Chapter 20: Trade Finance Instruments

20.5 Factoring and Forfaiting

Over the last few years, factoring and forfaiting have gained importance as one of the main sources of export financing. Factoring and forfaiting are also considered effective in managing an organization’s cash flow imbalance.

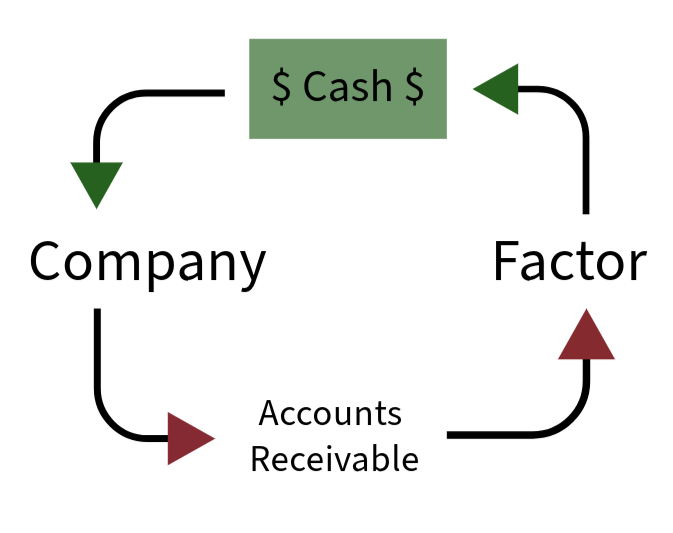

Factoring is a financial transaction whereby a business sells its accounts receivable to a third party (called a “factor”) at a discount. Factoring makes it possible for a business to convert a readily substantial portion of its accounts receivable into cash (See Figure 20.6). This provides the funds needed to pay suppliers and improves cash flow by accelerating the receipt of funds. Companies factor accounts when the available cash balance held by the firm is insufficient to meet current obligations and accommodate its other cash needs, such as new orders or contracts. In other industries, however, such as textiles or apparel, for example, financially sound companies factor their accounts simply because this is the historical method of finance.

Credit: © Conestoga College. CC BY-NC-SA.

Debt factoring is also used as a financial instrument to provide better cash flow control, especially if a company currently has a lot of accounts receivables with different credit terms to manage. Factoring companies charge what is known as a “factoring fee.” The factoring fee is a percentage of the amount of receivables being factored. The rate charged by factoring companies depends on factors like:

- The industry the company is in.

- The volume of receivables to be factored.

- The quality and creditworthiness of the company’s customers.

- Days outstanding in receivables (average days outstanding).

Additionally, the factoring fee depends on whether it is recourse factoring or non-recourse factoring. Under recourse factoring, the client is not protected against the risk of bad debts. On the other hand, the factor assumes the entire credit risk under non-recourse factoring (i.e., the full amount of the invoice is paid to the client in the event of the debt becoming bad). Factoring companies usually charge a lower rate for recourse factoring than it does for non-recourse factoring. When the factor is bearing all the risk of bad debts (in the case of non-recourse factoring), a higher rate is charged to compensate for the risk. With recourse factoring, the company selling its receivables still has some liability to the factoring company if some of the receivables prove uncollectible.

Forfaiting, on the other hand, is “the purchase of a series of credit instruments such as bills of exchange, promissory notes, drafts drawn under usance (time), letters of credit or other freely negotiable instruments on a “non-recourse” basis (non-recourse means that there is no comeback on the exporter if the importer does not pay)” (Bhogal & Trivedi, 2019). The other difference between factoring and forfaiting is that factoring is a way of short-term financing, the receivables which are due within 90 days, for instance, whereas in forfaiting medium to long-term receivables are sold (Key Differences, n.d.).

Let’s Explore: Factoring vs. Forfaiting

To explore the differences between factoring and forfaiting in more detail, check out this comparison chart on the difference between factoring and forfaiting page on the Key Differences website.

References

Key Differences, (n.d.). Difference between factoring and forfaiting. https://keydifferences.com/difference-between-factoring-and-forfaiting.html#ComparisonChart

Bhogal, T. & Trivedi, A. (2019). International trade finance: A pragmatic approach. Springer.

Attributions

“20.5 Factoring and Forfaiting” is adapted from the following:

- “Financial Management: Short-Term Financing” by “Boundless Business,” licensed under CC BY-SA, except where otherwise noted and shared on Course Sidekick.

- “Module 6: Receivables and Revenue: Factoring Accounts Receivable“ by Joseph Cooke in “Financial Account“ provided by Lumen Learning under CC BY 4.0.

Image Descriptions

Figure 20.6: Factoring Cash Flow

The image depicts a simplified circular flowchart modelling the factoring process cycle with arrows indicating the movement between the entities. Starting from a green rectangular shape with the text “$Cash$” representing money, a black line with an arrow extends around to the word “Company,” written in large black letters. From “Company,” another black line with an arrow points towards “Accounts Receivable” in large black letters. A line with an arrowhead extends from “Accounts Receivable” to the word “Factor.” Finally, a line with an arrow leads from “Factor” back to “$Cash$,” completing the cycle.

[back]

a financial transaction in which a business sells its accounts receivable at a discount to a third party, known as a factor

sales for which a firm has not yet been paid

the percentage of the amount of receivables being factored which goes to the factor

a method of financing in which an exporter sells accounts receivables to a third party through bills of exchange, promissory notes, drafts drawn under usance (time), letters of credit in exchange for immediate cash