12.3 Cannabis Industry Challenges

The legal Canadian cannabis industry has made a significant contribution to the Canadian economy. Since its inception in 2018, the industry “contributed $43.5 billion to Canada’s GDP…and $13.3 billion to Ontario’s GDP… [and] sustained 98,000 jobs annually” across the country (Deloitte, 2022, p.3). Given its early start in the industry, Canada is positioned to become a leader in the world cannabis market as the number of countries around the world enacting and/or considering enacting medical and/or recreational cannabis legalization continue to grow (Canadian Cannabis Exchange, October 25, 2022). Despite the industries economic impact and future market opportunities, in both Canada and other nations, the legal cannabis industry has been plagued by difficulties since its inception. Several of the most common issues are addressed below, including: access to banking industry services and the impact of the illegal cannabis market and other industry stressors.

Access to Banking Industry Services

International drug prohibition (see Chapter on International Drug Policies) and banking regulations have negatively impacted the financial resources available to the cannabis industry since its start. Just after Uruguay became the first country in the world to legalize cannabis, US banks put the Uruguayan banking industry on notice that they would cease involvement with Uruguayan banks offering services to cannabis industry businesses (Londoño, August 25, 2017). This problem persists into 2023, with Uruguayan banks reluctant to provide financial services to the industry, due to foreign banking and international money laundering regulations (Maas, May 4, 2022).

Despite the number of U.S. states that have legalized medical and/or recreational cannabis between 1996 and 2023, the cannabis industry in the U.S continues to struggle due to the Federal prohibition on cannabis. Those who can obtain licences experience difficulty finding banks that will offer them services (e.g., bank accounts, loans, mortgages, etc.), cutting businesses off from important financial sector assets necessary for raising capital. Cash-only businesses also complicate financial transactions (e.g., paying employees, vendors, and taxes) (Mallison, Hannah, & Cunningham, 2020) and make potential business investment risky, due to difficulties obtaining insurance, including bankrupt insurance (Kavousi et al., 2022).

Needed US legislative change, however, may be on the horizon. An article in Reuters in January 2023 reported on the expected re-introduction of several important pieces of legislation for the cannabis industry in the 2023 legislative session, including: The Secure and Fair Enforcement (SAFE) Banking Act, that will “provide protections to financial institutions and…other professional service[s providers] doing business with state-legal cannabis businesses”; and the States Reform Act (SRA), that would both Federally decriminalize cannabis and defer “to state powers over prohibition and commercial regulation” (Malyshev & Ganley, January 19, 2023, para. 10-11). In September 2023, the former of these two pieces of legislation was introduced to the US Senate, under a slightly revised name (i.e., The Secure and Fair Enforcement Regulation [SAFER] Banking Act) and was subsequently amended during a Senate Banking Committee hearing (Herrington, October 2, 2023; Kumar & Bose, September 27, 2023).

The Canadian cannabis industry has faced similar problems with the banking industry. Although credit cards can be used by consumers to purchase cannabis products, some companies in Canada struggle to access and/or maintain banking services. In an effort to address these issues, in February 2023 the legal cannabis industry brought a class action suit against major Canadian banks (RBC, BMO, TD, CIBC, National Bank, and Desgardins Federation) alleging “that the named banks have engaged in financial discrimination against actors” in the legal industry (Groupe SGF, February 10, 2023, para. 1). The listed services denied the industry detailed in the suit include: opening bank accounts (and sudden closure of existing accounts) and access to financial tools (e.g., mortgages, lines of credit).

VIDEO: The cannabis industry has a banking problem. But that could change.

This video from the Wall Street Journal explores the challenges the legal cannabis industry in various U.S. states continues to face, due to their lack of access to banking industry resources.

