Chapter 10: Financial Management and Accounting

Chapter 10 Learning Outcomes

After reading this chapter, you should be able to do the following:

- Explain the importance of forecasts, budgets, and financial controls to a company’s financial health.

- Distinguish between short-term and long-term business financial needs and where businesses may look for sources of funding.

- Describe the difference between debt and equity financing options.

- Describe the functions of balance sheets, income statements, and statements of cash flows.

- Calculate a break-even point given the necessary information.

- Describe how to evaluate a company’s performance using financial statements and ratio analysis.

World’s Most Valuable Company

Chip designer and artificial intelligence juggernaut Nvidia narrowly topped Microsoft’s market capitalization to become the world’s most valuable public company, less than two weeks after it surpassed Apple’s market cap (2024).[1] Nvidia designs and sells GPUs for gaming, cryptocurrency mining, and professional applications; the company also sells chip systems for use in vehicles, robotics, and more. Nvidia’s Compute and Networking business segment, which includes artificial intelligence (AI), is the company’s biggest revenue generator.

Apple, Nvidia, and Microsoft are the top three global companies by that measure, each with market caps of over $3 trillion. The world’s biggest companies by market capitalization are mainly tech companies, although other sectors, such as energy, financial services, and pharmaceuticals, also make an appearance in the top 10. Most of these companies generate hundreds of billions of dollars in annual revenue and are highly profitable. However, there are a few exceptions, with the focus of investors being on future growth potential.[2]

These companies know how to manage finances. Let’s see who will be at the top of the list next!

What is Financial Management?

Without good financial controls and planning, a company will not be able to respond to unexpected challenges or planned expansion. Financial management involves the strategic planning and budgeting of short- and long-term funds for current and future needs. This may include activities such as investing, borrowing, lending, budgeting, saving, and forecasting. In most companies, the finance department comprises two divisions: accounting and financial management. To remain competitive, a business must make large strategic investments such as buying or building a new factory or investing in more advanced equipment or technology. At the same time, the business must continue to pay its monthly expenses.

There are three main types of finance: personal finance, corporate finance, and government finance. In this chapter, we will discuss corporate finance.

The Financial Manager’s Role

A financial manager oversees the financial operations of a company. Many financial managers have backgrounds in accounting, banking, business management, economics, or finance. In most organizations, financial managers hold mid to upper-level roles requiring multiple years of experience. They can work in the private or public sectors.[3]

Generally, a financial manager assumes accounting responsibilities for the company and is responsible for planning and managing the company’s financial resources, including the following:

- Developing plans that outline the company’s financial short-term and long-term needs.

- Defining the sources and uses of funds that are needed to reach goals.

- Monitoring the cash flow of a company to ensure that obligations are paid in a timely and efficient manner and that funds owed to the company are collected efficiently.

- Investing any excess funds so that those funds can grow and be used for future development.

- Raising capital for future growth and expansion.

Financial managers analyze short-term and long-term money flows to optimize a firm’s profitability and make the best use of its money. This is usually done in three steps: 1) forecasting the firm’s short-term and long-term financial needs, 2) developing budgets to meet those needs, and 3) establishing financial controls to see whether the company is achieving its goals.

Forecasts, Budgets, and Financial Controls

Forecasts

Forecasts predict revenue, costs, and expenses for a specific future period. Short-term forecasts would include predictions for the upcoming year, while long-term forecasts would include predictions for a period longer than one year into the future. In developing forecasts, the financial manager considers many factors, including the current and anticipated changes in government regulations, consumer trends, competitor actions, changes in company goals, etc., and the impact these changes might have on the company’s financial situation.

Budgets

Using forecast expectations, a financial manager creates a budget, a financial plan that outlines the company’s planned cash flows, expected operating expenses, and anticipated revenues. The master budget has two major categories: the financial budget and the operating budget. The financial budget plans the use of assets and liabilities and results in a projected balance sheet. The operating budget helps plan future revenue and expenses and results in a projected income statement. Another component of the budgeting process is the capital budget, which considers the company’s long-range plans and outlines the expected financial needs for significant capital purchases such as real estate, manufacturing equipment, plant expansions, or technology. Since capital projects are often financed with borrowed money or money raised through the sale of stocks or bonds, it is important to plan to ensure that necessary funds are available when needed. During the capital budget process, each department in the organization puts together a list of its anticipated needs. Then, senior management and the board evaluate these needs to determine which will best maximize the company’s overall growth and profitability.

Financial Controls

Financial controllers are responsible for updating financial controls and overseeing all the accounting activities in an organization. Financial controls are procedures and policies that monitor and manage financial resources to prevent errors, fraud, and optimize allocation. These are used in strategic management planning. Preventive controls avoid issues, while directive controls guide actions. Internal controls ensure accurate reporting and compliance. Financial controls are regular checks of financial statements and processes. The financial statements are examined to identify losses and areas of potential losses and to reduce extravagant expenses. Financial Controls also assist in mitigating financial risks and meeting financial objectives.[4]

Play the video below, Financial Control and Management Best Practices, to learn about these top four internal controls that reduce fraud losses and can improve detection:

- A robust code of conduct.

- A strong internal audit department.

- Management certifications of financial statements.

- Management reviews of internal controls, processes, accounts, or transactions.

The video will also mention that the Finance DPro (FMD Pro) model includes these four fundamental, inter-linked building blocks that must be in place to ensure good practice in financial management:

- Accounting Records – All organizations are required to maintain records of their financial transactions to demonstrate how funds have been used.

- Financial Planning – Involves creating budgets and cash flow forecasts for specific projects and overall strategies, ensuring the organization’s financial stability and the success of its initiatives.

- Financial Monitoring – Entails reviewing financial reports to track project progress and support managerial decision-making, while also ensuring transparency and accountability to funders and stakeholders.

- Internal Control – Refers to a system of checks and safeguards put in place to manage risk, prevent financial loss from errors, theft, or fraud, and ensure the protection of both resources and personnel.

Play the YouTube video below, “Financial Control and Management Best Practices,” to gain an overview of what the term Finance is all about.[5] Transcript for “Financial Control and Management Best Practices” Video [PDF–New Tab]. Closed captioning is available on YouTube.

Business Financial Needs

To raise capital for business needs, companies primarily have two types of financing options: equity financing and debt financing. Most companies use a combination of debt and equity financing, but there are some distinct advantages to both. Equity financing carries no repayment obligation and provides extra working capital that can be used to grow a business. Debt financing, on the other hand, does not require giving up a portion of ownership. A company would choose debt financing over equity financing if it doesn’t want to surrender any part of its company. A company that believes in its financials would not want to miss out on the profits it would have to pass to shareholders if it assigned someone else equity. Which one a business needs depends on the business goals, risk tolerance, and need for control. Many businesses in the startup stage will pursue equity financing, while those already established and those that have no problem with debt and possess a strong credit score might pursue traditional debt financing types like business loans.[6]

Debt Financing

Some sources of debt financing are:[7]

- Term loans

- Business lines of credit

- Invoice factoring

- Business credit cards

- Personal loans, usually from a family or friend

- Peer-to-peer (P2P) lending services

- SBA (small business) loans

The ability to secure debt financing is largely based on your existing financials and creditworthiness.

Equity Financing

Some sources of equity financing are:[8]

- Angel investors

- Crowdfunding

- Venture capital firms

- Corporate investors

- Listing on an exchange with an initial public offering (IPO)

Securing equity financing can be simpler than debt financing, but you need to have an extremely attractive product or financial projections, as well as being able to surrender a portion of your company, and often a good amount of control.

