Chapter 5 Summary

Key Concepts

- 5.1 Net Present Value

- The characteristics of making decisions including decision types, monetary sources, and interest rates.

- Making decisions through net present value.

- 5.2 Internal Rate of Return

- Using internal rate of return to choose whether to pursue one course of action.

Glossary of Terms

Cash Flow. A movement of money into or out of a particular project.

Cost of Capital. A weighted average of all of the debt and equity financing rates used to provide needed funds for a project.

Internal Rate of Return ([latex]IRR[/latex]). The annual rate of return on the investment being made such that the net present value of all cash flows in a particular project equals zero.

Net Present Value ([latex]NPV[/latex]). The difference in today's dollars between all benefits and costs for any given project.

Formula & Symbol Hub

Symbols Used

- [latex]NPV[/latex] = net present value

- [latex]IRR[/latex] = internal rate of return

Formulas Used

-

Formula 5.1 - Net Present Value

[latex]NPV = \text{(Sum of}\;PV\;\text{of All Future Cash Flows)} − \text{(Initial Investment)}[/latex]

or

[latex]NPV = \text{(Sum of }\;PV\;\text{of Cash Inflows)} − \text{(Sum of}\;PV\;\text{of Cash Outflows)}[/latex]

Calculator

-

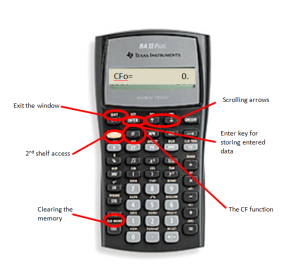

Cash Flow Worksheet

- Access the cash flow function by pressing [latex]CF[/latex] on the keypad.

- Always clear the memory using 2nd CLR WORK so that any previously entered data is deleted.

- Use the up arrow and down arrow to scroll through the various lines.

- Strictly adhere to the cash flow sign convention when using this function and press ENTER after keying in the data.

- To exit the window, press 2nd QUIT.

- The various lines are summarized below:

- [latex]CFo[/latex] = any cash flow today.

- [latex]CXX[/latex] = a particular cash flow, where [latex]XX[/latex] is one of a series of cash flow numbers starting with [latex]01[/latex]. You must key in cash flows in order from the first time segment to the last. You cannot skip a time segment, even if it has a value of zero, because each time segment is a placeholder on the timeline.

- [latex]FXX[/latex] = the frequency of a particular cash flow, where [latex]XX[/latex] is the cash flow number. It is how many times in a row the corresponding cash flow amount occurs. This allows you to enter recurring amounts together instead of keying them in separately. By default, the calculator sets this variable to [latex]1[/latex].

-

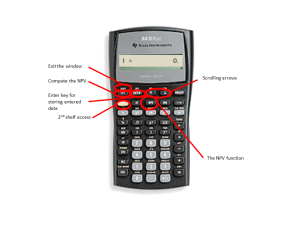

Net Present Value

- Use this function after you have entered all cash flows.

- Press [latex]NPV[/latex] on the keypad to access the function.

- Use the up arrow and down arrow to scroll through the window.

- To exit the window, press 2nd QUIT.

- This window has two lines:

- [latex]I[/latex] = the matching periodic interest rate for the interval of each time segment.

- [latex]NPV[/latex] = the net present value. Press [latex]CPT[/latex] to calculate this amount.

-

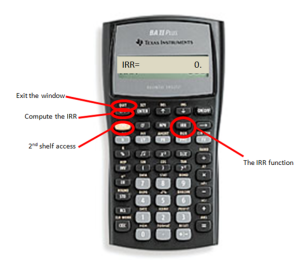

Internal Rate of Return

- Use this function after you have entered all cash flows.

- Press [latex]IRR[/latex] on the keypad to access the function.

- Press [latex]CPT[/latex] button to perform the calculation. The output is in percent format.

- To exit the window, press 2nd QUIT.

Figure 5.4.3

Cash Flows 1: Net Present Value (NPV) and IRR Calculations by Joshua Emmanuel [2:52] (transcript available).

Attribution

"Chapter 5 Summary" from Financial Math - Math 1175 by Margaret Dancy is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.