By the end of this unit, participants will be able to:

- Recognize options available for sustainable organizational development and resourcing.

- Discern between a social purpose enterprise and a for-profit model without social purpose.

- Critique financing mechanisms that can support social purpose activity.

Background

“There is strong evidence to suggest that Canada’s charities and non-profit organizations are facing a profound and growing sustainability challenge. Government funding is in decline and charitable donations have fallen sharply with the recession. At the same time, governments and citizens are increasingly relying on the sector to meet societal demands that governments alone cannot.”

– Elizabeth Mulholland, Matthew Mendelsohn and Negin Shamshiri, Mowat Centre for Policy Innovation, 2011.

Unit 7 examines the various ways in which organizations can structure their operations in full or in part and/or fund initiatives through social enterprise and social finance. Social enterprise and social finance are approaches to business and finance designed to support transformation across social systems and to help people and organisations adapt to address immediate social challenges on the way to such transformation.

For social sector and community organisations, familiarity with social enterprise and social finance is important. With increasing competition for diminishing government and community grants combined with decreasing levels of philanthropic donations, many non-profits have been forced rethink their business and finance models. While there are no miracle solutions, social enterprise and social finance may provide greater organizational autonomy and sustainability. These new business and finance models however may come with risks to nonprofits, including the risk to drift away from the nonprofit’s core mission and values.

Core Concepts

Bricolage

In Social Innovation and Resilience: How One Enhances the Other (Unit 3), Frances Westley ties the development of the Barefoot College, a social enterprise, to the idea of resilience and, in doing so, introduces the concept of bricolage.

‘Bricolage’ is a French word used to refer to the process involved in constructing something by using whatever comes to hand. The word is derived from the French verb bricoler (“to tinker”)

Bricolage is an approach rooted in the idea that innovation does not always mean novelty: we do not and cannot sustain a planet by constantly introducing new products and new things. Rather, we can make creative use of the assets and resources already at our disposal. This involves imagining and creating ways of doing, being and living that can produce better outcomes for people and the planet by minimising the negative impact humans have on it.

Westley uses the idea of bricolage to explain the development of Barefoot College as social enterprise:

“In one way, Barefoot College’s innovations were deeply radical—challenging the conventions of village life, professional associations and traditional culture. In another way they were classic bricolage, a term drawn from the junk collectors in France and defined as ‘making creative and resourceful use of whatever materials are at hand (regardless of their original purpose).’ In this case the juxtaposition of elements not normally combined addressed a cluster of intractable problems including the health needs, gender inequalities, energy needs and educational needs of the developing South” (Westley, 2013, p.6).

Social enterprise and social finance tools and mechanisms are forms of bricolage in the following sense: they are adaptations of models that have existed in business communities for centuries, particularly in the Global South as is the case, for instance, women-led community finance in African and South Asian communities. They are not new, but newly deployed in places like the Global North.

Social Enterprise

Social enterprises are revenue-generating businesses with a “social and/or environmental impact twist”. A social enterprise aims to achieve social, cultural, community, economic and/or environmental outcomes while generating revenue and it can be operated equally well by a non-profit organization or by a for-profit company.

More specifically, the benefit of social enterprise is that they tend to reconcile revenue generation with a mission and activities that are aligned with the interests and needs of community beneficiaries. For instance, social enterprises often provide opportunities for training and in-the-world experience by hiring people who are in a vulnerable position. Likewise, their missions may be to provide community members who are dealing with specific challenges (e.g. homelessness, mental health issues) with new resources, networks and partners.

Mission is at the centre of a social enterprise, with revenue generation – and even profit – playing an important supporting role. Nonprofit moving towards a social enterprise model may do so to avail themselves of the benefit of generating new types of revenue while preserving their mission as a social purpose organisations and ensuring alignment with the well-being of its beneficiaries. Social enterprises may also fulfil their social purpose by providing employees with opportunities for new training and practical experiences and open the possibility to access new resources, networks and partners.

Illustrations

B Corporations

[Website]

In the Global North, the opposition between non-profit and for-profit organisation does not overlap exactly with the distinction between social purpose organisation and business. Even within the category of businesses that pursue a social purposes, there are distinctions to make. While Ben & Jerry’s Ice-cream, Patagonia and Danone Inc. are well established business, few are aware that they are for profit-businesses registered as B Corporations.

