Mathematics of Merchandising

7.2 Cash Discounts

Payment Terms and Cash Discount

When businesses, including those within the supply chain, sell goods and services, they often do so on credit. This practice allows buyers to receive goods immediately but pay for them later. The total amount due for these purchases is indicated on the invoice and typically has a set credit period before payment is required, commonly 30 or 60 days after the invoice date.

To incentivize quicker payment, sellers may offer a cash discount. This discount is a reduction of the invoice's net amount and is only available within a specified time frame, shorter than the full credit period. The discount is calculated as a percentage of the invoice's net amount. For example, terms such as "2/10, net 30" imply a 2% discount is available if payment is made within 10 days; otherwise, the full net amount is payable within 30 days.

If the buyer does not take advantage of the cash discount by paying within the allotted time frame, the full net amount becomes due at the end of the credit period. This system of cash discounts benefits both the seller, by improving cash flow, and the buyer, by reducing the cost of their purchases.

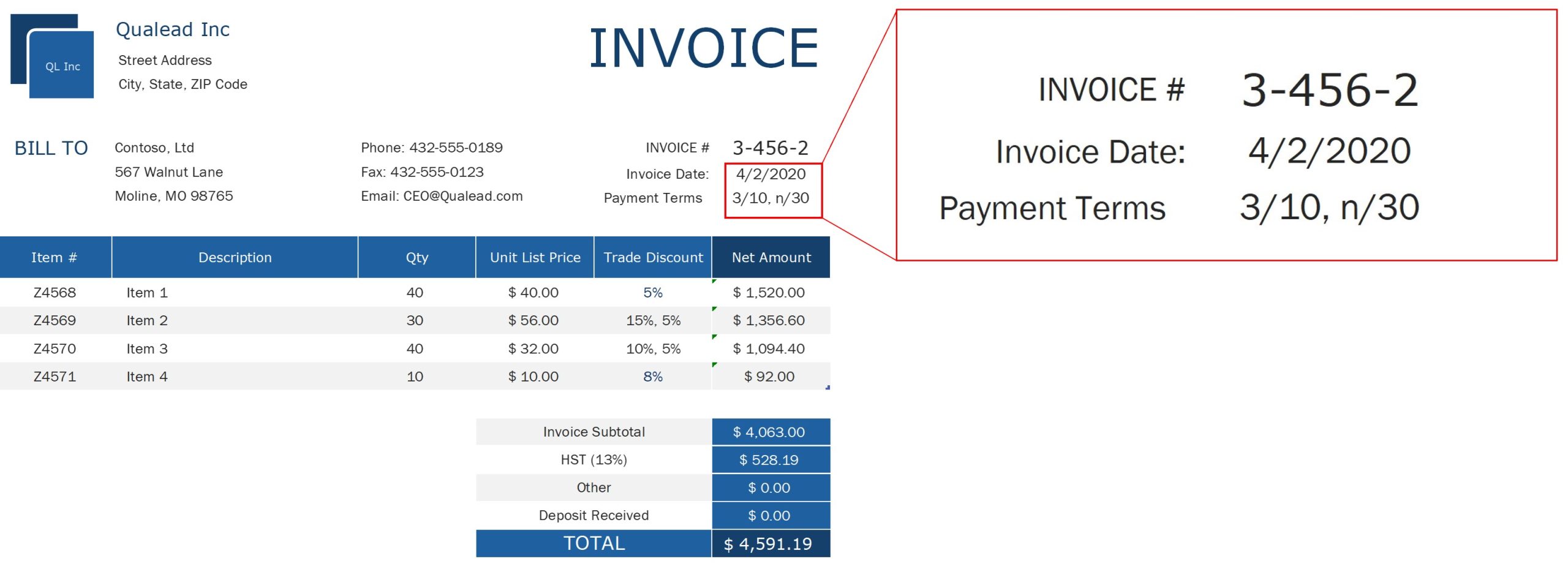

Figure 7.2.1 illustrates a sample invoice with a description of the payment terms. In the invoice, the payment term is indicated as "3/10, n/30" implying a 2% discount is available if payment is made within 10 days from the invoice date of 4/2/2020; otherwise, the full net amount is payable within 30 days.

Figure 7.2.1 A sample invoice with a description of the payment terms

There are several types of cash discounts commonly used in business transactions.

- Ordinary Dating:

- This is the most common type of cash discount, where the discount and credit terms are calculated from the date of the invoice. For example, "2/10, net 30" means the buyer can take a 2% discount if the invoice is paid within 10 days from the invoice date; otherwise, the full amount is due in 30 days.

- End of Month (EOM) Dating:

- The discount and credit periods start from the end of the month in which the invoice is issued. If the terms are "2/10 EOM," it means the buyer has until the 10th day of the following month to pay the invoice and receive a 2% discount.

- Receipt of Goods (ROG) Dating:

- The discount period begins from the day the buyer receives the goods. This is used when delivery times are uncertain. Terms might be "2/10 ROG," allowing a 2% discount if payment is made within 10 days of receiving the goods.

How to Apply the Cash Discounts

- Ordinary dating assumes terms are calculated from the invoice date unless specified as EOM (End of Month) or ROG (Receipt of Goods).

- Terms without EOM or ROG indicate ordinary dating.

- Ordinary Dating: For "2/10, n/30," a 2% discount applies if paid within 10 days from the invoice date.

- End-of-the-Month (EOM): "2/10 EOM" indicates a 2% discount if payment is within 10 days after the invoice month's end.

