2 Economics and Business

Learning Objectives

By the end of the chapter, you should be able to:

- Describe the foundational philosophies of capitalism and socialism.

- Discuss private property rights and why they are key to economic development.

- Discuss the concept of GDP (gross domestic product).

- Explain the difference(s) between fiscal and monetary policy.

- Discuss the concept of the unemployment rate measurement.

- Discuss the concepts of inflation and deflation.

- Explain other key terms related to this chapter including: supply; demand; equilibrium price; monopoly; recession; depression.

Show What You Know

[h5p id=”6″]

What is Economics?

To appreciate how a business functions, we need to know something about the economic environment in which it operates. We begin with a definition of economics and a discussion of the resources used to produce goods and services.

Resources: Inputs and Outputs

Economics is the study of how individuals, businesses, governments and nations allocate their limited resources to satisfy their unlimited wants and needs. The allocation of resources is concerned with the production, distribution, and consumption of goods and services. Resources are the inputs used to produce outputs. Resources may include any or all of the following and their connections with one another:

- Land and other natural resources

- Labour (physical and mental)

- Capital, including buildings and equipment

- Entrepreneurship

- Knowledge

Resources are combined to produce goods and services. Land and natural resources provide the needed raw materials. Labour transforms raw materials into goods and services. Capital (equipment, buildings, vehicles, cash, and so forth) are needed for the production process. Entrepreneurship provides the skill, drive and creativity needed to bring the other resources together to produce a good or service to be sold to the marketplace.

Because a business uses resources to produce things, we also call these resources factors of production. The factors of production used to produce a shirt would include the following:

- The land that the shirt factory sits on, the electricity used to run the plant, and the raw cotton from which the shirts are made

- The labourers who make the shirts

- The factory and equipment used in the manufacturing process, as well as the money needed to operate the factory

- The entrepreneurship skills and production knowledge used to coordinate the other resources to make the shirts and distribute them to the marketplace

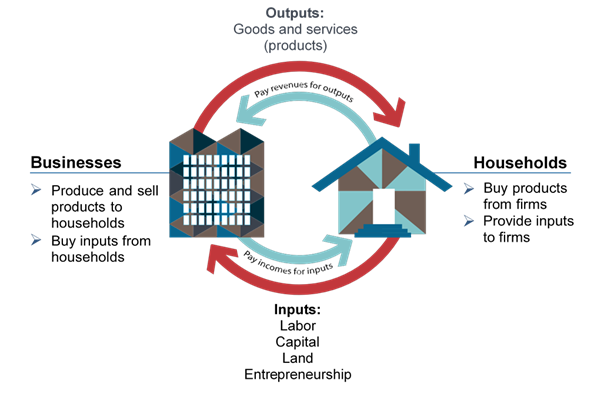

Input and Output Markets

Many of the factors of production are provided to businesses by households. For example, households provide businesses with labour (as workers), land and buildings (as landlords), and capital (as investors). In turn, businesses pay households for these resources by providing them with income, such as wages, rent, and interest. The resources obtained from households are then used by businesses to produce goods and services, which are sold to provide businesses with revenue. The revenue obtained by businesses is then used to buy additional resources, and the cycle continues. This is described in the figure below, “The Circular Flow of Inputs and Outputs”, which illustrates the dual roles of households and businesses:

- Households not only provide factors of production (or resources) but also consume goods and services

- Businesses not only buy resources but also produce and sell both goods and services

Economic Systems

Economists study the interactions between households and businesses and look at the ways in which the factors of production are combined to produce the goods and services that people need. Basically, economists try to answer three sets of questions:

- What goods and services should be produced to meet consumers’ needs? In what quantity? When?

- How should goods and services be produced? Who should produce them, and what resources, including technology, should be combined to produce them?

- Who should receive the goods and services produced? How should they be allocated among consumers? The answers to these questions depend on a country’s economic system—the means by which a society (households, businesses, and government) makes decisions about allocating resources to produce products and about distributing those products. The degree to which individuals and business owners, as opposed to the government, enjoy freedom in making these decisions varies according to the type of economic system.

