in Stocks: There is a speculative risk when investing in stocks. The stock price may rise, resulting in gains or falls and losses.

- Real Estate Investments: Buying property with the hope that its value will increase over time involves speculative risk.

- Starting a New Business: Entrepreneurship carries speculative risk. The success or failure of a new venture is uncertain.

- Sports Betting: Betting on sports events is speculative because the outcome is unpredictable.

Speculative risk can lead to both profits and losses, making it distinct from pure risk, where only losses are possible.

Speculative Risks in Investments

There is a significant Speculative Risk involved in the investments. The following risks cover areas within the investment:

- Inflation Risk: This risk results from the erosion of purchasing power caused by a general increase in the overall price level within the economy. Inflation can reduce the real value of investments.

- Market Risk: This risk arises from fluctuations in the prices of financial securities, including bonds and stocks. It reflects the potential for losses due to market movements.

- Interest Rate Risk: This risk pertains to a security’s future value due to changes in interest rates. When rates rise, bond prices tend to fall, affecting the value of fixed-income investments.

- Liquidity Risk: This risk relates to the ease of selling an investment quickly and at a reasonable price. Illiquid assets may be challenging to convert into cash without significant loss.

Pure risk is all about unavoidable losses, while speculative risk involves conscious choices with the potential for both gains and losses. Understanding these distinctions is crucial for effective risk management and decision-making.

Subjective and Objective Risk

When people or organizations need to make decisions that involve risk, they typically rely on either opinions (which are subjective) or facts (which are objective) to assess that risk. Opinions are based on personal beliefs or feelings, while facts are based on verifiable evidence. So, it’s important to consider both perspectives when evaluating risks.

Objective Risk

Objective risk refers to the probability of an event occurring based on concrete data and facts. It is quantifiable, measurable, and independent of personal opinions or biases.

Objective Risk Example

A car insurance company has analyzed accident data over the past decade. On average, 20% of policyholders file yearly claims due to accidents. This historical data provides an objective risk assessment.

Subjective Risk

Subjective risk is influenced by personal beliefs, perceptions, and experiences. It is more individualized and can vary from person to person.

Subjective Risk Example

A small business owner is considering expanding into a new market. They’ve done their homework, researching the market thoroughly and objectively evaluating risks like economic conditions, competition, and regulatory changes. But despite all this analysis, they still feel uneasy. It’s called subjective risk, where feelings or experiences play a role.

Subjective risk is influenced by perception, emotions, and cognitive factors, while objective risk relies on empirical evidence and statistical analysis. These differences can lead to substantial disparities in risk assessments.

Example

Scenario: A tech startup is developing a cutting-edge software product. They’ve objectively assessed the risks related to development costs, market demand, and competition.

Objective Risk: Based on historical data, they estimate a 10% chance of the project failing due to unforeseen technical issues.

Subjective Risk: However, the startup’s lead developer has a gut feeling that the software might encounter compatibility problems with existing systems. This feeling isn’t quantifiable but contributes to the overall subjective risk.

The startup weighs both objective and subjective risks. If they decide to proceed, they acknowledge that their intuition plays a role alongside the hard data.

Diversifiable and Non-Diversifiable Risk

Diversifiable Risk

Diversifiable risk refers to firm-specific risks that impact individual stock prices rather than affecting the entire industry or sector in which the firm operates.

Components of Diversifiable Risk:

- Business Risk: Arises from challenges specific to a firm’s operations. For example, a pharmaceutical company investing heavily in research and development but failing to find a patent for its new drug faces internal business risk.

- Financial Risk: An internal risk related to the firm’s capital structure and cash flow. A robust capital structure helps the firm weather turmoil.

- Management Risk: The riskiest segment, influenced by leadership changes.

Diversifiable Risk Example

A firm facing a labour strike or regulatory penalty. Even if the industry is growing, this firm will face challenges, and shareholders might see lower stock prices due to these specific risks.

Non-Diversifiable Risk (Systemic Risk)

Non-diversifiable risk affects an entire class of assets or liabilities and is independent of overall market conditions.

Characteristics:

- Market Risk: Inherent risk in the marketplace as a whole, affecting all investments.

- Interest Rate Risk: Changes in interest rates impact various assets uniformly.

- Economic Factors: Factors like inflation, recession, and geopolitical events affect all investments.

Non-diversifiable Example

A global economic downturn affecting stock markets worldwide is a nondiversifiable risk. Diversification cannot eliminate this risk entirely. For example, COVID-19, where the entire world, irrespective of industries, is affected.

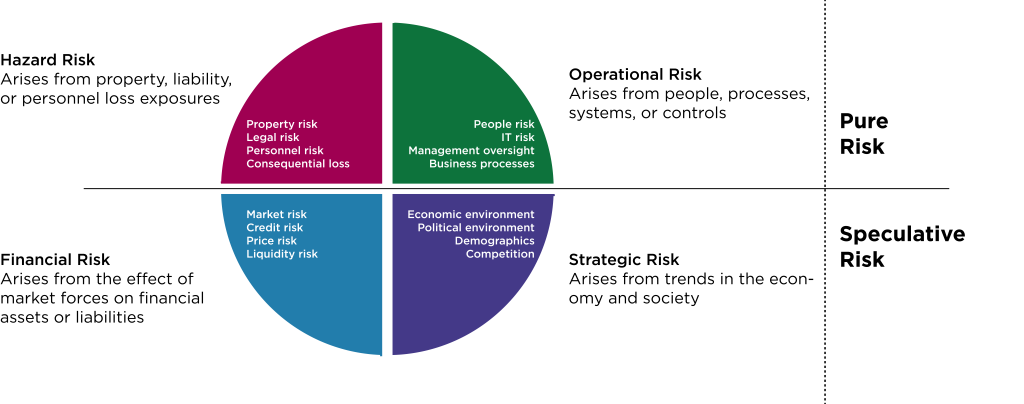

Risk Quadrants: Hazard, Operational, Strategic, and Financial Risks

Risks have been categorized differently in different regions and organizations. However, in North America, risks are normally placed into the following four quadrants (IRM’s Risk Management Standard, 2002).

- Hazard

- Operational

- Strategic

- Financial

Image Description

Risk Quadrants Image.

A circle is divided into four quarters for each type of risk.

Clockwise from top left:

Hazard Risk: Arises from property, liability, or personnel loss exposures. Includes property risk, legal risk, personnel risk, and consequential risk.

Operational Risk: Arises from people, processes, systems, or controls. Includes people risk, IT risk, management oversight, and business processes.

Strategic Risk: Arises from trends in the economy and society. Includes economic environment, political environment, demographics, and competition.

Financial Risk: Arises from the effect of market forces on financial assets or liabilities. Includes market risk, credit risk, price risk, and liquidity risk.

Hazard Risk and Operational Risk are Pure Risk and Financial Risk and Strategic Risk are Speculative Risk.