4.8 Total Ownership Cost

Consumers and business firms purchase products at a specific price to fulfill operational or consumption needs. However, the true economic burden associated with a product extends beyond its initial purchase price. Once a product is acquired, the owner incurs additional costs throughout its lifecycle. These supplementary expenses, combined with the purchase price, constitute the Total Ownership Cost (TOC), also known as Total Cost of Ownership (TCO).

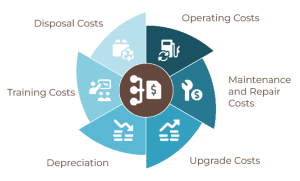

TOC encompasses a wide range of direct and indirect costs, including:

- Operating Costs: Ongoing expenses related to the product's function, such as energy or fuel consumption.

- Maintenance and Repair Costs: Expenditures required to keep the product in working order.

- Upgrade Costs: Expenses associated with enhancing the product's capabilities or extending its lifespan.

- Depreciation: The reduction in the product's value over time.

- Training Costs: Expenses related to educating personnel on the product's proper use.

- Disposal Costs: Expenses incurred at the end of the product's useful life.

The following video provides a concise overview of the Total Cost of Ownership concept:

Video: "How to Calculate the Total Cost of Ownership" by Edspira [1:34] is licensed under the Standard YouTube License.Transcript and closed captions available on YouTube.

The Total Cost of Ownership (TCO) is a financial estimate that helps consumers and enterprise managers determine the direct and indirect costs of a product or system over its entire lifecycle. The following example explains TCO for a small manufacturing firm

Example: Medway Metal Products - Press Machine Acquisition

Medway Metal Products has recently acquired a specialized press machine for a purchase price of $100,000. In addition to this initial cost, several other acquisition-related expenses were incurred: $2,000 for legal review of the contract, $5,000 for shipping and handling, $10,000 for on-site installation, $7,000 for customization to meet specific production requirements, and $3,000 for initial operator training. The projected lifecycle of this machine is five years, at the end of which its disposal is estimated to cost $5,000. Due to the machine's specialized application, beyond the annual routine maintenance cost of $3,000, a significant recalibration and upgrade costing $15,000 will be required in the third year of operation. The machine's operation will also incur annual costs of $5,000 for energy consumption and $10,000 for specific custom materials. Furthermore, ongoing training for new operators is estimated at $1,000 per year. The objective is to determine the Total Cost of Ownership (TCO) for this press machine over its five-year lifecycle.

The Total Cost of Ownership (TCO) is calculated by aggregating the Total Acquisition Cost (TAC) and all subsequent operational and end-of-life costs.

Total Acquisition Cost (TAC):

[latex]\begin{align*} {\small \text{TAC}} =& {\small \text{Purchase Price}} + {\small \text{Legal Fees}} + {\small \text{Shipping}}\\ &+ {\small \text{Installation}} + {\small \text{Customization}} + {\small \text{Initial Training}} \\ {\small \text{TAC}} =& \$100,000 + \$2,000 + \$5,000 + \$10,000 + \$7,000 + \$3,000 \\ {\small \text{TAC}} =& \$127,000 \end{align*}[/latex]

Usage Costs (Operational and End-of-Life Costs):

Usage costs include all expenses associated with owning and operating the machine throughout its lifecycle, including disposal.

[latex]\begin{align*} {\small \text{Usage Costs}} =&{\small \text{(Annual Energy Cost}} + {\small \text{Annual Material Cost)}} \times {\small \text{Lifecycle (Years)}}\\ &+ {\small \text{(Annual Maintenance Cost}} \times {\small \text{Lifecycle (Years))}} \\ &+ {\small \text{(Annual New Operator Training Cost}} \times {\small \text{Lifecycle (Years))}}\\ &+ {\small \text{Upgrade Cost}} + {\small \text{Disposal Cost}}\\ {\small \text{Usage Costs}} =&(\$5,000 + \$10,000) \times 5 + (\$3,000 \times 5) + (\$1,000 \times 5) \\&+ \$15,000 + \$5,000\\ {\small \text{Usage Costs}} =&\$75,000 + \$15,000 + \$5,000 + \$15,000 + \$5,000\\ {\small \text{Usage Costs}} =&\$115,000 \end{align*}[/latex]

Total Cost of Ownership (TCO):

The TCO is the sum of the Total Acquisition Cost and the total Usage Costs over the asset's lifecycle.

[latex]\begin{align*} {\small \text{TCO}} &= {\small \text{TAC}} + {\small \text{Usage Costs}}\\ {\small \text{TCO}} &= \$127,000 + \$115,000\\ {\small \text{TCO}} &= \$242,000 \end{align*}[/latex]

Therefore, the Total Cost of Ownership for the Medway Metal Products press machine over its five-year lifecycle is $242,000. This comprehensive figure provides a more accurate understanding of the long-term financial implications of this capital investment compared to solely considering the initial purchase price.

Comparing TAC and TOC

Total Acquisition Cost (TAC) and Total Ownership Cost (TOC) represent distinct but complementary perspectives on the financial implications of acquiring and utilizing an asset. TAC primarily focuses on the initial, upfront expenditures associated with obtaining an asset or a customer. In contrast, TOC provides a more encompassing view of all costs accrued throughout the entire lifecycle of the asset, extending beyond the initial acquisition phase to include operational, maintenance, and disposal expenses.

The strategic application of both TAC and TOC metrics enables more informed and robust decision-making processes. TAC is particularly valuable for immediate budgetary planning and for conducting comparative analyses of the initial capital outlays required for different acquisition options. Conversely, TOC is instrumental in long-term financial planning and can reveal scenarios where a seemingly higher initial investment (leading to a higher TAC) may ultimately result in lower overall costs over the asset's lifespan due to factors such as reduced operating expenses, lower maintenance requirements, or enhanced durability.

To further elucidate this concept, consider a comparative analysis of the press machine example from Medway Metal Products (Machine A) with an alternative machine (Machine B) that presents a different cost profile. Machine A had a TAC of $127,000 and a TOC of $242,000 over five years.

Let's assume Machine B has a higher acquisition cost ($150,000 TAC) but significantly lower usage costs of $80,000 over five years due to superior energy efficiency and reduced maintenance needs.

| Cost Component | Machine A | Machine B |

|---|---|---|

| Total Acquisition Cost (TAC) | $127,000 | $127,000 |

| Total Usage Costs | $115,000 | $80,000 |

| Total Ownership Cost (TOC) | $242,000 | $230,000 |

In this revised scenario, while Machine B has a higher initial TAC, its lower usage costs result in a lower overall TOC ($230,000) compared to Machine A's $242,000 over the five-year period. This demonstrates how focusing solely on the initial purchase price (TAC) could lead to a suboptimal long-term financial decision.

By strategically considering both TAC and TOC, businesses can make more judicious decisions that effectively balance short-term budgetary constraints with the imperative of long-term financial efficiency and overall value creation.

Video: "Life Cycle Costing" by Angie Rodriguez [5:42] is licensed under the Standard YouTube License.Transcript and closed captions available on YouTube.