Chapter 5: Trade Restrictions: Non-Tariff Barriers

5.4 An Import Quota Versus a Voluntary Export Restraint (VER)

A voluntary export restraint is not at all voluntary! A VER is a non-tariff trade barrier in which the importing country effectively forces the exporting country to limit the quantity of exports to the importing country. VERs are policies by foreign suppliers, usually in conjunction with their governments and governments in importing countries agree to limit imports into a particular market. As is usual with all types of import protection, a VER is intended to protect domestic producers that are facing stiff import competition. One of the main reasons that importing countries were using VERs to grant import protection was to circumvent the rules of the World Trade Organization, which had outlawed absolute import quotas. One of the more well-known VERs is that implemented with regard to exports of motor vehicles from Japan to the United States beginning in 1981 and lasting through 1994 (Pugel, 2020; Carbaugh, 2015). In the 1980s, there was much concern in other advanced countries about import competition from Japan in their domestic market. Indeed, Japan was among the countries most often forced to restrict their exports through VERs.

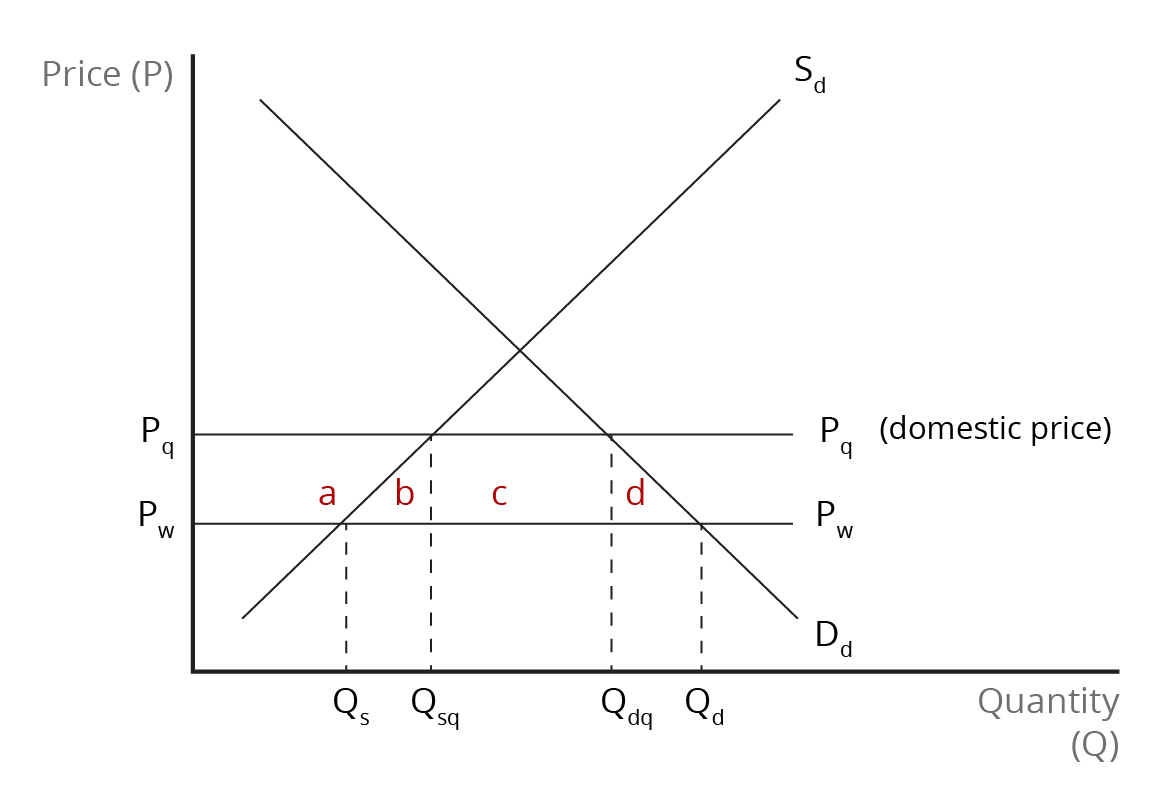

The graphical analysis of a VER is very similar to that of an absolute import quota, as it is a quantitative restriction on the quantity of imports. The key difference in the case of a VER is that the foreign (exporting) country or, more specifically, the foreign export suppliers, will be administering the VER. In essence, the foreign suppliers will act in concert in supplying the limited quantity. The effects of the VER are shown for a small country in Figure 5.3.

Credit: © by Kenrick H. Jordan and Conestoga College, CC BY-NC-SA 4.0.

Suppose domestic producers lobby the importing-country government for protection and the government accommodates them with a VER, i.e., by asking the foreign government to have its producers limit supplies to the importing country. This changes the supply situation within the importing country’s domestic market. Below the world price line [latex](\text{P}_{w})[/latex], supply comes only from domestic producers; above the world price line [latex](\text{P}_{w})[/latex], the domestic supply [latex](\text{S})[/latex] increases by the extent of the quantity allowed under the VER. The pertinent domestic supply curve with international trade now becomes [latex]\text{S}+{Q}[/latex], where [latex](\text{Q})[/latex] represents the quantity under the VER. For this quantity restriction to be effective, the level of imports must be set lower than that which would have occurred in the absence of free trade. Since supply is now reduced below the free-trade level, the domestic price rises above the world price and is given by the intersection of the “new” supply curve, [latex]\text{S}+{Q}[/latex], and the demand curve, [latex]\text{D}[/latex]. The domestic price is indicated by the horizontal line, [latex](\text{P}_{d})[/latex], parallel to and above the world price, [latex]\text{P}_{w}[/latex].

