1.1 What is Risk?

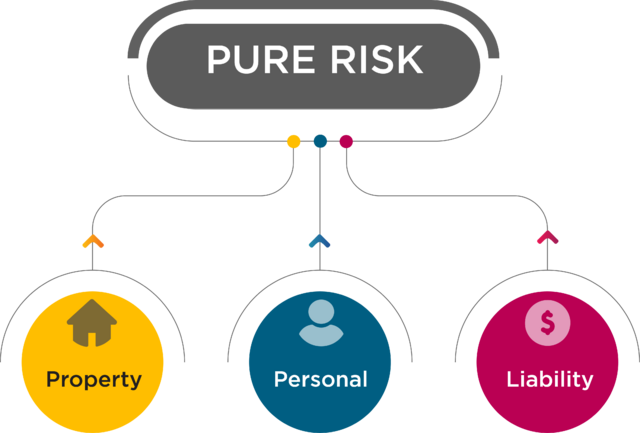

Risk is defined according to its context. Most would view risk as being negative; “I took the risk of being late for work by leaving home late.” Insurance is based on the premise that risk can or will cause losses, and as a result, defines risk in negative but simple terms, which is the chance of loss. For insurance to exist, there must be insurable risks. Examples of insurable risks are risks associated with property, liability and personnel. Note that insurable risks are hazard risks, which in turn are considered to be pure risks comprised of property, liability and personnel risks.

- Property Risks are losses arising from the destruction or damage to property. An example would be a house fire.

- Liability Risks are losses associated with the legal obligation requiring an individual to pay damages to others as a result of that person’s negligence. An example would be the manufacturing of a product that causes injury to a consumer.

- Personnel Risks are losses associated with bodily injury, loss of life or income resulting from death or disability.

Definitions of risk in the modern risk management space include using the term uncertainty as it applies to outcomes. ISO 31000 defines risk as “the effect of uncertainty on objectives, whether positive or negative” (International Organization for Standardization, 2022). Risk, therefore, can have an upside and a downside. The upside of risk means that the risk can be a benefit to the organization, meaning that the risk is an advantage. In contrast, the downside of risk does not work in the organization’s favour, and the risk is a disadvantage. International students arriving in Canada to attend Fanshawe College are exposed to risk. The upside of risk in this case is that they will experience life in Canada, meet new friends, enjoy success at school, and go on to a successful career. The downside of risk in this case is that students could have trouble adjusting to the climate, experience separation anxiety, face financial pressures, and struggle with the curriculum at school.

This book will consider risks to be multi-directional, meaning that they have an upside and a downside. The only exception will be hazard risks, which have downsides.