Chapter 21: International Financial Institutions

21.2 Types of International Financial Institutions

Financial institutions are the firms and regulatory agencies that oversee our financial system. These institutions were created by the national governments of different countries to facilitate investment practices in the global economy.

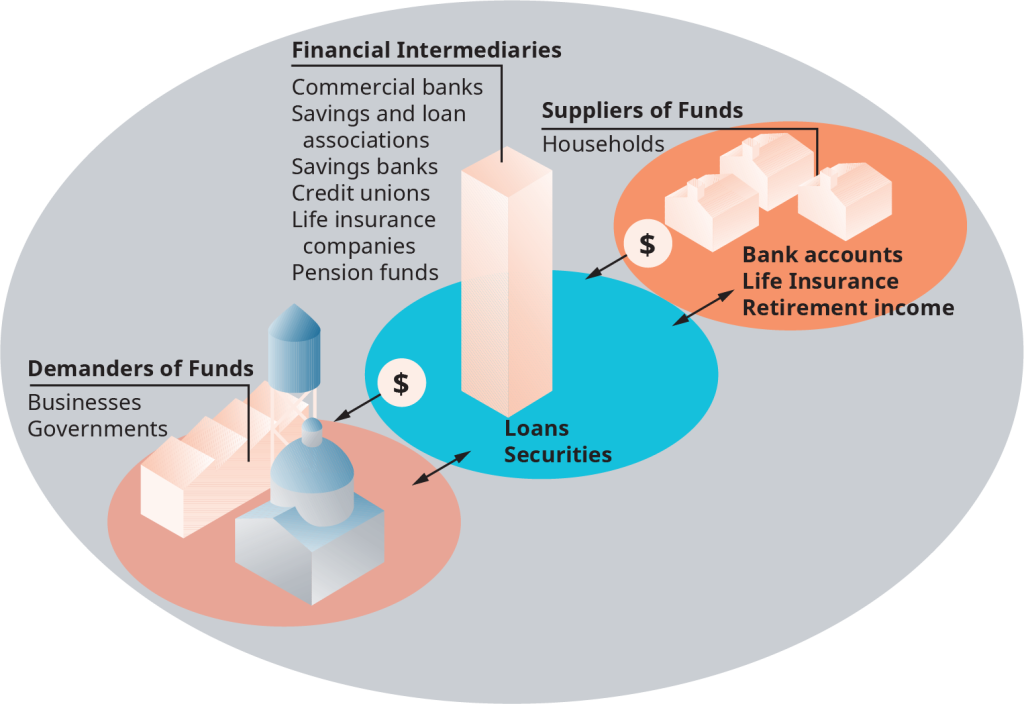

Most often, financial institutions act as intermediaries between the suppliers and demanders of funds. The institutions accept savers’ deposits and invest them in financial products (such as loans) that are expected to produce a return. This process, called financial intermediation, is shown in Figure 21.2.

Credit: “Exhibit 15.5 The Financial Intermediation Process,” © Rice University, OpenStax, under CC BY 4.0 license.

As shown in Figure 21.2, households are suppliers of funds and businesses and governments are the demanders. Financial Intermediaries act as middlemen and facilitate the movement of funds between borrowers and lenders. There are several types of International Financial Institutions (IFIs):

- Multilateral Development Banks: A multilateral development bank (MDB) is an institution created by a group of countries that provides financing and professional advice for the purpose of development. MDBs have large memberships, including both developed donor countries and developing borrower countries. MDBs finance projects in the form of long-term loans at market rates, very-long-term loans (also known as credits) below market rates and through grants. Examples include The World Bank, the International Fund for Agricultural Development (IFAD), the European Development Bank, etc. The Islamic Development Bank is among the leading multilateral development banks in the world.

- Bretton Woods Institutions: The best-known IFIs were established after World War II to assist in the reconstruction of Europe and provide mechanisms for international cooperation in managing the global financial system. They include the International Monetary Fund, the International Finance Corporation, the International Bank of Reconstruction and Development, etc. Today, the largest IFI in the world is the European Investment Bank.

