Part II – A Treatise on Economics for the 21st Century

Thomas Jefferson and Jeffersonian Theory

The purpose of a treatise is to provide a solution, in order to provide said solution, there must be a problem presented. To this point, we have found the problem of crony capitalism, neo-Marxian resentment and response, and monopolistic influence through corporatocracy. We have set a plan for a solution to be done through trust, transparency, individualism, return to basics, and an embrace of a national democracy. This part will go even further in providing a theoretical lens and pragmatic solutions to these economic problems under the ethos we have solidified. To start with a theoretical framework, I look toward Thomas Jefferson[1] and his theory on democracy as a base of economic freedom and expression. Jeffersonianism holds the belief of equal political opportunity that is centered around the common man — while emphasizing natural ethics of honesty and virtue for individuals in a society.

Jeffersonianism holds the ideal of a society free of artificial aristocracy, accepting republicanism, and accepting anti-clerical actions. Similar to Lockean Liberalism referring to the freedom from tyranny and the natural law of the free man. Rejecting artificial aristocracy refers to exiling the literal function of cronyism of the professional managerial class (corporate media, government lobbyist etc.) from the levers of constitutional power. Also, from-and-for-the public doctrine of rights balanced with a social contract and no belief to be above another religious belief in the form of anti-clericalism. Thomas Jefferson – and Jeffersonianism – introduces the most pertinent and effective theoretical framework for this economic treatise. Respect of the individual and reject the pernicious forms of collectivization; yet again, we can also accept the problem of powerful individuals and their proclivities especially the cronies that are aware and liable for the economic divide.

In a political framework, Jeffersonianism attempts to take out the right and left spectrum creating an elite-populist spectrum – with embrace of the populist side. Elites are found on the political spectrum both on the left and right, but it is in their elite actions that they work in tandem – behind the curtain and above the veldt against the populist for their own self-interest. The Jeffersonian framework will encompass a populist message toward the shift in economic practices in the 21st century as a call for reform on the framework of individualization, rights doctrine, and rejection of cronyism.

National Economics

For this treatise, economics will be more focused on a western/Americanized economy. Much like Jeffersonian concepts, this national focus is tailored to freedom, merit, and diversity of opinion — with rights and individualization comes a form of identity, predominantly a political or national identity will be described. Classical economics have always been the national game based on the macroeconomics of imports and exports of countries, taxation, investment, and inflation all focused on the country’s interest. However, starting in the Autumn of 1989 – after the fall of the Berlin Wall and the end of the Cold War – economics changed in the direction of globalized governance and borderless agreements. The growth of the multi-national corporation became ever apparent and the influence of NGO’s and IGO’s[2] on corporations and national politics came to the forefront. Of course, NGO’s and IGO’s have expressed ethical interest, but they also have political interests, and their seat at the table removes the concept of the national economy; thus, moves economic autonomy away from the individual.

Most in the corporate world (neoliberals) would scoff at the suggestion of thinking anything is ill-mannered about the influence of NGO/IGO in national politics and their economies; nevertheless, questions can be asked about the implications of this globalized economic posture. First, are the interests of the United States aligned with a nation like China? Are the interests of Sweden aligned with the Kingdom of Saudi Arabia? Does China’s belt and road initiative[3] with groups like the Kim Dynasty in North Korea and the Taliban in Afghanistan introduce ethical challenges to NATO countries like the United States, United Kingdom, France, Germany etc.? Are constitutional motives for nations aligned with profit motives for multi-national corporations? Do the globalized nations – along with NGO, IGO, and multi-national corporations – have human individuality, freedom, expression, and autonomy at their heart? I will not opine on the answers as I am not in one of these in high positions of power — I can surmise, a predictive assessment that most of these questions can be answered by readers with rhetorical vigor based on their own knowledge of foreign policy.

Simply put, there are valid criticisms with the combination of national economics with international influences and motivations. Have it been the 1970’s and the push by the World Bank to influence more governments as an alternative to the state, or the push for globalized technology identification from the UN[4]; national interest is largely seen as threatened by international influences in a power vacuum. This treatise will push toward constitutional economics and focus on areas related to national interest opposed to global interest.

