Chapter 7: Trade Policies: Dumping and Export Subsidies

7.2 The Effects of Anti-Dumping and Countervailing Duties

As indicated previously, the rules of the World Trade Organization (WTO) permit countries to retaliate if dumping is found to materially injure import-competing producers. If both dumping and material injury are found, the government of the importing country is allowed to impose an anti-dumping duty. An anti-dumping duty is an additional tariff that is equal to the difference between the actual export price and the fair market value or the “dumping margin.”

Let’s Explore: Anti-Dumping and Countervailing Duties

Before continuing this section, watch this video, which provides a brief overview of dumping and countervailing duties.

Source: GHY International. (2019, May 23). Anti-dumping (AD) and countervailing duties (CVD) [Video]. YouTube. https://www.youtube.com/watch?v=FNz5EqMRqQo

Under anti-dumping law, a case starts with the filing of a complaint by the affected domestic producers. Relevant governmental agencies then examine whether dumping and material injury to domestic producers has occurred. In the United States, the case is filed with the U.S. Department of Commerce (USDC) and the U.S. International Trade Commission (USITC). The USD C checks for dumping and the USITC checks for injury. At any point in the process, producers in the importing country may negotiate with foreign exporters to get them to either raise prices or limit their exports. If agreement is reached between domestic and foreign producers, the case may be terminated or suspended.

If both the USDC and the USITC find dumping and material injury, a permanent tariff is imposed that is equal to the dumping margin (Pugel, 2020; Carbaugh, 2015). A similar process is used in other advanced countries. The evidence for the United States suggests that there is a marked tendency to find dumping as well as injury. In more than 90% of its investigations, the USDC finds dumping and in about two-thirds of its cases, the USITC finds material injury. In the United States and elsewhere, anti-dumping process is biased toward the finding of dumping and injury and the imposition of antidumping duties. A country charged with dumping can appeal to the WTO.

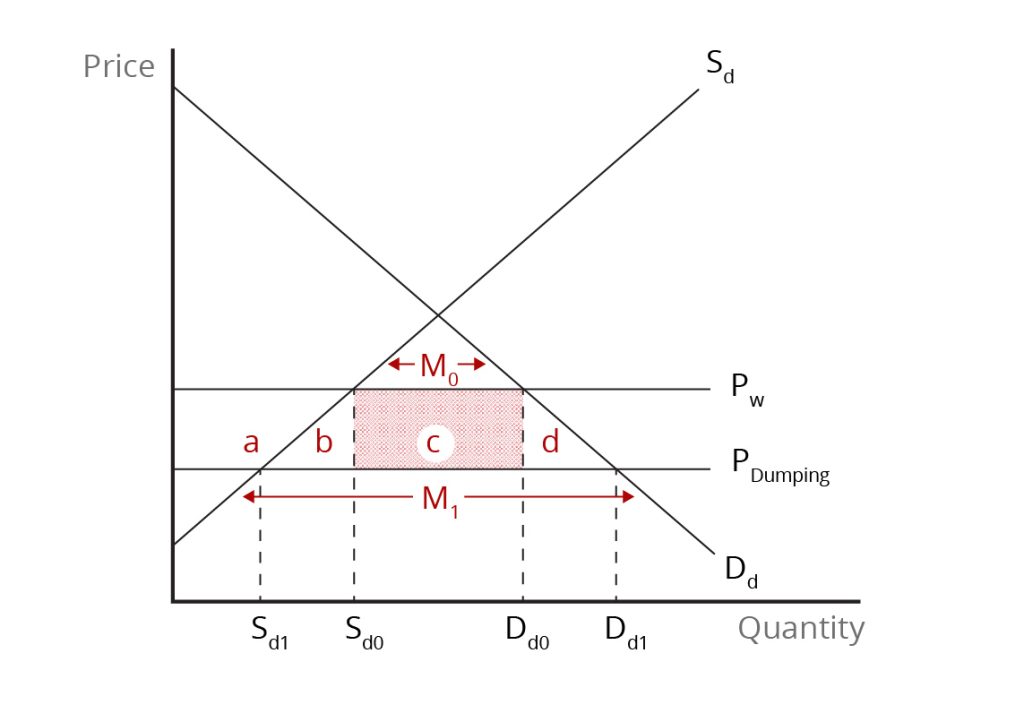

The effects of an anti-dumping duty in a small country are illustrated in Figure 7.5. Prior to the occurrence of dumping, domestic consumers purchase [latex]\text{D}_{d0}[/latex] at the world price, [latex]\text{P}_{w}[/latex] while domestic producers supply [latex]\text{S}_{d0}[/latex]. Since the quantity demanded is greater that the quantity supplied domestically, the difference, [latex]\text{D}_{d0}-\text{S}_{d0}[/latex], represents the quantity of imports, [latex]\text{M}_{0}[/latex]. With dumping taking place in the domestic market, the price of the imported product falls below the world price. This price is represented by the price line [latex]\text{P}_{dumping}[/latex]. As a result of the lower price, domestic consumers buy a larger quantity while domestic producers scale back their production. Imports, therefore, increase to [latex]\text{X}_{1}[/latex], the difference between [latex]\text{D}_{d1}-\text{S}_{d1}[/latex].