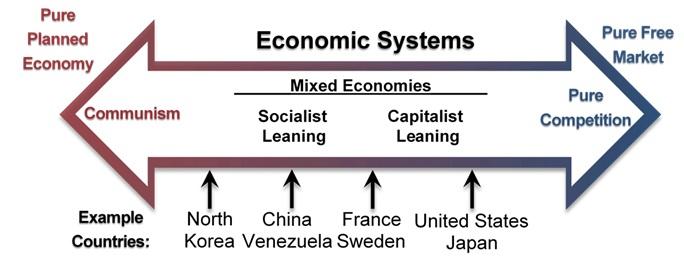

Generally speaking, economic systems can be divided into two systems: planned systems and free market systems.

Planned Systems

In a planned system, the government exerts control over the allocation and distribution of all or some goods and services. The system with the highest level of government control is communism. In theory, a communist economy is one in which the government owns all or most enterprises. Central planning by the government dictates which goods or services are produced, how they are produced, and who will receive them. In practice, pure communism is practically nonexistent today, and only a few countries (notably North Korea and Cuba) operate under rigid, centrally planned economic systems.

Under socialism, industries that provide essential services, such as utilities, banking, and health care, may be government owned. Some businesses may also be owned privately. Central planning allocates the goods and services produced by government-run industries and tries to ensure that the resulting wealth is distributed equally. In contrast, privately owned companies are operated for the purpose of making a profit for their owners. In general, workers in socialist economies work fewer hours, have longer vacations, and receive more health care, education, and child-care benefits than do workers in capitalist economies. To offset the high cost of public services, taxes are generally steep. Examples of countries that lean towards a socialistic approach include Venezuela, Sweden, and France.

Free Market System

The economic system in which most businesses are owned and operated by individuals is the free market system, also known as capitalism. In a free market economy, competition dictates how goods and services will be allocated. Business is conducted with more limited government involvement concentrated on regulations that dictate how businesses are permitted to operate. A key aspect of a free market system is the concept of private property rights, which means that business owners can expect to own their land, buildings, machines, etc., and keep the majority of their profits, except for taxes. The profit incentive is a key driver of any free market system. The economies of the United States and other countries, such as Japan, are based on capitalism. However, a purely capitalistic economy is as rare as one that is purely communist. Imagine if a service such as police protection, one provided by government in the United States, were instead allocated based on market forces. The ability to pay would then become a key determinant in who received these services, an outcome that few in American society would consider to be acceptable.

How Economic Systems Compare

In comparing economic systems, it can be helpful to think of a continuum with communism at one end and pure capitalism at the other, as in the following Economic Systems Figure. As you move from left to right, the amount of government control over business diminishes. So, too, does the level of social services, such as health care, child-care services, social security, and unemployment benefits. Moving from left to right, taxes are correspondingly lower as well.

Mixed Market Economies

Though it’s possible to have a pure communist system, or a pure capitalist (free market) system, in reality many economic systems are mixed. A mixed market economy relies on both markets and the government to allocate resources. In practice, most economies are mixed, with a leaning towards either free market or socialistic principles, rather than being purely one or the other. Some previously communist economies, such as those of Eastern Europe and China, are becoming more mixed as they adopt more capitalistic characteristics and convert businesses previously owned by the government to private ownership through a process called privatization. By contrast, Venezuela is a country that has moved increasingly towards socialism, taking control of industries such as oil and media through a process called nationalization.

The Canadian Economic System

Like most countries, Canada features a mixed market system much like its neighbor to the south: though the Canadian and U.S. economic systems are primarily free market systems, the federal government controls some basic services, such as the postal service and air traffic control. The Canadian economy also has some characteristics of a socialist system, such as providing social security retirement benefits to retired workers or free health care to its population.

The free market system was espoused by Adam Smith in his book The Wealth of Nations, published in 1776. According to Smith, competition alone would ensure that consumers received the best products at the best prices. In the kind of competition he assumed, a seller who tries to charge more for his product than other sellers would not be able to find any buyers. A job-seeker who asks more than the going wage won’t be hired. Because the “invisible hand” of competition will make the market work effectively, there won’t be a need to regulate prices or wages. Almost immediately, however, a tension developed among free market theorists between the principle of laissez-faire—leaving things alone—and government intervention. Today, it’s common for the Canadian government to intervene in the operation of the economic system. For example, government exerts influence on the food and pharmaceutical industries through Canada’s Food and Drug Act and Regulations, which protect consumers by preventing unsafe or mislabeled products from reaching the market.

To appreciate how businesses operate, we must first get an idea of how prices are set in competitive markets. The next section, “Perfect Competition and Supply and Demand,” begins by describing how markets establish prices in an environment of perfect competition.

