Chapter 5: Trade Restrictions: Non-Tariff Barriers

5.2 The Economic Effects of an Absolute Import Quota – The Small-Country Case

One idea that we have seen regarding international trade is that it affects different groups in society differently. Therefore, in our analysis of an absolute quota, we will identify the effects on domestic consumers and domestic producers. We will also evaluate the economic impact on the nation and the world. As in the case of an import tariff, we will see that the effects of a quota are different for a small nation, which has no influence over the world price, from those for a large nation, which is able to influence the world price for the product due to its buying power.

The effects of an import quota are largely the same as those of an equivalent tariff (i.e., a tariff that leads to the same level of imports), if the market is competitive. Producers in import-competing industries benefit as they are able to boost production and receive higher prices. Meanwhile, consumers buy a smaller quantity of the product and must pay a higher domestic price. This means that there are the usual deadweight losses which reduce national economic well-being. National economic well-being can be further hurt depending on the way in which licences, which permit legal importation of the quota quantity, are distributed. The government will collect the tariff-equivalent revenue if the quota licences are auctioned off, and import distributors receive this revenue (or quota rent) if the import licences are given to them for free. In these cases, the effects of an import quota are effectively the same as those of a tariff. If the government distributes the licences to domestic suppliers through resource-using procedures or to foreign suppliers for free, then some or all of the tariff-equivalent revenue is lost to the country, and the reduction in national economic well-being is greater.

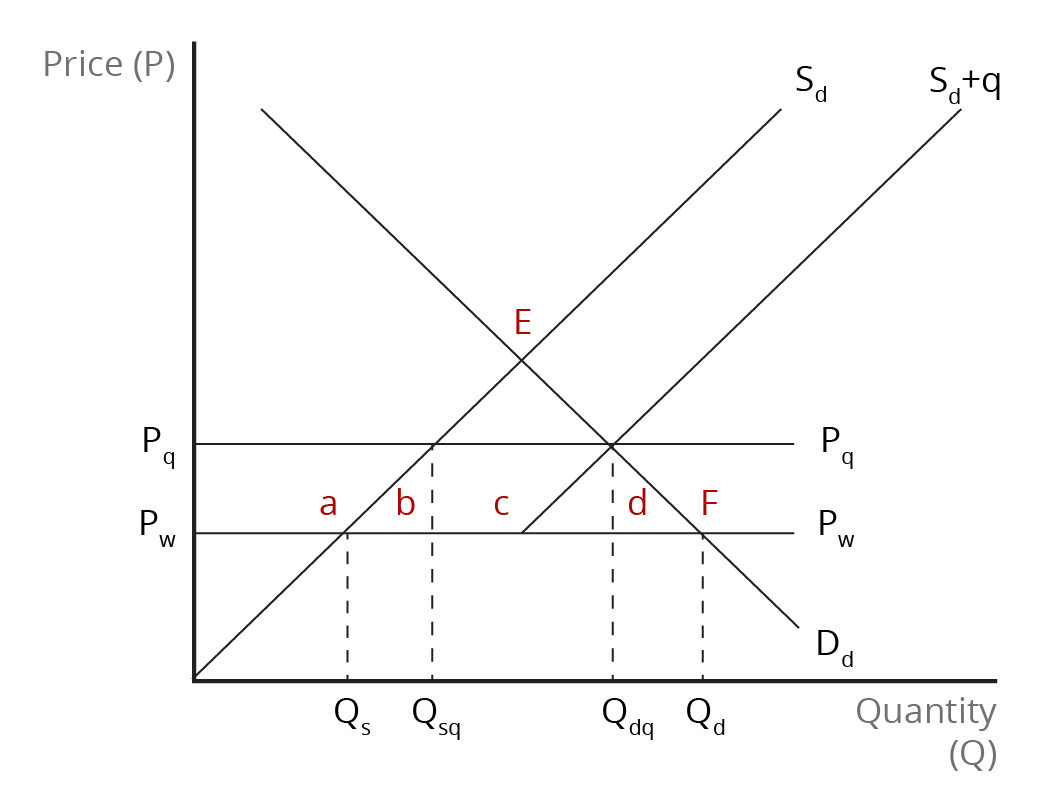

We first consider the case of a small country which is unable to influence the world price of the product. (See Figure 5.1)

Credit: © by Kenrick H. Jordan and Conestoga College, CC BY-NC-SA 4.0.

