Chapter 11. Auditing in the Public and Not-for-Profit Sector

11.05. Ethical Considerations in Public and Not-for-Profit Auditing

Key Questions

![]() Briefly reflect on the following before we begin:

Briefly reflect on the following before we begin:

- What ethical dilemmas are unique to auditing in the public and not-for-profit sectors?

- How can auditors maintain independence and objectivity when auditing public and not-for-profit organizations?

- What role does confidentiality play in auditing public and not-for-profit entities?

- How can training and awareness programs support auditors in navigating ethical considerations in these sectors?

Ethical considerations are paramount in public and not-for-profit auditing, ensuring the integrity, objectivity, and trustworthiness of audit processes and outcomes. It is essential to uphold integrity and objectivity in the public sector and not-for-profit audits to maintain public confidence in the transparency and accountability of government entities and charitable organizations. Auditors in these sectors must adhere to strict ethical standards to avoid conflicts of interest and maintain independence in their assessments.

Navigating conflicts of interest is crucial for auditors operating in the public and not-for-profit sectors, where relationships with stakeholders can present ethical challenges. Maintaining auditor independence ensures impartiality and credibility in audit findings and recommendations. Confidentiality is another critical ethical consideration, particularly in the public sector, where sensitive information may be involved. Auditors must safeguard the confidentiality of audit information while balancing the need for transparency and accountability.

Ethical dilemmas are inevitable in auditing, requiring auditors to apply decision-making frameworks guided by professional ethics. Transparency and accountability are essential for strengthening public trust, emphasizing the importance of ethical conduct in audit practices. Training and awareness programs on ethics are vital for auditors in these sectors to enhance their understanding of moral principles and their application in auditing processes. Additionally, auditors must be vigilant in addressing and reporting unethical behaviour and fraud to uphold the integrity of the audit profession and safeguard public interests.

Internal Audit in Action

Internal Audit in Action

Background

Seraphicus NonProfit Aid, a large not-for-profit organization dedicated to global disaster relief efforts, faces scrutiny over the allocation and use of its funds. The organization initiated an internal audit on ethical practices in financial management and program delivery to address these concerns and uphold its reputation.

Challenge

The audit must navigate sensitive issues, ensuring that all financial practices and program operations comply with legal standards and align with the highest ethical norms. This includes managing donor funds responsibly, operating transparently, and avoiding conflicts of interest among board members or staff.

Action Taken

- Upholding Integrity and Objectivity: The audit team prioritizes integrity and objectivity, conducting the audit with an impartial stance and ensuring findings and recommendations are based solely on evidence.

- Navigating Conflicts of Interest: Special attention is given to identifying potential conflicts of interest, with auditors reviewing board and staff affiliations and financial dealings to ensure that personal interests do not influence organizational decisions.

- Confidentiality Issues: Given the sensitive nature of financial and operational data, the team strictly adheres to confidentiality protocols, ensuring that information gathered during the audit is securely handled and only shared with authorized individuals.

- Ethical Dilemmas and Decision-Making: Throughout the audit, the team encounters several ethical dilemmas, such as handling anonymously reported instances of mismanagement. These situations are approached with a structured decision-making framework, balancing legal compliance with moral considerations.

- Strengthening Public Trust: The final audit report, while maintaining confidentiality where necessary, is crafted to transparently communicate findings to stakeholders, highlighting both strengths and areas for improvement, thereby reinforcing public trust in Seraphicus NonProfit Aid.

Outcome

The audit reveals areas where Seraphicus NonProfit Aid can enhance its financial and operational practices to better align with ethical standards. Implementing audit recommendations leads to improved transparency with donors, stricter conflict-of-interest policies, and enhanced mechanisms for ethical decision-making, bolstering the organization’s credibility and effectiveness.

Reflection

This scenario emphasizes the critical role of ethical considerations in not-for-profit auditing. By conducting audits that prioritize integrity, objectivity, and transparency, organizations like Seraphicus NonProfit Aid can navigate complex ethical landscapes, ensuring that they operate in compliance with legal requirements and in a manner that earns and maintains public trust.

Upholding Integrity and Objectivity in Public Sector and Not-for-Profit Audits

Upholding integrity and objectivity are foundational to the trust stakeholders, including the public, place in auditors. Integrity involves adherence to moral and ethical principles, ensuring honesty and fairness in all audit activities. Objectivity requires auditors to remain unbiased and impartial, providing truthful and accurate assessments of an organization’s financial and operational health.

Tests of Integrity

Auditors in the public sector and not-for-profit organizations face unique challenges that can test their integrity. Public sector auditors must navigate complex political environments where pressures from government officials or interest groups can influence their work. Similarly, auditors in the not-for-profit sector may encounter pressures from donors, management, or board members who have vested interests in specific outcomes. Despite these pressures, auditors must remain steadfast in their commitment to ethical standards. To uphold integrity, auditors should adhere to the principles of the Code of Ethics established by professional bodies such as the IIA and the Chartered Professional Accountants (CPA) of Canada. These codes provide guidelines on ethical conduct, including honesty, diligence, and responsibility. Auditors should consistently apply these principles, avoiding any actions that could compromise their moral standards. For example, accepting gifts or favours from clients or stakeholders can create conflicts of interest and undermine the auditor’s integrity.

