Chapter 2: Comparative Advantage and the Standard Trade Model

2.1 The Importance of Economic Theories and Models

Economists apply the scientific method to develop theories or models to explain economic behaviour in the real world. In this chapter specifically (and in this course, generally), we will use economic models to explain international trade and its implications. Therefore, it is important to understand the role played by economic models or theories in economic analysis.

Review: The Scientific Method

Review or refresh your understanding of the scientific method by watching this video [8:38].

Source: Sprouts. (2017, October 5). The scientific method: Steps, examples, tips, and exercise. [Video]. YouTube. https://www.youtube.com/watch?v=yi0hwFDQTSQ

An economic model is a simplification of economic reality, which allows us to observe, understand, and make predictions about cause and effect in the real world. Since the world is complex, with many factors constantly changing, economic models capture only the elements that are important to the problem under consideration. If we were to include too many details, this can make an economic model unwieldy, limiting its usefulness in understanding and predicting economic behaviour.

As an example, we can think of the demand model. While many other factors besides price influence the quantity of a product that consumers purchase, the demand model looks only at the relationship between price and quantity, holding income, prices of related products, and consumer preferences constant. If all the main influences on demand were to change continually, it would be difficult to make conclusions about the effects of changes in price on consumer purchases. Assuming they ignore other influencing factors, if the price of gasoline were to increase, people might immediately expect gasoline purchases to fall. A good economic model, therefore, provides a shortcut to help people process information and make decisions.

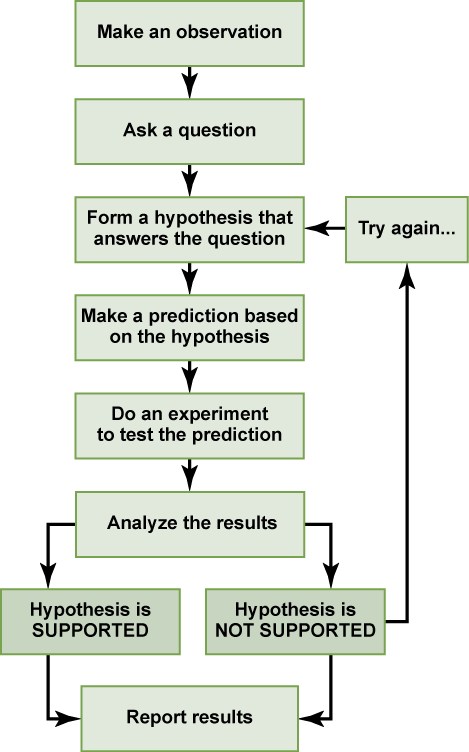

We use the scientific method to develop and discover useful economic models. The scientific method involves the following steps (McEachern, 2017):

- Identifying the question of interest and defining the variables that will help in answering it

- Specifying the assumptions under which the results of the model will be applied;

- Framing a hypothesis or theory about how the key variables relate to one another, and

- Testing hypotheses by subjecting them to real-world situations and events.

Figure 2.1 illustrates the traditional steps of the scientific method, which align with the steps used to develop an economic model.

Credit: Figure 1.18 in “1.2 The Process of Science” © OpenStax – Rice University, CC BY 4.0.

Let us discuss each of these further. First, the question may relate to anything in which we are interested, e.g., how does the value of the exchange rate affect the volume of exports? The variables that may help in answering this question are the exchange rate and the quantity of exports. By definition, a variable takes on different values over time or in different circumstances. Because the variables are critical to answering the question, we must be careful in deciding which variables we include in a model.

The assumptions are crucial to the interpretation of the results of any economic model. One type of assumption is the other-things-equal assumption. The idea is to focus entirely on the relationship between the variables relevant to answering our question while keeping all other important influences constant. If we are talking about the relationship between the exchange rate and exports, we assume, for instance, that there is no change in the preferences of foreigners for our products. The other type of assumption relates to how the variables of interest are expected to relate to each other. These are behavioural assumptions.

The framing of the hypothesis captures our view or theory about how the key variables relate to each other. We may expect that a fall in the exchange rate – because it makes our products less expensive to foreigners – will lead to an increase in our exports, other things equal. The purpose of the hypothesis is to make predictions about cause and effect in real-world situations where the value of a variable changes.

The final step of the scientific method is to test our hypothesis. To properly test a model’s predictions, we must compare its results with real-world evidence. For instance, if we wanted to test the model of demand, we might conduct a survey in which we ask consumers whether they would buy a larger quantity of a product if its price fell. If an overwhelming proportion of the respondents indicate that they will buy more in response to a fall in price, our hypothesis would be supported. If real-world testing supports the hypotheses, then we will have a workable theory that can be used until a better one is developed. If we cannot validate our hypothesis in real-world applications, then we can modify our model to yield better predictions.

We must use economic models with caution (McEachern, 2017). In particular, we must recognize that a model’s predictions apply to average or typical behaviour, not the specific behaviour of any individual, business, nation, or other entity. Also, determining cause and effect in the real world is not straightforward. Specifically, the fact that two variables are related does not imply that one variable causes the other. For instance, ice cream sales and shark attacks may correlate positively at a beach, but this does not mean that cream sales cause shark attacks. It is more likely that ice cream sales and shark attacks are more likely related to another common factor (Frost, n.d.). Lastly, but still significant, we must interpret the predictions of any model based on its assumptions.

References

Frost, J. (n.d.). Spurious correlation: Definition, examples, and detecting. Statistics by Jim. https://statisticsbyjim.com/basics/spurious-correlation/

McEachern, W. A. (2017). Macroeconomics: A contemporary introduction, (11th ed.). Cengage Learning.

Attributions

Figure 2.1: The Scientific Method reuses Figure 1.18 in “1.2 The Process of Science” from Concepts of Biology by OpenStax – Rice University, licensed under a Creative Commons Attribution 4.0 International License, except where otherwise noted. Access for free on the OpenStax website.

Image Descriptions

Figure 2.1: The Scientific Method

The image is a flowchart of blocks arranged vertically and containing a step in the process. Starting from the top, the blocks read “Make an observation,” “Ask a question,” “Form a hypothesis that answers the question,” “Make a prediction based on the hypothesis,” “Do an experiment to test the prediction,” “Analyze the results,” followed by two outcomes at the bottom: “Hypothesis is SUPPORTED” or “Hypothesis is NOT SUPPORTED.” These two outcomes then connect to “Report results.” A line goes from the right side of “Hypothesis is NOT SUPPORTED” and back up to a box labelled “Try again…” with an arrow completing the loop back to “Form a hypothesis that answers the question.”

[back]

a simplified representation of the economic world (i.e., of economic reality)

a measure (e.g., height, quantity) that can take on different values in different situations or at different times

a theory about how key variables relate to each other