Chapter 3 Summary

Key Concepts Summary

- 3.1 Amortization Schedules

- The concept of amortization.

- The development of an amortization schedule.

- The development of a partial amortization schedule.

- 3.2 Calculating the Principal and Interest Components of a Loan

- How to calculate interest and principal components for a single payment.

- How to calculate interest and principal components for a series of payments.

- Variable changes in future value annuity calculations.

- 3.3 Calculating the Final Payment

- Understanding why the final payment is different than all the other payments.

- How to calculate the exact amount of the final payment.

- 3.4 Mortgages

- The language and concepts involved in mortgages.

- How to calculate the mortgage payment.

- The procedure involved in renewing a mortgage.

- The procedure involved with prepayment options.

Glossary of Terms

Amortization. A process by which the principal of a loan is extinguished over the course of an agreed-upon time period through a series of regular payments that go toward both the accruing interest and principal reduction.

Amortization Period. The length of time it will take for the principal of a loan to be reduced to zero.

Amortization Schedule. A table that shows the payment amount, principal component, interest component, and remaining balance for every payment in the annuity.

Amortization Term. The length of time for which the interest rate and payment agreement between the borrower and the lender will remain unchanged.

Closed Mortgage. A type of mortgage that has many strict rules and does not allow the mortgager to pay off the debt in full until the loan matures. Early payment incurs substantial penalties.

Foreclosure. A process that allows a financial institution to evict tenants from a mortgaged property and put the property up for sale. The proceeds of the sale are then used to pay off the mortgage.

Mortgage. A special type of loan that is collaterally secured by real estate property.

Mortgagee. The financial institution that lends the money for a mortgage.

Mortgagor. The individual or business that borrows the money for a mortgage.

Open Mortgage. A type of mortgage that has very few rules and allows the mortgagor to pay off the debt in full or with additional prepayments at any given point without penalty.

Partial Amortization Schedule. Amortization schedules that show only a specified range of payments and not the entire annuity.

Formula & Symbol Hub

Symbols Used

- [latex]BAL[/latex] = Principal balance immediately after a loan payment

- [latex]INT[/latex] = Interest portion of a loan payment or a series of payments

- [latex]PRN[/latex] = Principal portion of a loan payment or a series of payments

