Chapter 22: Sustainable Finance

22.2 Global Initiatives Towards Sustainable Finance

Sustainability is becoming increasingly important to our society. However, how can organizations become more sustainable? Many initiatives have come into existence which provide a network and support for organizations that want to operate more sustainably. Some larger initiatives include:

- Paris Agreement

- United Nations Sustainable Development Goals (SDGs)

- Principles of Responsible Investment

Paris Agreement

The Paris Agreement is a legally binding international treaty on climate change that brings the world together to combat climate change. It was adopted by 196 Parties at COP 21(Coreference of Parties) in Paris, on December 12, 2015, and entered into force on November 4, 2016. Negotiated under the Framework Convention on Climate Change, a unit of the United Nations, it is the result of 20 years of international effort. The parties to the Agreement are sovereign states who agree to take actions to meet an ambitious goal: to hold the rise in global temperature “well below” 2 degrees Celsius, and to try for 1.5 degrees (United Nations Climate Change, n.d.b).

The main focus of the Paris Agreement is lowering greenhouse gas emissions by a system of pledge and review. Each party commits to declare a plan of climate action—its “nationally determined contribution” or NDC (United Nations Climate Change, n.d.a). Each NDC includes a pledge to reduce emissions by a certain amount before a target date, 2030 for most. The Agreement also requires nations to report regularly on their progress, and it lays out the accounting rules for tracking national emissions. NDCs are updated on a five-year schedule, with each update calling for steeper reductions in emissions. An update of the first NDCs occurred in 2021, with commitments beyond 2030 to be pledged in 2025.

The Agreement also covers many other aspects of a global response to the climate threat. For example, it includes provisions to strengthen efforts to adapt to a changing climate, and it sets rules and procedures for international cooperation, where countries that exceed their NDCs can sell the excess reductions to other countries to help meet their pledges (Federal Ministry for Economic Affairs and Climate Action, n.d.). Moreover, the 2015 Paris Agreement on Climate Change anchors an earlier pledge by developed countries to raise USD 100 billion per year; indeed, this is established as the “floor” from which climate finance should be up-scaled post-2020. The Paris Agreement states that financial flows generally must be made “consistent with a pathway towards low greenhouse gas emissions and climate-resilient development.” To this end, the public sector increasingly looks to the private sector to leverage its limited financial resources. For financial institutions, the Paris alignment is a process through which a financial institution aims to align its business, portfolios, and strategy with the objectives of the Paris Agreement consistent with achieving a global target of net-zero emissions by 2050.

Did You Know? Net Zero and Paris Agreement

The Paris Agreement is a globally significant agreement to limit global warming. It is important to go to the source itself to understand what the Paris Agreement states. Let’s look at some of the key statements in the Paris Agreement. The preamble includes a statement about human rights, which begins with an acknowledgement “that climate change is a common concern of humankind” (United Nations, 2015, p.2).

In other words, tackling climate change is not really about saving the planet – the planet will still be here even if humans are not! Tackling climate change is about maintaining life-supporting systems for humans, their activities, and their development – humans and other species are vulnerable and dependent on the functioning and state of our natural systems, specifically our climate. Article 2 of the agreement states (p. 3):

-

This Agreement […] aims to strengthen the global response to the threat of climate change, in the context of sustainable development and efforts to eradicate poverty, including by:

(a) Holding the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels, recognizing that this would significantly reduce the risks and impacts of climate change;

(b) Increasing the ability to adapt to the adverse impacts of climate change and foster climate resilience and low greenhouse gas emissions development, in a manner that does not threaten food production; and

(c) Making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development.

-

This Agreement will be implemented to reflect equity and the principle of common but differentiated responsibilities and respective capabilities, in the light of different national circumstances.

This is a key article in the Paris Agreement. It highlights the temperature limit agreed upon, that development should integrate both adaptation and be low carbon, and that rich nations have a greater responsibility to address climate change. This last point reflects that rich countries have more capability to address climate change, but also recognizes that these nations’ economic development resulted from them producing the majority of global emissions to date (we will discuss this further later in the chapter). This is what the climate negotiations at the Conference of Parties (COP) every year are about nations coming together to discuss progress, commitments, and responsibilities.