Capitalism over Socialism – with Fairness

Generally speaking – capitalism is a superior method of economic authority than socialism, that is an undeniable fact considering most ‘socialist’ countries that individuals cite as success are capitalist countries with broad social safety nets – not to mention inherent contradictions and failures of most fully-socialist countries throughout history (Cuba, Venezuela, North Korea, 20th Century Pakistan etc.). Capitalism in turn is the best option we own to maximize freedom and to raise all ships. With fairness, however, socialism can provide some justification for capitalists to think deeper about implications on said actions; therefore, I will accept debate from socialism as it can help us understand our economic motivations.

One of the glaring concerns I see with socialism is the motivation of unions – especially in the modern age. For example, one can see clear differences between private sector unions and public sector unions as related to their motivations. I for one am accepting of private unions as the classical ethos of the union is to protect the laborer – typically of manual tradition (i.e. factory, farm etc.). This is contrasted with the public union, which I am unaccepting of, given their appetite to obtain political power against the motivations of their members, sometimes at the expense of their members (i.e. teachers unions). The socialists seem to not have reconciled with this reality yet, mainly because it would be some slight against their ethic. However, for the case of actual change in economics, bureaucratic squabbles are not needed, as time is of the essence. This should be reviewed as ideals change.

The Five Rules for Economics in the 21st Century

A solution to a problem must be clear and methodic toward obtaining a goal. Thus, economics in the 21st century need clear and methodic solutions for now and into the future. I have outlined five rules that will be a catalyst for the 21st century success of our economic future, they are as follows:

I: A Nationalized Base for Industry

II: The 5-3 Rule of Asset Taxation

III: Diversification Limitation

IV: Market and Debt Transparency

V: Corporate and Government Stakeholders, Decoupled

These rules will look to enhance national sovereignty, fair taxation, limiting heavy corporate diversification, debt burden and market fairness, and a complete decoupling of cronyism inside of our economy. This is to complement our ethos of trustworthiness, transparency, individuality, classicalism, and sovereign democracy.