Sources of Funding

Refer to Table 10.1 for a list of funding sources where businesses can secure either debt or equity financing:[9]

| Source | Description |

|---|---|

| Big Five Banks | The big banks — Chartered Banks — in Canada, including BMO, CIBC, RBC, Scotiabank, and TD Canada Trust, offer a large variety of banking products. Banks can provide loans and lines of credit as well as other funding options. |

| Credit Unions | Credit unions are cooperative savings institutions, owned by their members with a common interest, who receive shares of their profits. They offer almost anything that a chartered bank offers — savings accounts and loans, chequing accounts, home and car loans, credit cards, and even some commercial loans. |

| Trust Companies | A trust company safeguards property, funds, and estates entrusted to it. It may serve as a trustee, transfer agent, and registrar for corporations, and provide other services as well. In recent years, trust companies have declined in importance. |

| Online Banks | Online banks have significant advantages over their traditional counterparts. They have developed a business model that provides customers with the best of both worlds: low — and even no—monthly fees, along with accessible customer service administered remotely. Examples in Canada include Tangerine, EQ Bank, Neo Financial, Simplii Financial, and Manulife Bank. |

| Finance Companies | Finance companies are non-deposit institutions because they do not accept deposits from individuals or provide traditional banking services, such as chequing accounts. They do, however, make loans to individuals and businesses, using funds acquired by selling securities or borrowed from chartered banks. Those that lend money to businesses, such as General Electric Capital Corporation, are commercial finance companies, and those that make loans to individuals or issue credit cards, such a PCFinancial, are consumer finance companies. Some, such as General Motors Acceptance Corporation, provide loans to both consumers (car buyers) and businesses (GM dealers). |

| Insurance Companies | Insurance companies sell protection against losses incurred by illness, disability, death, and property damage. To finance claims payments, they collect premiums from policyholders, which they invest in stocks, bonds, and other assets. They also use a portion of their funds to make loans to individuals, businesses, and government agencies. Manulife is the leading Canadian life insurance company, and it has an international presence. |

| Brokerage Firms and Factoring Companies | Companies like Commercial Capital LLC, which buy and sell stocks, bonds, and other investments for clients, are brokerage firms (also called securities investment dealers). A mutual fund invests money from a pool of investors in stocks, bonds, and other securities. Investors become part-owners of the fund. Mutual funds reduce risk by diversifying investments because assets are invested in dozens of companies in a variety of industries, and poor performance by some firms is usually offset by good performance by others. Mutual funds may be stock funds, bond funds, and money market funds, which invest in safe, highly liquid securities. Finally, pension funds, which manage contributions made by participating employees and employers and provide members with retirement income, are also non-deposit institutions. |

| Venture Capital Firms | Venture Capital Firms provide private equity financing or funds to start-ups, early-stage, and emerging companies that have been deemed to have high growth potential or that have demonstrated high growth. Venture capital generally comes from wealthy investors, investment banks, and other financial institutions. However, it does not always take a monetary form; it can also be provided in the form of technical or managerial expertise. Financing a new and untested venture can be risky for investors who put up funds, however, the potential for above-average returns is an attractive payoff. |

| Government Financial Institutions and Granting Agencies | The Canadian government provides government funding support to businesses across the country. This funding support comes in the form of government grants, government loans, tax breaks, tax credits, and other types of financial contributions. Several provincial agencies also provide funding to developing business firms in the hope that they will provide jobs in the province. There are both federal and provincial programs supporting the agriculture industry and providing grants to business operations. Some examples of federal agencies include: The Business Development Bank of Canada (BDC), the Government’s Export Development Corporation (EDC), the Canada Mortgage and Housing Corporation (CMHC), the Crown-Indigenous Relations and Northern Affairs Canada (CIRNAC) and Indigenous Services Canada (ISC), and Futurpreneur Canada. |

| Pension Funds | A pension fund is any plan, fund, or scheme that provides retirement income in the future to subscribers. Pension funds typically have large amounts of money to invest and are the major investors in listed and private companies. |

Financing Short-term Needs

Short-term financing means business financing from short-term sources, which are for less than one year. There are many different types of short-term financing for businesses, including business line of credit, working capital advance, merchant cash advance, equipment financing, bridge loans, and invoice factoring. Crowdfunding is a way of attracting investors to support your business in return for equity (a shareholding in your business) or a reward.

Financing Long-Term Needs

Long-term financing refers to borrowing or issuing equity shares for more than one year. The sources for long-term financing include equity capital, preference capital, debentures, term loans, and retained earnings. Venture capitalists often have a long-term investment horizon, allowing startups to focus on growth and development rather than short-term profitability. Venture capitalists provide business financing in return for a significant stake in the company. The percentage they want will be much higher than the percentage required on crowdfunding sites when businesses offer equity and not a reward for investing. To maintain a healthy asset-liability management (ALM) position, a company’s management should ensure a mix of short-term and long-term financing sources.[10]

Explore the Concept: Overcoming Entrepreneurial Financial Challenges

While there has been an increase in the success of the Indigenous economy, Indigenous small businesses are faced with a higher number of financial barriers than their non-Indigenous counterparts. These institutional barriers hinder Indigenous business owners from seeking financial aid through common avenues, whether through government programs or loans via centralized banks. Evidence suggests that over 50% of Indigenous entrepreneurs struggle to keep their businesses afloat due to inadequate access to debt financing. To aid FNMI businesses, Indigenous-led financial institutions such as Aboriginal Capital Corporation have been launched, though few Indigenous entrepreneurs are cognizant of their services. Indigenous entrepreneur Kat Pasquach emphasizes the importance of seizing every available option, and Sarah Hopkins-Herr, founder of Three Sisters Consulting, speaks of positive experiences when seeking financial resources to keep their businesses operational.[11]

The Role of Accounting

Understanding the numbers on the organization’s balance sheet can indicate its current financial position and show whether it’s on a trajectory for success or failure. By examining its cash flow statement, a business can gain insight into how cash is being generated and used. Through reviewing its income statement, a business can gauge how the business is doing in relation to its expected performance.[12]

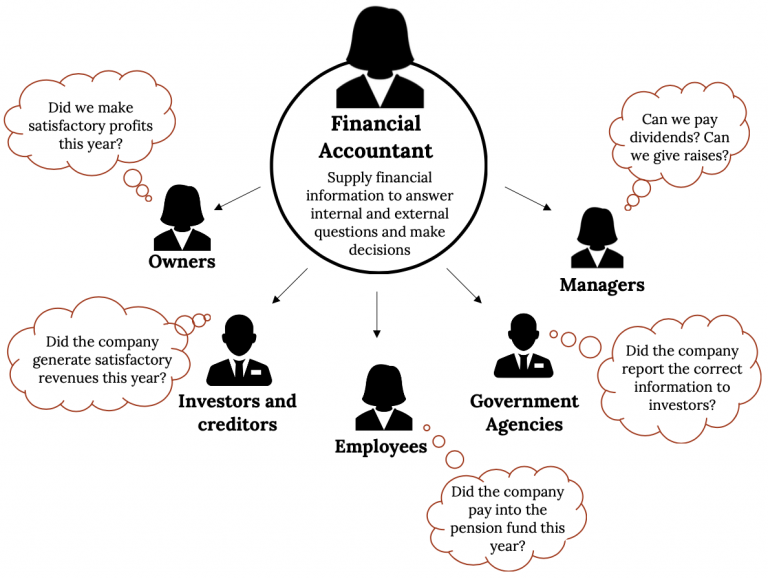

Financial accounting provides information not only to internal managers but also to people outside the organization (such as investors, creditors, government agencies, suppliers, employees, and labor unions) to assist them in assessing a firm’s financial performance.

Fields of Accounting

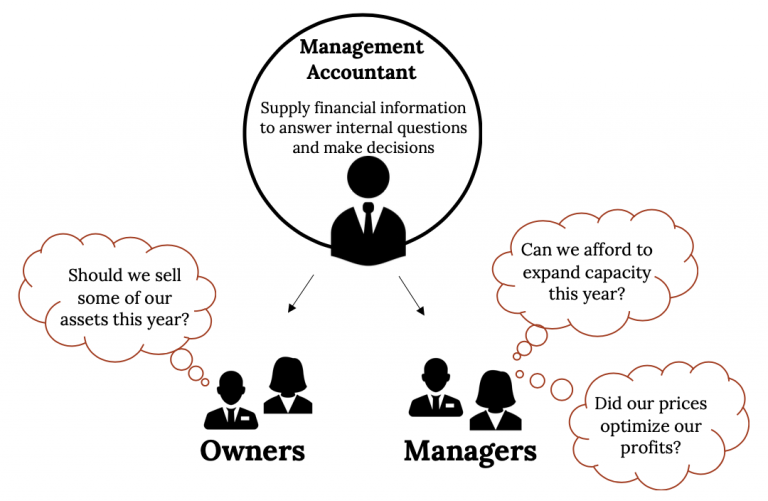

Accountants typically work in one of two major fields. Management accountants provide information and analysis to decision makers inside the organization in order to help them run it.