In Article 4, the agreement further states that

-

In order to achieve the long-term temperature goal set out in Article 2, Parties aim to reach global peaking of greenhouse gas emissions as soon as possible, recognizing that peaking will take longer for developing country Parties, and to undertake rapid reductions thereafter in accordance with best available science, so as to achieve a balance between anthropogenic emissions by sources and removals by sinks of greenhouse gases in the second half of this century, on the basis of equity, and in the context of sustainable development and efforts to eradicate poverty. (p. 4)

This article actually refers to “net zero” – the balancing of carbon sources with sinks. However, note that it is in the context of Article 2, and needs to be paired with rapid reductions. It is not possible, at this point, to create enough carbon sinks to absorb our emissions.

Download the entire Paris Agreement [PDF] from the United Nations Climate Change website.

United Nations Sustainable Development Goals (UN SDGs)

The Sustainable Development Goals (SDGs) are a set of 17 goals, with 169 targets, that are “a blueprint to achieve a better and more sustainable future for all” (United Nations, n.d.). All 193 of the world’s countries have committed to these goals, which are to be achieved by 2030.

Organizations, including financial companies, have a part to play in meeting the SDGs. The United Nations Global Compact (UNGC) was launched in 2000 to assist them to do this. The UNGC is the largest global corporate sustainability initiative and has over 23,000 signatories from 166 countries.

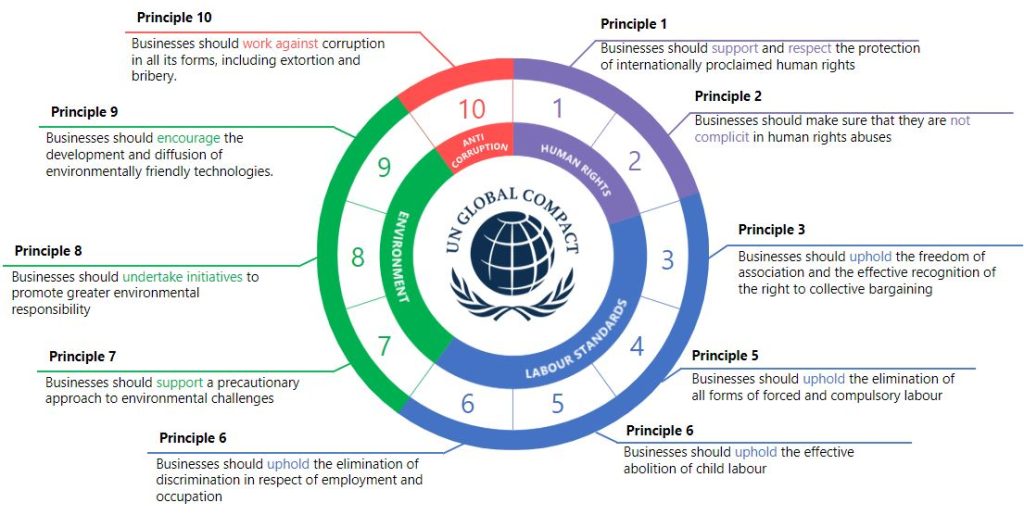

UNGC signatories commit to responsibility in their everyday operations, strategies and culture across four areas: human rights, labour, environment and anti-corruption. UNGC signatories are required to implement ten principles, shown in Figure 22.1, and communicate how they are implementing these principles in their annual or sustainability report. The UNGC also provides education and training to its signatories on how they can more effectively embed the SDGs into their businesses.

Source: Adapted from The Ten Principles of the UN Global Compact by the United Nations Global Compact. The logo is a trademark of the United Nations Global Compact.

Credit: “UNGC Ten Principles” in Frameworks for Sustainable Investment © 2024 by The University of Queensland, CC BY-NC 4.0.

Let’s Explore: UN Sustainable Development Goals

Credit: © United Nations, available for non-commercial use.

To learn more about the UN Sustainable Development Goals, explore this interactive map created by Working Group: FabLabs and Sustainable Development Goals. Click on each goal to learn more, zoom-in to reveal the subgoals by clicking on the node to the right of each goal.

For a full-text version of the goals, visit the UN SDG website.