Rule I: A Nationalized Base for Industry

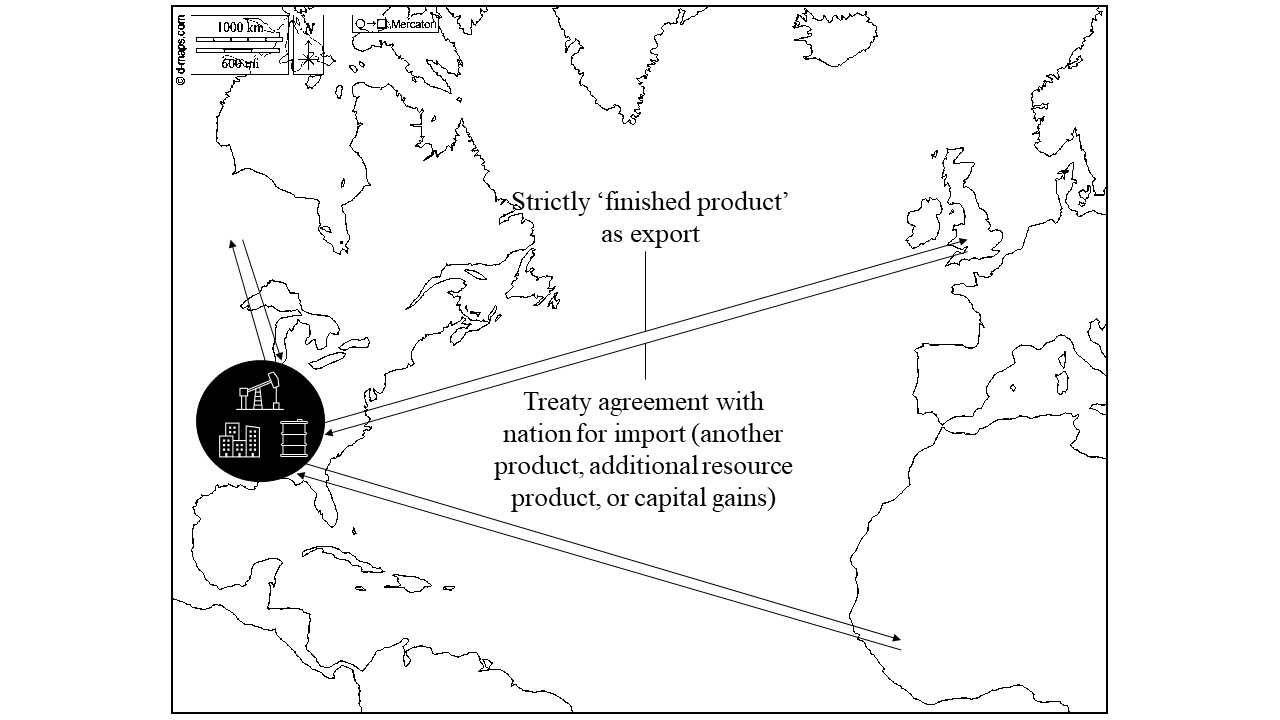

A nationalized base for industry is not to intervene in general trade with other nations, rather an enhancement of corporate and manufacturing remaining home in nations that they are founded in. Of course, a complete removal of trade with other nations in other economies is not conducive; rather, a modern mercantilism that embraces an import/export relationship with other countries through treaties of finished products for sale going out, with manufacturing, collection of raw materials, and logistical management held within the mother country. For this example, lets use the oil trade out of the United States.

As you can see from the image, the focus here keeps well over 50% of an oil company’s industry at home. All of the prospecting, geological survey, bulk-head manufacturing, pipe fitters, extraction, processing plants, and transportation to export; along with corporate management, middle management, and capital investment all stay within the United States. What are the implications of this? Well, if we go to the tech sector and take a portfolio like Amazon’s, an estimation can be made that only 30% of their business is conducted in the United States (HQ’s, fulfillment centers, call centers etc.). If that was raised to 50% that could end up being 40,000 new Amazon jobs – and if extrapolating to all multi-national corporations could equal up to 4-5 million new jobs in the United States.

Although these are estimates, 4-5 million jobs could drastically lower the unemployment rate anywhere from 30-50% solely by introducing this method of national importance for a large quantity of industry. This ends up being a benefit for the United States economy as more money is circulating due to job growth and spending by citizens.