Dumping provides a benefit for consumers in the importing country since they buy a larger quantity and pay a lower price than before. Consumer surplus rises by the combined area [latex]\textit{a}+{b}+{c}+{d}[/latex]. In contrast, domestic producers are hurt by the lower price and the smaller level of production. Producer surplus falls by area [latex]\textit{a}[/latex], which is transferred to consumers. Because consumers gain more than producers lose, the country as a whole derives a net gain in economic well-being from dumping.

Suppose domestic producers convince the government that dumping has occurred and is causing material injury. The government imposes an anti-dumping duty equal to the dumping margin, the vertical distance between [latex]\text{P}_{w}[/latex] and [latex]\text{P}_{dumping}[/latex]. This reverses the previous benefit to consumers as consumer surplus falls by the combined area [latex]\textit{a}+{b}+{c}+{d}[/latex] as the import price returns to [latex]\text{P}_{w}[/latex]. Domestic producers become more competitive and regain their lost surplus (area [latex]\textit{b}[/latex]) as the produce more and sell at the higher price. The government collects revenue from the antidumping duty equal to area [latex]\textit{c}[/latex]. Still, the country as a whole suffers a net national loss equal to area [latex]\textit{b}[/latex] plus area [latex]\textit{d}[/latex]. The sources of the national loss are the usual deadweight losses due to the production and consumption effects. Anti-dumping duties usually lower the economic well-being of the importing country and of the world as a whole.

Credit: © by Kenrick H. Jordan and Conestoga College, CC BY-NC-SA 4.0.

The WTO has rules that allow an importing country to counteract the use of unfair subsidies that encourage exports that hurt its domestic industry. Subsidies that are directly related to exporting are outlawed, except export subsidies used by developing countries with very low incomes. Other subsidies, even though not directly linked to exporting, are actionable if they cause exports to increase notably. If an importing country can demonstrate the existence of a prohibited or actionable subsidy, as well as injury to its domestic producers, it is allowed to impose a countervailing duty. A countervailing duty is a tariff that is used to offset the price or cost advantage that the subsidy provides to foreign exports.