Principles of Responsible Investment

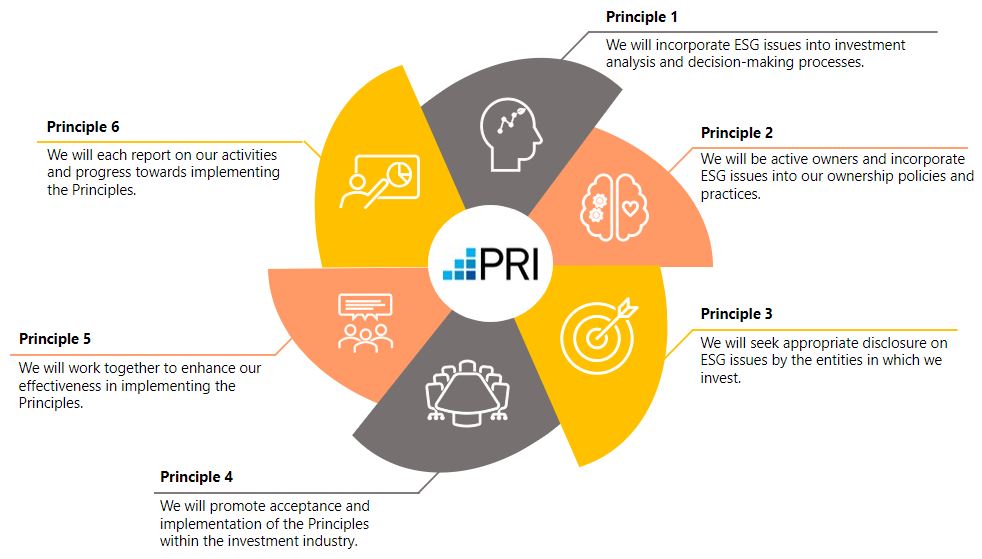

The United Nations-supported Principles for Responsible Investment (PRI) is another important large global sustainability initiative. The PRI was designed to help the finance industry – asset owners, investment managers and service providers – to become more sustainable by integrating ESG into investment and operating decisions.

The PRI was launched in 2006 with 46 signatories. The number of signatories has grown astronomically since its launch, and today, there are over 5,300 global signatories. PRI signatories commit to six principles on how they will operate and invest (See Figure 22.2). Signatories are also required to report annually to the PRI on their progress on ESG issues. Signatories that fail to report for two years are delisted.

Source: Adapted from What are the Principles for Responsible Investment? The PRI logo is a trademark of Principles for Responsible Investment.

Credit: “The Six Principles for Responsible Investment” in Frameworks for Sustainable Investment © 2024 by The University of Queensland, CC BY-NC 4.0.

The PRI also provides education and investor tools for its signatories to help them to become more sustainable. PRI conferences and workshops provide an opportunity for signatories and academics working in ESG to share knowledge, information, and networks.

In addition, the PRI facilitates collective action on ESG issues e.g., writing joint letters to companies, engaging or voting collectively on ESG issues. A recent example of a collective action coordinated by the PRI is when signatories could sign a letter addressed to Nike for reparations because their largest supplier had not paid wages to 4,500 garment workers in Cambodia and Thailand.

Other Sustainability Initiatives

Recent years have seen a proliferation of voluntary sustainability initiatives. Table 22.1 highlights some of those larger initiatives.

| Initiative name | Summary | Number and type of signatories |

|---|---|---|

| Climate Action 100+ | Investor-led initiative to engage with companies on how they are taking climate-related action. Launched in 2017. | Over 700 investors |

| Net Zero asset owner alliance | Convened by the UN. Investor-led initiative of institutional investors who commit to transitioning their portfolios to net zero emissions by 2050. Launched in September 2019. | 86 asset owners, with combined worth of US$11 trillion |

| Net Zero asset managers | Convened by the UN. Asset managers who support and commit to investment aligned with achieving net zero emissions by 2050. Launched in December 2020. | Over 315 signatories with US$59 trillion in AUM |

| Net Zero banking alliance | Convened by the UN. Leading global banks who commit to financing climate action to meet net zero emissions by 2050. Launched in April 2021. | 133 banks worth US$74 trillion (41% of banking assets globally) |