Rule II: The 5-3 Rule of Asset Taxation

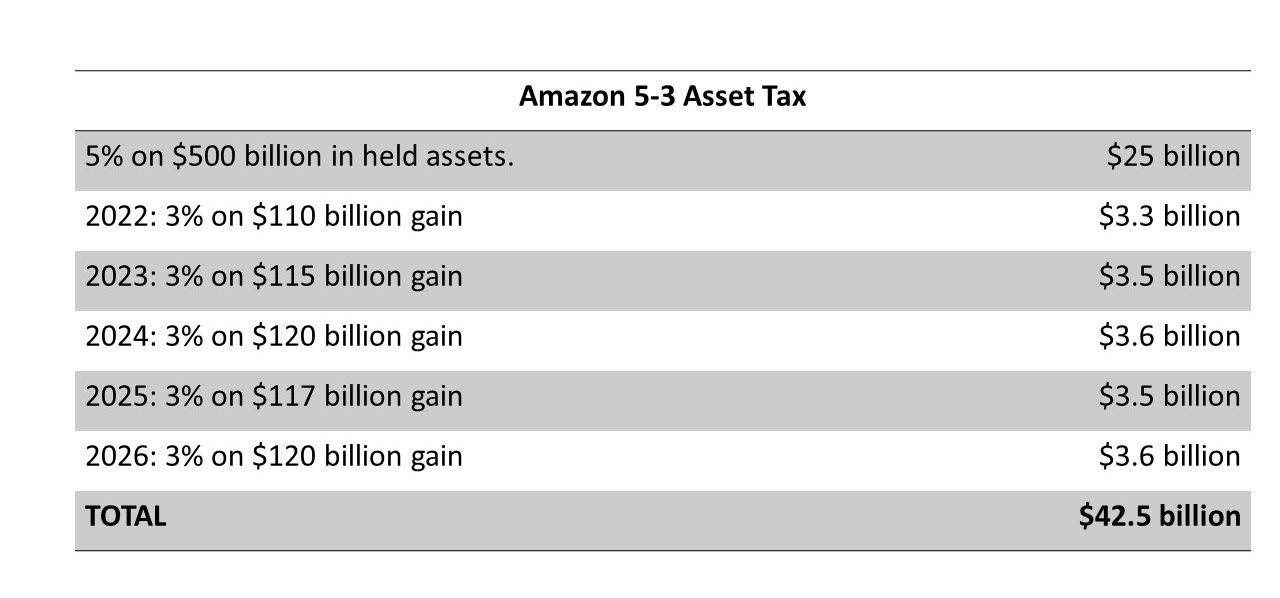

There is no doubt, the wealthy use a significant tax loophole and is contributing to the wealth gap. As someone who would identify as a conservative – Republican voter; full disclosure, Bernie Sanders was onto something when talking about Wall Street Speculation tax. In thinking about the speculation tax, it had me looking for a more macro approach to how wealthy individuals could pay a small but significant share on the real money they earn. Let’s use Amazon as an example again. The CEO of Amazon only earns $81,000 per year, if we render a tax rate at 25% is a little over $20,000 in taxes. That is more than you and I pay, but this discussion relating to corporations is not taxes on salary, rather taxes on assets.

When we look at Amazon’s assets – owned and managed by the CEO and shareholders – Amazon’s asset worth is upwards of 400-500 billion, and a 52-week market cap net-worth of 1.7 trillion (about the GDP of Canada). It is safe to say the assets are where the taxation needs to happen in order to make sufficient economic change. The 5-3 rule is simple, an immediate one-time 5% commission tax on total assets, with subsequent yearly 3% taxes on earned asset capital. Given the margin of worth and asset capital with Amazon, it is safe to say an immediate 5% tax to be taken from 500 billion with subsequent 3% tax on yearly asset capital – usually ranging around 100 billion – what might this look like:

