Chapter 4: Tariffs

4.3 The Economic Effects of an Import Tariff – The Large-Country Case

An important question is whether an import tariff can ever benefit a nation economically. We have just seen that if producer surplus and consumer surplus do not have the same value as far as society is concerned, it is possible for a tariff to bring benefits. Another situation in which an import tariff can bring economic benefits is if a large country is able to influence the price of the imported product due to its significant market share. While the small-country assumption is very often a valid one, sometimes a nation has a large enough share of the market that its purchases of the imported product can influence its world price. For instance, if the United States imposed a tariff on motor vehicle imports, the resulting reduction in international demand could hurt foreign exporters, who might be willing to lower their export price in an attempt to maintain sales.

An importing country with such buying power could seek to benefit economically by imposing a tariff on imports. If the tariff lowers the prices that exporters receive, then the terms of trade of the importing country improve. In the typical situation, the tariff raises the domestic price somewhat and lowers the export price somewhat. This means that buyers of the import and foreign suppliers share the burden of the tariff. The difference between the price that domestic consumers pay and the price that foreign sellers receive represents the size of the tariff. Because its terms of trade improve, a large importing country can benefit from a tariff.

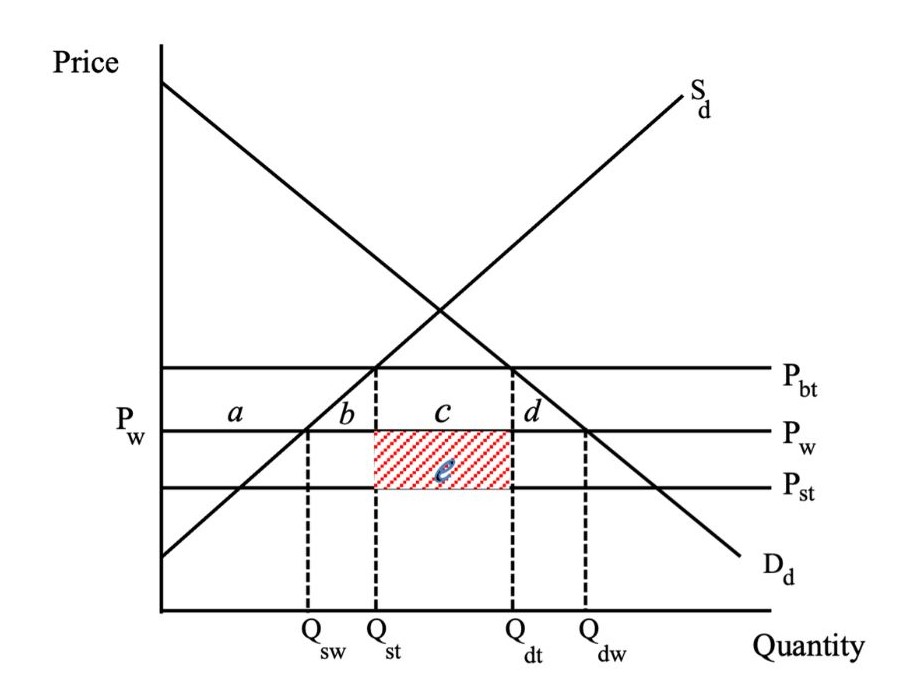

The analysis of the effects of an import tariff in the large-country case is shown in Figure 4.2. The demand for the imported product is given by [latex]\textit{D}_{d}[/latex] and the domestic supply is given by [latex]\textit{S}_{d}[/latex]. The intersection of supply and demand in the importing country before trade determines the equilibrium price and quantity. When the domestic market opens up to international trade, the importing country faces an international price of [latex]\textit{P}_{w}[/latex]. With free trade, equilibrium in the domestic markets shifts. Domestic consumers now purchase [latex]\textit{Q}_{dw}[/latex] and domestic producers supply [latex]\textit{Q}_{sw}[/latex]. The difference between the quantity purchased and the quantity supplied domestically represents the initial quantity of imports.

Credit: © by Kenrick H. Jordan and Conestoga College, CC BY-NC-SA 4.0.

Image Descriptions

Figure 4.2: The Economic Effects of a Tariff, Large Country

The image is a graph with a vertical axis labelled "Price" and a horizontal axis labelled "Quantity." A downward-sloping line labelled "Sd" and an upward-sloping line labelled "Dd" insert at the centre. Three horizontal lines representing different price levels: "Pbt" is the highest line, followed by "PW" and "Pst" Four points on the quantity axis are labelled from left to right as "QsW," "Qst," "Qdt," and "QdW.”

Area a is above the intersection of Sd and PW and below Pbt. Area b is the triangle formed by Sd, PW and QsW. Area c is the rectangle in the middle formed by QsW, Pw, Qst and Pbt. Area d mirrors b, formed by Qdt, PW, and Dd. A rectangle below area c and above Pst is shaded and labelled e.

[back]

an importing country that has a sufficiently large share of the world market to influence the world price of the product by using tariffs to alter the quantity of imports