Perfect Competition and Supply and Demand

Under a mixed economy, such as we have in Canada, businesses make decisions about which goods to produce or services to offer and how they are priced. Because there are many businesses making goods or providing services, customers can choose among a wide array of products. The competition for sales among businesses is a vital part of our economic system. Economists have identified four types of competition—perfect competition, monopolistic competition, oligopoly, and monopoly. We’ll introduce the first of these—perfect competition—in this section and cover the remaining three in the following section.

Perfect Competition

Perfect competition exists when there are many consumers buying a standardized product from numerous small businesses. Because no seller is big enough or influential enough to affect price, sellers and buyers accept the going price. For example, when a commercial fisher brings his fish to the local market, he has little control over the price he gets and must accept the going market price.

The Basics of Supply and Demand

To appreciate how perfect competition works, we need to understand how buyers and sellers interact in a market to set prices. In a market characterized by perfect competition, price is determined through the mechanisms of supply and demand. Prices are influenced both by the supply of products from sellers and by the demand for products by buyers.

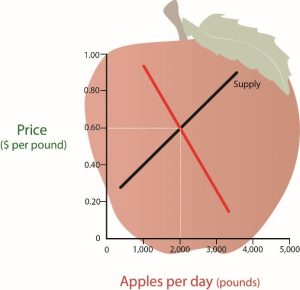

To illustrate this concept, let’s create a supply and demand schedule for one particular good sold at one point in time. Then we’ll define demand and create a demand curve and define supply and create a supply curve. Finally, we’ll see how supply and demand interact to create an equilibrium price—the price at which buyers are willing to purchase the amount that sellers are willing to sell.

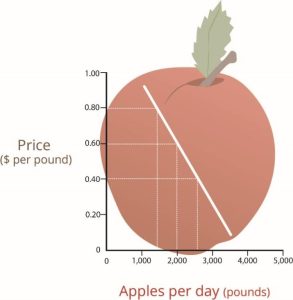

Demand and the Demand Curve

Demand is the quantity of a product that buyers are willing to purchase at various prices. The quantity of a product that people are willing to buy depends on its price. You’re typically willing to buy less of a product when prices rise and more of a product when prices fall. Generally speaking, we find products more attractive at lower prices, and we buy more at lower prices because our income goes further.

Using this logic, we can construct a demand curve that shows the quantity of a product that will be demanded at different prices. Let’s assume that the diagram “The Demand Curve” represents the daily price and quantity of apples sold by farmers at a local market. Note that as the price of apples goes down, buyers’ demand goes up. Thus, if a pound of apples sells for $0.80, buyers will be willing to purchase only fifteen hundred pounds per day. But if apples cost only $0.60 a pound, buyers will be willing to purchase two thousand pounds. At $0.40 a pound, buyers will be willing to purchase twenty-five hundred pounds.

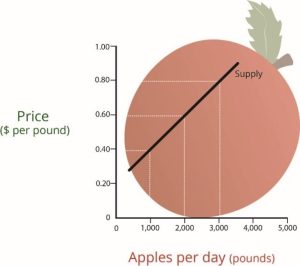

Supply and the Supply Curve

Supply is the quantity of a product that sellers are willing to sell at various prices. The quantity of a product that a business is willing to sell depends on its price. Businesses are more willing to sell a product when the price rises and less willing to sell it when prices fall. Again, this fact makes sense: businesses are set up to make profits, and there are larger profits to be made when prices are high.

Now we can construct a supply curve that shows the quantity of apples that farmers would be willing to sell at different prices, regardless of demand. As you can see in “The Supply Curve”, the supply curve goes in the opposite direction from the demand curve: as prices rise, the quantity of apples that farmers are willing to sell also goes up. The supply curve shows that farmers are willing to sell only a thousand pounds of apples when the price is $0.40 a pound, two thousand pounds when the price is $0.60, and three thousand pounds when the price is $0.80.

Equilibrium Price

We can now see how the market mechanism works under perfect competition. We do this by plotting both the supply curve and the demand curve on one graph, as we’ve done in the figure below, “The Equilibrium Price”. The point at which the two curves intersect is the equilibrium price.