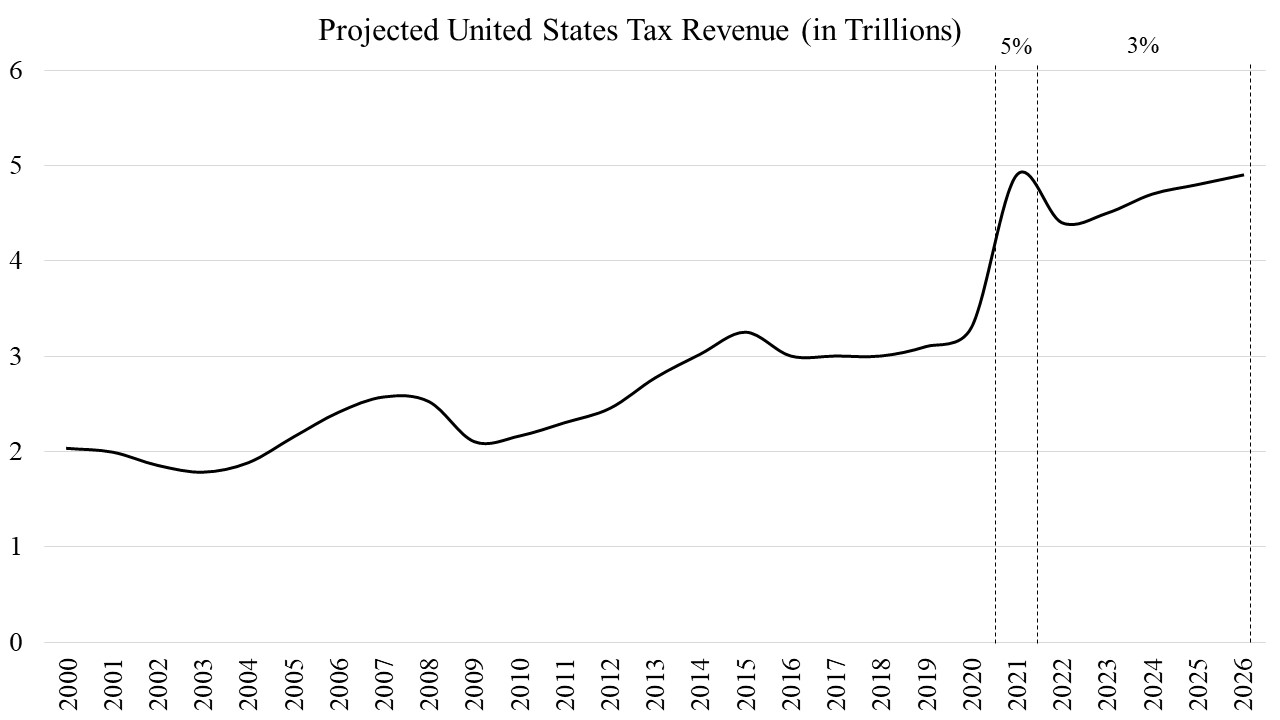

All in, over five years one company would be contributing 42.5 billion dollars back to the national commonwealth. Again, if we extrapolate this to all multi-national firms, we could see an asset tax return of close to 4 trillion dollars (1 trillion in 2021 with 600 billion in subsequent years). To put this into context here is how the tax revenue would change in the United States just through this measure alone.

This increase in tax revenue not only benefits the corporations and their operation inside of a country, but this also pleases citizens who advocate and need a social safety depending on circumstances. This increased tax revenue can work with new infrastructure, health care, workers who have been displaced through technology and are seeking new employment, entrepreneurship, and national investment toward future grants and projects. Furthermore, it can provide an option for debt elimination by removing the debt burden (see Rule IV). Taxation on assets is a way to satisfy the needs of the citizens to close the wealth gap by corporations and wealthy endowments (i.e. Ford Foundation and Harvard Endowment) paying their comparable share, at the same time does not hamper or stifle economic growth, research, and capital development.