- Receipt of Goods (ROG): "2/10 ROG" allows a 2% discount if payment is within 10 days of goods receipt.

- Ordinary Dating: Add the discount period (e.g., 10 days) to the invoice date.

- EOM: The discount period starts from the first day of the month following the invoice.

- ROG: The discount period starts from the goods receipt date.

The Date Worksheet on financial calculators can be used to determine the discount period.

For staggered discounts like "5/10, 3/20, n/60," a 5% discount is available within 10 days, 3% within 20 days, and the full amount is due within 60 days from the invoice date.

4. Calculate the Discount: If paying within the discount period, apply the discount rate to the invoice amount. You can

- Subtract the calculated discount from the invoice amount for the net price.

- Alternatively, use the net price factor (NPF), where the invoice amount is multiplied by the NPF (1 minus the discount rate).

K2 Distributors has received an invoice of $10,000 dated September 10, terms 3/10, n/30. a) What is the last day for taking the cash discount? b) How much is to be paid if the discount is taken?

Show/Hide Solution

a) Given that it's an ordinary dating term of "3/10", we calculate the final day to take the cash discount by adding 10 days to the invoice date, excluding the day the invoice is issued. This places the deadline for the cash discount on September 20th. The credit term "n/30" indicates that the full payment is due 30 days following the invoice date, which would be October 10th.

b) Given the term "3/10", the cash discount rate is 3%. To find the net price, we can apply the net price factor approach:

[asciimath]"Net amount"=10,000(1-3%)[/asciimath]

[asciimath]=10,000(0.97)[/asciimath]

[asciimath]=$9700[/asciimath]

Therefore, $9700 should be paid if the payment is made within the cash discount period.

Try an Example

A retailer received an invoice for $3000 issued on January 2, 2023, with the following payment terms: 5/10, 2/25, n/45. What will settle the invoice if it is paid on a) January 10th, b) January 25th, or c) January 30th.

Show/Hide Solution

The terms "5/10, 2/25, n/45" mean:

- A 5% discount is available if the invoice is paid within 10 days (by January 12th).

- A 2% discount is available if the invoice is paid within 25 days (by January 27th).

- The full amount is due without any discount if the invoice is paid within 45 days (by February 16th).

a) The retailer can take advantage of the 5% discount if they pay the invoice amount on January 10th.

[asciimath]"Net amount"=3000(1-5%)[/asciimath]

[asciimath]=3,000(0.95)[/asciimath]

[asciimath]=$2850[/asciimath]

b) The retailer receives a 2% discount if they pay the invoice amount on January 25th.

[asciimath]"Net amount"=3000(1-2%)[/asciimath]

[asciimath]=3,000(0.98)[/asciimath]

[asciimath]=$2940[/asciimath]

c) No discount applies, but the payment of $3000 is still within the credit period if the invoice is paid on January 30th.

Try an Example

K2 Distributors has received an invoice of $10,000 dated September 10, terms 3/10, n/30 EOM. a) What is the last day for taking the cash discount? b) How much is to be paid if the discount is taken?

Show/Hide Solution

a) The terms "3/10, n/30 EOM" mean that a 3% cash discount is available if the payment is made within 10 days from the end of the month in which the invoice is dated. Since the invoice is dated September 10, the end of September is September 30. Therefore, the last day for taking the cash discount is 10 days after September 30, which is October 10. The credit term "n/30" indicates that the full payment is due 30 days from the end of the month in which the invoice is dated, which would be October 30th.

Note that if the payment is made before the start of the cash discount period, for example, September 15th, it is qualified for the 3% discount.

b) Given the term "3/10", the cash discount rate is 3%. To find the net price, we can apply the net price factor approach:

[asciimath]"Net amount"=10,000(1-3%)[/asciimath]

[asciimath]=10,000(0.97)[/asciimath]

[asciimath]=$9700[/asciimath]

Therefore, $9700 should be paid if the payment is made within the cash discount period.

Try an Example

K2 Distributors has received an invoice of $10,000.00 dated September 10, terms 4/10, n/30 ROG, for a shipment of lamps that arrived on October 29. a) What is the last day for taking the cash discount? b) How much is to be paid if the discount is taken?

Show/Hide Solution

a)The terms "4/10, n/30 ROG" indicate that a 4% cash discount is available if payment is made within 10 days of the date that goods have been received. Since the shipment of lamps arrived on October 29, the last day to take the cash discount is 10 days later, which is November 8.

b) Given the term "4/10", the cash discount rate is 4%. To find the net price, we can apply the net price factor approach:

[asciimath]"Net amount"=10,000(1-4%)[/asciimath]

[asciimath]=10,000(0.96)[/asciimath]

[asciimath]=$9600[/asciimath]

Therefore, $9600 should be paid if the payment is made within the cash discount period.

Try an Example

Section 7.2 Exercises

- A wholesaler has received an invoice of $19,180 dated May 30, terms 3/20, n/30, for a shipment of coffee makers that arrived on June 24. a) What is the last day for taking the cash discount? b) How much is to be paid if the discount is taken?

Show/Hide Answer

a) June 19

b) $18,604.60

- A retailer received an invoice for $9,500 issued on November 1, with the following payment terms: 4/20, 3/25, n/60. What will settle the invoice if it is paid on November 26?

Show/Hide Answer

$9,215.00

- A retailer has received an invoice of $20,190 dated June 22, terms 6/15, n/30 EOM, for a shipment of leaf blowers that arrived on July 28. a) What is the last day for taking the cash discount? b) How much is to be paid if the discount is taken?

Show/Hide Answer

a) July 15

b) $18,978.60