You can see in “The Equilibrium Price” that the supply and demand curves intersect at the price of $0.60 and quantity of two thousand pounds. Thus, $0.60 is the equilibrium price: at this price, the quantity of apples demanded by buyers equals the quantity of apples that farmers are willing to supply. If a single farmer tries to charge more than $0.60 for a pound of apples, he won’t sell very many because other suppliers are making them available for less. As a result, his profits will go down. If, on the other hand, a farmer tries to charge less than the equilibrium price of $0.60 a pound, he will sell more apples but his profit per pound will be less than at the equilibrium price. With profit being the motive, there is no incentive to drop the price.

What have you learned in this discussion? Without outside influences, markets in an environment of perfect competition will arrive at an equilibrium point at which both buyers and sellers are satisfied. But you must be aware that this is a very simplistic example. Things are much more complex in the real world. For one thing, markets rarely operate without outside influences. Sometimes, sellers supply more of a product than buyers are willing to purchase; in that case, there’s a surplus. Sometimes, they don’t produce enough of a product to satisfy demand; then we have a shortage.

Circumstances also have a habit of changing. What would happen, for example, if incomes rose and buyers were willing to pay more for apples? The demand curve would change, resulting in an increase in equilibrium price. This outcome makes intuitive sense: as demand increases, prices will go up. What would happen if apple crops were larger than expected because of favorable weather conditions? Farmers might be willing to sell apples at lower prices rather than letting part of the crop spoil. If so, the supply curve would shift, resulting in another change in equilibrium price: the increase in supply would bring down prices.

Monopolistic Competition, Oligopoly, and Monopoly

As mentioned previously, economists have identified four types of competition—perfect competition, monopolistic competition, oligopoly, and monopoly. Perfect competition was discussed in the last section; we’ll cover the remaining three types of competition here.

|

Characteristic |

Four Major Market Structures |

|||

|

Perfect Competition |

Monopolistic Competition |

Oligopoly |

Pure Monopoly |

|

|

Number of firms |

Very many |

Many |

A few |

One |

|

Types of product |

Homogeneous |

Differentiated |

Homogeneous or differentiated |

Homogeneous |

|

Barriers to entry or exit from industry |

No substantial barriers |

Minor barriers |

Considerable barriers |

Extremely great barriers |

|

Examples |

Agriculture |

Retail trade |

Banking |

Public utilities |

Monopolistic Competition

In monopolistic competition, we still have many sellers (as we had under perfect competition). Now, however, they don’t sell identical products. Instead, they sell differentiated products—products that differ somewhat, or are perceived to differ, even though they serve a similar purpose. Products can be differentiated in a number of ways, including quality, style, convenience, location, and brand name. Some people prefer Coke over Pepsi, even though the two products are quite similar. But what if there was a substantial price difference between the two? In that case, buyers could be persuaded to switch from one to the other. Thus, if Coke has a big promotional sale at a supermarket chain, some Pepsi drinkers might switch (at least temporarily).

How is product differentiation accomplished? Sometimes, it’s simply geographical; you probably buy gasoline at the station closest to your home regardless of the brand. At other times, perceived differences between products are promoted by advertising designed to convince consumers that one product is different from an- other—and better than it. Regardless of customer loyalty to a product, however, if its price goes too high, the seller will lose business to a competitor. Under monopolistic competition, therefore, companies have only limited control over price.

Oligopoly

Oligopoly means few sellers. In an oligopolistic market, each seller supplies a large portion of all the products sold in the marketplace. In addition, because the cost of starting a business in an oligopolistic industry is usually high, the number of firms entering it is low. Companies in oligopolistic industries include such large-scale enterprises as automobile companies and airlines. As large firms supplying a sizable portion of a market, these companies have some control over the prices they charge. But there’s a catch: because products are fairly similar, when one company lowers prices, others are often forced to follow suit to remain competitive. You see this practice all the time in the airline industry: When American Airlines announces a fare decrease, Continental, United Airlines, and others do likewise. When one automaker offers a special deal, its competitors usually come up with similar promotions.

Monopoly

In terms of the number of sellers and degree of competition, a monopoly lies at the opposite end of the spectrum from perfect competition. In perfect competition, there are many small companies, none of which can control prices; they simply accept the market price determined by supply and demand. In a monopoly, however, there’s only one seller in the market. The market could be a geographical area, such as a city or a regional area, and doesn’t necessarily have to be an entire country.

