Chapter 20: Trade Finance Instruments

20.3 Documentary Collection

Let’s Explore: Documentary Collection

Watch this video for an introduction to the documentary collection method of payment.

Source: International Trade Administration, (2021, April 5). Using documentary collections with trusted foreign buyers. [Video]. YouTube. https://www.youtube.com/watch?v=9ezhlvXkQxc

The documentary collection (D/C) payment method is recommended to be used in established trade relationships in economically and politically stable markets (FITT, 2023 and International Trade Administration, n.d.b). Banks act as intermediaries between exporters and importers to facilitate the transfer of payment and documents and simplify the transaction for them.

In a documentary collection transaction, the exporter’s bank (remitting bank) sends documents to the importer’s bank (collecting bank) along with instructions for payments and then funds are received from the importer and remitted to the exporter through the banks in exchange for those documents (Noah, 2019, Sept). However, banks do not verify the documents being transferred from exporters to importers and do not guarantee payment, which means that if the buyer does not pay, the exporter will either have to pay or find a different supplier on an urgent basis, sell the goods at cost or dispose of them off (International Trade Administration, n.d.b).

Documentary collections are subject to a set of rules and practices called the Uniform Rules for Collections (URC), which was published by the International Chamber of Commerce (ICC) in Paris. (FITT, 2023, p. 53)

According to Noah (2019, Sept.) with D/C, there is little an exporter can do if the importer does not pay. This means that D/C should only be used when the exporter and importer already have a relationship and the importing country has a stable economy and political situation. Noah also suggests that D/C can be used if it is too risky to use an open account sale and the importer will not accept a letter of credit.

Bills of Exchange

The D/C transaction uses bills of exchange as a method of payment. Historically, bills of exchange have been a very popular method for financing merchandise trade. It gained even more importance when negotiating or transferring the bill between parties became legal (Accominotti & Ugolini, 2019). Negotiation (also called endorsement of bills of exchange) provides a provision to transfer the original creditor’s claim on the debtor to a third party.

Think About It! What Is a Bill of Exchange?

According to Canada’s Bills of Exchange Act:

16 (1) A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay, on-demand or at a fixed or determinable future time, a sum certain in money to or to the order of a specified person or to bearer.

Scroll through the slides to review a detailed break down of this legal definition.

