Chapter 21: International Financial Institutions

21.1 The Global Financial System

A financial system refers to a set of components and mechanisms, such as monetary policies, insurance, and banks, that allows economic transactions to occur. There are many types of financial systems that exist on different levels of society, ranging from those used to operate transactions within a company to those that facilitate international financial transactions. The absence of these systems drastically impact economies as people may not have access to credit, there would be no monetary products to exchange for goods and there would be no policies regulating complex transactions.

Since the dawn of creation, people have engaged in financial transactions of some sort. Today, financial transactions often take place on an international level within the global financial system. This system allows markets to exchange information and financially impact each other around the clock.

A global financial system can be defined as a system composed of financial institutions and regulators that act on an international level.

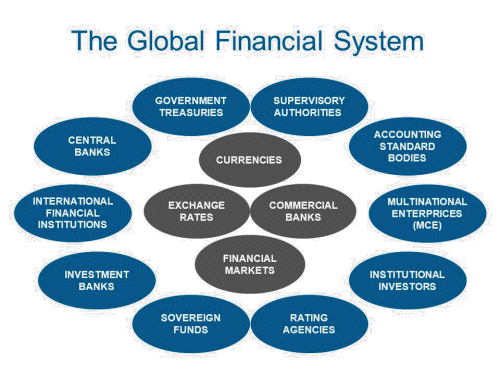

The global financial system (see Figure 21.1) helps economies and organizations by providing core economic functions such as facilitating trade, providing a mechanism for the pooling of resources, managing financial risks, providing price information, and providing ways for countries to transfer economic resources across borders and among different industries with ease. The financial system is a complex system that functions and changes with the economic and political climate.

Consumers, multinational corporations, individual and institutional investors, and financial intermediaries (such as banks) are the key economic actors within the global financial system.

- Central banks (such as the European Central Bank or the U.S. Federal Reserve System) undertake open market operations in their efforts to achieve monetary policy goals.

- International financial institutions such as the Bretton Woods institutions, multilateral development banks and other development finance institutions provide emergency financing to countries in crisis, provide risk mitigation tools to prospective foreign investors, and assemble capital for development finance and poverty reduction initiatives.

- Trade organizations such as the World Trade Organization, Institute of International Finance, and the World Federation of Exchanges attempt to ease trade, facilitate trade disputes and address economic affairs, promote standards, and sponsor research and statistics publications.

Did You Know? The Bank of Canada

The Bank of Canada is Canada’s central bank. It was created in 1935 during the depression. The Bank plays a crucial role in managing the Canadian economy and is very important to Canada’s financial system as it regulates certain areas of chartered bank operations. The Bank is a government-owned crown corporation but is run independently of the federal government, where the Prime Minister (or anyone else in the government) does not make decisions for the Bank, nor can it instruct the Bank of Canada on how to operate. The Bank is managed by a board of governors, which consists of a governor, a deputy governor, and 12 directors appointed from different regions of the country. The Bank has four main responsibilities: regulating the financial system, designing and issuing bank notes, and managing monetary policy and funds for the federal government.

The Bank of Canada’s primary mission is to oversee the nation’s monetary and credit system and to support the ongoing operation of Canada’s private banking system. The Bank’s actions affect the interest rates banks charge businesses and consumers, help keep inflation under control, and ultimately stabilize the Canadian financial system.

Video: Bank of Canada: Count on Us

Watch this video from the Bank of Canada to learn how Canada’s central bank promotes the economic welfare of all Canadians.

Source: Bank of Canada – Banque du Canada. (2011, March 16). Bank of Canada: Count on us [Video]. YouTube. https://www.youtube.com/watch?v=ULqvuY2penk

Attributions

“21.1 The Global Financial System” is adapted from “Econ 2302 Notes: Global Finance” by Amy S. Glenn, licensed under CC BY-NC-SA 3.0.

“Did You Know? The Bank of Canada” is adapted from “Chapter 7: Money and Banking” in Introduction to Business by Seneca College, licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted.

Image Descriptions

Figure 21.1: The Global Financial System

The image is a diagram illustrating components of the global financial system. It’s composed of interconnected oval shapes labelled with various entities within the financial system. The ovals are arranged in an outer circle and an inner circle.

The outer circle includes, clockwise from the top right

- supervisory authorities

- accounting standard bodies

- multinational enterprises (MCE)

- institutional investors

- rating agencies

- sovereign funds

- investment banks

- international financial institutions

- central banks

- government treasuries

The inner circle includes, clockwise from the top

- currencies

- commercial banks

- financial markets

- exchange rates

[back]

a set of institutions (such insurance companies and banks) and policies (such as regulations and laws) that allow economic transactions to occur

a system composed of financial institutions and regulators that act on an international level