Management Accounting

The main objective of managerial accounting is to assist the management of a company in efficiently performing its functions: planning, organizing, directing, and controlling. Because the information that it provides is intended for use by people who perform a wide variety of jobs, the format for reporting information is flexible. Reports are tailored to the needs of individual managers, and the purpose of such reports is to supply relevant, accurate, and timely information that will aid managers in making decisions. In preparing, analyzing, and communicating such information, accountants work with individuals from all the functional areas of the organization—human resources, operations, marketing, etc.

Financial Accounting

Financial accountants deliver information to both internal and external stakeholders to help evaluate the organization’s financial health. However, their main focus is on serving external users. Put simply, management accounting supports the day-to-day operation of your business, while financial accounting communicates your business’s performance to the outside world.

Financial accounting is responsible for preparing the organization’s financial statements—including the income statement, the statement of owners’ equity, the balance sheet, and the statement of cash flows—that summarize a company’s past performance and evaluate its current financial condition. If a company is traded publicly on a stock market such as the NASDAQ, these financial statements must be made public, which is not true of the internal reports produced by management accountants. In preparing financial statements, financial accountants adhere to a set of standards or guidelines, known as Generally Accepted Accounting Principles (GAAP). GAAP is used mainly by companies headquartered in the U.S., while most other countries follow the International Financial Reporting Standards (IFRS). These multinational standards, which are issued by the International Accounting Standards Board (IASB), differ from US GAAP in several important ways, but exploring these fine distinctions is not part of this chapter. Bear in mind, however, that, according to most experts, a single set of worldwide standards will eventually emerge to govern the accounting practices of both US and non-US companies.

As of 2011, the Canadian Accounting Standards Board (CASB) requires that all publicly accountable enterprises use the International Financial Reporting Standards (IFRS) when preparing financial statements. While IFRS is mandatory for publicly owned companies, private companies can choose to use the Canadian Generally Accepted Accounting Principles (Canadian GAAP).[13] Users want to be sure that financial statements have been prepared according to IFRS or GAAP because they want to be sure that the information reported in them is accurate. They also know that when financial statements have been prepared by the same rules, they can be compared from one company to another.

Figures 10.1 and 10.2 illustrate the main users of management and financial accounting and the types of information produced by accountants in the two areas. In the rest of this chapter, we’ll learn how to prepare a set of financial statements and how to interpret them. We’ll also discuss issues of ethics in the accounting community and career opportunities in the accounting profession.

Who Uses Financial Accounting Information?

The users of managerial accounting information are pretty easy to identify—basically, they’re a firm’s managers. In summarizing the outcomes of a company’s financial activities over a specified period of time, financial statements are, in effect, report cards for owners and managers. They show, for example, whether the company did or didn’t make a profit and furnish other information about the firm’s financial condition. They also provide some information that managers and owners can use in order to take corrective action, though reports produced by management accountants offer a much greater level of depth.

Investors and creditors furnish the money that a company needs to operate, and not surprisingly, they want to know how that business is performing. Because they know that it’s impossible to make smart investment and loan decisions without accurate reports on an organization’s financial health, they study financial statements to assess a company’s performance and to make decisions about continued investment.

Businesses are required to furnish financial information to several government agencies. Publicly-owned companies, for example, the ones whose shares are traded on a stock exchange, must provide annual financial reports to the Securities and Exchange Commission (SEC), a federal agency that regulates stock trades and which is charged with ensuring that companies tell the truth with respect to their financial positions. Companies must also provide financial information to local, state, and federal taxing agencies, including the Internal Revenue Service (IRS).

A number of other external users have an interest in a company’s financial statements. Suppliers, for example, need to know if the company to which they sell their goods is having trouble paying its bills or may even be at risk of going under. Employees and labor unions are interested because salaries and other forms of compensation are dependent on an employer’s performance.

The Function of Financial Statements

Since this book is an introductory level, the focus will remain on the basic financial statements: the income statement, balance sheet, and cash flow statement, even though there are many other types of financial statements. Later in your business studies, when you complete accounting, finance, management, and other courses, you will learn more about these concepts.

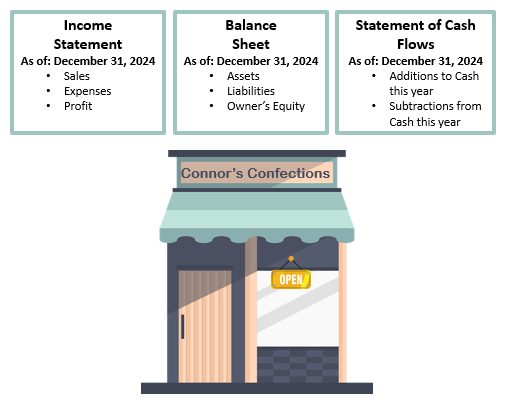

The three core financial statements include:

- Income Statement = Shows sales, expenses, and whether the business made a profit.

- Balance Sheet = Shows assets and liabilities, the amount invested in the business.

- Statement of Cash Flows = Shows how much cash is coming in and going out of the business.

Explore the Concept: Connor’s Confections

Meet Connor. He operates a business out of his home, “Connor’s Confections”. He loves what he does, and he feels that he’s doing pretty well. He has an opportunity to take over a nearby store at very reasonable rent, and he can expand by getting a modest bank loan and investing some more of his own money. So, it’s decision time for Connor. He knows that the survival rate for start-ups isn’t very good, and before taking the next step, he’d like to get a better idea of whether he’s doing well enough to justify the risk.

Figure 10.3 shows the information Connor will obtain by analyzing the three basic financial statements: the Income statement, balance sheet, and statement of cash flows. Connor determined that his income was better than expected, as it grew very fast this past year after he opened the option for customers to order online and have confections shipped to their homes. While the shipping costs could be high, depending on shipping location, Connor opted for customer-paid shipping, and he already had a business website, so he had few additional expenses from opening the online ordering option to customers.

Although Connor is nervous about expansion because he knows as a sole proprietor, he will be liable for all expenses, he has decided he has enough equity in the business that he can afford the risk of expansion. Go Connor!

Toying with a Business Idea

To bring this concept closer to home, let’s assume that you need to earn money while you’re in college and that you’ve decided to start a small business. Your business will involve selling stuff to other college students, and to keep things simple, we’ll assume that you’re going to operate on a “cash” basis: you’ll pay for everything with cash, and everyone who buys something from you will pay in cash.

You may have at least a little cash on you right now—some currency, paper money, and coins. In accounting, however, the term cash refers to more than just paper money and coins. It also refers to the money that you have in chequing and savings accounts and includes items that you can deposit in these accounts, such as money orders and different types of cheques.

Your first task is to decide exactly what you’re going to sell. You’ve noticed that with homework, exams, social commitments, and the hectic lifestyle of the average college student, you and most of the people you know always seem to be under a lot of stress. Sometimes you wish you could just lie back between meals and bounce a ball off the wall. And that’s when the idea hits you: Maybe you could make some money by selling a product called the “Stress-Buster Play Pack.” Here’s what you have in mind: you’ll buy small toys and other fun stuff—instant stress relievers—at a local dollar store and pack them in a rainbow-colored plastic treasure chest labeled “Stress-Buster.”

And here’s where you stand financially:

- You have enough cash to buy a month’s worth of plastic treasure chests and toys. After that, you’ll use the cash generated from sales of Stress-Buster Play Packs to replenish your supply.

- Each plastic chest will cost $2.00, and you’ll fill each one with a variety of five simple toys, all of which you can buy for $1.00 each.

- You plan to sell each Stress-Buster Play Pack for $10 from a rented table stationed outside a major dining hall.

- Renting the table will cost you $20 a month.

- To make sure you can complete your schoolwork, you decide to hire fellow students to staff the table at peak traffic periods. They’ll be on duty from noon until 2:00 p.m. each weekday except Fridays, and you’ll pay them a generous $17.50 an hour. Wages, therefore, will cost you $560 a month (2 hours × 4 days × 4 weeks = 32 hours × $17.50).