| New Plastics Economy | Launched by the Ellen MacArthur Foundation and the UN Environment Programme. Targets the production, use, and reuse of plastics and works towards a circular economy for plastics. Launched in 2018. | Over 500 signatories, including corporations and governments |

| High ambition coalition to end plastic pollution | Intergovernmental group to end plastic use 2040. Launched in March 2022. | 60 countries |

| Valuing water finance initiative | Investor-led group facilitated by Ceres, a sustainability NGO. Designed to engage with companies that use and pollute a large amount of water-on-water management and protect global freshwater resources. Launched in August 2022. | 85 investor signatories with approximately US$14 trillion in assets under management. |

| High ambition coalition for nature and people | Intergovernmental group to conserve and manage at least 30% of global land and oceans by 2030. Launched in January 2021. | 115 countries |

References

Coleton A., Font Brucart, M, Gutierrez, M., Le Tennier, F. & Moor, C. (2020). Sustainable finance: Market practices. EBA Staff Paper Series (No.6). European Banking Authority https://data.europa.eu/doi/10.2853/24624

Federal Ministry for Economic Affairs and Climate Action. (n.d.). Cooperative Action under Article 6. https://www.carbon-mechanisms.de/en/introduction/the-paris-agreement-and-article-6/

United Nations Climate Change. (n.d.a). Nationally determined contributions (NDCs). https://unfccc.int/process-and-meetings/the-paris-agreement/nationally-determined-contributions-ndcs

United Nations Climate Change. (n.d.b). The Paris Agreement. https://unfccc.int/process-and-meetings/the-paris-agreement

United Nations Conference on Trade and Development. (2023). Chapter III: Capital markets and sustainable finance [PDF]. In World Investment Report 2023. https://unctad.org/system/files/official-document/wir2023_ch03_en.pdf

United Nations. (2015). Paris Agreement [PDF]. https://unfccc.int/sites/default/files/english_paris_agreement.pdf.

United Nations. (n.d.). The 17 Goals. https://sdgs.un.org/goals.

Attributions

“22.2 Global Initiatives towards Sustainable Finance” is adapted from “Frameworks for Sustainable Investment” by Jacquelyn Humphrey and Saphira Rekkerfrom, from Sustainable Finance by The University of Queensland is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted.

“Paris Agreement” is adapted from “Explainer: The Paris Agreement” © Henry Jacoby, published on the MIT Climate Portal under a CC BY-NC-SA 4.0 license.

“United Nations Sustainable Development Goals (UN SDGs)” is adapted from “Frameworks for Sustainable Investment” by Jacquelyn Humphrey and Saphira Rekkerfrom, from Sustainable Finance by The University of Queensland is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted.

“United Nations Sustainable Development Goals poster” is © United Nations, and available for non-commercial use from UN Sustainable Development Goals website.

“Principles of Responsible Investment” is adapted from “Frameworks for Sustainable Investment” by Jacquelyn Humphrey and Saphira Rekkerfrom, from Sustainable Finance by The University of Queensland is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted.

Figure 22.1: UN Global Compact’s 10 principles reuses “UNGC Ten Principles” in Frameworks for Sustainable Investment by Jacquelyn Humphrey and Saphira Rekker, from Sustainable Finance, © 2024 by The University of Queensland, licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted.

Figure 22.2: The Six Principles for Responsible Investment reuses “The Six Principles for Responsible Investment” in Frameworks for Sustainable Investment by Jacquelyn Humphrey and Saphira Rekker, from Sustainable Finance, © 2024 by The University of Queensland, licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted.

Table 22.1: Sustainability Initiatives is adapted from Frameworks for Sustainable Investment by Jacquelyn Humphrey and Saphira Rekker, from Sustainable Finance, © 2024 by The University of Queensland, licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted.

Image Descriptions

Figure 22.1: UN Global Compact’s 10 principles

The image presents a thematic circular diagram titled “UN GLOBAL COMPACT” in the centre. The diagram has four concentric rings, divided into ten segments representing ten principles, covering areas like human rights, labour standards, environment, and anti-corruption. Each segment is colour-coded and labelled with its corresponding principle, ranging from 1 to 10. The innermost circle is coloured in navy blue, featuring the title and a laurel wreath emblem. Moving outward, the rings alternate in shades of green, purple, blue, and red, with white text stating the specifics of each principle. The principles are summarizing business responsibilities, such as working against corruption, supporting human rights, and encouraging environment-friendly technologies. The principles are listed as follows:

- Human Rights (Purple)

- Principle 1: Businesses should support and respect the protection of internationally proclaimed human rights.