Rule III: Diversification Limitation

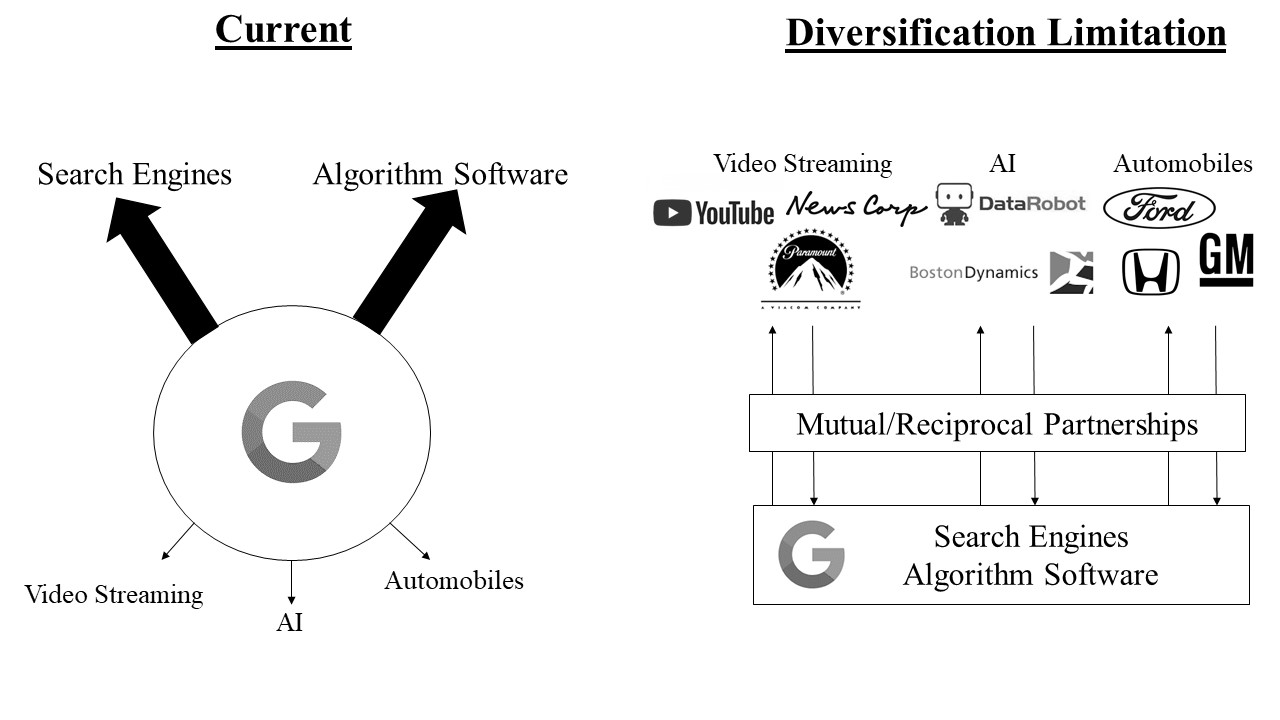

Limiting diversification – in an economic sense – is limiting the portfolio of a company to certain sectors of the economy. Essentially, acting as a check and balance against monopolistic and oligopolistic inclinations of corporations. It places a reliance on trade within national corporations, or leniency with international partnerships. Now this may sound like an ‘over-step’ but the utility of diversifying has benefits and negative not only for the company but for the health of the economy. For example, lets take a massive company like Google who dominates the tech sector through search engines, and algorithm software. They are also starting to dominate in video streaming, AI, and even automobiles. Changes come with mutual and reciprocal partnerships with someone like Google, to sector giants in originating areas they are diversifying in.

This is perhaps one of the most challenging rules to regulate, considering companies could just change their corporate structure; thus, difficult to keep track. This would need to start with legislation inside of government bodies to handle anti-competition and anti-collusion statutes such as the Sherman Anti-Trust Act[5] to effectively implement this rule. Otherwise, it will be difficult, and corporations will find loopholes.

Rule IV: Market and Debt Transparency

As we have seen from Rule III, taxation when not hindering growth is beneficial for the entire polis or commonwealth. Thus, the discussion here will be about solving the lack of market transparency and the alleviation of the debt burden on countries – more succinctly – the United States. The United States at this moment in time holds a federal debt to GDP ratio of 125.8% which is among the highest in the world. Here are some other debt statistics for the US.

- US National Debt (principal amount from securities outstanding): $28 Trillion

- US Total Debt (including household, institution, and government): $84 Trillion

- US Treasury Interest on Debt: $406 Billion

- US Debt Per Citizen (total consumer debt): $65,000

Let us first look at the stock market and consider Bernie Sanders’ tax on Wall Street speculation. Estimates from this range upwards of 40 billion per year combined with the 5-3 rule yearly with 660 billion. Unfortunately, this does not put much of dent; however, this puts more money into American pockets – therefore, progressive increases on income tax and with marginal cuts to big budget items government can alleviate U.S. Treasury interest collected on debt. This alleviation will help the continual accumulation of additional debt, avoid defaults, and have less interest payments to hinder the speed of debt growth. For now, that can be one solution to alleviate the burden of debt, but questions remain: what volatility this might cause in the market? Also, how with all these changes, do investors continue to buy US debt in turbulent economic times? Market and debt transparency is a gesture toward the problem of defaulting through interest working within a balance of progressive taxation, marginal cutting programs, protecting against market volatility through speculation tax, and having investors buy debt – not just in turbulent markets – but for reinvestment based on market stability through national growth and consumer influx. In turn, this may help our masochistic intentions to cause pain on ourselves through acts such as endless money printing through quantitative easing[6] — which is burdening the public.

Rule V: Corporate and Government Stakeholders, Decoupled

The topic of crony capitalism needs to be addressed considering it is the most detrimental aspect to the modern economy. One look at Democrat and Republican politicians, money lobbied for them in congress, senate, and even the presidency needs to be understood and remedied as the problem of corporate-government stakeholder collusion, and disproportionate power is rotting the republic. Crony capitalism is anti-republican and reeks of artificial aristocracy in the Jeffersonian sense; furthermore, attempts to be a thorn in American decision-making on economics now and in the future. What is odd is that in the 21st century, supposed ‘liberals’ have embraced the crony capitalist model as a way for apparent ‘effective’ and ‘progressive’ socio-economic and socio-political change. This comes from the perception that America is some sort of capitalist evil that beats people down, while the irony on the other hand is palpable. Forcefully fighting the classical capitalism mindset by the Founding Fathers that actually helps the people of a commonwealth; in turn, support neoliberal crony capitalism that intends to effectively eliminate the middle class.