- Finally, you’ll publish ads in the college newspaper at a monthly cost of $40.

Thus, your total monthly costs will amount to $620 ($20 + $560 + $40).

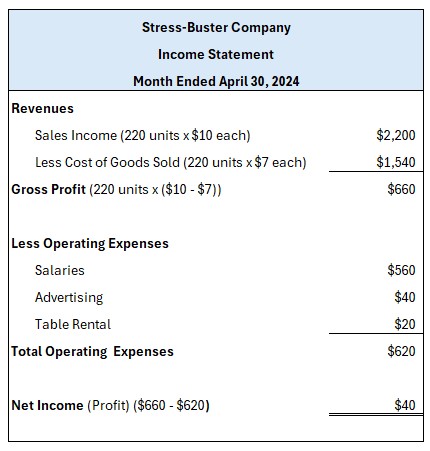

The Income Statement

Let’s say that during your first month, you sell 220 play packs. Not bad, you say to yourself, but did I make a profit? To find out, you prepare an income statement showing revenues, or sales, and expenses—the costs of doing business. You divide your expenses into two categories:

- Cost of goods sold: the total cost of the goods that you’ve sold

- Operating expenses: the costs of operating your business except for the costs of things that you’ve sold.

Now you need to do some subtracting:

The difference between sales and cost of goods sold is your gross profit, also known as gross margin. The difference between gross profit and operating expenses is your net income or profit, which is the proverbial “bottom line.”

Your income statement for the first month is shown in Figure 10.4. (Remember that we’ve made things simpler by handling everything in cash.)

Did You Make Any Money? Not in your first month. Many businesses operate at a net loss when they first open. It takes time to build a customer following and begin to earn profits. Human resources are one of the highest expenses for many companies. If you could run your business without the need for hiring others, how much profit would you have made?

What does your income statement tell you? It has provided you with four pieces of valuable information:

- You sold 220 units at $10 each, generating total sales revenue of $2,200.

- Each unit cost $7 to produce, which includes $2 for the treasure chest and $5 for the five toys inside, resulting in a cost of goods sold of $1,540 (220 units × $7 per unit).

- Subtracting the cost of goods sold from sales gives a gross profit of $660 (220 units × $3 per unit).

- After accounting for operating expenses (the costs of doing business other than the cost of goods sold) of $620, you generated a net income for the period of $40.

The Balance Sheet

The balance sheet shows the cumulative effect of the income statement over time.

Companies prepare financial statements on at least a twelve-month basis—that is, for a fiscal year which ends on December 31 or some other logical date, such as June 30 or September 30. Fiscal years can vary because companies generally pick a fiscal-year end date that coincides with the end of a peak selling period; thus, a crabmeat processor might end its fiscal year in October, when the crab supply has dwindled. Most companies also produce financial statements on a quarterly or monthly basis.

A balance sheet reports the following information:

- Assets: the business resources from which it expects to gain some future benefit (what the company owns)

- Liabilities: the business debts that it owes to outside individuals or organizations (what the company owes to others)

- Owner’s equity: the investment the owner(s) made in the business (the difference between assets and liabilities)

Whereas your income statement tells you how much income you earned over some period of time, your balance sheet tells you what you have at a specific point in time.

Debits, Credits, and Double-Entry Accounting

It’s important to mention that Debits and credits are used in a company’s bookkeeping in order for its books to balance. Debits increase asset or expense accounts and decrease liability, revenue, or equity accounts. Credits do the reverse of debits, they decrease asset or expense accounts and increase liability, revenue or equity accounts. The individual entries on a balance sheet are referred to as debits and credits. Debits (often represented as DR) record incoming money, while credits (CR) record outgoing money. How these show up on your balance sheet depends on the type of account they correspond to. In double-entry accounting, every transaction is recorded with a debit and credit in two or more accounts, which categorize different types of financial activities in a company’s general ledger. You will put these concepts into practice when you complete your first accounting course.

For Stress-Buster, you’ll want to prepare them monthly to stay on top of how your new business is doing. Let’s prepare a balance sheet at the start and end of your first month in business.

The Accounting Equation

To prepare a balance sheet, one must first understand the fundamental accounting equation:

Assets = Liabilities + Owner’s Equity

This simple but important equation highlights the fact that a company’s assets came from somewhere: either from investments made by the owners (owner’s equity) or from loans (liabilities). This means that the asset section of the balance sheet, on the one hand, and the liability and owners’ equity section on the other, must be equal, or balanced. Thus, the term balance sheet. The Accounting Coach has a comprehensive online tutorial that you may wish to review. It includes the following information about the Accounting Equation.

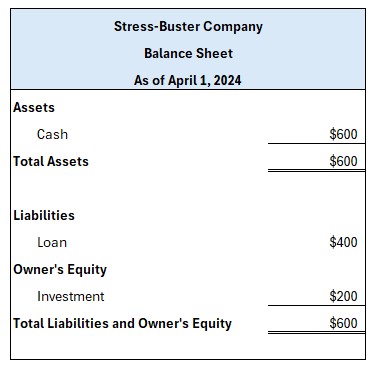

Let’s prepare the two balance sheets we mentioned: one for the first day you started and one for the end of your first month of business. We’ll assume that when you started Stress-Buster, you borrowed $400 from your parents and put in $200 of your own money. If you refer to Figure 10.5, your business’s first balance sheet, you’ll find that your business has $600 in cash (your assets). Of this total, you borrowed $400 (your liabilities) and invested $200 of your own money (your owner’s equity). So far, so good, your assets section balances with your liabilities and owner’s equity section.

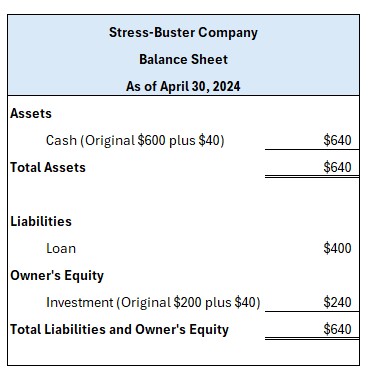

Now let’s see how things have changed on the balance sheet by the end of the month. Recall that Stress-Buster, your income statement showed a net income of $40 during the month of April (the first month in operation). The $40 gain increases two items on your balance sheet: the assets of the company (its cash) and your investment in it (its owner’s equity). Figure 10.6 shows what your balance sheet will look like on April 30. You now have $640 in cash, $400 that you borrowed, plus a positive amount you invested of $240 (your original $200 investment plus the gain of $40 from the first month of operations).

Breakeven Analysis

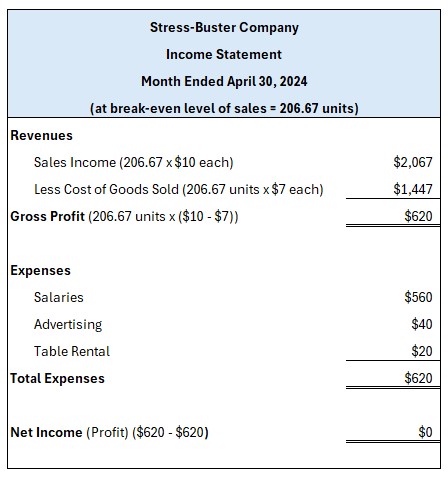

Let’s take a short detour to see how this information might be applied. When reviewing your first financial statements, you might ask yourself: Is there a way to determine the level of sales needed to avoid a loss, to “break even”?

This can be done using break-even analysis. To break even (i.e., earn no profit or incur no loss), your total sales revenue must exactly equal your total expenses — both variable and fixed.

-

Variable costs depend on the quantity produced and sold. For example, each Stress-Buster includes a treasure chest and toys inside — these are costs that increase as you produce more units.

-

Fixed costs remain the same regardless of the number of units sold. For instance, you’ll pay for advertising whether or not you sell any Stress-Busters.