Objectivity

Objectivity is vital in ensuring audit findings and recommendations are based on unbiased evidence. Auditors must approach their work with an open mind, free from preconceived notions or external influences. This requires a disciplined adherence to professional skepticism, where auditors critically assess all information and evidence before arriving at conclusions.

Maintaining objectivity also means auditors must avoid situations that could damage their independence. This includes financial relationships with the audited entity, personal relationships with key personnel, or any other connections that could influence their judgment.

The application of rigorous audit methodologies is essential in supporting objectivity. Auditors should follow established procedures and standards, such as those outlined in the International Standards for the Professional Practice of Internal Auditing (ISPPIA). These standards provide a framework for conducting audits systematically and consistently, ensuring findings are based on credible and verifiable evidence.

Auditors can demonstrate their commitment to integrity and objectivity by adhering to these standards.

Factors for Preserving Integrity and Objectivity

Factors for preserving integrity and objectivity include the following:

Training and Continuous Professional Development

Auditors should regularly participate in ethics training programs that address the specific challenges faced in the public and not-for-profit sectors. These programs should cover ethical decision-making, conflict of interest management, and maintaining professional skepticism. By staying informed about the latest ethical standards and best practices, auditors can better navigate the complex ethical landscapes they encounter.

The Role of Leadership within Audit Organizations

Audit leaders and managers should model ethical behaviour and foster a culture of integrity and objectivity within their teams. This includes establishing clear policies and procedures for handling ethical issues, providing support and guidance to auditors facing moral dilemmas, and promoting an environment where ethical concerns can be raised without fear of retribution. Leadership commitment to ethical standards sets the tone for the entire organization and reinforces the importance of these principles in everyday audit activities.

Transparency and Accountability

Auditors should communicate their findings and recommendations clearly and candidly, providing a transparent account of their audit processes and conclusions. This transparency helps to build credibility and demonstrates the auditor’s commitment to integrity and objectivity. Additionally, auditors should be accountable for their work, willingly subjecting their findings to scrutiny by stakeholders, including audit committees, regulatory bodies, and the public.

Addressing and Reporting Unethical Behaviour

Auditors should be vigilant in identifying any signs of dishonest conduct, whether within the audited entity or their organization. They should have clear procedures for reporting such behaviour, including whistleblower protections, to ensure that individuals can report concerns without fear of retaliation

Navigating Conflicts of Interest and Maintaining Auditor Independence

Conflicts of interest occur when auditors have personal or financial interests that could improperly influence their professional judgment. Maintaining independence means ensuring that auditors are free from such influences and can provide unbiased and objective assessments of the entities they audit, thereby preserving the integrity and credibility of the audit process. Public sector auditors face unique challenges in navigating conflicts of interest. Government auditors may encounter situations where political pressures or relationships with government officials could impact their objectivity. Similarly, auditors in the not-for-profit sector might face pressures from donors, board members, or management who have specific expectations or vested interests in the audit outcomes. To address these challenges, auditors must adhere to stringent ethical guidelines and professional standards emphasizing independence and objectivity.

Strategies for Maintaining Independence

Auditors can used several tried-and-true strategies to maintain independence. By following these practices, auditors help maintain public trust in the audit process and ensure that government programs and not-for-profit initiatives are managed ethically and effectively.

Some of these strategies are discussed below:

Conflict of Interest Policy

One fundamental strategy for maintaining auditor independence is establishing clear policies and procedures for identifying and managing conflicts of interest. Organizations should have a formal conflict of interest policy that requires auditors to disclose any potential conflicts before commencing an audit. This disclosure process helps identify situations where an auditor’s impartiality could be compromised. For example, suppose an auditor has a financial interest in a company that supplies goods to the entity being audited. In that case, this relationship must be disclosed and addressed to prevent any bias in the audit.

Safeguards to Mitigate the Impact of Conflicting Interests

In addition to disclosure requirements, audit organizations should implement safeguards to mitigate the impact of identified conflicts of interest. These safeguards include assigning different auditors to the engagement, regularly rotating audit staff, and establishing oversight mechanisms such as audit committees. Audit committees are vital in overseeing the auditor’s work, ensuring that conflicts of interest are managed appropriately and that independence is maintained throughout the audit process.

Adherence to Professional Standards and Codes of Ethics

Independence is also reinforced through adherence to professional standards and codes of ethics, such as those established by the IIA and the Chartered Professional Accountants (CPA) of Canada. These standards provide comprehensive guidelines for maintaining independence and managing conflicts of interest. For instance, the IIA’s Code of Ethics requires auditors to perform their work with integrity, objectivity, and confidentiality, emphasizing the need to avoid situations that could impair their impartiality.