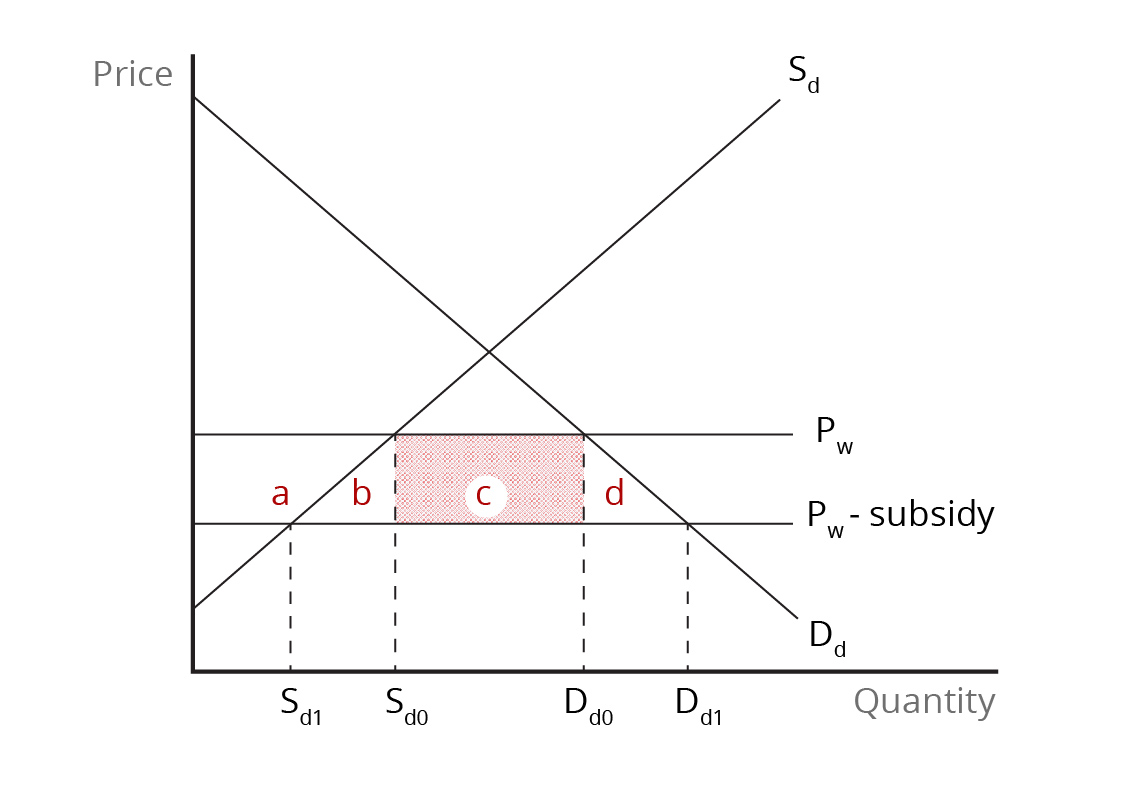

We analyze the impact of a countervailing duty using Figure 7.6. We assume the large exporting country passes the subsidy fully on to consumers in a small importing country. This causes the export price to fall below the world price, [latex]\text{P}_{w}[/latex] by the amount of the subsidy. The lower export price causes consumers to buy more at the lower price. Consumer surplus increases by the combined area [latex]\textit{a}+{b}+{c}+{d}[/latex]. Meanwhile, producers lose surplus as they receive a lower price and sell a smaller quantity. The country as a whole is better off as the benefit to consumers outweighs the loss of producer surplus. The net national gain is the sum of areas [latex]\textit{b}+{c}+{d}[/latex]. However, for the world as a whole, there is too much trade in the product as importing-country consumers value the additional purchases less than their resource cost (indicated by the world price, [latex]\text{P}_{w}[/latex]).

Credit: © by Kenrick H. Jordan and Conestoga College, CC BY-NC-SA 4.0.

Suppose the importing country imposes a countervailing duty equivalent to the export subsidy. The price in the importing country returns to its level before the export subsidy. Consumer surplus falls back to its pre-subsidy level, domestic producers regain their lost surplus, and the deadweight loss of excessive world trade disappears. Although the government collects tariff revenue equivalent to area [latex]\textit{c}[/latex] – the level of imports times the tariff – the importing country is worse off when compared to the situation with the export subsidy and no countervailing duty.

Combining all the changes in surplus for consumers [latex](-\textit{a}-{b}-{c}-{d})[/latex], producers [latex](+\textit{a})[/latex], and the government [latex](+\textit{c})[/latex], we see that the net national loss is the sum of area b and d, the production and consumption effects. The countervailing duty is good for the world as it eliminates inefficient overproduction but bad for the importing country. If we compare the situation of the export subsidy and the countervailing duty with free trade (i.e., the situation before the export subsidy is given), the difference is that the importing country's government now receives revenue from the duty. The exporting country is, in effect, transferring subsidy payments into the coffers of the importing-country government. The well-being of the importing country with the countervailing duty is higher than under free trade.

References

Carbaugh, R.J. (2015). International economics, (15th ed.). Cengage Learning.

Pugel, T. A. (2020). International economics, (17th ed.). McGraw-Hill.

Image Descriptions

Figure 7.5: The Effects of Anti-Dumping Duty in a Small Importing Country

The image is a graph with the x-axis labelled “Quantity” and the y-axis labelled “Price.” Two intersecting lines form an X in the graph: the downward-sloping line is labelled “Dd,” and the upward-sloping line is labelled “Sd.” A horizontal line below the intersection of supply and demand point is labelled “PW” Below it, another horizontal line is labelled “PDumping” Four points on the quantity axis are labelled from left to right as “Sd1” “Sd0,” “Dd0,” and “Dd1” At each intersection of supply, demand, and the price lines are dotted vertical lines down to the points on the quantity axis.

Area a is above the intersection of S and PDumpingand below PW. Area b is the triangle formed by S, PDumping and Sd0. Area c is a shaded rectangle in the middle formed by Sd0, PW, Dd0 and PDumping. Area d mirrors b, formed by Dd0, Pd, and Dd.

Between Sd and Dd and above PW is a horizontal double-sided arrow labelled M0. Between Sd and Dd and below PDumping is a horizontal double-sided arrow labelled M1.

[back]

Figure 7.6: The Effects of a Countervailing Duty in Small Importing Country

The image is a graph with the x-axis labelled “Quantity” and the y-axis labelled “Price.” Two intersecting lines form an X in the graph: the downward-sloping line is labelled “Dd,” and the upward-sloping line is labelled “Sd.” A horizontal line below the intersection of supply and demand point is labelled “PW” Below it, another horizontal line is labelled “PW - subsidy” Four points on the quantity axis are labelled from left to right as “Sd1” “Sd0,” “Dd0,” and “Dd1” At each intersection of supply, demand, and the price lines are dotted vertical lines down to the points on the quantity axis.

Area a is above the intersection of S and PW - subsidy and below PW. Area b is the triangle formed by S, PW - subsidy and Sd0. Area c is a shaded rectangle in the middle formed by Sd0, PW, Dd0 and PW - subsidy. Area d mirrors b, formed by Dd0, Pd, and Dd.

[back]

an international organization that seeks to negotiate reductions in barriers to trade and to adjudicate complaints about violations of international trade policy; successor to the General Agreement on Tariffs and Trade (GATT)

the difference between the actual price charged by the exporting firm and the fair-market or normal value

a duty that an importing country charges on imported products with the aim of offseting export (or other) subsidies provided by foreign governments