Chapter 16: Introduction to International Trade Finance

16.4 Managing and Mitigating Trade Risk

So far, we have identified many different types and categories of risks related to international trade finance and provided a few examples of these risks. To operate successfully, all business organizations must find ways to manage and mitigate the risks to which they are exposed. To manage risk successfully requires the decision-maker to understand and assess the impact of risk on the operations and earnings of the business. While there are multiple ways to manage risk, some organizations follow a formal procedure to identify, analyze, and mitigate risk. We will investigate one such procedure in the next section.

One way to mitigate trade finance risks is to use an appropriate method of payment and to ensure that the trade organization is working with reliable international financial institutions or supporting governmental agencies.

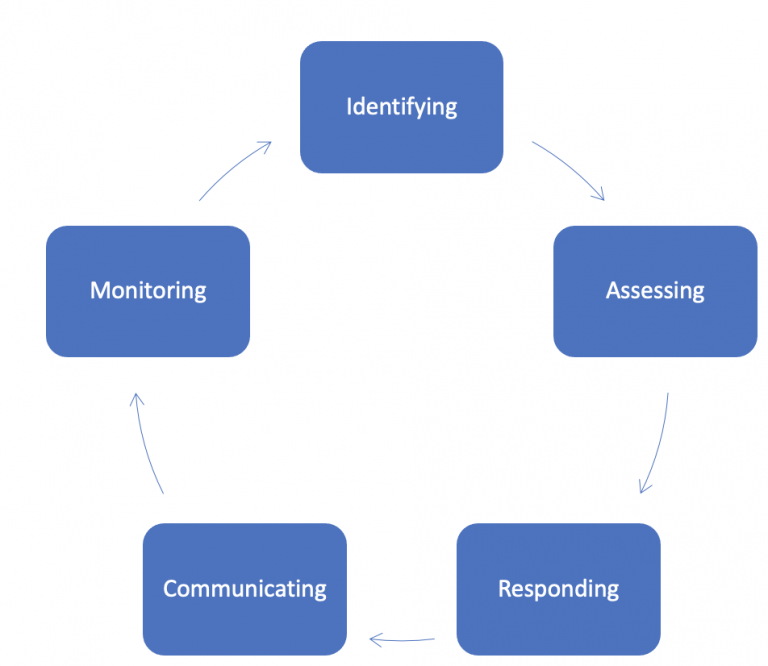

Foreign organizations need to use an effective risk management process that includes identifying, assessing, responding, communicating, and monitoring risks in trade. One process is called the risk management cycle, in which these five steps are followed in a continuous way, as illustrated in Figure 16.1. In this sense, risk management is an ongoing process, with known risks being monitored consistently and new risks being identified as they arise.

Source: Adapted from Treasury Board of Canada Secretariat (2016).

Credit: Figure 7.4 Risk Management Cycle in “7.4 Risk Management Strategies to Mitigate the Supply Chain Vulnerability” by Kiranjot Kaur and Iuliia Kau, CC-BY-NC-SA 4.0.

Identifying Risk

Identifying risk is the initial step in the risk management process. In this step, the organization has to identify as many risks as possible and share them with every stakeholder. Next, identify warning signs of risks by creating questions (FITT, 2021). For example, is our new technology proven and mature for our business? Why does the organization have significant gaps between partners and in information? Why does the organization not have a mitigation or contingency plan?

Assessing Risk

Assessing risk includes analyzing and prioritizing steps (Treasury Board of Canada Secretariat, 2016). The scope of the risk must be determined by the assigned person. Also, determine the factors influencing the severity of this risk and how this risk impacted businesses in the past. The likelihood and the impact of an event are the significant parts of this step. There is a variety of assessments: qualitative, quantitative, and semi-quantitative. Quantitative assessment consists of numerical risk criteria which can be measured. Qualitative assessment is based on the qualitative descriptions of risks, for example, characteristics or information that cannot be counted. Semi-quantitative assessment combines quantitative and qualitative data. After getting information, risks must be measured and ranked. The top priority risks have the highest probability and greatest impacts (FITT, 2021).

Responding to Risk

According to the Treasury Board of Canada Secretariat (2016), responding to risk includes selecting and implementing measures to the risk. Responding to the threat has several mitigation strategies: accepting, reducing, avoiding, monitoring, and transferring risks (Treasury Board of Canada Secretariat, 2016).

- Accepting risk is the same as retention risk, and an organization accepts a particular risk because it is not worthwhile to spend money to mitigate it. Accepting risk is the most common approach for small risks in any business.

- Reducing risks can be done through control or prevention. Installing security systems, burglar alarms, protective equipment, and insurance companies are common approaches to minimizing risks.

- Risk avoidance is applicable for organizations that want to eliminate as many challenges as possible and potential risk sources. This strategy is not acceptable for all hazards, but some risks can be mitigated by creating policies, procedures, training and so forth. For example, if a country is not politically stable, the company can avoid the political risk by avoiding expansion into that country.

- Risk monitoring must be an ongoing process within the global value chain. Companies can transfer risks to insurance companies by purchasing an insurance policy.

- Also, risk can be transferred to the third party who will be responsible for consequences and loss.

Communicating Risk

The Treasury Board describes this step as the risk management process of making decisions according to the communication and reporting information about risks. The communication process must be, internally, between employees and, externally, among clients, stakeholders, and third parties. An integral part of communications is providing enough information to make the right decision (Treasury Board of Canada Secretariat, 2016).

Monitoring Risk

Regular review of information on risks and of the risk mitigation plan should be an ongoing process for any business. The responses to risk should be reviewed to ensure that the mitigation plan is properly implemented. It is an essential part of the whole cycle because improvements or opportunities can be effectively identified and executed (Treasury Board of Canada Secretariat, 2016).

References

FITT. (2021). FITTskills: Global value chain, (7th Ed.). Forum for International Trade Training.

Treasury Board of Canada Secretariat. (2016, May 12). Guide to integrated risk management. https://www.canada.ca/en/treasury-board-secretariat/corporate/risk-management/guide-integrated-risk-management.html

Attributions

“16.4 Managing and Mitigating Trade Finance Risk” is adapted from “7.4 Risk Management Strategies to Mitigate the Supply Chain Vulnerability” from Global Value Chain by Dr. Kiranjot Kaur and Iuliia Kau, licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.

Image Descriptions

Figure 16.1: The Risk Management Cycle

The image is a circular flow chart composed of five blue rectangular boxes connected by arrows. Each box contains white text. The flow chart begins at the top with the first box labelled “Identifying,” followed by the second box labelled “Assessing” on the right. Moving clockwise, the third box labelled “Responding” is at the bottom right, followed by the fourth box labelled “Communicating” at the bottom left. Completing the cycle, the fifth box labelled “Monitoring” is at the top left, connecting back to the “Identifying” box.

[back]