Chapter 4: Name the trade agreements with which Canada is a signatory.

4.1. Canada-European Union Comprehensive Economic and Trade Agreement (CETA)

Before you begin

Before you begin reading, check your understanding of some of the key terms you will read in this chapter:

The European Union (EU) is one of the largest economies in the world and Canada’s second-largest trading partner. The Canada-European Union Comprehensive Economic and Trade Agreement (CETA) presents Canadian businesses with preferential access to and excellent opportunities for growth in the EU. September 21, 2022, marks the fifth anniversary of CETA’s provisional application. The Agreement will come into full effect when all EU Member States have completed the ratification process. Until then provisional application of CETA will continue and remain accessible to Canadian and EU business alike.

Investing in Canada

More and more global companies are investing in Canada thanks to our top talent, abundant natural resources and preferential access to markets around the globe. The Canada-European Union Comprehensive Economic and Trade Agreement (CETA) has made our market even more attractive to investors from the EU:

- Welcoming investment climate – Canada is recognized as the best country in the G20 to do business. For more than a decade, we’ve led all G7 countries in economic growth.

- Priority access to global markets – If you’re an EU company operating in Canada, CETA offers you guaranteed preferential market access to both the EU and North American markets. Unlike the other top destinations for EU investment in the Americas, such as the United States, Mexico, and Brazil, only Canada has investment treaties in place with all 27 EU member states.

- Enhanced investor protection – If you’re an investor from the EU, CETA provides greater certainty, transparency and protection for your investments. CETA’s Investment Chapter offers important guarantees to EU investors in Canada. Some of its core protections include:

- National treatment which prohibits Canada from discriminating against EU investors in favour of Canadian investors

- Most-favoured-nation treatment which prohibits Canada from discriminating against EU investors in favour of investors from a third country

- Treatment of investors and of covered investments which establishes a minimum standard of treatment

- Expropriation which prohibits Canada from expropriating or nationalizing investments made by EU investors, except for a public process, under due process of law, in a non-discriminatory manner and on payment of prompt and adequate compensation

- Lower investment restrictions – CETA was designed to encourage investment by limiting market access restrictions on investors. Under CETA, the net benefit review threshold under the Investment Canada Act has been raised from Can$600 million to Can$1.5 billion.

- Non-discriminatory treatment – CETA ensures Canada and EU investors receive fair and non-discriminatory treatment. Canada and the EU must provide each other’s investors with treatment no less favourable than they provide to their own investors and any third country investor in like situations.

Source:

Government of Canada. (2023). Canada-European Union Comprehensive Economic and Trade Agreement (CETA).

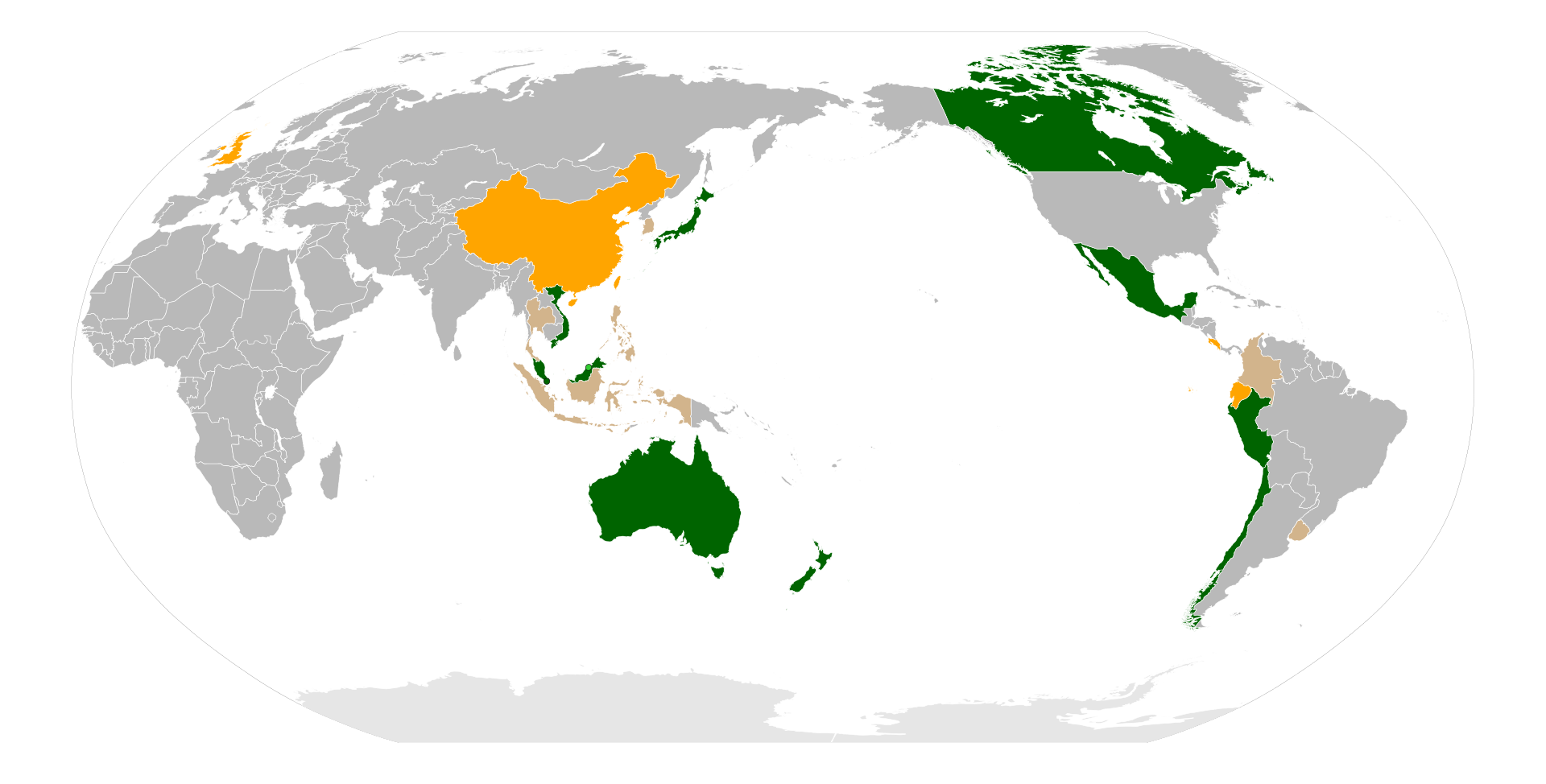

4.2. Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

The Asia-Pacific is now the world’s leading region of economic growth, offering big opportunities for trade and expansion. Canadian businesses can get ahead of the global competition by using the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)—a free trade agreement between Canada and 10 other countries in the Asia-Pacific: Australia, Brunei, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam.

CPTPP provides greater certainty, transparency and protection for investments. Here are some highlights:

- Most-favoured nation provision to prevent discrimination against investors from member countries

- Assurance that your investments will not be nationalized or expropriated by the Government of Canada, except in specific circumstances and where accompanied by adequate compensation

- No restrictions on covered investments to favour domestic industry, such as requirements that the investor purchase local goods, export a certain percentage, or transfer technology to the host country

- Ability to freely transfer capital and profits related to an investment into and out of the host country (subject to some exceptions)

- Access to an investor-state dispute settlement mechanism to resolve disputes between states and investors

Government of Canada. (2023). Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)