3.2 Where Does the Money Come From?

Every recreation and leisure-based organization has its way of generating revenue, managing expenses, and (with any luck) turning a profit. Every organization does this differently, and it can vary wildly based on the size of the agency, the sector the agency operates under, and the nature of its goods and services.

Sources of Revenue

All recreation-based organizations, agencies, and businesses have different ways of generating revenue (making money). Here are eight ways the leisure-based businesses in our communities keep the lights on and keep their programs going for their clients:

-

Photo by Caroline Cagnin, Pexels License. User Fees: The basic cost to the client, customer or patron for being able to participate in, or gain entrance to, a given activity or program. Examples: Renting ice-pad time at a local arena, the cost of a ski-lift ticket, amusement park entrance fees, the green fee for a round of golf, the ticket price for a concert, a Provincial Park vehicle fee. User fees are often set at different price points, depending on factors like the age (a children’s ticket versus an adult’s ticket), the length of the activity (a less expensive day-use fee, versus a multi-day overnight camping fee at a Conservation Authority), or the perks and benefits associated with that fee.

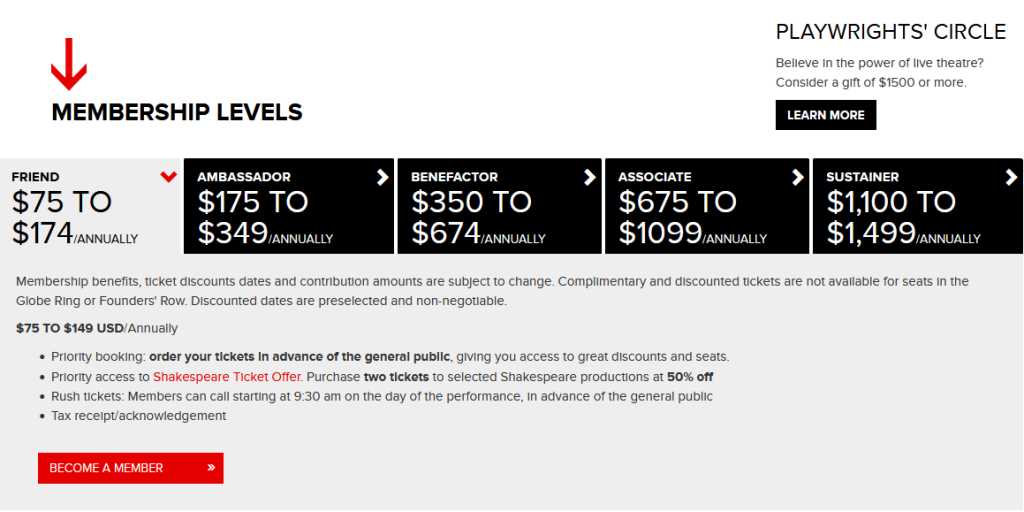

- Memberships: Memberships are costs that allow an individual to have regular access to a program, club or activity, OR, the price members pay to be affiliated with an association or organization from across sectors. Examples: Membership at a private golf club, a fitness club membership, becoming a seasonal theatre ticket holder at the Stratford Festival, signing up for a family membership at the local YMCA. Members often pay a reduced price for services over a longer run of time, making memberships, in many cases, highly economical. Memberships are a great way to provide stability and predictability to an organization, as they allow administrators to accurately predict attendance and project revenue. Membership is not without its drawbacks, however. Membership fees may be out of reach for some. The long-term commitment that comes with membership may be unappealing to some people who may not be sure whether they will still be interested in the organization months down the road. Some organizations, like the Stratford Festival, offer tiered memberships, different levels of membership that come with increased perks, incentives and rewards:

Screenshot of Stratford Festival tiered membership levels. Used under Fair Dealing for Educational Purposes (Canada). - Tax-based Funding: Canadian Public sector organizations often struggle with finding adequate financial resources to fund and support recreation-based programs and services, as much of the money is generated from constituent taxes and is therefore uncertain, as it is based on facility and services usage. As such, municipal recreation budgets are rarely robust enough to adequately support the recreation and leisure needs of the community (Pitas et al., 2017) without needing to dip into constituent pocketbooks. Municipal parks and recreation departments are given annual base budgets in which to operate. As public entities, they are held closely accountable to these budgets. Sadly, “Recreation is vulnerable to budget cuts, as it is seen as a non-essential service” (Imagine a Winnipeg, 2018, p.41), which means municipalities are often looking for ways to offset the high costs of recreation programming, often coming by way of increased taxes to those who live in the community. For example, on July 1, 2010, the City of Ottawa implemented the HST (Harmonized Sales Tax) on recreation services. This meant constituents “…will have to pay more for using facilities such as swimming pools and soccer fields”. (Soloman, 2010). Arguing for more equitable and affordable access to recreation services, a 2021 Value Survey conducted by PRO (Parks and Recreation Ontario) determined, “97% of Ontarians believe parks, green spaces and community recreation are important to quality of life” (p.3) and “91% believe municipal investment in parks and green space make their communities a desirable place to live” (p.3). Given that recreation is deemed so valuable by Ontarians, there is little doubt that local governments will continue to increase recreation-related usage fees and municipal taxes to ensure the continued funding for public recreation-based organizations and services.

