Chapter 13: Managing Personal Finances

Chapter 13 Learning Outcomes

After reading this chapter, you should be able to do the following:

- Define personal finances and financial planning.

- Explain the financial planning life cycle.

- Discuss the advantages of a college education in meeting long-term financial goals.

- Describe strategies to manage and minimize personal debt.

- Explain how to manage monthly income and expenses.

- Explain compound interest and the time value of money.

- Discuss the value of getting an early start on your plans for saving.

- Explain how you can build a credit history that will give you a high credit score.

Financial Planning

Before we go any further, you need to understand a couple of key concepts. First, just what, exactly, is meant by personal finances? Finance itself concerns the flow of money from one place to another, and your personal finances concern your money and what you plan to do with it as it flows in and out of your possession. Essentially, then, personal finance is the application of financial principles to the monetary decisions that you make either for your individual benefit or for that of your family.

Second, as suggested earlier, monetary decisions work out much more beneficially when they’re planned rather than improvised. Thus, our emphasis on financial planning—the ongoing process of managing your personal finances in order to meet goals that you’ve set for yourself or your family.

Financial planning requires you to address several questions, some of them relatively simple:

- What’s my annual income?

- How much debt do I have, and what are my monthly payments on that debt?

Others will require some investigation and calculation:

- What’s the value of my assets?

- How can I best budget my annual income?

Still others will require some forethought and forecasting:

- How much wealth can I expect to accumulate during my working lifetime?

- How much money will I need when I retire?

Financial Planning Life Cycle

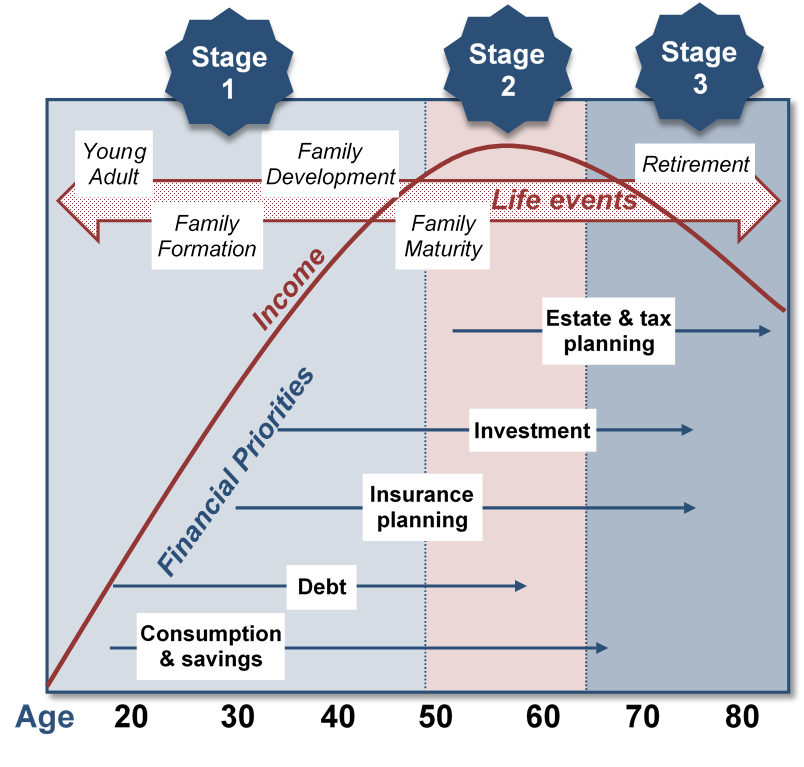

Another question that you might ask yourself—and certainly would do if you worked with a professional in financial planning—is, “How will my financial plans change over the course of my life?” Figure 13.3 illustrates the financial planning life cycle of a typical individual, one whose financial outlook and likely outcomes are probably a lot like yours.[1] As you can see, the diagram divides this individual’s life into three stages, each of which is characterized by different life events (such as beginning a family, buying a home, planning an estate, retiring).

Financial planning priorities evolve over time, typically across three key stages:

-

Stage 1 is centered on wealth accumulation.

-

Stage 2 shifts the focus to protecting and growing the wealth already built.

-

Stage 3 emphasizes drawing from that wealth in retirement—ideally, while still allowing it to grow.

Naturally, unexpected changes—such as shifts in employment, marital status, or the broader economy—can affect planning at any stage. It’s also important to note that your financial needs often peak during Stage 2, usually around age 55, roughly a decade before the average retirement age.

Until you’re financially independent and earning your own income, you’re likely relying on your parents’ resources. In our example of the financial life cycle, planning typically starts in a person’s early twenties. While that might seem early, it’s actually a crucial time—this is when you begin making key decisions about your career path, which will shape both your earning potential and the lifestyle you aim to achieve.

Manage Personal Debt

Your “personal debt” is how much money you owe to other people, businesses, banks, credit card companies, and other creditors. Do you sometimes wonder where your money goes? Do you worry about how you’ll pay off your student loans? Would you like to buy a new car or even a home someday, and you’re not sure where you’ll get the money? If these questions seem familiar to you, you could benefit from help in managing your personal finances.

Let’s say that you’re 28 and single. You have a good education and a good job—you’re pulling down $60K working with a local accounting firm. You have $6,000 in a retirement savings account, and you carry three credit cards. You plan to buy a condo in two or three years, and you want to take your dream trip to the world’s hottest surfing spots within five years. Your only big worry is the fact that you’re $70,000 in debt, due to student loans, your car loan, and credit card debt. In fact, even though you’ve been gainfully employed for a total of six years now, you haven’t been able to make a dent in that $70,000. You can afford the necessities of life and then some, but you’ve occasionally wondered if you’re ever going to have enough income to put something toward that debt.[2]

Student Loans for College and University Studies

With increased demand for college education, students are willing to take on debt for the potential benefits, such as better earning potential and more job opportunities.