Training and Continuous Professional Development

Regular ethics training programs should be mandatory for auditors, covering topics such as identifying conflicts of interest, understanding the importance of independence, and applying ethical decision-making frameworks. These programs should be tailored to address the challenges faced in the public and not-for-profit sectors, providing practical examples and scenarios that auditors will likely encounter.

Culture of Ethical Behaviour

An essential aspect of maintaining auditor independence is fostering a culture of ethical behaviour within the audit organization. Leadership plays a crucial role in setting the tone at the top, demonstrating a commitment to moral principles, and creating an environment where integrity and objectivity are valued. Audit leaders should model ethical behaviour, provide guidance on handling ethical dilemmas, and encourage auditors to raise concerns without fear of retaliation. This culture of ethics supports auditors in making unbiased decisions and reinforces the importance of independence.

Quality Assurance Program

Another critical strategy for maintaining independence is implementing a robust quality assurance program. Regular internal and external reviews of the audit function can help ensure that professional standards are used while conducting audits and that conflicts of interest are appropriately managed. These reviews can identify areas for improvement, provide feedback on audit practices, and ensure that the audit organization maintains high standards of integrity and objectivity.

Transparency

Auditors should clearly and publicly communicate their findings, methodologies, and potential conflicts of interest. Transparent communication with stakeholders, including management, audit committees, and the public, helps build trust and demonstrates the auditor’s commitment to unbiased and objective reporting. By providing a transparent account of their work, auditors can mitigate concerns about conflicts of interest and reinforce their independence.

Procedures for Reporting and Investigating Breaches of Ethical Standards

Violations of independence and conflicts of interest should be addressed promptly and effectively. Audit organizations should have clear procedures for reporting and investigating breaches of ethical standards. Swift and appropriate action, including disciplinary measures, if necessary, ensures that violations are taken seriously and that the integrity of the audit process is preserved.

Confidentiality Issues Unique to Public and Not-for-Profit Sectors

Auditors in the public and not-for-profit sectors often handle sensitive information that, if disclosed improperly, could have severe implications for public trust, individual privacy, and organizational integrity. Understanding and navigating confidentiality issues in these contexts is essential for auditors to maintain the highest ethical standards and effectively serve the public interest.

Confidentiality Issues in the Public Sector

In the public sector, auditors frequently deal with information about government operations, public funds, and citizens’ data. The confidentiality of this information is critical because its unauthorized disclosure could compromise national security, disrupt public services, and erode trust in government institutions. Auditors might have access to sensitive social services and healthcare records or national defence data during an engagement. Ensuring this information is protected from unauthorized access and disclosure is paramount to maintaining public confidence in the audit process and the entities being audited.

Confidentiality Issues in the Not-for-Profit Sector

In the not-for-profit sector, auditors encounter confidential information that includes donor details, financial records, and beneficiary data. These organizations rely heavily on the trust of their donors and the communities they serve. Breaches of confidentiality can lead to a loss of donor support, damage to the organization’s reputation, and potential legal consequences. For example, if an auditor inadvertently discloses information about a high-profile donor’s contribution, it could result in donor withdrawal and diminished funding, significantly impacting the organization’s ability to fulfill its mission.

Measures to Address Confidentiality Related-issues

Some measures to address confidentiality related-issues are as follows:

Balance Between Transparency and Privacy

One of the critical challenges in managing confidentiality in these sectors is the balancing act between transparency and privacy. Public sector entities and not-for-profits are expected to operate transparently to ensure accountability and public trust. However, this transparency must not come at the expense of confidentiality. Auditors must navigate this delicate balance by being transparent about their audit processes and findings while rigorously protecting sensitive information.

Adherence to Professional Standards and Ethical Guidelines

The IIA and the Chartered Professional Accountants (CPA) of Canada provide clear guidelines for maintaining confidentiality. These standards require auditors to safeguard information obtained during audits and prohibit using such information for personal gain or in a manner that would harm the organization. Auditors must be familiar with and adhere to these standards to handle confidential information appropriately.

Implementing Robust Internal Policies and Procedures

Audit organizations should establish clear protocols for handling, storing, and sharing confidential information. This includes using secure communication and data storage methods, restricting access to sensitive information to authorized personnel only, and ensuring that all staff are trained on confidentiality protocols. For example, encrypted email systems and secure cloud storage can prevent unauthorized access to confidential audit information.

Training and Continuous Professional Development

Continuous training ensures auditors understand and effectively manage confidentiality issues. Regular training sessions should cover data protection laws, ethical standards, and best practices for safeguarding information. Auditors should be aware of the latest information security and confidentiality developments to address emerging threats and vulnerabilities. For instance, training on new data privacy regulations, such as the General Data Protection Regulation (GDPR), can help auditors navigate complex legal requirements related to data confidentiality.