The break-even point is reached when total contribution margin equals total fixed costs. Here’s how to calculate it, using data from the previous example:

Break-even Calculation:

-

Determine total fixed costs:

-

Salaries = $560

-

Advertising = $40

-

Table rental = $20

-

Total Fixed Costs = $620

-

-

Identify variable costs per unit:

-

Treasure chest = $2

-

Toys = $5

-

Variable Cost per Unit = $7

-

-

Calculate contribution margin per unit:

-

Selling Price = $10

-

Variable Cost = $7

-

Contribution Margin = $3 per unit

-

-

Calculate the break-even point in units:

-

Break-even Units = Fixed Costs ÷ Contribution Margin

-

= $620 ÷ $3 = 206.67 units

-

Since you can’t sell a fraction of a unit, you need to sell at least 207 units to break even.

-

If you sell 206.67 units, you will earn zero profit, just enough to cover all costs. To test your calculation, you can create a “what-if” income statement based on this breakeven point. For example:

-

At 220 units sold, with a $3 contribution margin per unit = $660 total gross profit

-

Break-even requires only $620 in contribution margin

-

So, you earn a net income of $40

This confirms that selling above the break-even point leads to profit.

Of course, you want to do better than just break even, so you could modify this analysis to a targeted level of profit by adding that amount to your fixed costs and repeating the calculation. Breakeven analysis is rather handy. It enables you to determine the level of sales that you must reach to avoid losing money and the level of sales that you have to reach to earn a certain profit. Such information will be vital to planning your business. Refer to Figure 10.4 for an example of a break-even income statement for Stress-Buster Company.

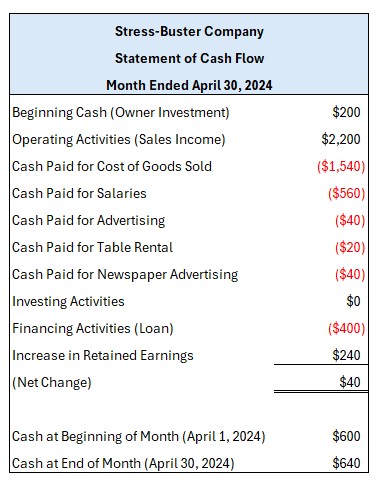

The Cash Flow Statement

The cash flow statement provides valuable information about a company’s expenses and receipts and allows insights into its future income needs in order to be able to meet its future obligations (expenses and receipts). The cash flow statement reports cash inflows and outflows, and it will identify the amount of cash the company currently holds, which is also reported in the balance sheet. The key difference between the income statement and the cash flow statement is that the income statement can show a profit even if you didn’t receive cash yet, while the cash flow statement only tracks actual cash transactions.

While cash flow statements are usually prepared on a monthly basis, a consolidated statement of cash flows is created to align with the requirements of the International Financial Reporting Standards (IFRS).

A statement of cash flow reports cash in three distinct areas of business:

- Cash from Operations

- Cash from Investing

- Cash from Financing

Refer to Figure 10.8 to review the statement of cash flow for Stress-Buster company for the one-month period ending April 30, 2024. Stress-Buster would have incurred a Net Income of $40 from Operations during the first month of operation, after deducting the month’s expenses from the month’s revenues. The business also incurred cash from Financing from the initial $400 loan taken out to start the business and the additional $200 of personal income. As Stress-Buster did not invest in new equipment, machinery, or other assets for the business or use prior cash flows and/or retained earnings to earn further investment income, Stress-Buster would not report any cash from investing activities.

Self-Check Exercise: Financial Statements

Financial Statement Analysis

Now that you know a bit about financial statements, let’s see how they’re used to help owners, managers, investors, and creditors assess a firm’s performance and financial strength. You can glean a wealth of information from financial statements, but first, you need to learn a few basic principles for “unlocking” it.

Trend Analysis from the Income Statement

A trend analysis is done by collecting data at selected times and then plotting any observed changes over longer periods. A trend analysis examines the factors that drive business success. The analysis is used to make projections for the future, identify areas that need attention from managers, and benchmark the business against others in the industry. Some of the most common operating factors tracked in trend analysis include gross margin, sales (in units/dollars), earnings before interest and taxes (EBIT), earnings per common share (EPS), stock price, etc. The most common line items on the balance sheet included in a trend analysis are total assets, total liabilities, total shareholder equity, debt-to-equity ratio, current ratio, and acid test ratio.[14]

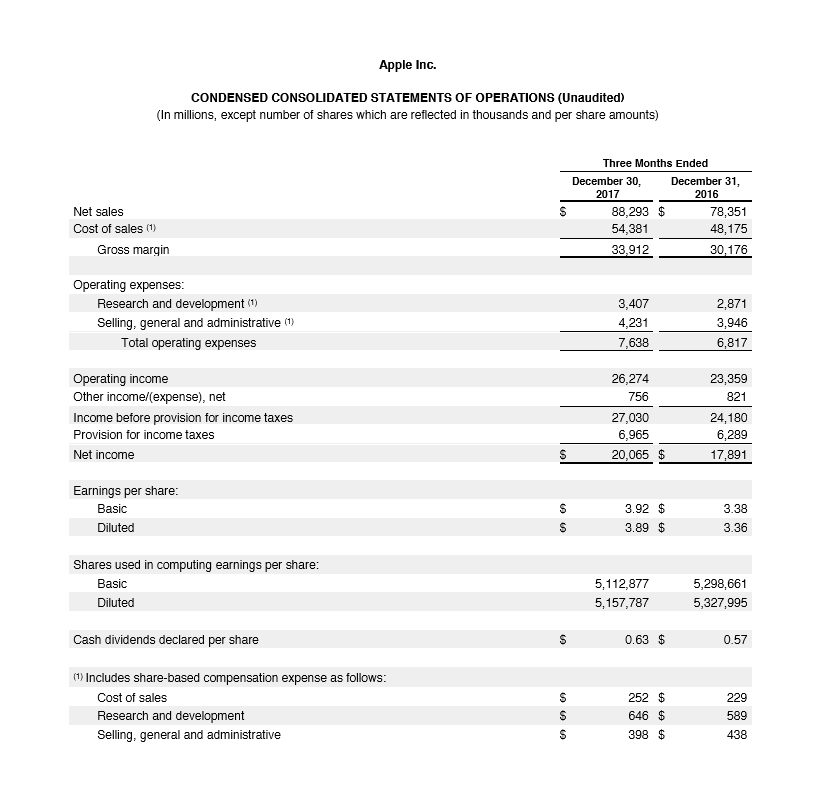

Refer to Figure 10.9, which is an abbreviated financial statement for Apple for 2017 taken directly from their website (also available for download in PDF form via Google search). You will note that instead of showing only the current year’s results, the company has shown data for the prior year as well. From this relatively simple exhibit, considerable information about Apple’s performance can be obtained.

For example:

- Apple sales grew at 12.7% from 2016 to 2017, not bad for a company with such a large base of sales already, but certainly not the rapid-growth company it once was. When making yearly comparisons, this is commonly referred to as performing a horizontal analysis.

- Net income as a percent of sales (a ratio also known as return on sales) was 22.7% in 2017, or in other words, for every $5 in sales, Apple turned more than $1 of it into profit. That is substantial! When calculating ratios as a percent of a larger figure (i.e., Net income as a percent of sales, or cash as a percent of Total Assets), this is commonly referred to as performing a vertical analysis.

Many other calculations are possible from Apple’s data, and we will look at a few more as we explore ratio analysis.

Ratio Analysis

How do you compare Apple’s financial results, shown in Figure 10.10, with those of other companies in your industry or with the other companies whose stock is available to investors? And what about your balance sheet? Are there relationships in this statement that also warrant investigation? These issues can be explored by using ratio analysis, a technique for evaluating a company’s financial performance.

Remember that a ratio is just one number divided by another, with the result expressing the relationship between the two numbers. It’s hard to learn much from just one ratio, or even a number of ratios covering the same period. Rather, the deeper value in ratio analysis lies in looking at the trend of ratios over time and in comparing the ratios for several time periods with those of other companies. There are a number of different ways to categorize financial ratios.

Types of Financial Ratios

- Profitability ratios tell you how much profit is made relative to the amount invested (return on investment) or the amount sold (return on sales).