Here are a few statistics (2022/2023) about Canadian student loans:[3]

- The average student loan debt in Canada is approximately $28,000.

- The total amount of student loan debt in Canada is more than $23.5 billion.

- Women make up the majority of Canada’s student loan debt borrowers.

- 20-to-24-year-olds hold the most student loan debt.

- Ontario holds the most student loan debt, followed by Alberta and British Columbia.

- Nova Scotia has the highest tuition costs.

How long does it take to pay off $50,000 in student loans?

Your potential savings from refinancing will vary based on your loan terms. For example, say you have a $50,000 loan balance with a 6.22% interest rate — the average student loan interest rate for graduate students. On the standard 10-year repayment plan, you’d pay $561 per month and $17,277 in interest over time.

College and university graduates earn significantly more per year than those without these credentials throughout their careers. Statistics Canada provides the following statistics from 2020 within Ontario’s 35-44-year-old population:[4]

- High school graduates earned $46,960

- College graduates made $56,550

- University graduates with a bachelor’s made $80,100

- University graduates with a master’s made $90,700

Naturally, there are exceptions to these average outcomes. You’ll find some college graduates stocking shelves or serving coffee, and you’ll find college dropouts running multibillion-dollar enterprises. Microsoft co-founder Bill Gates dropped out of college after two years, as did his founding partner, Paul Allen. Generally, a college or university education opens doors to increased job opportunities, increased earning potential, and a path to advancement.

How Can You Get Out of Debt?

There are several strategies to help reduce or eliminate personal debt. These include consolidating your debts, boosting your income, setting a realistic budget, cutting down on monthly expenses, limiting impulse purchases, and following a structured debt repayment plan. You might also consider credit counselling, using cashback rewards wisely, temporarily reducing your savings contributions, and building an emergency fund to avoid future debt. While bankruptcy is a last-resort option, it should be avoided if possible, as it can severely damage your credit rating for years to come.

Here are some ways to get out of personal debt:

- Create a budget: Adjust your budget and cut back on spending.

- Reduce monthly bills: Choose less costly options.

- Curb impulse spending: Wait a day or two to see if you feel strongly about buying an item before you buy it. Stick to a budget.

- Consolidate debt: Look into consolidating your debt to simplify payments and potentially lower interest rates. Combine multiple debts into one loan or line of credit with a single monthly payment.

- Consider credit counseling: A nonprofit credit counselor can review your finances and debt and recommend next steps.

- Increase income: Find ways to make extra money, such as taking on a part-time job.

- Use a debt repayment strategy: Simplify your debt repayment schedule and stay accountable.

- Use cashback rewards: Use cashback rewards to pay down your balance.

- Scale back on savings: Temporarily reduce your savings until you’re debt-free.

- Create an emergency fund: Set aside money for emergencies and avoid relying on credit in the future.

- Cut up your credit cards and start living on a cash-only basis. Although credit cards can be an important way to build a credit rating, many people simply lack the financial discipline to handle them well. If you see yourself in that statement, then moving to a pay-as-you-go basis, i.e., cash or debit card only, may be for you. Be honest with yourself; if you can’t handle credit, then don’t use it.

- Pay your most expensive debts (high-interest) first. Pay down the debt with the highest interest charges.

By following these steps, you can begin to regain control of your finances and work toward becoming debt-free.

If you’re unable to get out of debt, you may need to consider bankruptcy. However, bankruptcy is a lengthy process, and it won’t erase all debts, like student loans. It can also ruin your credit rating and make it difficult to get loans or credit for future years.

Create a Personal Budget

A budget is a plan that helps you manage your money. It helps you figure out how much money you get, spend, and save. Making a budget can help you balance your income with your savings and expenses. It guides your spending to help you reach your financial goals (Government of Canada, n.d.). To learn how to make a personal budget and stick to it, visit Making a Budget from the Financial Consumer Agency of Canada.

Apps like Mint, YNAB (You Need a Budget), or Excel spreadsheets can simplify budgeting and track spending. Regular review of the budget is important to ensure you stay on track, and you will need to adjust categories if unexpected expenses arise or your priorities change.

A budget is especially important if you:

- Don’t know where your money is going

- Don’t save regularly

- Have problems paying off your debts

- Feel overwhelmed by your finances

- Feel like you’re not in control of your finances

- Want to make the most of your money

- Are planning for a major purchase or a life event

Making a budget can help you:

- Set spending limits

- Find ways to pay down your debts

- Reduce costs and save more

- Live within your means

- Reduce financial stress

- Have more money for things that are important to you

- Feel in control of your finances

Below are a few suggestions on how college students can more effectively manage their money while furthering their education:

- Set up a self-enforced budget and manage your credit card responsibly

- Utilize meal plans or make your own meals rather than eating out, and share expenses with roommates

- Investigate economic ways to buy essential items and supplies

- Distinguish between essential and non-essential purchases

- Take advantage of scholarships and grant awards

- Investigate off-campus housing and whether or not you can share a place with another student

- Get a paid, part-time job if your schedule permits, but don’t work full-time hours; otherwise, you may not have time to keep up with your studies

- Take advantage of free (on campus) or low-priced (Value Village, Salvation Army) options for food, clothing, and furniture

- If asked, request practical gifts for your birthday and other special occasions

- Buy used books when possible and resell them when you are finished with them, or check out the library to see if you can borrow a course textbook

- Investigate whether or not you can remain on your parents’ health insurance plan instead of purchasing health insurance yourself

Creating and using a budget is not just for those who need to closely monitor their cash flows from month to month because money is tight. Almost everyone can benefit from budgeting.[5] Building the right college student budget for your situation can help you stay on track for your financial life after graduation. Plus, learning to build and maintain a budget is an important skill to carry with you for the rest of your life. If you aren’t sure how to create the perfect college budget that works for you, then check out this free budgeting course. It will walk you through the steps of building a budget that actually sticks.[6]

Self-Check Exercise: Create a Personal Budget

One of the best ways to manage your money and personal finances is to build a personal budget.