There are few monopolies in the United States because the government limits them. Most fall into one of two categories: natural and legal. Natural monopolies include public utilities, such as electricity and gas suppliers. Such enterprises require huge investments, and it would be inefficient to duplicate the products that they provide. They inhibit competition, but they’re legal because they’re important to society. In exchange for the right to conduct business without competition, they’re regulated. For instance, they can’t charge whatever prices they want, but they must adhere to government-controlled prices. As a rule, they’re required to serve all customers, even if doing so isn’t cost efficient.

A legal monopoly arises when a company receives a patent giving it exclusive use of an invented product or process. Patents are issued for a limited time, generally twenty years.[1] During this period, other companies can’t use the invented product or process without permission from the patent holder. Patents allow companies a certain period to recover the heavy costs of researching and developing products and technologies. A classic example of a company that enjoyed a patent-based legal monopoly is Polaroid, which for years held exclusive ownership of instant-film technology.[2] Polaroid priced the product high enough to recoup, over time, the high cost of bringing it to market. Without competition, in other words, it enjoyed a monopolistic position in regard to pricing.

Measuring the Health of the Economy

Every day, we are bombarded with economic news (at least if you watch the business news stations). We’re told about things like unemployment, home prices, and consumer confidence trends. As a student learning about business, and later as a business manager, you need to understand the nature of the Canadian economy and the terminology that we use to describe it. You need to have some idea of where the economy is heading, and you need to know something about the government’s role in influencing its direction.

Economic Goals

The world’s economies share three main goals:

- Growth

- High employment

- Price stability

Let’s take a closer look at each of these goals, both to find out what they mean and to show how we determine whether they’re being met.

Economic Growth

One purpose of an economy is to provide people with goods and services—cars, computers, video games, houses, rock concerts, fast food, amusement parks. One way in which economists measure the performance of an economy is by looking at a widely used measure of total output called the gross domestic product (GDP). The GDP is defined as the market value of all goods and services produced by the economy in a given year. The GDP includes only those goods and services produced domestically; goods produced outside the country are excluded. The GDP also includes only those goods and services that are produced for the final user; intermediate products are excluded. For example, the silicon chip that goes into a computer (an intermediate product) would not count directly because it is included when the finished computer is counted. By itself, the GDP doesn’t necessarily tell us much about the direction of the economy. But change in the GDP does. If the GDP (after adjusting for inflation, which will be discussed later) goes up, the economy is growing. If it goes down, the economy is contracting. There is some debate amongst economists that GDP provides the most accurate measure of an economy’s performance. Many economists believe that GDP per capita, which is the measure of total production of goods and services divided by the number of households, is a better indicator of an economy’s performance. For example, according to The World Bank, as of 2017, India’s GDP ranked 7th in the world at $2.439 trillion (USD) while Canada’s GDP ranked 10th at $1.640 trillion (USD). However, as of 2017, Canada’s GDP per capita ranks 18th at $44,773 per household, compared to India’s GDP per capita which ranked 142nd in the world at $1,852 per household.

The economic ups and downs resulting from expansion and contraction constitute the business cycle. Similar to a product lifecycle, as a business cycle introduces new products, those products grow, mature and decline, when all business cycles in an economy are combined it creates an economy’s business cycle. A typical cycle runs from three to five years but could last much longer. Though typically irregular, a cycle can be divided into four general phases of prosperity, recession, depression (which the cycle generally skips), and recovery:

- During prosperity, the economy expands, unemployment is low, incomes rise, and consumers buy more products. Businesses respond by increasing production and offering new and better products.

- Eventually, however, things slow down. GDP decreases, unemployment rises, and because people have less money to spend, business revenues decline. This slowdown in economic activity is called a recession.

- Economists often say that we’re entering a recession when GDP goes down for two consecutive quarters.

- Generally, a recession is followed by a recovery or expansion in which the economy starts growing again.

- If, however, a recession lasts a long time (perhaps a decade or so), while unemployment remains very high and production is severely curtailed, the economy could sink into a depression. Unlike for the term recession, economists have not agreed on a uniform standard for what constitutes a depression, though they are generally characterized by their duration. Though not impossible, it’s unlikely that the United States will experience another severe depression like that of the 1930s. The federal government has a number of economic tools (some of which we’ll discuss shortly) with which to fight any threat of a depression.

