5.2 Internal Rate of Return

Learning Objectives

- Calculate the internal rate of return of an investment

- Evaluate and compare investment decisions using the internal rate of return

Formula & Symbol Hub

Symbols Used

- [latex]NPV[/latex] = net present value

- [latex]IRR[/latex] = internal rate of return

Formulas Used

-

Formula 5.1 - Net Present Value

[latex]NPV = \text{(Sum of}\;PV\;\text{of All Future Cash Flows)} − \text{(Initial Investment)}[/latex]

or

[latex]NPV = \text{(Sum of }\;PV\;\text{of Cash Inflows)} − \text{(Sum of}\;PV\;\text{of Cash Outflows)}[/latex]

Introduction

The net present value presented in the previous section provides an exact monetary magnitude of a project. However, the common mindset in business focuses on profitability as a percentage and not as a dollar amount. Thus, decisions are based on the internal rate of return for a project, or [latex]IRR[/latex] for short. The [latex]IRR[/latex] is the annual percentage rate of return on the investment so that the present value of all cash inflows equals the present value of all cash outflows. That is, the [latex]IRR[/latex] is the rate of return required to make [latex]NPV=0[/latex].

To interpret the [latex]IRR[/latex] and how the [latex]IRR[/latex] can be used to make a decision about a project, consider the relationship between the value of [latex]NPV[/latex] and the [latex]IRR[/latex].

- [latex]NPV=0[/latex]. By definition, the cost of capital and the [latex]IRR[/latex] are the same value.

- [latex]NPV>0[/latex].Because the [latex]IRR[/latex] is the rate of return that makes [latex]NPV=0[/latex], this means that a higher rate of return must be used in order for the [latex]NPV>0[/latex]. In other words, the [latex]IRR[/latex] is greater than the cost of capital.

- [latex]NPV<0[/latex]. Because the [latex]IRR[/latex] is the rate of return that makes [latex]NPV=0[/latex], this means that a lower rate of return must must be used in order for the [latex]NPV<0[/latex]. In other words, the [latex]IRR[/latex] is less than the cost of capital.

In summary, here is how to interpret the [latex]IRR[/latex] and use it to make a decision about the viability of a project.

- [latex]IRR=\mbox{cost of capital}[/latex]. The project breaks even. This is the minimum financial condition to pursue the project. The business should accept the project.

- [latex]IRR>\mbox{cost of capital}[/latex].The project is profitable because the project makes enough money to cover the costs. The business should accept the project.

- [latex]IRR<\mbox{cost of capital}[/latex]. The project is not profitable because the project does not make enough money to cover the costs. The business should reject the project.

Solving for the internal rate of return is difficult without the use of a financial calculator or other technology. Similar to calculating the [latex]NPV[/latex] in the previous section, the [latex]IRR[/latex] can be calculated by using the cash flow worksheet on the financial calculator and a built-in function to calculate the internal rate of return.

Using the TI BAII Plus Cash Flow Worksheet to Calculate the Internal Rate of Return

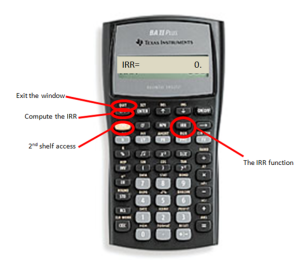

Enter the cash flow data into the cash flow worksheet, as discussed in the previous section. Once you have entered all cash flows, you must access other functions to generate the output. For internal rate of return, press [latex]IRR[/latex] on the keypad, as illustrated in the photo, followed by the [latex]CPT[/latex] button to perform the calculation. The output is a percentage in percent format. To exit the window, press 2nd QUIT.

Image Description

This image displays a Texas Instruments BA II Plus calculator. It highlights specific buttons labeled with red circles and annotations demonstrating the functions of those buttons:

- The button labeled "Exit the window" is the [latex]CE|C[/latex] button located near the top left of the numeric keypad.

- The button labeled "Compute the [latex]IRR[/latex]" is the [latex]CPT[/latex] button positioned below the [latex]CE|C[/latex] button and slightly to the right.

- The button labeled "[latex]2^{nd}[/latex]shelf access" is the [latex]2^{nd}[/latex] button located to the right of the [latex]CPT[/latex] button.

- The "[latex]IRR[/latex] function" is highlighted as being located on an oval button directly below the screen on the calculator (next to the

2ndbutton).

The display screen at the top of the calculator shows "[latex]IRR = 0[/latex]."

Video: Cash Flows 1: Net Present Value (NPV) and IRR Calculations by Joshua Emmanuel [2:52] Transcript Available.

Key Takeaways

Create a table to record the cash flows for each time period. The table should record the cash inflows, the cash outflows, and the net cash flow for each time period. Alternatively, use a timeline to illustrate the cash flows for each time period.

Because cash flows can be inflows or outflows, write all numbers with their cash flow sign conventions in the table to avoid confusion. That is, cash inflows are recorded as positive and cash outflows are recorded as negative. This helps you keep track of the different flows and minimizes the possibility of incorrectly netting out all present values.

For each period, only one cash flow can be entered in the financial calculator. If more than one cash flow exists for a certain period, enter the NET cash flow for that period. The net cash flow for a period is the sum of the cash inflows minus the sum of the cash outflows.

When using the cash flow worksheet on a financial calculator, you must enter a cash flow for EVERY period. If there is no cash flow for a certain period, a [latex]0[/latex] is recorded as the net cash flow for that period. Enter [latex]0[/latex] for [latex]C0[/latex] on the calculator for that period and [latex]1[/latex] for F[latex]0[/latex].