A personal budget (for an individual) or household budget (for a group sharing a household) is a plan for the coordination of income and expenses.

You will need to have all your information gathered. This includes what you bring in – from employment to student loans – and what goes out – for food, entertainment, health and wellness, rent, utilities, etc. Be honest and thorough.

The Government of Canada, through the Financial Agency of Canada, created a tool that provides an in-depth account of your personal finances. Use the Budget Calculator to document your situation. Export your budget as an Excel spreadsheet. You will now be able to make improvements, if appropriate. If your balance is negative, or when your expenses exceed your income, you need to make some choices based on what you learned when you tracked your spending. Ask yourself some tough questions:

- What can be eliminated from my expenses?

- What can be reduced from my expenses?

- In what areas can I be a smarter consumer?

- Where does my money seem to get gobbled up?

After you have made some difficult choices, turn back to the budget worksheet and create a new “revised” column. You will want to work toward achieving a positive balance.

Should you end up with a surplus or positive balance, you need to make some choices about what to do with the extra money. Perhaps you could put it toward your financial SMARTER goal. Avoid the temptation to spend it.

Reduce Monthly Bills

Here are a few suggestions to help you reduce your monthly bills:

- Get a cheaper mobile phone bill.

- Pay your bills on time so you are not charged interest fees.

- Cancel unnecessary or unused subscriptions.

- Share rent, utilities, and grocery expenses with a roommate.

- Carpool to reduce travel costs, take transit, or buy less expensive auto insurance.

- Reduce, reuse, recycle. You can buy gently used clothing, furniture, bicycles, automobiles, and just about anything. Don’t throw out leftover food; make a new recipe from it.

- Seek student discounts such as no-fee bank accounts, 20% off at specific retailers with student cards, etc.

- Use the money-back on your credit cards or customer loyalty points from various vendors whenever you can.

- Cook more often so you don’t need to eat out or order in. Eat out as a reward, not as a rule. A sandwich or leftovers from home can be just as tasty and can save you $5 to $15 a day!

- Get a student scholarship or grant.

- Eliminate impulse buying.

Curb Impulse Spending

Here are a few suggestions to help you curb impulse spending:

- Build a budget that follows the 50-30-20 rule for budgeting.

- Take $100 out of the bank and don’t spend a penny more.

- Make a list of what you plan to buy over a week, a month, and stick to it. Seeing your planned purchases can help you stay on track.

- Eat before you grocery shop. You don’t want to be hungry and pick up a bunch of snack food while grocery shopping.

- Sleep on it. Wait a day or two and think about whether or not you really need the item or really want the item. Often, if you wait a few days, you will determine it is not needed, or you will find a better deal somewhere else.

You’ll probably be surprised at how much of your money can quickly become somebody else’s money. If, for example, you spend $3 every day for one cup of coffee at a coffee shop, you’re laying out nearly $1,100 a year just for coffee. If you use your ATM card at a bank other than your own, you’ll probably be charged a fee that can be as high as $3. If you do this even twice per month, that adds up to $72 per year in ATM fees. To avoid ATM fees, choose a bank with no ATM fees or a bank that refunds ATM fees for student accounts. You might also consider spending on your credit card, then paying off the balance each month. To do this, you must be self-disciplined in not charging more than you have saved for. This way you won’t pay so many bank fees, nor will you pay interest on your credit card balances. Planning ahead, reading the fine print, and making sure you’re knowledgeable about the banking services you’re using are the three most important things everyone who is looking for free banking should do.[7]

You may or may not be among the Canadian consumers, reported by Statistics Canada, who purchased more than 2 billion litres of beer (equivalent to 3.7 bottles of beer per week per person of legal drinking age) during the 2021/2022 fiscal year, or purchased one or more of the over 2 billion Tim Hortons coffees sold each year.[8][9] You may or may not be one of the 40% of Canadian consumers who regret holiday-spending bills.[10] Bottom line – if, at age 28, you have a good education and a good job, a $60,000 income, and $70,000 in debt—by no means an implausible scenario—there’s a very good reason why you should think hard about controlling your debt: your level of indebtedness will be a key factor in your ability—or inability—to reach your longer-term financial goals, such as home ownership, a dream trip, and, perhaps most importantly, a reasonably comfortable retirement.

Self-Check Exercise: Financial Savvy Quiz

How financially savvy are you? Are you good at managing your money month-to-month or do you need a budget? Quiz yourself to find out.

Grow Your Money

Choosing a career early in your financial life cycle is just one reason to start financial planning as soon as possible. Consider this scenario: it’s your eighteenth birthday, and you receive $10,000 that your grandparents had set aside in a trust for you. You could spend it, perhaps fulfilling a long-held dream like funding flight training for a private pilot’s license. Alternatively, your grandfather might encourage you to save it instead, taking advantage of the power of interest.

Interest is either the cost of borrowing money or the extra payment made to you by an investing institution, typically expressed as an annual percentage rate. If you deposit the $10,000 into a savings account earning 5 percent interest annually and leave it untouched until after college, your savings will grow to approximately $12,000—$10,000 in principal and $2,000 in interest. That extra $2,000 could be reinvested or spent on something else.

This prospect sparks curiosity: if $10,000 can grow to $12,000 in just four years, what might it be worth by the time you retire at age 65? A quick search using a compound interest calculator reveals that, after 47 years at a 5 percent interest rate, your $10,000 would grow to $104,345. While not enough to fully fund a retirement, it’s a solid foundation.