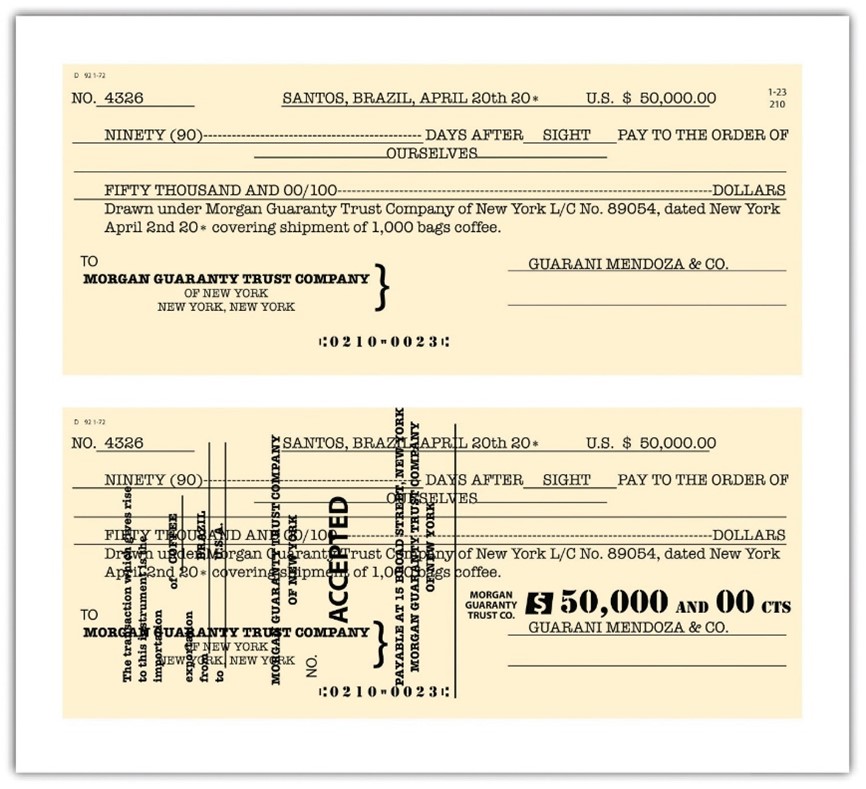

A bill of exchange must be signed by the issuing party (exporter) and accepted by the party to whom it is addressed (importer) to be valid. Acceptance of bills of exchange is a formal process where in the drawee of a usance or time bill of exchange writes the words “accepted” above their name and signature across a bill (Bhogal & Trivedi, 2019). See Figure 20.1 for samples of a bill of exchange and what it looks like after it has been accepted.

Credit: Figure 19.3 - A Time Draft in Chapter 19: Nature and Form of Commercial Paper by Anonymous. CC BY-NC-SA 3.0.

Acceptance of Bills of Exchange is very important. Let’s assume there are two companies. Company A issues a bill of exchange worth $500,000 for Company B on the date they purchase goods on credit, which is June 4, 2024. However, Company B accepted the bill five days later, i.e., on June 9. Even though it is clear in this situation that Company A becomes the creditor and Company B the debtor on June 4, the debtor is not legally bound to pay until he signs the bill and makes it a bill of exchange on June 9. This is how bills of exchange work.

Types of Bills of Exchange

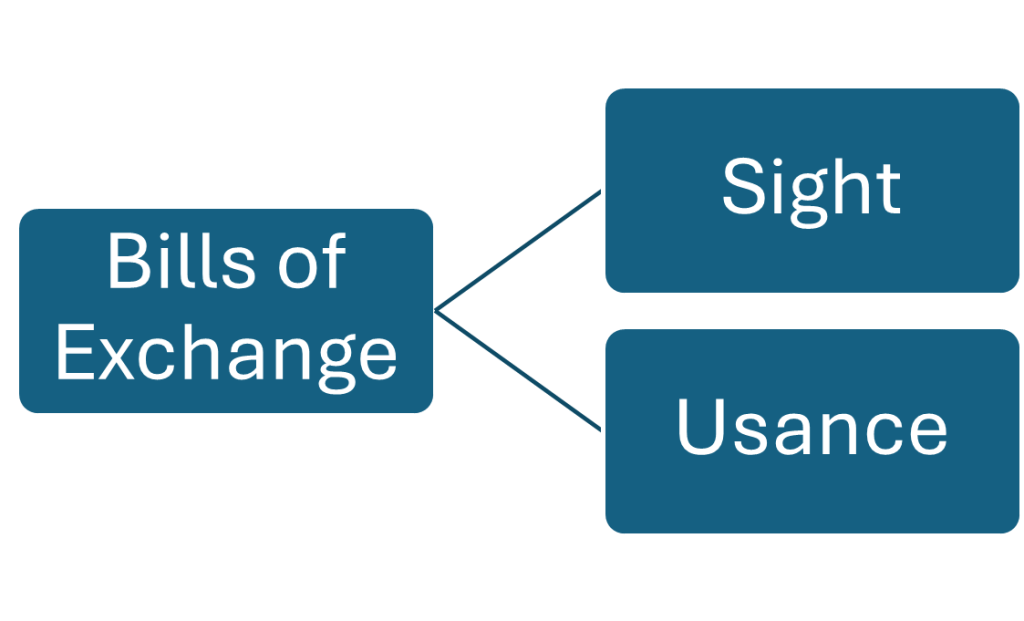

Bills of exchange can broadly be divided into two main categories: sight and usance or term.

Credit: © by Kiranjot Kaur. CC BY-NC-SA.

Sight Bills of Exchange

A sight bill of exchange requires the drawee to release the payment as soon as the bill has been seen, and thus, its acceptance is not required. If a bill of exchange is sight, banks will not release documents until and unless payment is released by the importer. This, in trade finance terminology, is known as documents against payment (D/P).