Fostering a Culture of Integrity and Ethical Behaviour

Leadership must emphasize the importance of confidentiality and model ethical behaviour. Creating an environment where auditors feel responsible for protecting sensitive information and are encouraged to speak up about potential breaches is crucial. This can be supported by establishing precise reporting mechanisms for confidentiality breaches and ensuring these reports are taken seriously and addressed promptly.

Technology

Using technology presents opportunities and challenges for maintaining confidentiality. While advancements in digital tools and data analytics can enhance the efficiency and effectiveness of audits, they also pose risks related to data security. Auditors must be vigilant in using these tools and incorporate strong security measures to protect confidential information. This includes regularly updating software, using strong passwords, and employing multi-factor authentication.

Regular Risk Assessments

Addressing confidentiality issues requires a proactive approach to risk management. Audit organizations should conduct regular risk assessments to identify potential threats to confidentiality and implement measures to mitigate these risks. This includes evaluating the security of information systems, assessing the adequacy of internal controls, and ensuring that contingency plans are in place to respond to breaches. For example, periodic security audits can help identify vulnerabilities in an organization’s information system and prompt timely corrective actions.

Ethical Dilemmas and Decision-Making Frameworks for Auditors

Ethical dilemmas are a common challenge for auditors in the public and not-for-profit sectors. These dilemmas arise when auditors face situations where they must choose between conflicting ethical principles or values. Navigating these dilemmas effectively is crucial for maintaining professional integrity and public trust. Decision-making frameworks provide auditors with structured approaches to analyze and resolve ethical dilemmas, ensuring their actions align with ethical standards and professional responsibilities.

Common Ethical Dilemmas:

Some common ethical dilemmas include the following:

Balancing Transparency with Confidentiality

One of the most common ethical dilemmas auditors face is balancing transparency with confidentiality. For example, an auditor may discover financial irregularities that suggest mismanagement or fraud. The moral dilemma arises when deciding how much information to disclose and to whom. On the one hand, transparency is necessary to hold the organization accountable and protect the public interest. On the other hand, revealing sensitive information prematurely can damage reputations and breach confidentiality agreements. In such situations, auditors must carefully consider the potential impacts of their actions on all stakeholders.

Conflicts of Interest

Another frequent dilemma involves conflicts of interest. Auditors must remain objective and impartial, but they may encounter situations where personal or financial interests conflict with their professional duties. For instance, an auditor might have a personal relationship with a member of the organization’s management team, which could influence their judgment. To maintain integrity, auditors must identify and manage these conflicts effectively, often by recusing themselves from specific audits or disclosing the conflict to appropriate authorities.

External Pressure

Ethical dilemmas arise when auditors encounter pressure from management or external parties to alter or omit findings. This pressure can be subtle, such as hints to be less critical, or overt, such as direct requests to falsify reports. Auditors must resist these pressures to ensure their reports remain accurate and truthful. Succumbing to such pressures compromises the audit’s integrity and damages public trust in the auditing profession.

Decision-making Frameworks

To address these dilemmas, auditors can use decision-making frameworks that provide structured approaches for ethical analysis. The majority of the commonly used frameworks involve the following steps:

- Identify the Facts: Gather all relevant information to understand the situation.

- Define the Ethical Issues: Clearly articulate the ethical dilemma and the conflicting values or principles.

- Identify the Stakeholders: Consider all parties affected by the decision, including the organization, its employees, donors, beneficiaries, and the public.

- Consider the Consequences: Evaluate the potential outcomes of different courses of action for each stakeholder.

- Identify Obligations: Determine the auditor’s ethical and professional responsibilities.

- Consider Character and Integrity: Reflect on how the decision aligns with personal and professional values.

- Think Creatively About Potential Actions: Explore alternative solutions that might resolve the dilemma without compromising ethical standards.

- Make a Decision and Act: Choose and implement the best action, ensuring the decision aligns with ethical principles and professional standards.

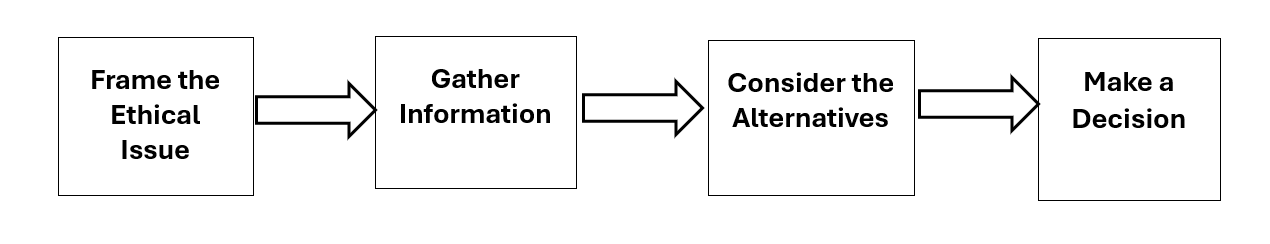

An alternative four-step ethical decision-making model is shown in Exhibit 11.1 and described below.