If you want or need a more interactive examples of the business cycle, this 10 minute video provides more details:

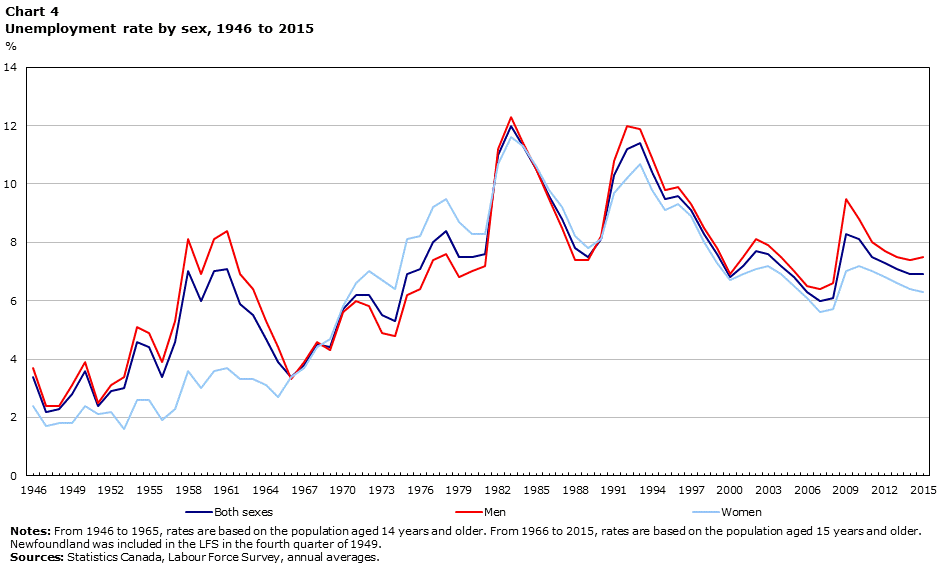

The Unemployment Rate

Statistics Canada tracks unemployment and reports the unemployment rate: the percentage of the labour force that’s unemployed and actively seeking work. The unemployment rate is an important measure of economic health. It goes up during recessionary periods because companies are reluctant to hire workers when demand for goods and services is low. Conversely, it goes down when the economy is expanding and there is high demand for products and workers to supply them.

“The Canadian Unemployment Rate, 1946–2015” traces the Canadian unemployment rate between 1946 and 2015. Please be aware that there are multiple measures of unemployment and that this graph is based on what is known as R4, the most commonly used measurement and is comparable to the U.S. unemployment measure, U3. Another measurement, R8, is considered to provide a broader picture of unemployment in Canada and includes unemployed workers that are discouraged by their job search, involuntary part-time workers and those unemployed workers that are awaiting confirmation for new work. Since by definition, R8 is always higher than R4, it is likely that R4 is discussed more often because it paints a more favourable, if not completely accurate, picture.

Consider what was happening in Canada and/or the world that helps explain one of the peaks or one of the valleys?

Full Employment

To keep the economy going strong, people must spend money on goods and services. A reduction in personal expenditures for things like food, clothing, appliances, automobiles, housing, and medical care could severely reduce GDP and weaken the economy. Because most people earn their spending money by working, an important goal of all economies is making jobs available to everyone who wants one. In principle, full employment occurs when everyone who wants to work has a job. In practice, we say that we have full employment when about 95 percent of those wanting to work are employed.

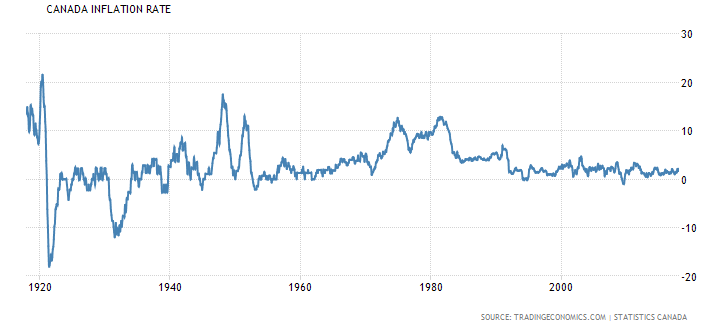

Price Stability

A third major goal of all economies is maintaining price stability. Price stability occurs when the average of the prices for goods and services either doesn’t change or changes very little. Rapidly rising prices are troublesome for both individuals and businesses. For individuals, rising prices mean people have to pay more for the things they need. For businesses, rising prices mean higher costs, and, at least in the short run, businesses might have trouble passing on higher costs to consumers. When the overall price level goes up, we have inflation. The graph shows inflationary trends in the Canadian economy since 1915. The inflation rate in Canada averaged 3.15 percent from 1915 until 2018, reaching an all time high of 21.60 percent in June of 1920 and a record low of -17.80 percent in June of 1921.