The complexity comes with politics and economics on a collision course with one another since the Industrial Revolution. The story of how crony capitalism came along has a lengthy history, but for now, all we need to know is that it has reached its peak utility. Crony capitalism is rejected by most of the classic economic scholars including Friedman[7] who differentiates the free-market capitalist and the crony capitalist suggesting the biggest threats to free-market are the ivory tower institutions (university, NFP trust funds, NGO/IGO) and the government colluding with corporations for their own interests. He brilliantly outlines the failure of socio-intellectuals and their ignorance on thinking society works through this collaboration but fails. It ties into the handwringing lobbyist and business tycoons that show up to Washington D.C. with pails for subsidies, bailouts, and tax exemptions. This is completely at odds with free-market capitalism as competition allows for failure, but the ‘too big to fail’[8] concept is all to common of a crony capitalist model and is wholly ingrained in halls on Wall Street to Pennsylvania Avenue.

Ironically enough – as if crony capitalism doesn’t provide us with enough irony – this type of action is what the right side of the political spectrum fears the most: the socialism of our corporations. With that said, let’s just call crony capitalism exactly what it is: hypocritical socialism or neoliberal Marxism. The failure of corporations looking for centralized handouts from a government or power, acting as poor and huddled masses in tailored bespoke suits playing the role of proletariat needing their ‘fair share’ from the government and the government capitulating in a never-ending mistake – the ignorance is nauseating. Its nauseating because with government and corporations coupled together, they depend on each other; thus, the person that loses out is the citizen – who takes on the role of both consumer and constituent.