But let’s take it a step further. Imagine that your college education pays off as planned, leading to a good job that allows you to add $10,000 annually to your retirement savings. With consistent contributions and the same 5 percent annual interest rate, your nest egg could grow to over $1.6 million by age 65. This example underscores the value of starting early with financial planning and making the most of compound interest to secure your financial future.

Investing

Investing is what someone does when they buy something in hopes that it will grow in value over time. While students don’t have a lot of money to invest after paying tuition and their bills, it is important to start early. Investing doesn’t have to be complicated. If you can afford to invest a small amount each month as a student, it could pay off big in the long run. Here are a few investment options for students:[11]

- Guaranteed investment certificates (GICs)

- Bonds

- Stocks

- Mutual Funds

- Exchange-traded Funds (ETFs)

If you’re in a position to start investing as a student, you can set yourself up on the right financial path.

Compound Interest

Compound interest is the process of earning interest on both the original principal and the accumulated interest from previous periods. Unlike simple interest, which is calculated only on the principal amount, compound interest allows your investment or loan to grow at an accelerating rate over time because interest is added to the principal at regular intervals.

Imagine, for instance, you follow your grandfather’s advice and invest $10,000 (your principal) in a savings account with an annual interest rate of 5 percent. At the end of the first year, your investment will earn $500 in interest, bringing your total balance to $10,500. If you then reinvest the entire $10,500 at the same 5 percent rate, you’ll earn $525 in interest during the second year, resulting in a total of $11,025. This process continues each year, with interest being earned on both your initial investment and the accumulated interest. Over time, this compounding effect can lead your investment to grow to $81,496.67 by the time you reach 65.

Prefer a video to help you decipher and understand compound interest? Visit Khan Academy’s seven minute explanation.

Time Value of Money

The time value of money is a key financial concept that emphasizes that a dollar received today holds more value than the same dollar received in the future. This principle stems from the earning potential of money: money available now can be invested to generate returns, such as interest or dividends, over time. The sooner money is received, the sooner it can be utilized to grow wealth, making it inherently more valuable in the present.

Inflation plays a significant role in this principle. Over time, the general increase in prices reduces the purchasing power of money, meaning that a dollar in the future will buy less than it can today. Additionally, the opportunity cost of delaying money is another critical factor. For example, if you lend someone money, you forgo your chance to invest or spend it now. To compensate for this sacrifice, interest is charged, which also accounts for factors like inflation and risk. Lending money to a government, for instance, might involve minimal risk, but lending to an individual introduces uncertainties, requiring higher compensation.

Ultimately, the time value of money reflects both the financial and practical realities of managing resources, emphasizing the importance of immediate access to funds for maximizing their potential. This principle underpins many financial decisions, from borrowing and lending to investment strategies.

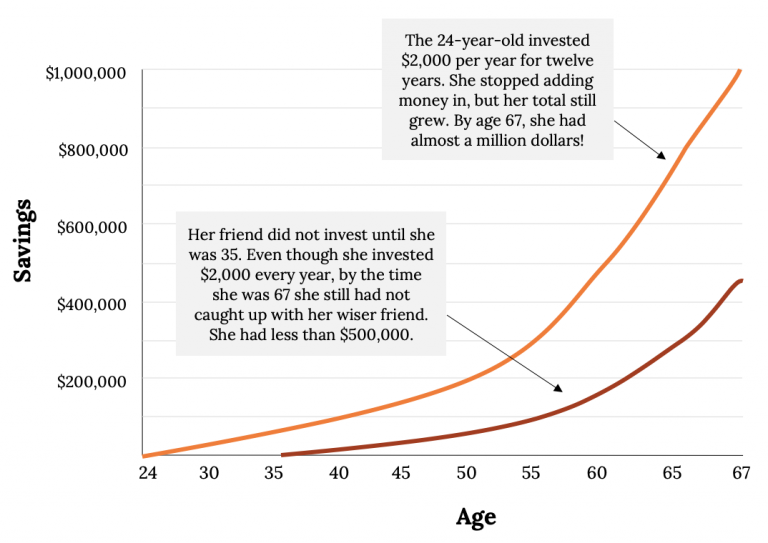

The time value of money principle emphasizes that a dollar received today begins earning interest immediately, while a dollar received tomorrow starts earning later. For example, suppose you receive $2,000 in cash gifts upon graduating from college. At 23, with your degree in hand and no immediate need for the money, you decide to invest the $2,000 in an account earning 10 percent interest compounded annually, adding another $2,000 each year (roughly $167 per month) for the next 11 years. Note that the 10 percent rate is used for illustration and is not representative of today’s market conditions.

The orange line in Figure 13.1 illustrates how your account balance grows each year, showing your total savings at various ages between 24 and 67. By age 36, you’d have almost $52,000, and by age 50, over $196,000. By the time you reach 67, you’d have nearly $1 million. In contrast, the yellow line shows what would happen if you didn’t start saving until age 36. Although you’d still accumulate a respectable sum by age 67, it would be less than half of what you would have accumulated by starting at 23. More importantly, to reach this amount, you would need to contribute $2,000 every year for 32 years, instead of just 12.