The Illegal Market and Other Industry Stressors

Although it was anticipated that the legal cannabis market, with regulated supply, quality control, and accurate product labelling, would displace the illegal market, the illegal market still persists in jurisdictions where legal cannabis production, sale, and use are permitted. The continuation of the illegal cannabis market impacts legal cannabis businesses’ profitability and sustainability (Deschamps, February 9, 2023). Several factors that contribute to the perpetuation of a dual market are: cost, availability, convenience of accessibility (Childs & Stevens, 2021; Goodman, Wadsworth & Hammond, 2022) and potency (Mahamad et al., 2020). In Canada, for example, at the start of legalization in 2018, legal cannabis retail prices were often much higher than those in the illegal market (Childs & Stevens, 2021), up to 55% more (Public Safety Canada, June 15, 2020). There were also issues with supply and availability, particularly of preferred products (i.e., edibles, extracts, and topicals were not legal until October 2019, with availability slowly rolling out in 2020 – see Chapter on Alternative Drug Control Policies) (Watts, Newell & Putyra, December 13, 2019).

Higher prices in the Canadian legal market are attributed to high taxes, the regulatory and licensing fees (El-Cheikh, Bontes & O’Riordan, July 20, 2022; EY, 2022), and the capital expenditures and start-up costs of new businesses and a new industry (Deloitte, 2022; Ekidna, May 23, 2022). Taxes account for a large portion of every cannabis sale. For example, according to an Ernst & Young (2022) industry report, in Ontario taxes and provincial mark-ups make up over 45% of the price of legal cannabis products. Legal retailers and producers are therefore only able to capture a very limited amount of what illegal businesses can for cannabis sales (e.g., in Ontario 26% of cannabis prices charged to customers go to retailers) (EY, 2022).