Figure 5.1 represents the domestic market for the product before international trade by bringing together domestic demand and supply. The domestic market is in equilibrium at the intersection of the demand [latex]\text{D}_{d}[/latex] and supply [latex]\text{S}_{d}[/latex] curves, at point [latex]\text{E}[/latex]. If the market is opened to trade, the nation can import an unlimited amount of the product at the prevailing world price. That is, the supply of imports is constant at the world price, shown as a horizontal line lying below the domestic equilibrium market price before trade. At the world price, the domestic market equilibrium shifts from point [latex]\text{E}[/latex] to point [latex]\text{F}[/latex], where the demand curve intersects the world price line, [latex]\text{P}_{w}[/latex]. At this point, the total quantity of the product that is purchased is [latex]\text{Q}_{d}[/latex] and the quantity supplied by domestic producers is [latex]\text{Q}_{s}[/latex].

Compared with the situation before trade, domestic consumption increases as a result of the lower world price while domestic production falls and a supply deficit emerges. This deficit is met by imports, with the quantity of imports being equal to the difference between [latex]\text{Q}_{s}[/latex] and [latex]\text{Q}_{d}[/latex]. With international trade, the economic well-being of consumers improves since they are able to consume more and pay a lower price. Meanwhile, domestic producers experience a decline in their economic well-being as their production falls due to imports, and the prices they receive are now lower. The domestic import-competing industry is, therefore, hurt by international competition.

Suppose domestic producers lobby the national government to protect their industry, and the government accommodates them with an import quota. This changes the supply situation within the domestic market. Below the world price line, supply comes only from domestic producers; above the world price line, the domestic supply increases by the extent of the quota (i.e., the quota quantity). The pertinent domestic supply curve with international trade now becomes [latex]\text{S}_{d}+\textit{q}[/latex], where [latex]\textit{q}[/latex] represents the quota quantity. For the quota to be effective, the level of imports must be set lower than that which would have occurred in the absence of free trade. Since supply is now reduced below the free-trade level, the domestic price rises above the world price and is given by the intersection of the “new” supply curve, [latex]\text{S}_{d}+\textit{q}[/latex], and the demand curve, [latex]\text{D}_{d}[/latex]. The domestic price is indicated by the horizontal line [latex]\text{P}_{q}[/latex] (parallel to the world price, [latex]\text{P}_{w}[/latex]).

Effects of Import Quotas on Domestic Producers and Consumers

The increase in the domestic price due to the import quota causes consumers to purchase a smaller quantity of the product. The quantity demanded falls from [latex]\text{Q}_{d}[/latex] to [latex]\text{Q}_{dq}[/latex]. Consumers are worse off compared with the free-trade situation as they must pay a higher price and get a smaller quantity. Graphically, consumer surplus falls by areas [latex]\textit{a}+{b}+{c}+{d}[/latex]. In contrast, the economic well-being of domestic producers improves as their production expands from [latex]\text{Q}_{s}[/latex] to [latex]\text{Q}_{q}[/latex] and they receive a higher price. As a result, producer surplus increases by area [latex]\textit{a}[/latex]. The increased domestic production comes at a cost to the nation as it replaces lower-cost production that could have been imported from foreign producers. This is the usual production effect. The consumption effect (area [latex]\textit{d}[/latex]) also represents a cost to the nation, as some consumers who are willing to pay prices higher than the world price are shut out of (excluded from) the market.

The production effect (area [latex]\textit{b}[/latex]) and the consumption effect (area [latex]\textit{d}[/latex]) are the usual deadweight losses that arise from import protection. They represent the lower limit to the social loss from the imposition of an import quota. The social loss can be greater depending on whether the tariff-equivalent revenue accrues in full to the nation. This, in turn, depends on how the licences to import the quota are distributed.

If the government auctions off the licences in a competitive market, competition among importers would drive up the price of a licence to a level where any excess profit is eliminated. Thus, the tariff-equivalent revenue is transferred fully to the government. The tariff-equivalent revenue is captured by area [latex]\textit{c}[/latex]. The effects of the import quota would, therefore, be the same as those of an import tariff – producer surplus increases, consumer surplus falls, and national economic well-being falls by the sum of the production and consumption effects.