- Principle 2: Businesses should make sure that they are not complicit in human rights abuses.

- Labour Standards (Blue)

- Principle 3: Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining.

- Principle 4: Businesses should uphold the elimination of all forms of forced and compulsory labour.

- Principle 5: Businesses should uphold the effective abolition of child labour.

- Environment (Green)

- Principle 6: Businesses should uphold the elimination of discrimination in respect of employment and occupation.

- Principle 7: Businesses should support a precautionary approach to environmental challenges.

- Principle 8: Businesses should undertake initiatives to promote greater environmental responsibility.

- Principle 9: Businesses should encourage the development and diffusion of environmentally friendly technologies.

- Anti-Corruption (Red)

- Principle 10: Businesses should work against corruption in all its forms, including extortion and bribery.

[back]

United Nations Sustainable Development Goals Poster

The image is a colorful infographic titled “Sustainable Development Goals.” It includes a grid of 17 small, square icons, each representing one of the United Nations Sustainable Development Goals (SDGs). The title “Sustainable Development Goals” is located at the top right, with the word “GOALS” written in blue, with the letter “O” formed by a multicoloured circle symbolizing the 17 goals.

- Icon for “No Poverty” with a red background featuring a white graphic of a family: two adults and two children holding hands.

- Icon for “Zero Hunger” with a dark yellow background, illustrating a white bowl with lines indicating steam.

- Icon for “Good Health and Well-Being” with a bright green background, depicting a white heartbeat line with a heart.

- Icon for “Quality Education” with a dark red background, showing a white open book and pencil.

- Icon for “Gender Equality” with a dark pink background featuring a combined male and female gender symbol.

- Icon for “Clean Water and Sanitation” with a cyan background, displaying a white glass of water with a drop.

- Icon for “Affordable and Clean Energy” with a yellow background, illustrating a white sun with a power button in the center.

- Icon for “Decent Work and Economic Growth” with a reddish-brown background, featuring a white graph with an upward trend.

- Icon for “Industry, Innovation, and Infrastructure” with an orange background, showing three white connected hexagons.

- Icon for “Reduced Inequalities” with a bright pink background, depicting four white arrows pointing inward.

- Icon for “Sustainable Cities and Communities” with a dark orange background, showing white city buildings.

- Icon for “Responsible Consumption and Production” with an orange background featuring a white infinity loop.

- Icon for “Climate Action” with a green background, displaying a white eye with a globe.

- Icon for “Life Below Water” with a blue background, showing a white fish and waves.

- Icon for “Life on Land” with a green background, illustrating a white tree and bird.

- Icon for “Peace, Justice, and Strong Institutions” with a dark blue background featuring a white dove with an olive branch and a gavel.

- Icon for “Partnerships for the Goals” with a dark blue background, showing five white interconnected circles.

[back]

Figure 22.2: The Six Principles for Responsible Investment

The image displays a circular diagram divided into six segments, each representing a principle related to investment analysis and decision-making. The diagram’s segments are colour-coded with different shades of orange, grey, and yellow. At the centre of the diagram is the “PRI” logo. Each segment has a number and a brief description of the principle it represents, along with a distinct icon that visually represents the principle’s theme. Starting at the top and moving clockwise, the principles are numbered from 1 to 6:

- Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

- Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

- Principle 6: We will each report on our activities and progress towards implementing the Principles.

[back]

formal agreement among 196 UN member states to address causes of climate change, adopted at the 2015 COP 21 conference in Paris, France

a government’s plan for national climate actions, including climate-related targets, policies, and measures, as per the Paris Agreement

public finance that promotes multilateral efforts to combat climate change through the UN Framework Convention on Climate Change (UNFCCC)

when a financial institution aims to align its business, portfolios, and strategy with Paris Agreement objective of net-zero emissions by 2050