- Regional Development Banks: The regional development banks consist of several regional institutions that have functions similar to the World Bank group’s activities but with a particular focus on a specific region. The best-known of these regional banks cover regions that roughly correspond to United Nations regional groupings, including the Inter-American Development Bank, the Asian Development Bank, the African Development Bank, the Central American Bank for Economic Integration, and the European Bank for Reconstruction and Development.

- Bilateral Development Banks and Agencies: A bilateral development bank is a financial institution set up by one individual country to finance development projects in a developing country and its emerging market, hence the term bilateral, as opposed to multilateral. For Instance, the Netherlands Development Finance Company FMO, the DEG German Investment Corporation, the French Development Agency, etc.

- Other Regional Financial Institutions: Financial institutions of neighbouring countries establish themselves internationally to pursue and finance activities in areas of mutual interest. Most of them are central banks, followed by development and investment banks. Some examples are the Bank of International Settlements (BIS), the European Investment Bank (EIB), the African Association of Central Banks (AACB), etc.

Did You Know? History of Financial Institutions in Canada

Financial institutions appeared in Canada in greater numbers and variety in the late 19th century. For most of the 19th century, banks in Canada were not particularly interested in deposits and not at all interested in consumer loans. Instead, they financed merchants’ inventories and facilitated the international payments required by imports and exports. The shift happened gradually, and by the outbreak of the Great War, savings deposits accounted for half of all bank liabilities. This, of course, required a completely different type of banking system.

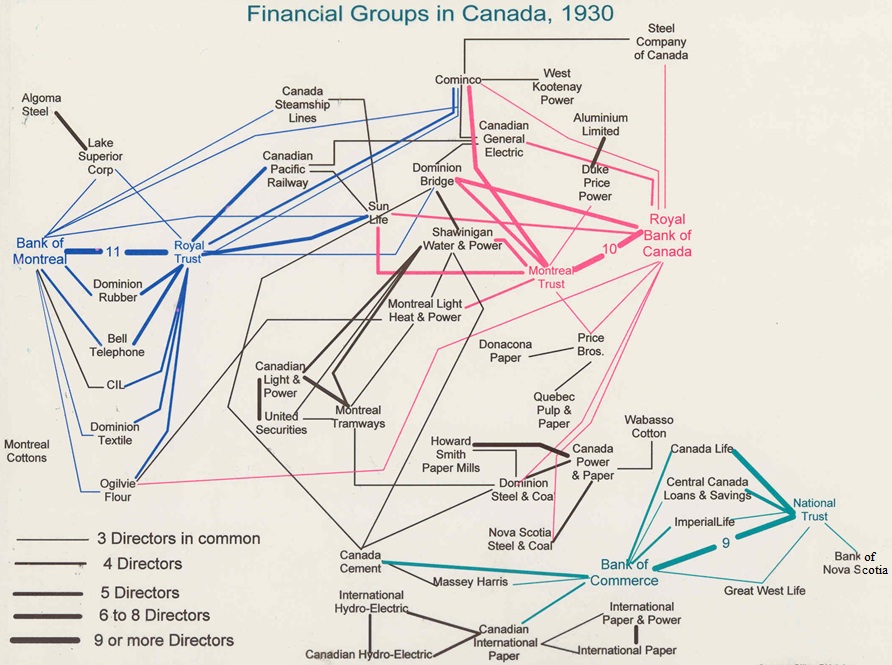

The changes wrought by corporate concentration profoundly affected the banking system and shaped the developing national capital market. Smaller regionally controlled pools of banking capital represented by the Imperial, Toronto, Dominion, and Nova Scotia banks continued to be active in both national and international money and commodity markets. Figure 21.3 shows financial groups in Canada in 1930.

Credit: “Figure 8.2 Directorships in common among the leading firms in Canada, 1930.” Research by Gilles Piédalue, graphic by Robert C.H. Sweeny, CC BY 4.0.