The difference between social enterprise and a B-Corporation rests on their respective understanding of the balance between mission and profit. A social enterprise’s purpose or mission is what drives the business, not profit. By contrast, a B-Corporation is a for-profit business that seeks to achieve equilibrium between purpose and profit. A B-Corporation does not need to have a specific social purpose, but it is required to evaluate their operations to identify ways to make their impact more positive.

Concretely, this means that B-Corporations must meet or exceed a list of criteria determined by a standard established by the B Lab, the regulatory body that issues the B-Corporation certification. B-Corporation certification signals compliance with standards of corporate accountability in the social sector. The assumption that underpins B-Corporations certification is that corporate accountability in the social sector can be expected to have a positive impact on a company’s bottom line.

“B Corp Certification is a designation that a business is meeting high standards of verified performance, accountability and transparency on factors from employee benefits and charitable giving to supply chain practices and input materials” (B Lab Global).

To become a certified B Corporation, an organisation must:

Demonstrate high social and environmental impact by achieving a “B Impact Assessment” score of 80 or above and successfully completing a risk review. Multinational corporations must also meet other baseline requirement standards.

Commit to changing their corporate governance structure – which has legal implication – to be accountable to all stakeholders, not just shareholders and achieve benefit corporation status if available in their jurisdiction.

Exhibit transparency by allowing information about their performance to be measured against B Lab’s standards and to be publicly available on their B Corp profile on the B Lab’s website.