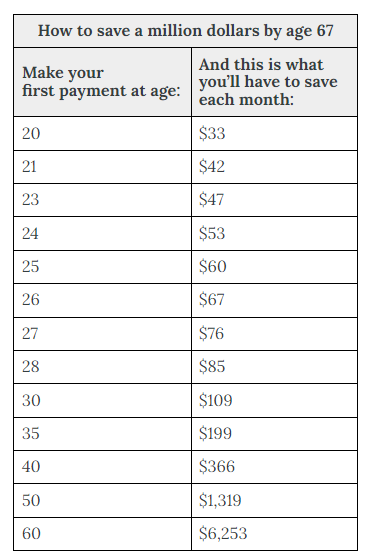

Here’s another way of looking at the same principle. Suppose that you’re 20 years old, don’t have $2,000, and don’t want to attend college full-time. You are, however, a hard worker and a conscientious saver, and one of your financial goals is to accumulate a $1 million retirement nest egg. As a matter of fact, if you can put $33 a month into an account that pays 12 percent interest compounded, you can have your $1 million by age 67. (Again, 12 percent may be unrealistic in today’s market). That is, if you start at age 20. As you can see from Figure 13.2, if you wait until you’re 21 to start saving, you’ll need $37 a month. If you wait until you’re 30, you’ll have to save $109 a month, and if you procrastinate until you’re 40, the ante goes up to $366 a month.[12] Unfortunately, in today’s low interest rate environment, finding 10–12 percent return is not likely. Nevertheless, these figures illustrate the significant benefit of saving early.

The reason should be fairly obvious: a dollar saved today not only starts earning interest sooner than one saved tomorrow (or 10 years from now) but also can ultimately earn a lot more money in the long run. Starting early means in your 20s—early in stage 1 of your financial life cycle. As one well-known financial advisor puts it, “If you’re in your 20s and you haven’t yet learned how to delay gratification, your life is likely to be a constant financial struggle.”[13]

Banking

Suppose you want to save or invest – do you know how or where to do so? You probably know that your branch bank can open a savings account for you, but interest rates on such accounts can be pretty unattractive. Investing in individual stocks or bonds can be risky, and usually requires a level of funds available that most students don’t have. In those cases, mutual funds can be quite interesting. A mutual fund is a professionally managed investment program in which shareholders buy into a group of diversified holdings, such as stocks and bonds. Any of the big 5 banks in Canada (RBC, CIBC, BMO, TD Canada Trust, or Scotiabank) offer a range of investment options, including indexed funds, which track with well-known indices such as the Toronto Stock Exchange, a.k.a. the TSX. Minimum investment levels in such funds can actually be within the reach of many students, and the funds accept electronic transfers to make investing more convenient. We’ll leave a more detailed discussion of investment vehicles to your more advanced courses.

You may choose to do your banking with a major bank or with a local credit union. Most people never notice the differences between credit unions and banks. They offer similar products and services, but they’re not the same. The following are some key points that highlight the differences:

Major Banks:

- Funds are secure

- Profitability– usually shareholders own a bank and expect financial performance from the bank management

- Offer a wide range of competitive and advanced banking products

- Inter-branch banking = convenience

Credit Unions:

- Customers are “members”; deposits are called “shares”

- Credit Unions are non-profit organizations that strive for service over profitability. They are NOT charities; credit unions must make sound financial decisions, collect revenue, pay salaries, and compete with other institutions.

- May not have all the banking products as major banks

- Inter-branch banking is limited

- Funds are also secure

Explore the Concept: Choose an Institution that is Right for You

As a college or university student, you might be out on your own for the first time. Part of handling your own finances will be choosing a banking institution or institutions that best suit your needs. Banks are eager to gain new clientele and establish brand loyalty early on. It should come as no surprise, then, that just about every major banking institution in Canada offers student banking plans.

Any of the big 5 banks in Canada (RBC, CIBC, BMO, TD Canada Trust, or Scotiabank) offer a range of investment options, including indexed funds, which track with well-known indices such as the Toronto Stock Exchange, a.k.a. the TSX. Minimum investment levels in such funds can be within the reach of many students, and the funds accept electronic transfers to make investing more convenient.

You may wish to review this article for more information on How to Choose a Bank That’s Right for You.

Now you are ready to start planning for your financial future.

Build a Good Credit Rating

If you can create a budget and stay on budget, that’s a good thing; however, as the saying goes, life happens, and you may find that your car breaks down when you least expect it, and the bill could be over $1000 – that may not have been in your budget. You may require a loan, so ensure you understand the different types of loans. You won’t get a bank loan unless you have a good credit rating. A good thing to do is to plan for crises and contingencies, which will help you mitigate these risks. It is always a good idea to have a special reserve of money, a “rainy day” fund, for emergencies or large expenditures you did not plan for.

The amount of money you should have in your emergency fund can vary depending on your personal and financial goals. As a rule of thumb, financial experts recommend having enough savings to cover three to six months’ worth of living expenses.[14]

For now, you are probably thinking about credit cards more than anything else. They are a great way to establish your credit history so that you can apply and qualify for some of those other loans later. There are some important things about credit cards that you need to know, though, a big part of that has to do with the way that you use the credit card and how the banks interpret that use – it’s called utilization. Read “How Does the Credit Utilization Percentage Impact My Credit Score?” to learn more.

Do you often find yourself splurging or impulse shopping? Are your monthly bills more than you can comfortably afford? If you find yourself unable to make timely payments on loans or rent, you risk damaging your credit rating, which could affect your ability to borrow money in the future.

So, how do potential lenders determine if you are a good or bad credit risk? If your credit is poor, how might this affect your ability to secure a loan or the interest rates you’ll be offered? In Canada, a credit rating is a numerical score that reflects an individual’s or business’s creditworthiness, based on their financial behavior and credit history. Every time you use a credit card or borrow money, such as from a bank, your spending and debt habits are recorded. This information is then used by lenders, such as banks and financial institutions, to assess the risk of lending money or extending credit. Credit ratings in Canada are typically provided by two main credit bureaus—Equifax Canada and TransUnion Canada.