In the United States, much of the regulatory structure for financial markets and institutions developed in the 1930s as a response to the stock market crash of 1929 and the subsequent Great Depression. In the United States, the desire for the safety and protection of investors and the financial industry led to the development of many of our primary regulatory agencies and financial regulations. The Securities and Exchange Commission (SEC) was formed with the passage of the Securities Act of 1933 and the Securities Exchange Act of 1934. Major bank regulations, such as the Glass-Steagall Act (1933) and the Banking Act of 1935, gave rise to government-backed bank deposit insurance and a more robust Federal Reserve Bank.

Attributions

“21.2 Types of International Financial Institutions” is adapted from the following:

- “Econ 2302 Notes: Global Finance” by Amy S. Glenn, licensed under CC BY-NC-SA 3.0.

- “Chapter 7: Money and Banking” in Introduction to Business by Seneca College, licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted.

Figure 21.2: The Financial Intermediation Process is reused from””15.3 U.S. Financial Institutions” in Introduction to Business by OpenStax – Rice University, licensed under a Creative Commons Attribution 4.0 International License, except where otherwise noted.

“Did You Know? History of Financial Institutions in Canada” is adapted from the following:

- “8.3 Capital Markets” in Canadian History: Post-Confederation by Robert Sweeny, Dept. of History, Memorial University of Newfoundland, licensed under a Creative Commons Attribution 4.0 International License, except where otherwise noted.

- “1.1 What Is Finance?” from Principles of Finance by OpenStax – Rice University, licensed under a Creative Commons Attribution 4.0 International License, except where otherwise noted.

Image Descriptions

Figure 21.2: The Financial Intermediation Process

This image presents an infographic of the flow of funds in a financial system. In the centre, in a large blue circle, is a horizontal 3D rectangle labelled “Financial Intermediaries” intended to represent a skyscraper; listed under the label are commercial banks, savings and loan associations, savings banks, credit unions, life insurance companies, and pension funds. “Loans” and “Securities” appear below the skyscraper on the blue circle.

To the left, in a pink circle, with the label “Demanders of Funds,” there are three 3D geometric shapes representing government, farming, and industrial buildings; listed under the label are businesses and governments.

To the right, within an orange circle labelled “Suppliers of Funds,” are three smaller 3D geometric representations of houses; listed under the label is “households.” “Bank accounts,” “Life Insurance,” and “Retirement income” appear on the orange circle under the houses.

There is a dollar sign on both the blue and orange circles. Arrows show the flow of money from the suppliers to the financial intermediaries and from the financial intermediaries to the demanders. Double-sided arrows also show the connection of the financial intermediaries to the demanders via the securities and loans and to suppliers via the bank accounts, life insurance and retirement income.

[back]

Figure 21.3: Financial Groups in Canada, 1930

The image is a network diagram illustrating the interconnectedness of various Canadian companies and financial institutions in 1930 through their boards of directors. Each bank is represented as a node with connections to various industrial businesses, including steel, coal, pulp and paper, cement, railways, and shipping, as well as electrical utilities and insurance companies. Lines, varying in thickness and colour, connect these nodes to signify shared board members. The key at the bottom left corner explains the line thickness: thin lines indicate 3 directors in common, progressively thicker lines represent 4, 5, and 6 to 8 directors, and the thickest lines signify 9 or more directors in common.

On the upper right, the “Bank of Montreal” and “Royal Trust” and their main connections are in blue; at the right, “Royal Bank of Canada” and “Montreal Trust” and their main connections are in red; and at the lower right, “Bank of Commerce” and “National Trust” and their connections are in teal. Other lines connecting all the companies are black. The lines crisscross and overlap, creating a complex web suggesting a highly interconnected financial industry and business landscape of that era.

[back]

any company or firm involved in the financial system and the regulatory agencies and organizations that oversee the financial system

the process in which financial institutions act as intermediaries between suppliers and demanders of funds

a financial institution set up by one individual country to finance development projects in a developing country and its emerging market