Social and Financial Return Continuum

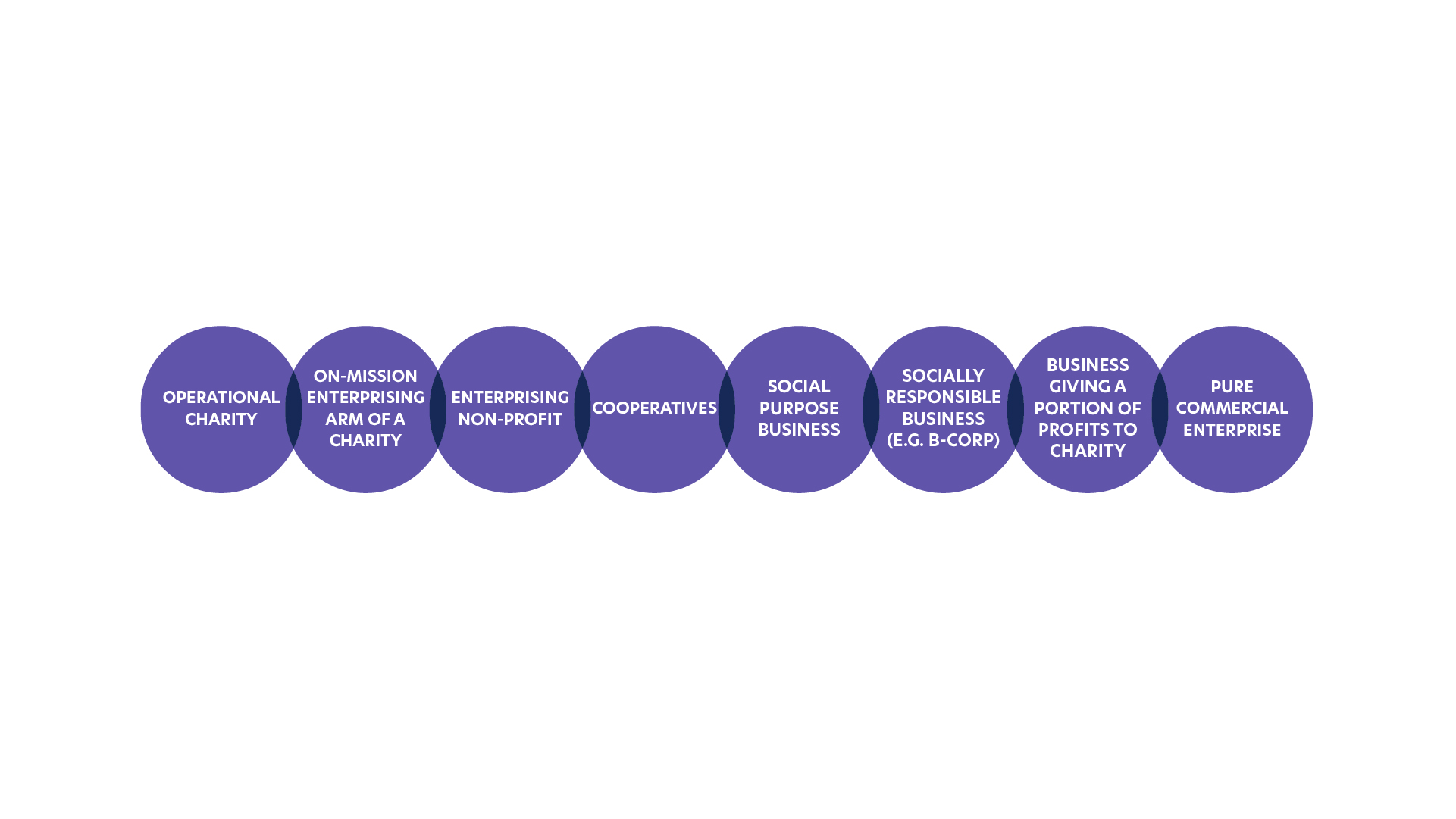

There is a range of business models for organizations and businesses to consider when it comes the ways in which they might finance their operations, define their legal status and ultimately generate social and/or financial return. One way to understand the balance between social and financial return in an organisation is to think of them on a continuum, with charitable entities at one end of the spectrum and pure commercial enterprise at the other. The Social and Financial Return Continuum is a useful tool when it comes to conceptualizing the realm of possibilities in between those extremes. [More information in: Financing Big Society: Why Social Investment Matters.]

Figure 7.1 Social and Financial Return Continuum.

Social Finance

There is a number of ways to use money to produce positive social impact. ‘Social finance’ is the name given to a range of financial tools, products and ways of doing investment that are intentionally designed to increase access to funds for individuals and organisations whose purpose is the social good and well-being of people, community and planet.

Typically, social finance aims to leverage existing capital to attract new investment for public benefit. Examples of social finance include:

- Community investing

- Social purpose bonds

- Microlending

- Sustainable business

- Social enterprise lending

- Impact investing.

Grant making and program-related investments may also fall under the umbrella of social finance.

Illustrations

Connecting the Dots

There are many ways for an organisation to contribute to positive change and social enterprise and social finance are useful instruments in the process. They belong to a larger conceptual space, the space of positive social change, that continues to evolve:

- Social innovation

- Social enterprise

- Social entrepreneurship

- Social innovation labs

- Social Connectivity and Partnerships

- Social Finance

Social transformation is more likely to happen when things are done in concertation – bringing the best of all approaches to bear on addressing problems in an ecosystem. Lateral thinking is an asset and using approaches and tools that were developed in other sectors or other fields of expertise and adapting them to work for social impact should be encouraged.

Organizations can adopt different approaches when it comes to their business model or the way they fund initiatives, or parts of their operations. To make sense of the options available to those who work in the social purpose sector, it makes sense to become familiar with what is involved in social enterprise and social finance.

Social enterprise and social finance tools and mechanisms are adaptations of models that have existed in the business community for a long time. While they are not new, they are newly deployed to the social sector. They are a form of bricolage: they make creative use of the assets and resources at one’s disposal.

Social enterprises are revenue-generating businesses with a twist. While they may be operated by a non-profit organization or by a for-profit company, a social enterprise has two distinctive goals:

- To achieve social, cultural, community economic and/or environmental outcomes (its mission);

- To earn revenue.

A social enterprise’s mission is its main purpose, and the income generation plays a supporting role.

B Corporations balance purpose and profit. B Corporations must meet/exceed a list of criteria which and certification is issued by an organisation called the B Lab.

Social finance refers to initiatives designed to support the financing of social purpose organisation and entrepreneurs by leveraging existing capital to attract new investments for project that benefit the public good. Examples of social finance include: community investing, microlending, sustainable business, social enterprise lending, and impact investing.

There are many ways to contribute to the work of positive change that can be placed on a continuum. Social innovation is most likely to succeed through a combination of approaches.