In the D/P clause, the exporter instructs their bank to release documents only and only if the importer pays as agreed upon in the sales contract.

Usance Bills of Exchange

Usance bills of exchange are the opposite of sight bills of exchange. Where in sight, payment is released immediately after seeing bills of exchange; in usance, payment is made at a future period of time and documents are released upon acceptance of bills of exchange. Thus, accepting usance bills of exchange is mandatory for the importer. Until and unless the bill is accepted, documents will not be released by the bank. This, in trade finance terminology, is called documents against acceptance (D/A).

In the D/A clause, the exporter instructs their bank to release documents only and only if the importer accepts the bills of exchange and thus promises to pay at a future date.

Let’s Explore: How Documentary Collection Works

Watch this video to learn more about the D/P documentary collection [4:50].

Source: Tradelinks Resources. (2017, May 17). How documents against payment work in international trade. [Video]. YouTube. https://www.youtube.com/watch?v=1h-QQOaLxoI&t=10s

Watch this video to learn more about the D/A documentary collection [4:55].

Source: Tradelinks Resources. (2017, May 25). How documents against acceptance works in international trade. [Video]. YouTube. https://www.youtube.com/watch?v=nrY1bZp6K18&t=9s

Endorsement of Bills of Exchange

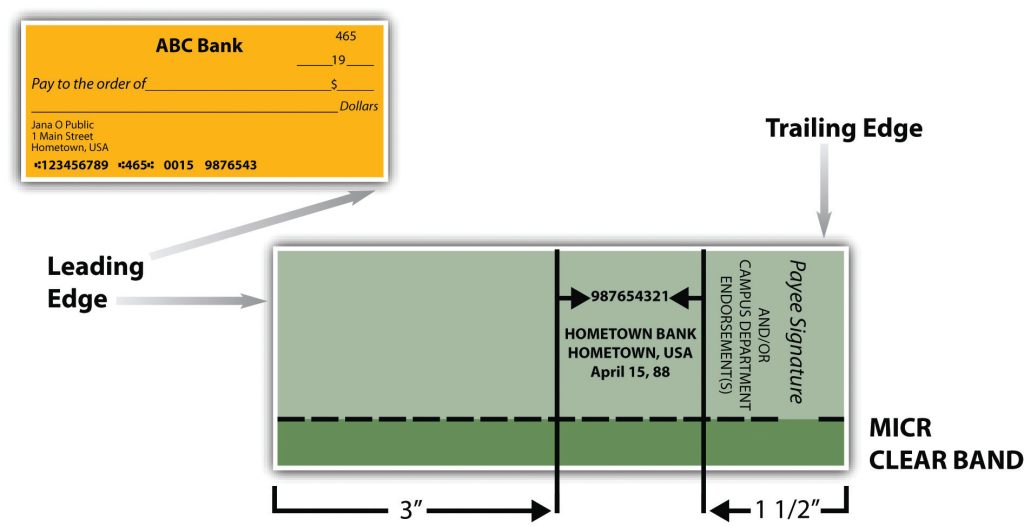

The main advantage of bills of exchange in modern finance is negotiability. Negotiability means that the document is freely and unconditionally transferable from one person to another by delivery or by delivery and endorsement. Endorsements are usually placed on the back of the instrument, as shown in Figure 20.3. There are many ways a bill can be endorsed, including blank, special, restrictive, and conditional.

Source: Based on Sec. 704-13: Check Endorsement Procedures, Diagram of Endorsement Standard. In UC Irvine Administrative Policies & Procedures, Business and Financial Affairs, Financial Services.

Credit: Figure 20.3 Endorsement Standard in “Chapter 20: Negotiation of Commercial Paper” by Anonymous. CC BY-NC-SA 3.0.