If the government gives out import licences for free to domestic import distributors, they can import the product at the lower world price and sell it (on the domestic market) at the higher domestic price. Thus, domestic import distributors will be able to capture the tariff-equivalent revenue, equal to area [latex]\textit{c}[/latex]. As this economic surplus remains within the country, this is not a social loss, and the economic effects of the import quota are the same as those of an import tariff – producers' surplus increases, consumer surplus falls, and national economic well-being falls by the sum of the production and consumption effects.

If the government distributes the import licences to domestic suppliers or distributors through resource-using application or selection procedures or to foreign suppliers for free, then some or all of the tariff-equivalent revenue is lost to the country, and the reduction in national economic well-being is greater than the sum of the production effect and the consumption effect. If resource-using procedures are used, then rent-seeking can completely exhaust the tariff-equivalent revenue. Also, if the licences are given to foreign suppliers, then they derive the tariff-equivalent revenue as they are able to sell the imported product at a higher domestic price.

In summary, the economic effects of an import quota are largely the same as those of an equivalent tariff, if the market is competitive. Producers in import-competing industries benefit, while consumers end up being worse off. The nation loses economic well-being due to the production and consumption effects. National economic well-being can be further reduced depending on how the licences, which permit legal importation of the quota, are distributed. If the government gets tariff-equivalent revenue by auctioning off the licences or if import distributors receive this revenue because the licences are given to them for free, the effects of a quota are the same as those of a tariff. If the government distributes the licences to domestic suppliers through resource-using procedures or to foreign suppliers for free, then some or all of the tariff-equivalent revenue will be lost to the country, and the reduction in national economic well-being will be greater.

There is one other way in which the economic effects of an import quota are different from those of an import tariff. A quota provides domestic producers of the import-competing good with more market (monopoly) power than a tariff if demand were to grow for any reason. This is because a quota absolutely limits the quantity of imports in a particular period, which means that when the quota is filled, domestic producers are the only source of supply and, therefore, attain monopoly power. With a tariff, in contrast, imports can continue as long as domestic consumers are willing to pay the higher prices that are prompted by the increase in demand.

The economic effects on an absolute import quota are depicted in Figure 5.1 and summarized in Table 5.1.

| Item | Gain/Loss |

|---|---|

| Producer surplus gain or loss | [latex]+\textit{a}[/latex] |

| Consumer surplus gain or loss | [latex]-\textit{a}-{b}-{c}-{d}[/latex] |

| Tariff-equivalent revenue | [latex]+\textit{c}[/latex] |

| National economic well-being | [latex]-\textit{b}-{d}[/latex] |

Review: Effects of Import Quota

Review your understanding of import quotas by watching this video [15:57].

Source: Stephen King. (2014, April 26). 11f: the effects of an import quota. [Video]. YouTube. https://www.youtube.com/watch?v=sGNvMI0-79M

Image Descriptions

Figure 5.1: The Economic Effects of an Import Quota in a Small Country

The image is a graph with a vertical axis labelled "Price (P)," and a horizontal axis labelled "Quantity (Q)."

Two horizontal lines extending from the lower half of the y-axis are labelled Pq and PW.

There are two supply curves and one demand curve drawn. The original supply curve, labelled Sd, is upward-sloping from the origin point of the graph. To the right, there is a second supply curve, labelled Sd+q, originating from the PW line.

The demand curve labelled Dd is downward sloping. There is an equilibrium point marked "E" where the original supply curve Sd intersects the demand curve Dd. The intersection of Dd and PW is labelled “F.”

Four quantity levels are marked along the horizontal axis, Qs, Qsq, Qdq, and Qd, with dotted horizontal lines up to the intersections of the price lines and supply curves with the demand curve.

Area a is above the intersection of Sd and PW and below Pq. Area b is the triangle formed by Sd, PW and Qsq. Area c is the rectangle in the middle formed by Qsq, PW, Qdq and Pq, with Sd+q passing through it. Area d mirrors b, formed by Qdq, PW, and Dd.

[back]

revenue that is generated by a trade policy other than a tariff that's equal to the revenue generated by a tariff

a market process in which a good or service is sold to the highest bidder

the difference between the domestic price of the imported product and the world price multiplied by the quantity of imports under the quota

procedures to allocate an item that uses up real resources, including first-come, first-served, proof of merit, or negotiation