- Liquidity ratios tell you how well positioned a company is to pay its bills in the near term. Liquidity refers to how quickly an asset can be turned into cash. For example, shares of stock are substantially more liquid than a building or a machine.

- Debt ratios look at how much borrowing a company has done to finance the operations of the business. The more borrowing, the more risk a company has taken on, and so the less likely it is for new lenders to approve loan applications.

- Efficiency ratios tell you how well your assets are being managed.

Refer to Table 10.2 for definitions and examples of various financial ratios used in business.

| Ratio | Definition | Formula | Type |

|---|---|---|---|

| Debt Ratio | Proportion of assets financed by debt | Total Liabilities / Total Assets | Leverage / Risk |

| Current Ratio | Ability to pay short-term obligations with short-term assets | Current Assets / Current Liabilities | Liquidity |

| Acid-Test Ratio | Ability to pay short-term obligations without relying on inventory | (Current Assets – Inventory) / Current Liabilities | Liquidity |

| Net Profit Margin | Profit made per dollar of sales after all costs (variable + fixed) are subtracted | Net Income / Sales Revenue | Profitability |

| Debt-to-Equity Ratio | Proportion of financing from debt vs owner investment | Total Liabilities / Shareholders’ Equity | Leverage / Risk |

| Return on Assets (ROA) | How effectively assets generate profit | Net Income / Total Assets | Effectiveness |

| Asset Turnover Ratio | How efficiently assets are used to generate sales | Sales Revenue / Average Total Assets

ATA = ((beginning total assets + ending total assets) /2) |

Efficiency |

| Inventory Turnover Ratio | How many times inventory is sold and replaced over a period | Cost of Goods Sold / Average Inventory

AI = ((beginning Inventory + ending inventory) /2) |

Efficiency |

| Receivables Turnover | How efficiently you collect on credit sales | Net Credit Sales / Average Accounts Receivable

AR = ((beginning AR + ending AR) /2) |

Efficiency |

We could employ many different ratios, but we’ll focus on a few key examples.

Profitability Ratios

Profitability ratios include gross profit margin, net profit margin, and return on equity. Earnings per share (EPS) is a measure of a company’s profitability that indicates how much profit each outstanding share of common stock has earned. It’s calculated by dividing the company’s net income by the total number of outstanding shares. The higher a company’s EPS, the more profitable it is considered to be. Earlier, we looked at the return on sales for Apple, and now we will look at its EPS. According to the earlier Figures 10.9 and 10.10, Apple saw its EPS increase from $3.38 in 2016 to $3.92 in 2017, which indicates a profit of about 15%, an excellent return for a company that is already among the world’s largest. Well-paid analysts will spend hours to understand how these results were achieved every time Apple issues new financial statements.

Liquidity Ratios

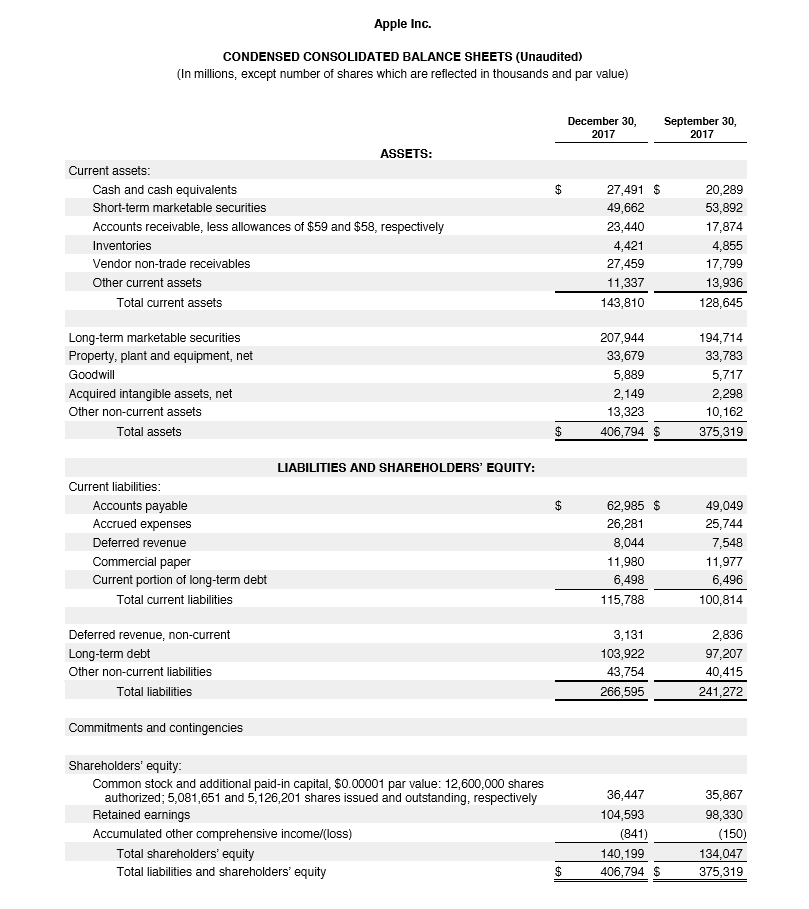

A liquidity ratio is a type of financial ratio used to determine a company’s ability to pay its short-term debt obligations. The metric helps determine if a company can use its current, or liquid, assets to cover its current liabilities. Liquidity ratios are one element of measuring the financial strength of a company. A key liquidity ratio is called the current ratio. It simply examines the relationship between a company’s current assets and its current liabilities. On December 30, 2017 (remember that balance sheets reflect a point in time), Apple had $68.5 billion in current assets and $63.5 billion in current liabilities. Simply, what this means is that Apple has more money on hand than it needs to pay its bills. When a company has a current ratio greater than 1, it is in good shape to pay its bills; companies selling to Apple on credit would not need to worry that it is likely to run out of money.

Apple’s current ratio = $68.5 Billion / $63.5 Billion = 1.08 (greater than >) 1

Now, let’s look quickly at something that is not part of the ratio; look down one line on the balance sheet to long-term marketable securities and see that Apple owns $207.9 billion. While they are long-term and so not part of the current ratio, these securities are still easily convertible to cash. So, Apple has far more cushion than the current ratio reflects, even though it reflects a healthy financial position already.

Debt Ratios

A key debt ratio, which tells us how the company is financed, is the debt-to-equity ratio, which calculates the relationship between funds acquired from creditors (debt) and funds invested by owners (equity). For this ratio calculation, we use Apple’s total liabilities, not just the line on the balance sheet that says long-term debt, because in effect, Apple is borrowing from those it owes but has not yet paid. Apple’s total liabilities at the end of 2017 were $266.6 billion versus owner’s equity of $140.2 billion, a ratio of 1.9, which means Apple has borrowed more than it has invested in the business.

Apple’s debt-to-equity ratio: $266.6 / $140.2 billion = 1.9

To some investors, that high level of debt might seem alarming. But remember that Apple has $207.9 billion invested in marketable securities. If it wished to do so, Apple could sell some of those securities and pay down its debts, thus improving its ratio. Likely, anyone thinking about lending money to Apple and seeing these figures would be confident that Apple can pay back what it borrows.

Efficiency and Effectiveness Ratios

Refer to Table 10.3 for definitions and examples of effectiveness and efficiency ratios used in business.

| Effectiveness Ratios | Efficiency Ratios |

|---|---|

| Focus on how well a business uses resources to achieve desired outcomes (like profits and returns) | Focus on how quickly or productively resources are used (like inventory, assets, and receivables) |

| Effectiveness Ratios help determine if you’re achieving your business goals, like turning assets into actual profit. | These ratios measure how efficiently a company uses its assets to generate revenues and its ability to manage those assets. |

| Emphasize results/output | Emphasize process/speed |

| Examples: Return on Assets (ROA), Return on Equity (ROE) | Example: Asset Turnover, Inventory Turnover, and Receivables Turnover |

There are many more ratios that we could review that aid companies in understanding their performance. Yet going deeper into ratios would be beyond the scope of an introductory business course. If you continue your study of business, you will get ample exposure to these ratios in your accounting and finance courses. So, we’ll leave the rest for another day.

Key Takeaways

- Financial management involves the strategic planning and budgeting of short- and long-term funds for current and future needs. This may include activities such as investing, borrowing, lending, budgeting, saving, and forecasting. In most companies, the finance department comprises two divisions: accounting and financial management.