While Canadian credit scores are similar to the U.S. FICO score, they are not the same. Credit bureaus in Canada, like Equifax and TransUnion, use their scoring models to assess creditworthiness. Canadian credit scores range from 300 to 900, with most individuals falling in the 600–700 range, which is considered a good score. Your score is influenced by factors such as payment history, debt-to-income ratio, length of credit history, and the types of credit accounts you have. While Canadians may not use FICO scores, the concept is similar: both systems assess an individual’s ability to repay debt and manage credit responsibly. You can access your Equifax score for free online or by mail, and residents of Quebec can access their TransUnion score for free. Some banks also provide free credit scores through online banking services. Ultimately, your credit score plays a key role in determining whether you qualify for credit and the interest rates you’ll pay.

A credit score is calculated by considering five main criteria:

- Payment history

- Use of available credit

- Length of credit history

- Number of inquiries

- Types of credit accounts

This score, along with other credit history information, is shared by the credit bureaus with their subscribers, helping lenders assess credit risk when considering loan applications.[15]

So, what does this mean for you? It depends on your credit behavior. If you pay your bills on time and don’t take on excessive debt, you’re likely to have a high credit score, which will make you more attractive to lenders. This could result in receiving loans with reasonable interest rates. However, if your credit score is low, lenders may be hesitant to approve your loan applications, or they might offer loans at higher interest rates. A low credit score can even impact your ability to rent an apartment or secure certain jobs. That’s why it’s crucial to do everything you can to maintain a strong credit score.

Credit Score Ranges and What They Mean

Although the exact credit score ranges may vary slightly depending on the credit bureau or scoring agency, understanding where your credit score falls is essential for assessing your financial health. Knowing your score will help you understand what actions you may need to take to improve your creditworthiness and achieve your financial goals.

Here’s a breakdown of typical Canadian credit score ranges and their implications:

- Poor (300 to 559): If your score falls in this range, you may be considered a higher credit risk. You might find it difficult to obtain loans or credit cards, and if approved, you could face higher interest rates or less favorable terms.

- Fair (560 to 659): With a score in this range, some lenders may still see you as a higher-risk borrower. You may have access to credit, but at higher interest rates and less favorable terms.

- Good (660 to 749): A good credit score indicates you are a reliable borrower and can likely qualify for many loans and credit cards with reasonable terms and rates.

- Very Good (750 to 849): At this level, you are seen as a low-risk borrower, which means you are likely to qualify for the best loan terms, lower interest rates, and higher credit limits.

- Excellent (850 and above): If your score is in this range, you’re considered an exceptional borrower, which typically means the best possible loan terms, lowest interest rates, and higher credit limits are available to you.

As a young person, building a strong credit history that will lead to a higher credit score can be achieved with a few key steps:

- Become an authorized user on a parent’s credit account.

- Obtain your own credit card, but don’t apply for several credit cards at the same time.

- Choose the right credit card for your needs.

- Use the credit card for small, regular purchases, but avoid large purchases unless necessary.

- Pay off your balance in full each month to avoid interest.

- Pay all your bills on time.

- Avoid cosigning loans for others or applying for multiple credit cards at once.

- Use student loans for education expenses only, and always make your payments on time.

If you qualify for your own credit card, aim for one with a low interest rate and no annual fee to build your credit responsibly.

Secured Versus Unsecured Credit

Credit Cards

Credit cards can be secured or unsecured. Unsecured credit cards don’t require a deposit and offer a credit limit based on your creditworthiness, such as your credit score and income. If you carry a balance, you’ll be charged interest, typically between 15% to 25% APR. The interest compounds, meaning you’ll pay interest on both the principal and any accumulated interest if the balance isn’t paid off in full each month. Secured credit cards, on the other hand, require a deposit that acts as collateral for your credit limit. These are often used by people building or rebuilding credit and may have similar interest rates to unsecured cards but carry less risk for the issuer.

Your credit card usage directly impacts your credit score, particularly through factors like credit utilization (the percentage of your limit used) and payment history. Many cards offer rewards such as cashback, points, or miles, along with benefits like purchase protection or travel insurance. However, credit cards can also come with fees, including annual fees, late payment fees, or foreign transaction fees. By managing your credit card well—paying on time, keeping balances low, and avoiding high-interest debt—you can build a strong credit history and minimize interest charges.

Bank Loans

Bank loans come in both secured and unsecured varieties, and the type of loan you choose impacts factors like interest rates, required collateral, and the potential for compound interest.

- Secured loans require you to provide collateral—something of value, such as a house (for a mortgage) or a car (for an auto loan). This collateral reduces the risk for the lender, which typically results in lower interest rates compared to unsecured loans. The interest rates for secured loans can vary widely based on factors like the type of loan, your creditworthiness, and the collateral involved, but they are generally more favorable than unsecured loans. For example, mortgage rates might range from 3% to 7%, while auto loan rates might be in the 4% to 10% range. In a secured loan, if you fail to repay, the lender has the right to seize the collateral.

- Unsecured loans, on the other hand, do not require collateral. Because there is no asset backing the loan, these loans are considered higher risk for the lender, which typically results in higher interest rates. Unsecured loans, such as personal loans or credit card debt, often come with interest rates ranging from 10% to 30%, depending on your credit score and financial history. Compound interest applies to unsecured loans as well, meaning the interest is calculated not only on the original amount borrowed but also on any interest that has accrued. This can cause the debt to grow quickly if not managed carefully, particularly if only minimum payments are made.

In both types of loans, interest is generally calculated as simple interest for personal loans, mortgages, and auto loans, meaning the interest is only charged on the initial loan amount. However, with credit cards and some other types of revolving credit, compound interest is used, leading to interest on both the principal and any accrued interest. To minimize the impact of interest, it’s important to understand the loan terms, make timely payments, and pay more than the minimum required whenever possible. For both secured and unsecured loans, maintaining a strong credit score can help you secure better interest rates and more favorable loan terms.

Key Takeaways

- Financial planning is the ongoing process of managing your personal finances in order to meet goals that you’ve set for yourself or your family.

- Personal finance is the application of financial principles to the monetary decisions that you make either for your individual benefit or for that of your family.