- Frame the Ethical Issue: Define the problem and the issues at stake.

- Gather Information: Collect facts and understand the context of the dilemma.

- Consider the Alternatives: Identify possible courses of action and evaluate their ethical implications.

- Make a Decision: Choose the best ethical action and take responsibility for the outcome.

Using these frameworks helps auditors systematically analyze ethical dilemmas and make informed decisions that uphold moral standards.

Resolving Dilemmas and Choosing Frameworks—Other Considerations

It is essential for auditors to seek guidance from peers, mentors, or professional bodies when faced with particularly challenging dilemmas. Discussing ethical issues with others can provide new perspectives and help auditors reach sound conclusions.

Training and continuous professional development are critical in equipping auditors with the skills to navigate ethical dilemmas. Regular ethics training programs should cover common ethical challenges and provide practical exercises for applying decision-making frameworks. These programs should also update auditors on changes in moral standards and best practices, ensuring they remain current in their knowledge and skills.

Organizations should foster a culture of ethical behaviour where auditors feel supported in making ethical decisions. Leadership must demonstrate a commitment to ethics by modelling ethical behaviour, providing clear guidance on ethical issues, and encouraging open discussions about ethical dilemmas. This supportive environment helps auditors feel confident in addressing ethical challenges and reinforces the importance of integrity in their work.

The Role of Professional Ethics in Strengthening Public Trust

Professional ethics strengthen public trust, especially in public and not-for-profit auditing. These sectors handle resources and information that significantly impact society, making integrity and ethical behaviour on the part of auditors essential for maintaining public confidence. Upholding high ethical standards ensures that auditors perform their duties honestly, impartially, and transparently, which fosters trust among stakeholders, including the public, government entities, donors, and beneficiaries.

The Public Sector

In the public sector, auditors oversee the use of public funds and ensure that government programs and services operate effectively and efficiently. The public relies on auditors to provide objective assessments and uncover any misuse of resources or inefficiencies. Professional ethics, codified in standards set by the IIA and the Chartered Professional Accountants (CPA) of Canada, mandate that auditors maintain integrity, objectivity, confidentiality, and competency. By adhering to these principles, auditors help ensure that their evaluations are fair and unbiased. This is critical for holding government officials accountable and ensuring that public resources are used appropriately.

The Not-For-Profit Sector

Similarly, organizations in the not-for-profit sector depend on donors’ trust and the communities they serve. Auditors play a crucial role in verifying that donations are used as intended and that the organization’s operations are transparent and efficient. Ethical auditing ensures that financial statements are accurate and that potential issues are promptly identified and addressed. This transparency is vital for maintaining donor confidence and securing continued support for the organization’s mission. When donors and beneficiaries see an organization being audited by professionals who adhere to strict ethical standards, their trust in the organization is reinforced.

Impact on Public Trust

Professional ethics ensure that auditors effectively serve the public interest, fostering trust and accountability in the management of public and not-for-profit organizations. Professional ethics affect and strengthen public trust in several ways some of which are discussed below.

Upholding the Independence and Objectivity of Auditors

One of the primary ways professional ethics strengthen public trust is by ensuring the independence and objectivity of auditors. Conflicts of interest can undermine the credibility of an audit, leading to biased findings and recommendations. Ethical guidelines require auditors to avoid situations where their independence could be compromised and to disclose any potential conflicts of interest. For example, auditors must not have financial interests in the entities they audit and should not engage in activities that could impair their objectivity. By maintaining independence, auditors can provide impartial evaluations that stakeholders can trust.

Confidentiality

Confidentiality is another critical aspect of professional ethics that enhances public trust. Auditors often have access to sensitive information, including financial records, strategic plans, and personal data. Ethical standards require auditors to protect and use this information only for the audit. This protection of confidential information reassures stakeholders that their private data will not be misused or disclosed without authorization. It also ensures that organizations can be candid with auditors, providing all necessary information without fear of leaks or breaches of confidentiality.

Competence

Professional ethics also emphasize the importance of competence in auditing. Auditors must possess the necessary skills and knowledge to conduct thorough and accurate audits. This involves continuous professional development and staying updated on the latest auditing standards and practices. Competence ensures that auditors can identify and assess risks, understand complex financial transactions, and provide relevant recommendations for improvement. When stakeholders see competent professionals conduct audits, their confidence in the audit’s findings and recommendations is strengthened.

Transparency

Transparency in the audit process is another way professional ethics build public trust. Auditors should communicate their methods, findings, and recommendations clearly, making the audit process understandable to non-experts. This transparency allows stakeholders to see how conclusions were reached and understand the basis for recommendations. Ethical auditors also disclose any limitations or uncertainties in their findings, providing a complete and honest picture of the organization’s performance. This openness fosters trust by demonstrating that the audit process is thorough and unbiased.