Blank Endorsement

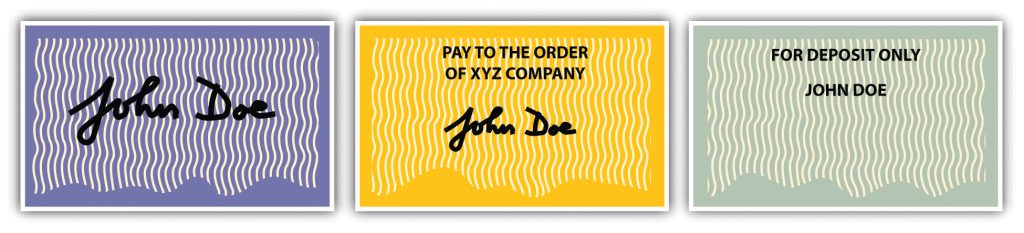

A blank endorsement consists of the endorser’s signature alone, as shown on the left of Figure 20.4. A blank endorsement converts the instrument into paper, closely akin to cash. Since the endorsement does not specify to whom the instrument is to be paid, it is treated like bearer paper—assuming, of course, that the first endorser is the person to whom the instrument was payable originally. A paper with a blank endorsement may be negotiated by delivery alone until a holder converts it into a special endorsement by writing over the signature any terms consistent with the endorsement. For example, a bill endorsed by the payee (signed on the back) may be passed from one person to another and cashed in by any of them.

A blank endorsement creates conditional contract liability on the endorser: he is liable to pay if the paper is dishonoured. The blank endorser also has warranty liability toward subsequent holders.

Credit: Figure 20.4 Forms of Endorsement in “Chapter 20: Negotiation of Commercial Paper” by Anonymous. CC BY-NC-SA 3.0.

Special Endorsement

A special endorsement, sometimes known as “endorsement in full,” names the transferee-holder. The payee of a bill can endorse it over to a third party by writing “Pay to the order of [name of the third party]” and then signing his name (see Figure 20.4 at centre). Once specially endorsed, the bill (or other instrument) can be negotiated further only when the special endorsee adds his own signature. A holder may convert a blank endorsement into a special endorsement by writing above the signature of the endorser words of a contractual nature consistent with the character of the instrument.

The main difference between the blank and special endorsement is the endorser’s way of indicating how the instrument can be subsequently negotiated, with or without further endorsement.

Restrictive Endorsement

A restrictive endorsement attempts to limit payment to a particular person or otherwise prohibit further transfer or negotiation. Words like “Pay to the order of XYZ only” represent that endorsement is restrictive in nature. There are two legitimate restrictive endorsements: collection endorsements and trust endorsements.

A collection endorsement, such as “For deposit” or “For collection,” is effective (See Figure 20.4, at right). However, a document with a collective endorsement can be stolen and used by another person or party very easily. For instance, suppose that John Doe endorses his paycheck “For deposit only, John Doe.” A thief steals the check, endorses their name below the restrictive endorsement, and deposits the check-in Last Bank, where they have an account, or cashes it. The check moves through the collection process to Second Bank and then to First Bank, which pays the check. John has the right to recover only from Last Bank, which did not properly honour the endorsement by depositing the payment in her account.

A second legitimate restrictive endorsement is an endorsement in trust, called a trust endorsement (sometimes agency endorsement). Trust endorsement is used when an agent or a third party manages finances for you. Trust endorsement ensures that the agent or third party works in your best interest.

Conditional Endorsement

An endorser might want to condition the negotiation of an instrument upon some event, such as “Pay Kalpna Patel if she finishes painting my house by July 15.”

References

Accominotti, O. & Ugolini, S. (2019, August 07). The evolution of international trade finance explained. World Economic Forum. https://www.weforum.org/agenda/2019/08/the-structure-of-global-trade-finance-a-very-long-run-view/

Bills of Exchange Act, RSC 1985, c. B-4 https://laws.justice.gc.ca/eng/acts/B-4/page-1.html#h-29132

Bhogal, T. & Trivedi, A. (2019). International trade finance: A pragmatic approach. Springer.

FITT. (2023). FITTskills: International Trade Finance (7.3 ed). Forum for International Trade Training.