- [latex]PMT[/latex] = Annuity payment amount

- [latex]I/Y[/latex] = Nominal interest rate

- [latex]P/Y[/latex] = Number of payments per year or payment frequency

- [latex]C/Y[/latex] = Number of compounds per year or compounding frequency

- [latex]N[/latex] = Total number of annuity payments

Calculator

-

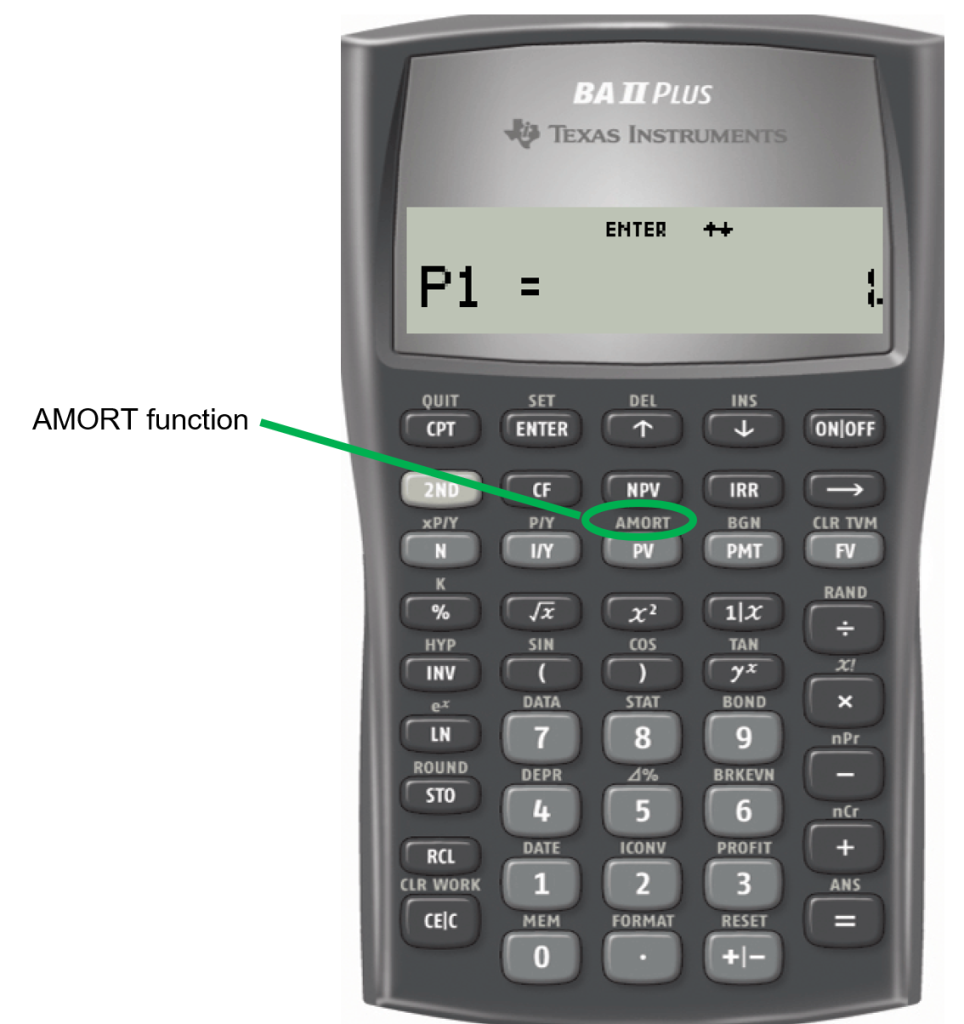

Amortization Worksheet

- AMORT is located on the 2nd shelf above the [latex]PV[/latex] button.

-

- There are five variables in the amortization worksheet:

- [latex]P1[/latex] is the starting payment number. The calculator can work with a single payment or a series of payments.

- [latex]P2[/latex] is the ending payment number. This number is the same as [latex]P1[/latex] when you are concerned with just a single payment. When working with a series of payments, you can set it to a higher number.

- [latex]BAL[/latex] is the principal balance remaining after the payment number entered into the [latex]P2[/latex] variable. The cash flow sign is correct as indicated on the calculator display.

- [latex]PRN[/latex] is the principal portion of the payments from [latex]P1[/latex] to [latex]P2[/latex] inclusive. Ignore the cash flow sign.

- [latex]INT[/latex] is the interest portion of the payments from [latex]P1[/latex] to [latex]P2[/latex] inclusive. Ignore the cash flow sign.

- To use the amortization worksheet:

- Enter all seven of the time value of money variables accurately ([latex]N[/latex], [latex]I/Y[/latex], [latex]PV[/latex], [latex]PMT[/latex], [latex]FV[/latex], [latex]P/Y[/latex], and [latex]C/Y[/latex]). If [latex]PMT[/latex] was computed, you must re-enter it with only two decimals while retaining the correct cash flow sign convention.

- Press 2nd AMORT.

- Enter a value for [latex]P1[/latex], press ENTER and then the down arrow.

- Enter a value for [latex]P2[/latex], press ENTER and then the down arrow. Note that the higher the numbers entered in [latex]P1[/latex] or [latex]P2[/latex], the longer it will take the calculator to compute the outputs. It is possible that the calculator will go blank and take a few moments before displaying the outputs.

- Press the down arrow to scroll through [latex]BAL[/latex], [latex]PRN[/latex], and [latex]INT[/latex] to read the output.

- There are five variables in the amortization worksheet:

Video: Amortization Schedule using BAII Plus by Joshua Emmanuel [3:55] Transcript Available.

Video: Mortgage Calculations using BAII Plus by Joshua Emmanuel [4:13] Transcript Available.

Attribution

"Chapter 3 Summary" from Financial Math - Math 1175 by Margaret Dancy is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.