Modelling

The role of leadership in promoting professional ethics is crucial. Leaders in auditing organizations must model ethical behaviour and create an environment that prioritizes ethical standards. This includes setting clear expectations for moral conduct, training on ethical issues, and supporting auditors in making ethical decisions. A culture of ethics within the auditing organization reinforces the importance of integrity and objectivity, ensuring these values are upheld in every audit.

Reporting Fraud

Ethical behaviour in auditing also extends to addressing and reporting unethical behaviour and fraud. Auditors are responsible for reporting any illegal or unethical activities they uncover during their audits. Ethical guidelines provide frameworks for auditors to follow when reporting such issues, ensuring they are addressed appropriately. By acting against unethical behaviour, auditors demonstrate their commitment to integrity and accountability, further strengthening public trust.

Ethics Training and Awareness Programs for Auditors in The Public and Not-for-profit Sectors

Training and awareness programs on ethics ensure that the auditors understand and adhere to the ethical standards for maintaining integrity, objectivity, and public trust. Given the unique challenges and pressures of these sectors, such training helps auditors navigate complex moral dilemmas and reinforces a culture of ethical behaviour within their organizations. Ethical training is foundational for auditors because it equips them with the knowledge and tools to handle situations that may compromise their integrity or objectivity. In the public sector, auditors often face pressures from political figures or government officials that could influence their judgment. Similarly, auditors in the not-for-profit industry might encounter pressures from donors or board members. Ethical training helps auditors recognize these pressures and respond appropriately, ensuring their work remains unbiased and credible.

Training Programs

Essential Components

Practical, ethical training programs for auditors should cover several key components:

- Understanding Ethical Principles and Standards: Auditors must be well-versed in the ethical principles and standards set by professional bodies such as the IIA and the Chartered Professional Accountants (CPA) of Canada. Training should include comprehensive sessions on these standards, emphasizing their importance and practical application in daily audit activities.

- Identifying and Managing Conflicts of Interest: Training should provide auditors with strategies to identify and manage conflicts of interest. This includes understanding the types of disputes that can arise, such as financial interests or personal relationships, and knowing how to disclose and mitigate these conflicts to maintain independence and objectivity.

- Confidentiality and Data Protection: Auditors often handle sensitive information. Training should emphasize the importance of protecting this information and provide practical guidance on confidentiality. This includes understanding legal requirements for data protection and implementing best practices for information security.

- Ethical Decision-Making Frameworks: Auditors should be trained to use structured decision-making frameworks to resolve ethical dilemmas. These frameworks, such as the American Accounting Association (AAA) model or the IIA’s ethical decision-making model, provide a systematic approach to analyzing and resolving ethical issues, ensuring that decisions are consistent with ethical standards.

- Case Studies and Practical Scenarios: Incorporating case studies and practical scenarios into training programs helps auditors apply theoretical knowledge to real-world situations. By working through examples of ethical dilemmas they might encounter, auditors can practice their decision-making skills and learn from best practices and past mistakes.

Delivery and Presentation

Ethical training can be delivered through various methods to accommodate learning styles and preferences. Interactive workshops and seminars allow auditors to engage with instructors and peers, discuss ethical issues, and participate in group exercises. These sessions can be conducted in person or virtually, making them accessible to a broad audience. Online courses and webinars allow auditors to complete training at their own pace. These platforms can include multimedia content, quizzes, and interactive elements to enhance learning. Pairing auditors with experienced mentors or coaches can provide personalized guidance and support. Mentors can share their experiences, offer advice on ethical dilemmas, and help auditors develop ethical decision-making skills. Ethical training should not be a one-time event. Regular refreshers and updates are essential to keep auditors informed about changes in ethical standards, emerging issues, and new best practices. Continuous learning ensures auditors remain vigilant and prepared to handle evolving ethical challenges.

Training and awareness programs are most effective when a broader organizational commitment to ethics is supported. Leadership plays a critical role in creating and sustaining an ethical culture. Leaders should model ethical behaviour, communicate the importance of ethics, and ensure that moral considerations are integrated into all aspects of the organization’s operations.

Implementation and Effectiveness

Organizations can also establish ethical policies and procedures, such as codes of conduct, conflict of interest policies, and whistleblower protection programs. These policies provide a clear framework for moral behaviour and reinforce the principles taught in training programs. Additionally, organizations should create safe channels for auditors to report unethical behaviour without fear of retaliation. Organizations should regularly assess their impact to ensure the effectiveness of ethical training programs. This can be done through surveys, feedback sessions, and performance evaluations. Monitoring the number and nature of ethical issues reported and the outcomes of ethical decision-making processes can provide insights into the program’s effectiveness and areas for improvement.