When the price level goes down (which rarely happens), we have deflation. A deflationary situation can also be damaging to an economy. When purchasers believe they can expect lower prices in the future, they may defer making purchases, which has the effect of slowing economic growth. Japan experienced a long period of deflation which contributed to economic stagnation in that country from which it is only now beginning to recover.

The Consumer Price Index

The most widely publicized measure of inflation is the consumer price index (CPI), which is reported monthly by Statistics Canada. The CPI measures the rate of inflation by determining price changes of a hypothetical basket of goods, such as food, housing, clothing, medical care, appliances, automobiles, and so forth, bought by a typical household.

The Bank of Canada currently measures prices against the base year of 2002, and the basket for that year is given the value of 100. In 2012 the CPI averaged 121.7, which means that what you could buy for $100 in 2002 cost $121.70 in 2012. The difference registers the effect of inflation. In fact, that’s what an inflation rate is—the percentage change in a price index.

The Bank of Canada created an inflation calculator: https://www.bankofcanada.ca/rates/related/inflation-calculator/. Compare the costs of consumer goods then and now. For example, ask a parent or an older neighbour what they paid for their first car, first house, or first formal wear.

Economic Forecasting

In the previous section, we introduced several measures that economists use to assess the performance of the economy at a given time. By looking at changes in the GDP, for instance, we can see whether the economy is growing. The CPI allows us to gauge inflation. These measures help us understand where the economy stands today. But what if we want to get a sense of where it’s headed in the future? To a certain extent, we can forecast future economic trends by analyzing several leading economic indicators.

Economic Indicators

An economic indicator is a statistic that provides valuable information about the economy. There’s no shortage of economic indicators, and trying to follow them all would be an overwhelming task. So in this chapter, we’ll only discuss the general concept and a few of the key indicators.

Lagging and Leading Indicators

Statistics that report the status of the economy a few months in the past are called lagging economic indicators. One such indicator is average length of unemployment. If unemployed workers have remained out of work for a long time, we may infer that the economy has been slow. Indicators that predict the status of the economy three to twelve months into the future are called leading economic indicators. If such an indicator rises, the economy is more likely to expand in the coming year. If it falls, the economy is more likely to contract.

It is also helpful to look at indicators from various sectors of the economy— labour, manufacturing, and housing. One useful indicator of the outlook for future jobs is the number of new claims for unemployment insurance. This measure tells us how many people recently lost their jobs. If it’s rising, it signals trouble ahead because unemployed consumers can’t buy as many goods and services as they could if they had paychecks.

To gauge the level of goods to be produced in the future (which will translate into future sales), economists look at a statistic called average weekly manufacturing hours. This measure tells us the average number of hours worked per week by production workers in manufacturing industries. If it’s on the rise, the economy will probably improve. For assessing the strength of the housing market, housing starts is often a good indicator. An increase in this statistic—which tells us how many new housing units are being built—indicates that the economy is improving. Why? Because increased building brings money into the economy not only through new home sales but also through sales of furniture and appliances to furnish them.

Since employment is such a key goal in any economy, the Canadian Industry Statistics in collaboration with Statistics Canada tracks total non-farm payroll employment from which the number of net new jobs created can be determined.

Government’s Role in Managing the Economy

Monetary Policy

Monetary policy is exercised by the The Bank of Canada, which is empowered to take various actions that decrease or increase the money supply and raise or lower short-term interest rates, making it harder or easier to borrow money. When The Bank of Canada believes that inflation is a problem, it will use contractionary policy to decrease the money supply and raise interest rates. When rates are higher, borrowers have to pay more for the money they borrow, and banks are more selective in making loans. Because money is “tighter”—more expensive to borrow—demand for goods and services will go down, and so will prices. In any case, that’s the theory.

The Bank of Canada will typically tighten or decrease the money supply during inflationary periods, making it harder to borrow money.

To counter a recession, The Bank of Canada uses expansionary policy to increase the money supply and reduce interest rates. With lower interest rates, it’s cheaper to borrow money, and banks are more willing to lend it. We then say that money is “easy.” Attractive interest rates encourage businesses to borrow money to expand production and encourage consumers to buy more goods and services. In theory, both sets of actions will help the economy escape or come out of a recession.