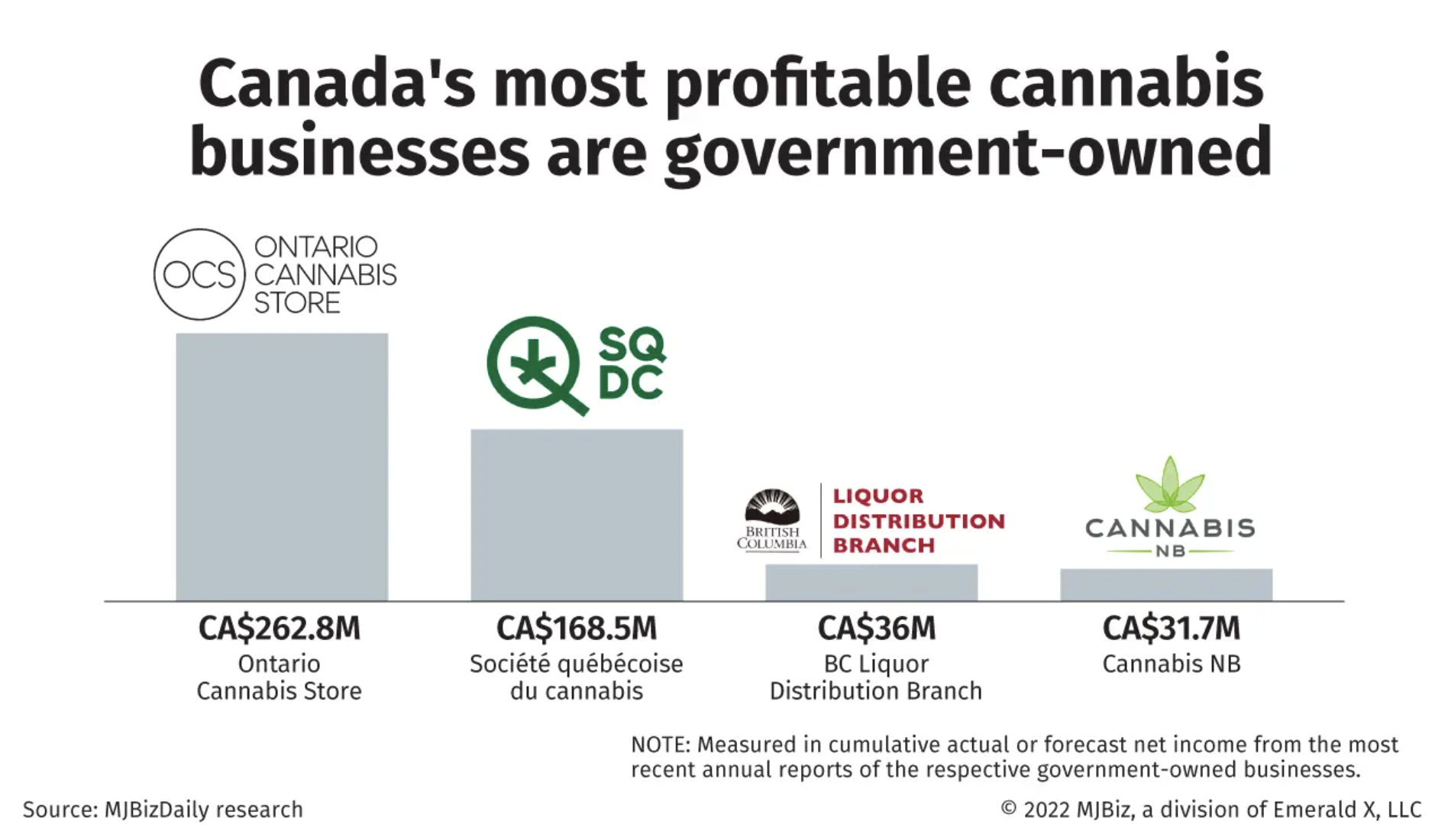

In Canada, the most profitable cannabis businesses are government owned (see bar graph below for details). For example, the Ontario Cannabis Store (OCS) (Ontario’s government owned online store and sole wholesale supplier to all legal cannabis retailers in the province) earn $234 million dollars in 2022 with a total of “$459 million of accumulated profits sitting in the bank” (Armstrong, November 29, 2023, para. 1). Although price reductions, improved product availability, and an increase in retail establishments since 2019 has helped to reduce illegal market demand by consumers (CCSA, June 2022), dropping product prices in the legal market (41% drop in wholesale prices in 2022) without a corresponding drop in taxes, combined with a highly competitive cannabis market, are particularly challenging for this nascent industry working toward profitability (EY, 2022).

The number of cannabis licences at the Federal level (Health Canada, December 21, 2022) and increases in retail stores, in those provinces and territories with a private retail system (Alberta, British Columbia, Manitoba, Newfoundland & Labrador, Nunavut, Ontario, Saskatchewan, Yukon), particularly Ontario (MJBizDaily, August 2023), has resulted in an over-surplus of cannabis and greater competition for a market share (Paglinawan, August 17, 2022). The outcome being licensees struggling for survival, with businesses laying off their work force, closing facilities, and some going out of business (Blunt, January 10, 2023; Yun, February 10, 2023). For example, according to the Cannabis Council of Canada (C3), in the first 6 weeks of 2023, over 1000 jobs in the industry were lost (Lamers, February 16, 2023). Even large businesses have been impacted, as evidenced by Canopy Growth’s February 2023 announcement of layoffs and plant consolidation plans (Deschamps, February 9, 2023). This has led C3 to lobby the government to consider changes in the current policy, advocating for reduced regulatory demands, fees, and rates of taxation (Eñano, December 1, 2022; EY, 2022; Lamers, February 16, 2023).

VIDEO: Canada’s cannabis industry asking government for help.

This CTV Your Morning segment from February 17, 2023, discusses the challenges faced by Canadian cannabis industry and the changes the industry is seeking.

The Cannabis Council of Canada ('C3') is the national and international representative of Canada’s licensed producers and processors of cannabis. "C3’s mission is to promote industry standards, support the development, growth, and integrity of the regulated cannabis industry, and serve as an important resource on issues related to responsible use of cannabis for medical and non-medical purposes" (Cannabis Council of Canada, n.d.).