Addressing and Reporting Unethical Behaviour and Fraud

The public and not-for-profit sectors are particularly vulnerable to ethical breaches due to their work, which often involves managing public funds, donations, and sensitive information. Auditors play a pivotal role in detecting, addressing, and reporting unethical practices, ensuring accountability, and maintaining public trust.

Detecting Fraud

The first step in addressing unethical behaviour and fraud is detection. Auditors must be vigilant and equipped with the necessary skills to identify signs of unethical conduct. This includes understanding common types of fraud, such as financial misstatements, misappropriation of assets, and corruption. Auditors should be trained to recognize red flags, such as discrepancies in financial records, unusual transactions, or behaviour that suggests conflicts of interest. Forensic auditing techniques can significantly enhance an auditor’s ability to detect fraud. These techniques involve examining financial records, transactions, and processes to uncover anomalies that might indicate fraudulent activities. Auditors should also employ data analytics tools to quickly analyze large volumes of data and identify patterns that could suggest unethical behaviour.

Addressing Fraud

Once unethical behaviour or fraud is detected, it must be addressed promptly and effectively. Auditors must take the following steps to investigate and resolve the issue:

- Auditors must collect all relevant evidence to support their findings. This includes financial documents, emails, transaction records, and other pertinent information. The evidence should be gathered systematically and preserved to maintain its integrity.

- Auditors must speak with individuals who can provide additional insights and corroborate documentary proof. Auditors should conduct these interviews carefully, ensuring they are unbiased and that the interviewees are not intimidated or coerced.

- Auditors must understand the scope and impact of unethical behaviour or fraud. Auditors should evaluate how the misconduct affects the organization’s financial health, operations, and reputation. This assessment helps determine the issue’s severity and the necessary corrective actions.

- Auditors should recommend specific actions, based on their findings, to address unethical behaviour or fraud. This may include disciplinary actions against those involved, policy and procedure changes, or internal control improvements to prevent future occurrences.

Reporting Fraud

Auditors must also ensure their findings are communicated effectively to the appropriate authorities.

Internal Reporting

Initially, auditors should report their findings to the organization’s management and, if applicable, the audit committee. This internal report should detail the nature of the unethical behaviour or fraud, the evidence supporting the findings, and the recommended corrective actions. Maintaining transparency and providing a clear, factual account of the situation is essential.

External Reporting

In cases where the unethical behaviour or fraud is severe or involves legal violations, external reporting may be necessary. This could include reporting to regulatory bodies, law enforcement, or professional organizations. Auditors must be familiar with the legal and regulatory requirements for reporting in their jurisdiction and ensure compliance.

Whistleblower Protection

Auditors should advocate for and support whistleblower protections within their organizations. Whistleblowers are often crucial in bringing unethical behaviour and fraud to light. Ensuring that they are protected from retaliation encourages more individuals to report misconduct.

Addressing and Reporting Fraud—Other Considerations

Common Challenges

Auditors may face several challenges in addressing and reporting unethical behaviour and fraud.

- Management may resist acknowledging or addressing unethical behaviour, especially if it involves senior personnel or could harm the organization’s reputation. Auditors must be prepared to handle such resistance and emphasize the importance of ethical conduct and transparency.

- Employees may be reluctant to report unethical behaviour due to fear of retaliation. Auditors should work to create a culture of trust and integrity where individuals feel safe to report misconduct without fear of adverse consequences.

- The legal and regulatory landscape regarding fraud and unethical behaviour can vary by jurisdiction. Auditors must stay informed about relevant laws and regulations to ensure proper reporting and compliance.

Best Practices

To effectively address and report unethical behaviour and fraud, auditors should adopt best practices that enhance their ability to detect and respond to such issues:

- Continuous Training and Education: Auditors should receive ongoing training on the latest fraud detection techniques, ethical standards, and legal requirements. This ensures that they are equipped with up-to-date knowledge and skills.

- Robust Internal Controls: Strong internal controls can help prevent and detect unethical behaviour and fraud. Auditors should regularly assess the effectiveness of these controls and recommend necessary improvements.

- Fostering an Ethical Culture: Organizations should promote an ethical culture where integrity is valued and unethical behaviour is not tolerated. This includes setting clear ethical guidelines, training regularly, and encouraging open communication.

- Collaboration with Other Professionals: Auditors should collaborate with other professionals, such as forensic accountants, legal experts, and regulatory authorities, to effectively address and report unethical behaviour and fraud. This multidisciplinary approach can provide a more comprehensive response to complex issues.

Internal Audit in Action

Internal Audit in Action

Background

Seraphicus City Library, a public library system funded by local government grants and community donations, audits its adherence to ethical standards and compliance with public sector regulations, particularly in procurement and community engagement activities.

Challenge

The audit aims to ensure that Seraphicus City Library’s operations are conducted ethically and transparently, focusing on the procurement process for new technologies and the management of community programs. Challenges include identifying any areas of non-compliance or ethical concern and recommending corrective actions that align with public expectations and legal standards.

