10.2 Sustainability and Risk

Sustainability issues and organizational risks are deeply interconnected in today’s business environment. This interconnectivity manifests in several key ways:

- Sustainability challenges can create significant risks for organizations, while organizational decisions and risk management practices can impact sustainability outcomes.

- Sustainability risks often have ripple effects across various aspects of an organization’s operations and the broader economy. For example, climate change can simultaneously affect supply chains, asset values, and market demand.

- These risks stem from complex environmental, social, and governance (ESG) systems, often affecting multiple organizational aspects concurrently.

- Sustainability risks typically unfold over longer timeframes than traditional business risks, making them challenging to predict and manage.

- The complex nature of sustainability risks often makes them difficult to quantify using traditional risk assessment methods.

Image Description

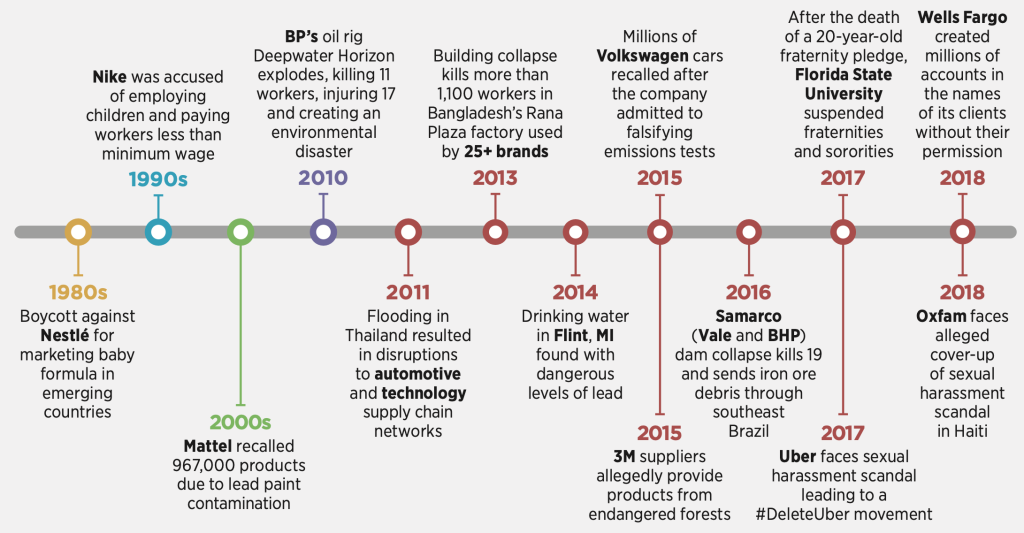

The image is a timeline that highlights various significant incidents involving organizations that have experienced environmental, social, and governance (ESG) related impacts. The events are as follows:

- 1980s: Boycott against Nestlé for marketing baby formula in emerging countries.

- 1990s: Nike accused of employing children and paying workers less than minimum wage.

- 2000s: Mattel recalls 967,000 products due to lead paint contamination.

- 2010: BP’s oil rig Deepwater Horizon explodes, killing 11 workers, injuring 17, and creating an environmental disaster.

- 2011: Flooding in Thailand disrupts automotive and technology supply chain networks.

- 2013: Building collapse in Bangladesh’s Rana Plaza factory kills more than 1,100 workers; over 25 brands used this factory.

- 2014: Drinking water in Flint, MI, found with dangerous levels of lead.

- 2015: Millions of Volkswagen cars recalled after the company admitted to falsifying emissions tests.

- 2015: 3M suppliers allegedly provided products from endangered forests.

- 2016: Samarco (Vale and BHP) dam collapse kills 19 and sends iron ore debris through southeast Brazil.

- 2017: Uber faces a sexual harassment scandal leading to the #DeleteUber movement.

- 2017: After the death of a 20-year-old fraternity pledge, Florida State University suspends fraternities and sororities.

- 2018: Wells Fargo created millions of accounts in the names of its clients without their permission.

- 2018: Oxfam faces alleged cover-up of a sexual harassment scandal in Haiti.

The figure above shows examples of how ESG-related risks impacted some known organizations.

To effectively manage these interconnected risks, organizations need to:

- Adopt a holistic approach to risk assessment and mitigation

- Integrate ESG factors into traditional risk management frameworks

- Develop new metrics and tools for measuring sustainability-related risks

- Enhance transparency around sustainability risks and opportunities

- Align business strategies with sustainability goals

Understanding this interconnectivity is crucial for modern risk management. It allows organizations to mitigate potential threats and identify opportunities for innovation and value creation in a rapidly changing world (Segun, 2023).