Effects of the VER On Domestic Producers and Consumers, the Nation, and the World

The results are exactly the same as that of an absolute import quota, except for the distribution of the tariff-equivalent revenue (or quota rent). The increase in the domestic price due to the VER causes domestic consumption of the product to fall. The quantity demanded falls from [latex]\text{Q}_{d0}[/latex] to [latex]\text{Q}_{dq}[/latex]. Consumers are worse off compared with the free-trade situation as they must pay a higher price and get a smaller quantity. Graphically, consumer surplus falls by areas [latex]\textit{a}+{b}+{c}+{d}[/latex]. In contrast, the economic well-being of domestic producers improves as their production expands from [latex]\text{Q}_{s0}[/latex] to [latex]\text{Q}_{sq}[/latex] and they receive a higher price. As a result, producer surplus increases by area [latex]\textit{a}[/latex]. The increased domestic production comes at a cost to the nation as it replaces lower-cost production that could have been imported from foreign producers. This is the usual production effect. The consumption effect also represents a cost to the nation, as some consumers who are willing to pay prices higher than the world price are shut out of the market.

The production effect (area [latex]\textit{b}[/latex]) and the consumption effect (area [latex]\textit{d}[/latex]) are the usual deadweight losses that arise from import protection. They are equivalent to the lower limit to the social loss from the implementation of an import quota. However, the social loss is greater than that from an import quota if the importing country provides the import licences to import distributors for free or if it auctions off the licences in a competitive market. As we have seen, in either of these two cases, the tariff-equivalent revenue accrues to domestic import distributors or to the national government and is, therefore, not a loss to the nation.

In the case of the VER, the set of foreign suppliers get the tariff-equivalent revenue, area [latex]\textit{c}[/latex], as they administer the VER and are able to get the mark-up by selling the product at the higher domestic price. This means that the national loss compared to the situation under free trade, in the case of a VER for a small country, is equal to area [latex]\textit{b}[/latex] [latex]+[/latex] area [latex]\textit{c}[/latex] [latex]+[/latex] area [latex]\textit{d}[/latex]. The loss of area [latex]\textit{c}[/latex] is a national loss due to the deterioration of the importing country’s terms of trade as its import prices relative to its export prices. For the world as a whole, the net social loss in comparison to free trade is the sum of areas [latex]\textit{b}[/latex] and [latex]\textit{d}[/latex]. Area [latex]\textit{c}[/latex] is not a loss to the world as it represents a transfer from the importing country to the exporting country.

Another important practical effect of the VER is that foreign producers may respond to the increased protection due to the VER by establishing production (facilities) within the importing country. Indeed, this was the response of Japanese automakers to the Japan-US auto VER. This represents foreign direct investment and represents a gain to the importing country. The VER may also cause foreign exporters to adjust the composition of their exported products in a way that satisfies the quantity restriction but raises the value of their exports. There is evidence that Japanese automakers exported higher-values vehicle models to the United States after the VER came into effect.

| Item | Gain/Loss |

|---|---|

| Producer surplus gain or loss | [latex]+\textit{a}[/latex] |

| Consumer surplus gain or loss | [latex]-\textit{a}-{b}-{c}-{d}[/latex] |

| Tariff-equivalent revenue | [latex]+\textit{c}[/latex] |

| National economic well-being | [latex]-\textit{b}-{c}-{d}[/latex] |

References

Carbaugh, R.J. (2015). International economics, (15th ed.). Cengage Learning.

Pugel, T. A. (2020). International economics, (17th ed.). McGraw-Hill.

Image Descriptions

Figure 5.3 The Economic Effects of a Voluntary Export Restraint (VER)

The image is a graph with a vertical axis labelled "Price (P)," and a horizontal axis labelled "Quantity (Q)."

Two horizontal lines extending from the lower half of the y-axis are labelled Pq and PW. The Pq is further labelled (domestic price). There is one supply curve and one demand curve that intersect in the centre of the graph. Four quantity levels are marked along the horizontal axis, Qs, Qsq, Qdq, and Qd, with dotted horizontal lines up to the intersections of the price lines and supply and demand curves.

Area a is above the intersection of Sd and PW and below Pq. Area b is the triangle formed by Sd, PW and Qsq. Area c is the rectangle in the middle formed by Qsq, PW, Qdq and Pq. Area d mirrors b, formed by Qdq, PW, and Dd.

[back]

a quantitative limit on exports of a product that's typically imposed at the urging of an importing country's government

an international organization that seeks to negotiate reductions in barriers to trade and to adjudicate complaints about violations of international trade policy; successor to the General Agreement on Tariffs and Trade (GATT)