Chapter 20: Trade Finance Instruments

20.4 Documentary Credit

Documentary credit, or letter of credit (L/C), is one of the widely used payment methods in international trade due to its secure and safe nature. Letters of credit are used when there is a lack of trust between exporters and importers and there are economic or political risks involved in trading (FITT, 2023). Like documentary collections, in letters of credit, banks act as intermediaries and ensure that exporters perform as per contract and importers pay on time.

Let’s Explore: Documentary Credit

Watch this video for an introduction to the documentary credit method of payment.

Source: Drip Capital. (2021, June 16). Letter of credit | Meaning and process explained in international trade. [Video]. Youtube. https://www.youtube.com/watch?v=tUIziJCLTzE

Letters of credit follow the Uniform Customs and Practice for Documentary Credit (UCP) rules, which were first published by the International Chamber of Commerce in 1933. Since then, the rules have been revised, with the current version being UCP 600. The UCP rules determine how the different parties to a letter of credit are supposed to act. These rules also apply to any banking institution involved in the transaction (ABN AMRO Bank, 2007).

Let’s Explore: eUCP

The UCP 600 rules have been further refined to outline the rules for electronic transactions. These supplementary rules are available online from the International Chamber of Commerce:

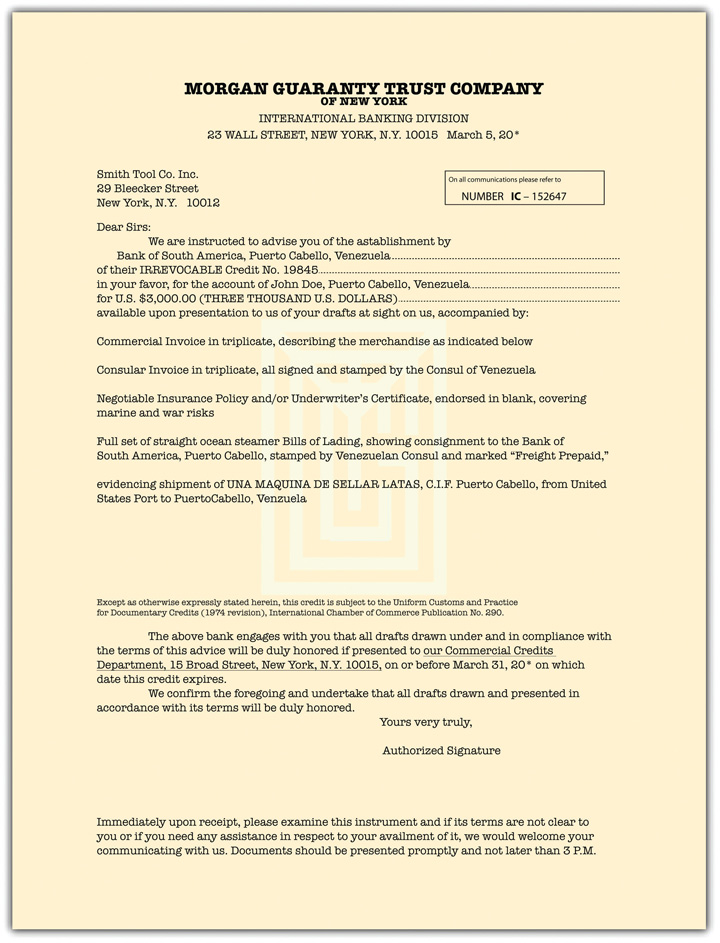

Unlike documentary collection, by issuing a letter of credit, the importer’s bank (or the collecting bank) promises to pay the exporter in the event that the importer does not pay as agreed upon in the sales contract. This is the reason it is considered the most secure method of payment, but it is the costliest one, too, as letters of credit generate the most fees for a bank (Becker, 2018). Using the letter of credit is a perfect solution to manage commercial risk, i.e. non-payment and non-performance risk. With a letter of credit, the buyer’s bank is obligated to pay the supplier’s bank on behalf of the buyer once the goods are shipped (Ahn, 2014). See Figure 20.5 for a sample letter of credit.

Credit: Figure 23.4: A Letter of Credit in “Chapter 23.3 Wholesale Transactions and Letters of Credit“ by Anonymous. CC BY-NC-SA 3.0.

Let’s Explore: Parties to a Letter of Credit

Types of Letters of Credit

According to Bhogal and Trivedi (2019), letters of credit can be divided broadly into two categories: clean and documentary. Both can be subdivided into sight and usance, which can be divided into revocable and irrevocable categories. Irrevocable Letters letters of credit can have irrevocable unconfirmed, irrevocable confirmed, and irrevocable special categories. See the Think About It: How to Categorize Letters of Credit for more information on these.

Think About It! How to Categorize Letters of Credit

Explore this flow chart to understand the different types of letters of credit.

Let’s Explore: Sight Letters of Credit

Watch this video to learn more about how to sight letters of credit work [4:50].

Source: Tradelinks Resources. (2017, May 8). How a sight letter of credit works (letter of credit). [Video]. YouTube. https://www.youtube.com/watch?v=CeZ8sJanRNE

References

ABN AMRO Bank. (2007). What is UCP 600? [PDF] ABN AMRO. https://www.letterofcredit.biz/wp-content/uploads/abn-amro-what-is-ucp600.pdf

Ahn, J. (2014). Understanding trade finance: Theory and evidence from transaction-level data [PDF]. International Monetary Fund. https://www.imf.org/external/np/seminars/eng/2014/trade/pdf/ahn.pdf

FITT. (2023). FITTskills: International Trade Finance (7.3 ed). Forum for International Trade Training.

Bhogal, T. & Trivedi, A. (2019). International trade finance: A pragmatic approach. Springer.

Attributions

Figure 20.5 Sample Letter of Credit reuses “Figure 23.4: A Letter of Credit” in “Chapter 23.3 Wholesale Transactions and Letters of Credit “ of “The Law, Corporate Finance, and Management” by Anonymous and available under a CC BY-NC-SA 3.0 license.

Image Descriptions

Figure 20.5: Sample Letter of Credit

The image is a scanned document with text content throughout. The top portion of the document features the title “MORGAN GUARANTY TRUST COMPANY OF NEW YORK” in bold capital letters with the subheading “INTERNATIONAL BANKING DIVISION” beneath it. Just below, the address “23 WALL STREET, NEW YORK, N.Y. 10015” and the date “March 5, 20__” are aligned to the left margin. The letter is addressed to Smith Tool Co. Inc. at “29 Bleecker Street, New York, N.Y. 10012.” A reference number, “IC-152647,” is indicated in the top right corner in a box that suggests all communications refer to it.

The body of the letter informs Smith Tool Co. Inc. about an irrevocable credit established by a bank in Venezuela, with details on the required supporting documents like commercial and consular invoices, insurance policy, and bills of lading for the shipment of goods, specifically “UNA MAQUINA DE SELLAR LATAS, C.I.F. Puerto Cabello,” from the United States to Puerto Cabello, Venezuela. There are signatures and instructions on the document, and the letter closes with a request to present documents by a specific date and time.

The content is formal in tone, implying a commercial transaction involving international trade. The document appears to be professionally formatted, following the style typically used in business correspondence, with clearly defined sections for addresses, references, the body of the letter, and closing signatures.

[back]

a legal document issued by an importer’s (or buyer’s) bank which promises to pay a specified amount of money when the bank receives documents from an exporter (or seller) about the shipment