- The financial planning life cycle of a typical individual’s life has three stages, each of which is characterized by different life events. Stage 1: Focus on building wealth, Stage 2: Focus on preserving and increasing wealth, and Stage 3: Focus on living on one’s saved wealth after retirement.

- Your “personal debt” is how much money you owe to other people, businesses, banks, credit card companies, and other creditors.

- A few ways to get out of personal debt include consolidating debt, increasing your income, creating a budget, using a debt repayment strategy, considering credit counselling, using cashback rewards, reducing monthly bills, curbing impulse spending, temporarily scaling back on savings, and creating an emergency fund. Bankruptcy is a final option, but not the best one, as it negatively affects your future credit rating.

- One of the best ways to manage your money and personal finances is to build a personal budget. A personal budget (for an individual) or household budget (for a group sharing a household) is a plan for the coordination of income and expenses.

- Investing is what someone does when they buy something in hopes that it will grow in value over time.

- Compound interest refers to the effect of earning interest on your interest.

- The time value of money is a key financial concept that emphasizes that a dollar received today holds more value than the same dollar received in the future.

- In Canada, a credit rating is a numerical score that reflects an individual’s or business’s creditworthiness, based on their financial behavior and credit history. Credit ratings in Canada are typically provided by two main credit bureaus—Equifax Canada and TransUnion Canada. While Canadian credit scores are similar to the U.S. FICO score, they are not exactly the same.

- Loans that involve some type of collateral are referred to as secured loans or secured credit. Collateral is something of value, such as a house (for a mortgage) or a car (for an auto loan). This collateral reduces the risk for the lender, which typically results in lower interest rates compared to unsecured loans.

- Loans that do not require collateral are referred to as unsecured loans or unsecured credit. Because there is no asset backing the loan, these loans are considered higher risk for the lender, which typically results in higher interest rates. Unsecured loans, such as personal loans or credit card debt, often come with interest rates ranging from 10% to 30%, depending on your credit score and financial history.

End-of-Chapter Exercises

- OECD Financial Literacy. The Organization for Economic Cooperation and Development began measuring the financial literacy of its OECD countries using this 5-Question Financial Literacy Survey. This simple 5-question survey tests basic financial literacy knowledge. You can Take the survey or download the examples with answers. How did you do?

- Find Your Latte Factor. Use this Find Your Latte Factor calculator to determine how much money, over time, you could save by cutting out a small, unnecessary thing from your daily/weekly expenses. What did you discover? Share with your class and/or professor.

- Budget Calculator. (Also, within the chapter) The Government of Canada, through the Financial Agency of Canada, created a tool that provides an in-depth account of your personal finances. Use the Budget Calculator to document your situation. Export your budget as an Excel spreadsheet. What did you learn? Where can you make improvements?

- Financial Literacy. Test your financial literacy knowledge by taking the My Money Sense (Singapore) Financial Literacy Quiz. How did you do? Did you learn a few things? Share your learning with the class and/or professor.

- Make a Budget. Follow the TD Bank Budgeting Advice for Students and make a budget for yourself. Your college or university may also have a learning strategist who can help you with this. Follow the 50-30-20 framework: 50% of your income should go toward your needs, 30% of your income should go toward your wants, and 20% of your income should go toward savings or financial goals. After you finish, reflect on how you are doing and what adjustments you may need to make to your spending habits. Discuss budgeting with the class and/professor. It’s quite conceivable that your peers have similar budgeting challenges as you.

- Reduce Expenses. Determine three ways in which you can reduce your expenses this week. Put your ideas to work this coming week and track how you do. Were you successful? If not, why not? If not, what will you change when you try again? If you were successful, how much did you save? Share your results with the class and/or professor.

- Online Banks. Use the Internet to research online banks, such as Tangerine, and review their bank fees. Usually, these banks have no fees or lower fees than brick-and-mortar banks (the Big Five). Would you trust your money to an online bank? Why or why not?

- Check Your Credit Rating. Use the Internet to find information on how you can check your FICO score. What is your credit rating? How can you find out? Are there free options? Share what you learned with your class and/or professor.

- Investing. Visit one of the Big Banks’ websites and learn more about investing as a student. What are the current interest rates banks are paying on investments? Do you like the idea of investing in GICs, or are you more interested in investing in Stocks? Explain. Share your findings with your class and/or professor.

- Financial Calculator. Use the calculators at Dinkytown.net to answer the following questions. Starting today, how much would you need to save each month to become a millionaire before you retire? You need $5,000 for a Caribbean Cruise in one year from today. How much would you need to deposit monthly in a savings account paying 1% interest to meet your goal? Share your results with the class and/or professor.

- Rent Versus Buy. Use the Internet to gather information regarding the cost to rent a two-bedroom apartment or to buy a two-bedroom condominium in your area. Go to Dinkytown.net and use the site’s “rent-versus-buy calculator” to compare these costs. Discuss your findings with the class and/or professor.

Self-Check Exercise: Managing Personal Finances Quiz

Check your understanding of this chapter’s concepts by completing this short self-check quiz.

Additional Resources

- TD Bank Budgeting Advice for Students

- Khan Academy’s Seven Minute Explanation of Compound Interest

- 7 Effective Tips for Reducing Your Expenses

- 30-Day No Spend Challenge

- How to Save Money on Household Bills

- How I Saved $10,000 in Six Months

- A Third of Canadians Say They’re “House Poor”, and a Fifth Regret Their Purchase

- Government of Canada, Credit Report and Score Basics

- How to Pay Off $50,000 of Debt in One Year

- What College Students Need to Know About Money. YouTube Video.

- Compound Interest. YouTube Video.