Fiscal Policy

Fiscal policy relies on the government’s powers of spending and taxation. Both taxation and government spending can be used to reduce or increase the total supply of money in the economy—the total amount, in other words, that businesses and consumers have to spend. When the country is in a recession, government policy is typically to increase spending, reduce taxes, or both. Such expansionary actions will put more money in the hands of businesses and consumers, encouraging businesses to expand and consumers to buy more goods and services. Expansionary fiscal policy is used to increase government expenditures and/or decrease taxes which causes the government’s budget deficit to increase or its budget surplus to decrease. When the economy is experiencing inflation, the opposite policy is adopted: the government will decrease spending or increase taxes, or both. Because such contractionary measures reduce spending by businesses and consumers, prices come down and inflation eases. Contractionary fiscal policy is used to decrease government expenditures and/or increase taxes which causes the government’s budget deficit to decrease or its budget surplus to increase.

The National Debt

If, in any given year, the government takes in more money (through taxes) than it spends on goods and services (for things such as defense, transportation, and social services), the result is a budget surplus. If, on the other hand, the government spends more than it takes in, we have a budget deficit (which the government pays off by borrowing through the issuance of Treasury bonds). Historically, deficits have occurred much more often than surpluses; typically, the government spends more than it takes in. Consequently, the Canadian government now has a total national debt of more than $1.154 trillion.

Key Takeaways

Important terms and concepts

- Economics is the study of the production, distribution, and consumption of goods and services.

- Economists address these three questions: (1) What goods and services should be produced to meet consumer needs? (2) How should they be produced, and who should produce them? (3) Who should receive goods and services?

- The answers to these questions depend on a country’s economic system. The primary economic systems that exist today are planned and free market systems.

- In a planned system, such as communism and socialism, the government exerts control over the production and distribution of all or some goods and services.

- In a free market system, also known as capitalism, business is conducted with only limited government involvement. Competition determines what goods and services are produced, how they are produced, and for whom.

- In a free market system, buyers and sellers interact in a market to set prices.

- When the market is characterized by perfect competition, many small companies sell identical products. The price is determined by supply and demand.

- Supply is the quantity of a product that sellers are willing to sell at various prices. Price also influences the quantity of a product that producers are willing to supply: they’ll sell more of a product when prices are high and less when they’re low.

- Demand is the quantity of a product that buyers are willing to purchase at various prices. The quantity of a product that people will buy depends on its price: they’ll buy more when the price is low and less when it’s high.

- In a competitive market, the decisions of buyers and sellers interact until the market reaches an equilibrium price—the price at which buyers are willing to buy the same amount that sellers are willing to sell.

- There are four types of competition in a free market system: perfect competition, monopolistic competition, oligopoly, and monopoly.

- Under perfect competition, many sellers offer differentiated products— products that differ slightly but serve similar purposes. By making consumers aware of product differences, sellers exert some control over price.

- In an oligopoly, a few sellers supply a sizable portion of products in the market. They exert some control over price, but because their products are similar, when one company lowers prices, the others follow.

- In a monopoly, there is only one seller in the market. The market could be a geographical area, such as a city or a regional area, and does not necessarily have to be an entire country. The single seller is able to control prices.

- Most monopolies fall into one of two categories: natural and legal.

- Natural monopolies include public utilities, such as electricity and gas suppliers. They inhibit competition, but they’re legal because they’re important to society.

- A legal monopoly arises when a company receives a patent giving it exclusive use of an invented product or process for a limited time, generally twenty years. Economies share three goals: growth, high employment, and price stability.

- Growth. An economy provides people with goods and services, and economists measure its performance by studying the gross domestic product (GDP)—the market value of all goods and services produced by the economy in a given year. If the GDP goes up, the economy is growing; if it goes down, the economy is contracting.

![The business cycle, also known as the economic cycle or trade cycle, is the downward and upward movement of gross domestic product (GDP) around its long-term growth trend.[1] The length of a business cycle is the period of time containing a single boom and contraction in sequence. These fluctuations typically involve shifts over time between periods of relatively rapid economic growth (expansions or booms), and periods of relative stagnation or decline (contractions or recessions). Business cycles are usually measured by considering the growth rate of real gross domestic product. Despite the often-applied term cycles, these fluctuations in economic activity do not exhibit uniform or predictable periodicity.](https://ecampusontario.pressbooks.pub/app/uploads/sites/2978/2022/11/2-BusinessLifeCycle-Graph-1024x707.png)