Action Taken

- Integrity and Emphasis on Objectivity: The audit is committed to integrity, ensuring that all evaluations are impartial and based on factual evidence.

- Review of Conflicts of Interest: The procurement processes are scrutinized for any signs of undue influence or conflicts of interest, with a review of vendor selection criteria and decision-making processes.

- Balancing Confidentiality and Transparency: The audit team balances the need for confidentiality in sensitive matters with the public’s right to transparency in using funds and delivering library services.

- Applying an Ethical Decision-Making Framework: Encountering ethical dilemmas, such as how to allocate resources among community programs fairly, the audit team applies a structured ethical decision-making framework, considering both legal obligations and moral principles.

- Recommendations for Ethical Governance: The report includes recommendations for enhancing Seraphicus City Library’s governance structures to promote better ethical practices, such as implementing a code of ethics for staff and establishing a transparent complaint resolution process for the public.

Outcome

The audit significantly improves Seraphicus City Library’s operations, including implementing more rigorous procurement procedures to avoid conflicts of interest and introducing an ethics training program for staff. These changes ensure compliance with regulations and strengthen the library’s commitment to ethical governance and community trust.

Reflection

Seraphicus City Library’s scenario highlights the importance of ethical considerations in public-sector auditing. Through thorough reviews and applying ethical frameworks, audits can uncover areas where organizations can improve both legally and ethically, fostering an environment of integrity and trust that benefits the public and the organization.

Key Takeaways

Key Takeaways

Let’s recap the concepts discussed in this section by reviewing these key takeaways:

- Integrity and objectivity are crucial for auditors to maintain credibility and public trust in the public and not-for-profit sectors.

- Navigating conflicts of interest and maintaining independence are essential to ensure unbiased and fair audit outcomes.

- Confidentiality protects sensitive information and maintains stakeholder trust in public and not-for-profit audits.

- Ethical dilemmas require structured decision-making frameworks to balance conflicting principles and uphold ethical standards.

- Professional ethics strengthen public trust by ensuring auditors perform their duties honestly, impartially, and transparently.

Knowledge Check

Knowledge Check

Review Questions

Review Questions

- Why is maintaining integrity and objectivity essential for auditors in the public and not-for-profit sectors?

- What challenges do auditors face in navigating conflicts of interest, and how can they manage them?

- How does confidentiality in public and not-for-profit auditing protect stakeholders?

- What role do ethical decision-making frameworks play in resolving dilemmas faced by auditors?

- How do professional ethics strengthen public trust in auditing?

Essay Questions

Essay Questions

- How can performance audits enhance the effectiveness of public sector programs, and what are the potential challenges in implementing audit recommendations?

- How do performance audits support transparency and accountability in government operations, and what are the limitations of relying solely on performance audits for these purposes?

- How do performance audits contribute to the continuous improvement of public sector programs, and what role does stakeholder engagement play in this process?

- How can performance audits enhance the effectiveness of public sector programs, and what are the potential challenges in implementing audit recommendations?

- How do confidentiality issues unique to public and not-for-profit sectors impact the audit process, and what measures can auditors take to mitigate associated risks?

- How does the role of professional ethics in auditing strengthen public trust, and what are the potential consequences of ethical breaches in the public and not-for-profit sectors?

Mini Case Study

Mini Case Study

GreeneLife Corporation is a not-for-profit organization in Canada that focuses on environmental conservation and education. The organization receives funding from various sources, including government grants, private donations, and corporate sponsorships. Recently, the Board of Directors has raised several concerns about ethical issues and potential fraud within the organization. They have requested a comprehensive audit to address these concerns and ensure ethical compliance across the organization.

Required: You are the audit team lead. Describe how your team should handle the following audit findings.

- Conflict of Interest: The audit team discovers that a senior manager at GreeneLife Corporation has a personal relationship with a vendor who supplies eco-friendly products. There is no formal disclosure of this relationship in the company’s records. How should the audit team address this to maintain auditor independence and integrity?

- Breach of Confidentiality: During the audit, it was found that sensitive donor information had been inadvertently shared with an unauthorized third party. This breach has not been reported to the donors or the board. What steps should the auditors take to handle this breach, and what recommendations should they make to prevent future occurrences?

- Ethical Dilemmas: An auditor discovers that specific environmental impact reports have been exaggerated to secure additional donor funding. Management pressures the auditor to overlook this discrepancy. How should the auditor resolve this ethical dilemma using an ethical decision-making framework?

- Reporting Unethical Behaviour: An internal whistleblower has reported potential financial mismanagement involving the misallocation of grant funds. How should the audit team investigate and report this unethical behaviour while ensuring the whistleblower is protected from retaliation?

- Training and Awareness: The audit reveals that formal ethics training programs exist for employees and volunteers. What recommendations should the audit team make to implement practical ethics training and awareness programs?