Attributions

“20.3 Documentary Credit: Endorsement of Bills of Exchange” is adapted from “Chapter 20: Negotiation of Commercial Paper“ in “The Law, Corporate Finance, and Management v.1.0“ by Anonymous. Available under a CC BY-NC-SA 3.0 licence.

Figure 20.1 Sample Bills of Exchange reuses “Figure 19.3 – A Time Draft” in “Chapter 19: Nature and Form of Commercial Paper of “The Law, Corporate Finance, and Management” by Anonymous and available under a 3.0 license.

Figure 20.3: Placement of Endorsement reuses “Figure 20.3 Endorsement Standard” in “Chapter 20: Negotiation of Commercial Paper” of “The Law, Corporate Finance, and Management” by Anonymous and available under a CC BY-NC-SA 3.0 license.

Figure 20.4 Forms of Endorsement reuses “Figure 20.4 Forms of Endorsement” in “Chapter 20: Negotiation of Commercial Paper” of “The Law, Corporate Finance, and Management” by Anonymous and available under a CC BY-NC-SA 3.0 license.

Image Descriptions

Figure 20.1: Sample Bills of Exchange

The image shows two copies of a rectangular financial document similar to a cheque, one above the other, on a cream-coloured background with black printed text and numbers. The document at the top is an original or unmarked example, while the document at the bottom is stamped “ACCEPTED” across it in a bold and large font, askew to the document’s text lines.

Each document has a number of fields filled with information, including reference numbers, location names, dates, monetary figures, and company names. Notably, the lower document includes additional details superimposed upon the original text, such as authorization signatures, transaction-specific details, and a large numeral indicating the sum of money involved.

Both documents feature the same serial number, “NO. 4326,” at the top left corner and a monetary amount, “U.S. $ 50,000.00,” top right. The amounts and text emphasize the transaction of fifty thousand U.S. dollars. The terms specify “90 days after sight,” indicating a time frame for the payment. The documents are related to the Morgan Guaranty Trust Company of New York and reference a shipment of 1,000 bags of coffee.

Significant parts of the details, especially numbers, are obscured or redacted with black lines for privacy or confidentiality reasons. The overall appearance of the documents conveys a professional and formal financial transaction.

[back]

Figure 20.3: Placement of Endorsement

The image is an illustration with a graphical representation of a personal bank check and highlights specific details about its format and dimensions. To the left side of the image is a bank check, depicted with an orange background outlined with a white border. At the top left of the check is “ABC Bank,” printed in bold white letters. Below that, the check features pre-printed fields, including “Pay to the order of,” followed by a line for writing the recipient’s name, a dollar amount box with a dollar sign, and a line for the amount in words ending with “Dollars.” The lower left corner includes a smaller font section for the account holder’s name and address: “Jana O Public, 1 Main Street, Hometown, USA,” followed by a routing number, account number, and check number at the bottom; all contained within a sequence of symbols and numbers, ostensibly representing the MICR (Magnetic Ink Character Recognition) line used for automated processing. The check number is also written in the top right corner.

On the right side of the illustration, there is a zoomed-in section of a check depicting the bottom part where details such as the MICR line are located. The section is outlined and tinted with varying shades of green, and the words “MICR CLEAR BAND” are prominently written along the bottom right side. Arrows and labels indicate the direction of the “Leading Edge” and “Trailing Edge” of the check. Above the MICR line, the check specifies a space for the endorsement, and there’s a note for “Payee Signature” aligned to the space. Measurements are indicated by arrows pointing between lines: “3” inches for the check’s width and “1 1/2” inches for the MICR clear band. Other texts include the check’s routing number, bank name and address, and a date stamp area marked with an example date “April 15, 88.”

[back]

a financial transaction in which an exporter's (seller's) bank presents documents to an importer's (buyer's) bank to facilitate payment

when a financial document is freely and unconditionally transferable from one person to another

a promise to pay the creditor when the drawee of a usance or time bill of exchange writes the words “accepted” above their name and signature across a bill