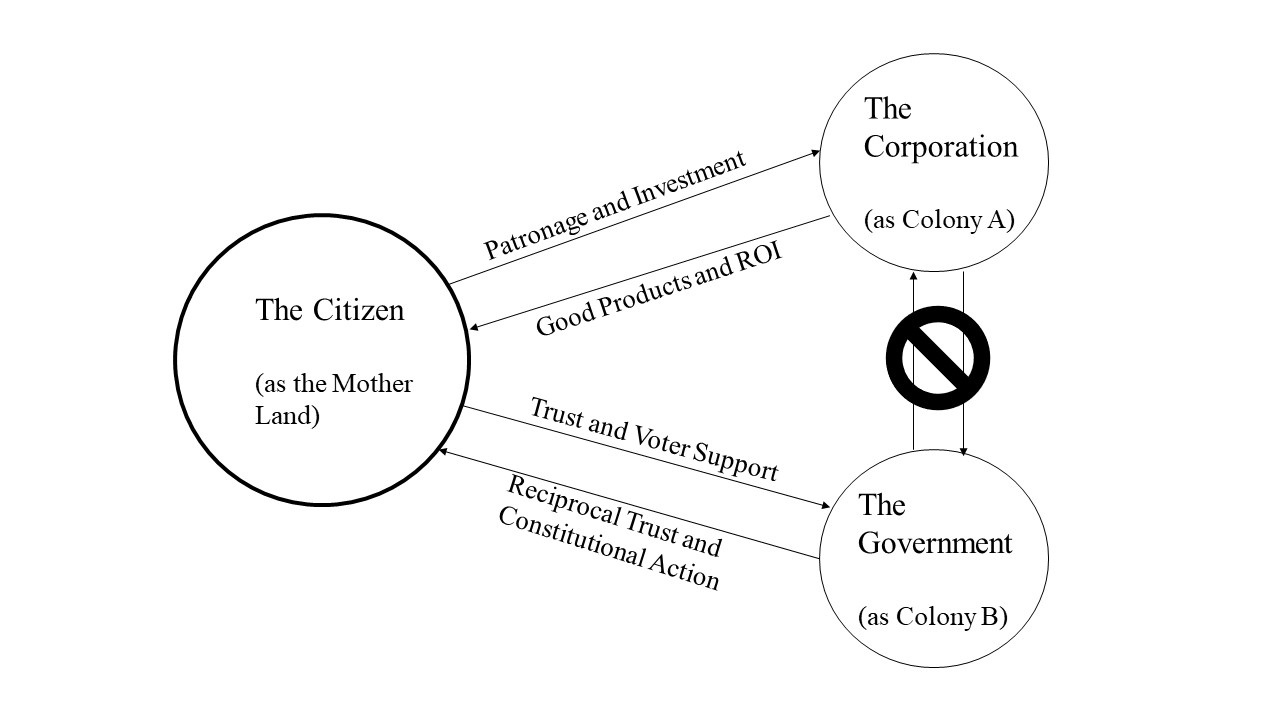

What can be done? A complete decoupling of corporate and government stakeholders. The corporate stakeholders are the citizen who have patronage through products or stock options, they are also the stakeholders in government through voting and voice in legislation. Think of this as more of a social mercantilism where the mother country is centered around the free individual and the colonies of corporation and government work to serve the shareholders, but do not collude with each other at the detriment of the shareholder – like two colonies unable to trade unless through the mother land. Social mercantilism would look something like this:

The solution comes not only from a political-economic standpoint, but at an ethical one. Again, it starts with regaining a patronage in our companies and institutions to make good products needed for the people; at the same time, reciprocity and trust in upholding the constitution – in a republic such as the United States – builds trust in governmental systems, something that has been and continues to lack well into this century. There is no telling if Rule V needs be in the beginning or the end of this process, all that is known, is that it needs to be done — and done soon.

A Quick Word on Governments

As is shown, this is not an anarchical call for removal of markets or governments, rather a bucket of cold water to wake governments and corporations up out of their corporatized neoliberal slumber. You can ask yourselves the ‘chicken and egg’ question: did corporate incompetence create bad government, or did bad government create corporate incompetence? Depending on political emotions, someone may lean toward one over the other, the easiest is to say both culpable and a central approach to checks on both bad business and bad government are needed. It is through free-market capitalism where competition, freedom, and choice are used to create patronage, products, and return on investment. Jeffersonian ideals of republicanism, rejection of artificial aristocracy, and rational individualization eliminates the cronyism and protect rights enshrined in the constitution. Capitalism and a Jeffersonian mindset are answers to the problem of cronyism and fosters in a new economic standard.

- Thomas Jefferson (1743-1826) was one of the Founding Fathers of the United States Constitution and the 3rd President of the United States. Jeffersonian Democracy or Jeffersonianism is a theory based on his writings, mostly his final 1826 letter to Roger C. Weightman and Notes on the State of Virginia, 1785. ↵

- NGO: Non-Governmental Organization (Amnesty International, World Wildlife Fund, World Economic Forum, Gates Foundation). IGO: Intergovernmental Organization (United Nations, World Health Organization, World Trade Organization, International Monetary Fund). ↵

- From the Council of Foreign Relations: China’s Belt and Road Initiative is a massive infrastructure project that stretches from East Asia into Europe. It is one of the biggest economic expansions in world history and a beacon of globalized influence economically, politically, and militarily for China. ↵

- From the Australian Marxist Review covering the World Bank’s influence as an alternative to the state. United Nations Initiative for ID2020: a techno-societal initiative for human identification on a large scale. ↵

- Sherman Anti-Trust Act is a U.S. Law that was passed in 1890 that outlaws trusts or business groups that collude to form a monopoly to regulate price or dictate standards on interstate commerce and competitiveness. ↵

- Quantitative Easing is done by the US Federal Reserve in buying assets, or securities, such as government bonds to print new money to be circulated in the economy. The continuous easing done by the US Federal Reserve after the 2008 financial collapse have some speculators concerned as demand is halting and hyperinflation is the only outcome from quantitative easing. ↵

- In 1991, Nobel Prize winning economist Milton Friedman describes crony capitalism vs. free market capitalism and the failure that comes with ineffective business and public leaders come together to the detriment of the citizen who they serve. ↵

- In reference to the Wall St. banks and investment firms during the 2008 market crash which received massive subsidies from the Obama Administration. An example of monetary mismanagement to start, and ending with federal compensation. ↵