- There are three main types of finance: personal finance, corporate finance, and government finance. In this chapter, we will discuss corporate finance.

- Financial managers analyze short-term and long-term money flows to optimize a firm’s profitability and make the best use of its money.

- Forecasts predict revenue, costs, and expenses for a specific future period. Short-term forecasts would include predictions for the upcoming year, while long-term forecasts would include predictions for a period longer than one year into the future.

- A budget is a financial plan that outlines the company’s planned cash flows, expected operating expenses, and anticipated revenues.

- The financial budget plans the use of assets and liabilities and results in a projected balance sheet.

- The operating budget helps plan future revenue and expenses and results in a projected income statement.

- The capital budget considers the company’s long-range plans and outlines the expected financial needs for significant capital purchases such as real estate, manufacturing equipment, plant expansions, or technology.

- Financial controllers are responsible for updating financial controls and overseeing all the accounting activities in an organization.

- Financial controls are procedures and policies that monitor and manage financial resources to prevent errors, fraud, and optimize allocation.

- Equity financing carries no repayment obligation and provides extra working capital that can be used to grow a business.

- Debt financing, on the other hand, does not require giving up a portion of ownership.

- Sources of Financing. There are many such as the Big Five Banks for loans and lines of credit, Trust Companies, Credit Unions, Online Banks, Finance Companies, Insurance Companies, Brokerage Firms and Factoring companies, Venture Capital Firms, Government Financial Institutes and Granting Agencies, and Pension Funds.

- Short-term financing means business financing from short-term sources, which are for less than one year. There are many different types of short-term financing for businesses, including business line of credit, working capital advance, merchant cash advance, equipment financing, bridge loans, and invoice factoring.

- Long-term financing refers to borrowing or issuing equity shares for more than one year. The sources for long-term financing include equity capital, preference capital, debentures, term loans, and retained earnings.

- Indigenous small businesses are faced with a higher number of financial barriers than their non-Indigenous counterparts.

- The main objective of managerial accounting is to assist the management of a company in efficiently performing its functions: planning, organizing, directing, and controlling.

- Financial accountants deliver information to both internal and external stakeholders to help evaluate the organization’s financial health. However, their main focus is on serving external users. Put simply, management accounting supports the day-to-day operation of your business, while financial accounting communicates your business’s performance to the outside world.

- In preparing financial statements, financial accountants adhere to a set of standards or guidelines, known as Generally Accepted Accounting Principles (GAAP). GAAP is used mainly by companies headquartered in the U.S., while most other countries follow the International Financial Reporting Standards (IFRS). These multinational standards, which are issued by the International Accounting Standards Board (IASB), differ from US GAAP in a number of important ways.

- Income Statement = Shows sales, expenses, and whether or not a profit was made.

- Balance Sheet = Shows assets and liabilities, the amount invested in the business.

- To prepare a balance sheet, one must first understand the fundamental accounting equation: Assets = Liabilities + Owner’s Equity

- Statement of Cash Flows = Show how much cash is coming in and going out.

- Cost of goods sold: the total cost of the goods that you’ve sold.

- Operating expenses: the costs of operating your business, except for the costs of things that you’ve sold.

- Gross profit, also known as gross margin. The difference between gross profit and operating expenses is your net income or profit, which is the proverbial “bottom line.”

- Debits increase asset or expense accounts and decrease liability, revenue, or equity accounts.

- Credits do the reverse of debits; they decrease asset or expense accounts and increase liability, revenue, or equity accounts. The individual entries on a balance sheet are referred to as debits and credits.

- Double-entry accounting: Every transaction is recorded with a debit and credit in two or more accounts, which categorize different types of financial activities in a company’s general ledger.

- Breakeven analysis: To break even (have no profit or loss), your total sales revenue must exactly equal all your expenses (both variable and fixed).

- The cash flow statement provides valuable information about a company’s expenses and receipts and allows insights into its future income needs in order to be able to meet its future obligations (expenses and receipts).

- A trend analysis is done by collecting data at selected times and then plotting any observed changes over longer periods.

- Profitability ratios tell you how much profit is made relative to the amount invested (return on investment) or the amount sold (return on sales).

- Liquidity ratios tell you how well-positioned a company is to pay its bills in the near term. Liquidity refers to how quickly an asset can be turned into cash. For example, shares of stock are substantially more liquid than a building or a machine.

- Debt ratios look at how much borrowing a company has done to finance the operations of the business. The more borrowing, the more risk a company has taken on, and so the less likely it is for new lenders to approve loan applications.

- Efficiency ratios tell you how well your assets are being managed.

End-of-Chapter Exercises

- Equity Capital and Preference Capital. Use the Internet to search for the terms, equity capital (common shares) and preference capital (preferred shares). What do they mean? Would you rather hold preferred shares or common shares? Is there a cost difference in buying these shares? How do preference shares affect a company’s finances? Discuss your findings with the class and/or your professor.

- Successful Investors. Use the Internet to research some investors who are well-known for their success in investing. Warren Buffett is one we have all heard of. Can you find a few others? What made them successful? Share your findings with the class and/or professor.

- Ratios. Identify two public companies operating in different industries. Collect at least three years’ worth of financial statements for the firms. Calculate these financial ratios: profitability, liquidity, and debt. Prepare a summary and share with your class and/or professor.

- Accounting Scandals. Use the Internet to research a recent accounting fraud scandal. What happened? How might this have been stopped? How can companies use better controls to stop accounting fraud? Share your findings with the class and/or teacher.

- Debit and Credit App. Download the App, Debit and Credit – Accounting. Practice debiting and crediting coins to learn basic accounting. Play against the world as you learn. How did you do?

- Accounting Flashcards App. Download the Accounting Flashcards app, which includes translation for English, Chinese, and Spanish. Learn financial accounting using illustrated flashcards. Topics include accounting standards, equations, terms, ratios, and more. How did you do?

- Government Support. Research one or more of the following government agencies and find out what they do: The Business Development Bank of Canada (BDC), the Government’s Export Development Corporation (EDC), the Canada Mortgage and Housing Corporation (CMHC), the Crown-Indigenous Relations and Northern Affairs Canada (CIRNAC) and Indigenous Services Canada (ISC), and Futurpreneur Canada. Who do they support? What do they offer? Do you think you could find help from one of these agencies if you were to start your own business? Share your findings with your class and/or professor.

- Bank Loan. Research one of the Big Five Banks and find out what they provide in the way of business loans for a new business. What are the interest rates? Some individuals take out loans to make investments, and then they can deduct the interest they pay on the loan on their taxes. Do you think this is worth it? Explain. Share your findings with the class and/or professor.

Self-Check Exercise: Financial Management and Accounting Quiz

Check your understanding of this chapter’s concepts by completing this short self-check quiz.

Additional Resources

- Biggest Companies in the World by Market Cap

- How Flexible Financing Can Unlock Your Business Potential

- What is Short-Term Financing?

- What is Equity Financing?

- How Does Debt Financing Work?

- Understanding IFRS and GAAP

- AccountingPlay.com Apps, Quizzes, Lessons

- Canadian Mortgage App, Google App, Apple App

- 10 Accounting Games to Make Education Fun

- Learn Accounting for Free – Accounting Coach

- Break-Even Analysis – How to Calculate Your Safe Point. YouTube Video

- Balance Sheet and Income Statement Relationship. YouTube Video

- Free Harvard Download: Financial Statement Templates

Attributions

The contents of this chapter is a compilation sourced from various OER resources, please refer to the Book Information for details.