- Fundraising: Ranging from small face-to-face community-based events to large-scale national campaigns, nonprofit organizations frequently hold fundraisers and fundraising campaigns to continue or increase funding for programs and services relied upon by their clients. As nonprofits often rely heavily on financial support from the public, fundraisers are often deemed essential to making (“raising”) monies. Whether it’s an ongoing appeal, a targeted annual campaign occurring over the span of 2 months, or a single evening, fundraising efforts are frequently found in the nonprofit sector. Fundraisers can take the form of just about anything – a bake sale, a silent auction, a live dessert auction, an annual gala, a charity paint night, a large annual campaign stretched out over months and more. Organizations put individuals (or committees) in charge of creating fundraisers that will appeal to stakeholders, staff, alumni, members, businesses, friends and families, with the goal of seeking financial contributions to the organization. Many fundraisers have specific themes and are designed to generate funds to support a specific cause or division of the organization. Example: Annual Fundraising Campaign – The Daffodil Campaign, Canadian Cancer Society. Occurring in the spring for more than 65 years, the Canadian Cancer Society’s Daffodil Campaign raises money for cancer research. Donating is as simple as clicking their website’s “Donate Now” button.

Screenshot of Canadian Cancer Society Daffodil donation page. Used under Fair Dealing for Educational Purposes (Canada). - Donations: (Occur mostly in the not-for-profit sector, occasionally in the public sector). For many non-profit organizations, gifts and donations are a significant form of revenue. Sometimes, gifts and donations occur as part of a fundraising campaign. In other instances, gifts and donations can occur at any time.

Term to Learn:

“Gifts In-Kind” (GIK) – A gift-in-kind (also known as an “In-Kind” donation), is any physical asset or materials freely given to an agency or organization by a donor who does not wish for or require any financial transaction or compensation for the gift. Examples: A piano or other musical instrument, books, plants, office supplies, sleeping bags, a vehicle, etc. In-kind gifts can also include services, like a sharing or donation of labour, facilities and/or other equipment, OR any donation of time performing a service that the non-profit organization would otherwise have to pay for. Examples: A yoga instructor commits to offering 4 weeks of beginner yoga classes, a chef gifts his time to run a 3-hr cooking workshop, an Art Therapist offers a free painting workshop at a Long Term Care Home.

- Sales: Sales are most frequently found in the commercial/private sector. Although direct sales of goods and services are generally associated with businesses in the private sector, nonprofit and public organizations sometimes engage in sales as well. When it comes to sales, a profit is almost always built into the retail costs to the consumer, known as a ‘mark-up’. Examples: Concession stand food items, company merchandise (t-shirts, mugs, pens), tuck shop items in a retirement home, branded t-shirts and ballcaps for purchase at the local sports arena.

- Sponsorships: Refers to the position of a person, group or organization to vouch for, support, advise or help fund another person, organization or project. Sponsorships almost always involve a promise from the recipient to somehow acknowledge the sponsor, often by way of advertising or the inclusion of the sponsor’s name or logo on marketing materials and merchandise. Sponsorships provide an organization with financial support or revenue while providing the sponsor with market recognition and promotional opportunities. The key to effective sponsorships is ensuring the relationship is mutually beneficial and reciprocal – a consciously created win-win. Corporate sponsorship is commonly seen at sporting events, museum programs, art installations, and festivals. “The conventional wisdom is that a corporate sponsor facilitates a mental link between a brand and a popular event, program, project or person, and customers—the so-called ‘halo effect’” (Kenton, 2021).

- Partnerships Partnerships happen most often among organizations in the nonprofit sector; however, partnerships can occur across sectors and involve partners in different sectors. Partnerships occur when one organization reaches out and connects with another, often like-minded, organization in the community. They create a vision together for a specific service, a project or an event designed to benefit both sides equally. In some cases, grant money may be involved. Partnerships allow organizations to work together to effect positive change in the community and to support or amplify each organization’s Mission, Vision and Core Values. Some partnerships are singular one-off events, while others are events that have been occurring annually for years.

“LUM Logo” by Michelle Hancock. Example: For several years, a partnership has existed between McCormick Care Group (in the non-profit sector) and the Fanshawe College Recreation and Leisure Services program (a public sector educational institution). Each year, the students design and facilitate a fundraising event for McCormick Care Foundation, aimed at advancing excellence in programs and research in dementia care. The partnership is mutually beneficial: Students have the opportunity to serve the needs of a non-profit organization and to practically apply their event-planning skills under the mentorship of fundraising professionals, while the McCormick Care Group benefits from the proceeds of the fundraising event. A win-win!