- Financial Empowerment: Personal Finance for Indigenous and Non-Indigenous People

- Student Banking 101: What you Need to Know About Investing as a Student

- Free Financial Literacy Program, Government of Canada

- One Page Financial Plan. YouTube Video

- Making a Budget. Government of Canada

- Financial Consumer Agency of Canada

Attributions

The contents of this chapter is a compilation sourced from various OER resources, please refer to the Book Information for details.

References

(Note: This reference list was produced using the auto-footnote and media citation features of Pressbooks)

Media Attributions

- The Financial Life Cycle © Unknown is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Impulse Shopping © Andrea Piacquadio | Pexels

- Time Value of Money © Tumisu | Pixabay

- The Power of Compound Interest © Unknown is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- How to Save a Million Dollars by Age 67 © Unknown is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Credit Card Payment © energepic.com

- Gallager T. J., & and Andrews, J. D. Jr., (2003). Financial Management: Principles and Practice, 3rd ed. Upper Saddle River, NJ: Prentice Hall. p. 34, 196. ↵

- Gerson, E. & Simon, J. (2016). “10 ways students can build good credit. CreditCards.com. http://www.creditcards.com/credit-card-news/help/10-ways-students-get-good-credit-6000.php ↵

- Siege Media. (2024, February 5). What's the average student loan debt in Canada? 19 staggering statistics. https://www.robertsoncollege.com/blog/studying-at-robertson/average-student-loan-debt-canada/#:~:text=The%20average%20student%20loan%20debt%20in%20Canada%20is%20approximately%20%2428%2C000,the%20most%20student%20loan%20debt. ↵

- OCUFA. (2024, September 6, 2024). CBC asks: Is university still worth it? We answered. https://ocufa.on.ca/general/cbc-asks-is-university-still-worth-it/#:~:text=Statistics%20Canada%20proves%20this%3A%20in,with%20a%20bachelor's%20made%20%2480%2C100 ↵

- Ganti, A. (2024, October 17). What is a budget? Plus 11 budgeting myths holding you back. https://www.investopedia.com/terms/b/budget.asp ↵

- Sharkey, S. (2024, September 27). How to create a college student budget you'll actually use. https://www.clevergirlfinance.com/college-student-budget/ ↵

- Wood, C. (2024, November 1). Canadian bank fees: The good, the bad and the ugly. https://loanscanada.ca/money/canadian-bank-fees-the-good-the-bad-and-the-ugly/ ↵

- Statistics Canada. (2023, July 4). Hot summer day...cold beer or cooler. https://www.statcan.gc.ca/o1/en/plus/4017-hot-summer-day-cold-beer-or-cooler ↵

- Tim Hortons. (n.d.). Fresh facts. https://company.timhortons.com/us/en/corporate/fresh-facts.php#:~:text=Each%20year%2C%20we%20serve%20more,maintain%20our%20consistently%20high%20quality. ↵

- Bazian, G. (2018, December 21). Over 40 percent of Canadians anticipate feelings of anxiety and regret over holiday-spending bills. https://mnpdebt.ca/en/resources/mnp-debt-blog/over-40-per-cent-of-canadians-anticipate-feelings-of-anxiety-and-regret-over-holiday-spending-bills ↵

- Scotiabank. (n.d.). Student banking 101: What you need to know about investing as a student. https://www.scotiabank.com/ca/en/personal/advice-plus/features/posts.investing-as-a-student.html#:~:text=Investment%20options%20for%20students%201%201.%20Guaranteed%20investment,a%20single%20fund.%20...%205%205.%20ETFs%20 ↵

- Keown, A. J. (2007). Personal Finance: Turning Money into Wealth, 4th ed. Upper Saddle River, NJ: Pearson Education. p. 23. ↵

- All Financial Matters. (2006, February 10). An interview with Jonathan Clements – Part 2. http://allfinancialmatters.com/2006/02/10/an-interview-with-jonathan-clements-part-2/. ↵

- Horton, C. (2023, July 19). Emergency fund calculator. https://www.forbes.com/advisor/banking/emergency-fund-calculator/ ↵

- Government of Canada. (n.d.). Credit report and score basics. https://www.canada.ca/en/financial-consumer-agency/services/credit-reports-score/credit-report-score-basics.html ↵

Personal finance is the application of financial principles to the monetary decisions that you make either for your individual benefit or for that of your family.

Financial planning—the ongoing process of managing your personal finances in order to meet goals that you’ve set for yourself or your family

The financial planning life cycle of a typical individual’s life has three stages, each of which is characterized by different life events. Stage 1: Focus on building wealth, Stage 2: Focus on preserving and increasing wealth, and Stage 3: Focus on living on one's saved wealth after retirement.

Your “personal debt” is how much money you owe to other people, businesses, banks, credit card companies, and other creditors.

A budget is a financial plan that estimates how much money you'll make and spend over a specific period of time. It can be used by individuals, families, businesses, and governments.

A personal budget (for an individual) or household budget (for a group sharing a household) is a plan for the coordination of income and expenses.

Investing is what someone does when they buy something in hopes that it will grow in value over time.

Compound interest refers to the effect of earning interest on your interest.

The time value of money, or TVM, means that any amount of money has more value now than it will have in the future.

In Canada, a credit rating is a numerical score that reflects an individual's or business's creditworthiness, based on their financial behavior and credit history. Every time you use a credit card or borrow money, such as from a bank, your spending and debt habits are recorded.

Personal credit is a measure of an individual’s creditworthiness, represented by a credit score. It serves as a determining factor for lenders when assessing loan applications and setting interest rates.

Loans that involve some type of collateral are referred to as secured loans or secured credit.

Unsecured loans, on the other hand, do not require collateral. Because there is no asset backing the loan, these loans are considered higher risk for the lender, which typically results in higher interest rates. Unsecured loans, such as personal loans or credit card debt, often come with interest rates ranging from 10% to 30%, depending on your credit score and financial history.