References

(Note: This reference list was produced using the auto-footnote and media citation features of Pressbooks)

Media Attributions

- Nvidia Internal Computer Card © Wikipedia Images | Pixabay

- Budget © Steve Buissinne | Pixabay

- The Role of Managerial Accounting © Verry. “Female.” Noun Project Inc. CC BY 4.0. Retrieved from: https://thenounproject.com/term/female/2788855; Chrystina Angeline. “Manager.” Noun Project Inc. CC BY 4.0. Retrieved from: https://thenounproject.com/search/?q=manager&i=1813155 is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- The Role of Financial Accounting © Verry. “Female.” Noun Project Inc. CC BY 4.0. Retrieved from: https://thenounproject.com/term/female/2788855; Chrystina Angeline. “Manager.” Noun Project Inc. CC BY 4.0. Retrieved from: https://thenounproject.com/search/?q=manager&i=2392337 is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Income Statement, Balance Sheet, and Statement of Cash Flows © Yor Ditsayakub, Store & Suman Sarkar, Open Sign | Pixabay adapted by Kerri Shields

- Income Statement End of First Month © Kerri Shields is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Balance Sheet First Day of Operations © Kerri Shields is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Balance Sheet End of First Month © Kerri Shields is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Break-even Income Statement © Kerri Shields is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Statement of Cash Flow After First Month © Kerri Shields is licensed under a CC BY-NC-SA (Attribution NonCommercial ShareAlike) license

- Apple Inc. Consolidated Statements (Income Statement) © Apple Inc. is licensed under a All Rights Reserved license

- Apple Inc. Consolidated Statements (Balance Sheet) © Apple Inc.

- Pesqueno, A. (2024, June 18). Nvidia now world's most valuable company--topping Microsoft and Apple. https://www.forbes.com/sites/antoniopequenoiv/2024/06/18/nvidia-now-worlds-most-valuable-company-topping-microsoft-and-apple/ ↵

- Liberto, D. (2024, October 16). Biggest companies in the world by market cap. https://www.investopedia.com/biggest-companies-in-the-world-by-market-cap-5212784 ↵

- Tobin, J. (2024, Ocotber 7). What does a financial manager do? https://www.accounting.com/careers/financial-manager/ ↵

- Khan, F. (2023, September 22). Financial controls. https://www.wallstreetoasis.com/resources/skills/finance/financial-controls#:~:text=Key%20Takeaways%201%20Financial%20controls%20are%20procedures%20and,creditworthiness%2C%20and%20efficient%20resource%20use.%20...%20More%20items ↵

- PM4NGOs. (2024, April 19). Financial control and management best practices.[Video]. YouTube. https://youtu.be/1pdwnyqrimY?si=_5suq6BZpMnO9NvM ↵

- Maverick, J. (2024, June 13). Equity financing vs. debt financing: What's the difference? https://www.investopedia.com/ask/answers/042215/what-are-benefits-company-using-equity-financing-vs-debt-financing.asp ↵

- Maverick, J. (2024, June 13). Equity financing vs. debt financing: What's the difference? https://www.investopedia.com/ask/answers/042215/what-are-benefits-company-using-equity-financing-vs-debt-financing.asp ↵

- Maverick, J. (2024, June 13). Equity financing vs. debt financing: What's the difference? https://www.investopedia.com/ask/answers/042215/what-are-benefits-company-using-equity-financing-vs-debt-financing.asp ↵

- Daddey, F. & Newton, R. (2022). The Fundamentals of Business. https://pressbooks.bccampus.ca/fundamentalsbusiness/chapter/economics-and-business/#term_46_663 ↵

- WallStreetMojo. (2024, August 21). Long-term financing. https://www.wallstreetmojo.com/long-term-financing/ ↵

- University of Windsor & Ryerson University. (2022). Indigenous lifeways in Canadian business. https://ecampusontario.pressbooks.pub/indigenousbusinesstopics/chapter/chapter-1/ ↵

- Gavin, M. (2020, June 2). 5 ways managers can use finance to make better decisions. https://online.hbs.edu/blog/post/financial-decision-making ↵

- QuickBooks Canada Team. (2020, September 18). Understanding IFRS and GAAP. https://quickbooks.intuit.com/ca/resources/accounting/understanding-ifrs-and-gaap/ ↵

- bdc. (n.d.) Trend analysis. https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/templates-business-guides/glossary/trend-analysis ↵

Financial management involves the strategic planning and budgeting of short- and long-term funds for current and future needs. In most companies the finance department comprises two divisions: accounting and financial management.

A financial manager oversees the financial operations of a company. Many financial managers have backgrounds in accounting, banking, business management, economics, or finance. In most organizations, financial managers hold mid to upper-level roles requiring multiple years of experience. They can work in the private or public sectors.

Forecasts predict revenue, costs and expenses for a specific future period. Short-term forecasts would include predictions for the upcoming year, while long-term forecasts would include predictions for a period longer than one year into the future.

A budget is a financial plan that estimates how much money you'll make and spend over a specific period of time. It can be used by individuals, families, businesses, and governments.

The financial budget plans the use of assets and liabilities and results in a projcted balance sheet.

The operating budget helps plan future revenue and expenses and results in a projected income statement.

capital budget, which considers the company's long-range plans and outlines the expected financial needs for significant capital purchases such as real estate, manufacturing equipment, plant expansions, or technology.

Financial controllers are responsible for updating financial controls and overseeing all the accounting activities in an organization.

Financial controls are procedures and policies that monitor and manage financial resources to prevent errors, fraud, and optimize allocation.

Debt financing, on the other hand, does not require giving up a portion of ownership.

Equity financing carries no repayment obligation and provides extra working capital that can be used to grow a business.

Short-term financing means business financing from short-term sources, which are for less than one year.

Long-term financing refers to borrowing or issuing equity shares for more than one year.

The main objective of managerial accounting is to assist the management of a company in efficiently performing its functions: planning, organizing, directing, and controlling.

Financial accountants deliver information to both internal and external stakeholders to help evaluate the organization's financial health. However, their main focus is on serving external users. Put simply, management accounting supports the day-to-day operation of your business, while financial accounting communicates your business’s performance to the outside world.

In preparing financial statements, financial accountants adhere to a set of standards or guidelines, known as Generally Accepted Accounting Principles (GAAP). GAAP is used mainly by companies headquartered in the U.S., while most other countries follow the international financial reporting standards (IFRS).

Income Statement = Shows sales, expenses, and whether or not a profit was made.

Balance Sheet = Show assets and liabilities, the amount invested in the business.

Statement of Cash Flows = Show how much cash is coming in and going out.

Cost of goods sold: the total cost of the goods that a business has sold.

Operating expenses: the costs of operating a business except for the costs of things that were sold.

The difference between sales and cost of goods sold is your gross profit, also known as gross margin.

The difference between gross profit and operating expenses is your net income or profit, which is the proverbial “bottom line.”

Assets: the business resources from which it expects to gain some future benefit.

Liabilities: the business debts that it owes to outside individuals or organizations.

Owner’s equity: the investment in the business.

Debits increase asset or expense accounts and decrease liability, revenue or equity accounts.

Credits do the reverse of debits, they decrease asset or expense accounts and increase liability, revenue or equity accounts.

In double-entry accounting, every transaction is recorded with a debit and credit in two or more accounts, which categorize different types of financial activities in a company’s general ledger.

fundamental accounting equation: Assets = Liabilities + Owner’s Equity

Breakeven analysis: to break even (have no profit or loss), the total sales revenue must exactly equal all the expenses (both variable and fixed).

Contirubition Margin is the revenue remaining after paying variable costs.

The cash flow statement reports cash inflows and outflows, and it will identify the amount of cash the company currently holds, which is also reported in the balance sheet.

Profitability ratios tell you how much profit is made relative to the amount invested (return on investment) or the amount sold (return on sales).

Liquidity ratios tell you how well positioned a company is to pay its bills in the near term. Liquidity refers to how quickly an asset can be turned into cash. For example, share of stock is substantially more liquid than a building or a machine.

Debt ratios look at how much borrowing a company has done in order to finance the operations of the business. The more borrowing, the more risk a company has taken on, and so the less likely it would be for new lenders to approve loan applications.

Efficiency ratios tell you how well your assets are being managed.

Gross Profit Margin measures how much of each dollar of sales revenue is left after deducting the cost of goods sold (COGS) — the direct costs of producing or purchasing the goods sold by the company.

Net Profit Margin measures the percentage of sales revenue that remains as net income (profit) after all expenses are deducted — including COGS, operating expenses, interest, and taxes.

ROE measures how effectively a company uses its owners’ or shareholders’ equity to generate net profit. It shows how much profit a business makes for every dollar of equity invested by its shareholders.