Example 5.2.1

Tim Hortons has purchased the lease on a three-year onsite concession space in the cafeteria at a local college for [latex]\$750,000[/latex]. The franchise is expected to earn [latex]\$400,000[/latex], [latex]\$500,000[/latex], and [latex]\$600,000[/latex] in profits per year for the first three years, respectively.

- Calculate the internal rate of return for this investment.

- If the cost of capital is [latex]20\%[/latex], did Tim Hortons make a smart financial decision?

Solution

Step 1: Record the cash flows in a table.

| Year | Cash Inflows | Cash Outflows | Net Cash Flows |

| [latex]0[/latex] | [latex]0[/latex] | [latex]-750,000[/latex] | [latex]-750,000[/latex] |

| [latex]1[/latex] | [latex]400,000[/latex] | [latex]400,000[/latex] | [latex]400,000[/latex] |

| [latex]2[/latex] | [latex]500,000[/latex] | [latex]500,000[/latex] | [latex]500,000[/latex] |

| [latex]3[/latex] | [latex]600,000[/latex] | [latex]600,000[/latex] | [latex]600,000[/latex] |

Step 2: Calculate the [latex]IRR[/latex].

| [latex]IRR[/latex] | [latex]40.92\%[/latex] |

- Press [latex]IRR[/latex].

- At the [latex]IRR[/latex] screen, press [latex]CPT[/latex].

Step 3: Write as a statement.

Because the [latex]IRR=40.92\% > 20\%[/latex], this was a smart decision.

Try It

1) A research project requires an investment of [latex]\$350,000[/latex] today and another investment of [latex]\$200,000[/latex] one year from today. Starting from the third year, the project will reduce costs by [latex]\$250,000[/latex] every year for three years.

- Calculate the internal rate of return for the project.

- If the cost of capital is [latex]12\%[/latex], is the project financially viable?

Solution

| Year | Cash Inflows | Cash Outflows | Net Cash Flows |

| [latex]0[/latex] | [latex]0[/latex] | [latex]-350,000[/latex] | [latex]-350,000[/latex] |

| [latex]1[/latex] | [latex]0[/latex] | [latex]-200,000[/latex] | [latex]-200,000[/latex] |

| [latex]2[/latex] | [latex]0[/latex] | [latex]0[/latex] | [latex]0[/latex] |

| [latex]3[/latex] | [latex]250,000[/latex] | [latex]0[/latex] | [latex]250,000[/latex] |

| [latex]4[/latex] | [latex]250,000[/latex] | [latex]0[/latex] | [latex]250,000[/latex] |

| [latex]5[/latex] | [latex]250,000[/latex] | [latex]0[/latex] | [latex]250,000[/latex] |

| [latex]IRR[/latex] | [latex]8.95\%[/latex] |

Because the [latex]IRR=8.95\% < 12\%[/latex], the project is not financially viable.

Like the net present value, the internal rate of return can be used to choose one project from several different projects. Relative to their initial investment, projects with higher [latex]IRR[/latex]s are more profitable. Consequently, [latex]IRR[/latex] can be used to rank projects. When making a choice from several options, the option with the highest [latex]IRR[/latex] should be accepted because it will be the most profitable.

Example 5.2.3

A company is consider two different investments.

- Investment A requires an initial investment of [latex]\$300,000[/latex] today and will provide returns of [latex]\$100,000[/latex] in year two, [latex]\$150,000[/latex] in year three, and [latex]\$400,000[/latex] in year five.

- Investment B requires an initial investment of [latex]\$500,000[/latex] today and will provide returns of [latex]\$350,000[/latex] in year one, [latex]\$200,000[/latex] in year four, and [latex]\$75,000[/latex] in year five.

Calculate the internal rate of return for each investment. Which investment should the company select?

Solution

Step 1: Calculate the [latex]IRR[/latex] for Investment A.

| Year | Cash Inflows | Cash Outflows | Net Cash Flows |

| [latex]0[/latex] | [latex]0[/latex] | [latex]-300,000[/latex] | [latex]-300,000[/latex] |

| [latex]1[/latex] | [latex]0[/latex] | [latex]0[/latex] | [latex]0[/latex] |

| [latex]2[/latex] | [latex]100,000[/latex] | [latex]0[/latex] | [latex]100,000[/latex] |

| [latex]3[/latex] | [latex]150,000[/latex] | [latex]0[/latex] | [latex]150,000[/latex] |

| [latex]4[/latex] | [latex]0[/latex] | [latex]0[/latex] | [latex]0[/latex] |

| [latex]5[/latex] | [latex]400,000[/latex] | [latex]0[/latex] | [latex]400,000[/latex] |

| [latex]IRR[/latex] | [latex]21.76\%[/latex] |

Step 2: Calculate the [latex]IRR[/latex] for Investment B.

| Year | Cash Inflows | Cash Outflows | Net Cash Flows |

| [latex]0[/latex] | [latex]0[/latex] | [latex]-500,000[/latex] | [latex]-500,000[/latex] |

| [latex]1[/latex] | [latex]350,000[/latex] | [latex]0[/latex] | [latex]350,000[/latex] |

| [latex]2[/latex] | [latex]0[/latex] | [latex]0[/latex] | [latex]0[/latex] |

| [latex]3[/latex] | [latex]0[/latex] | [latex]0[/latex] | [latex]0[/latex] |

| [latex]4[/latex] | [latex]200,000[/latex] | [latex]0[/latex] | [latex]200,000[/latex] |

| [latex]5[/latex] | [latex]75,000[/latex] | [latex]0[/latex] | [latex]75,000[/latex] |

| [latex]IRR[/latex] | [latex]10.14\%[/latex] |

Step 3: Write as a statement.

The company should select Investment A because it has the higher [latex]IRR[/latex].

Try It

2) A company is considering two different projects to deal with an equipment issue. The company can either upgrade the equipment (Project A) or they can retrofit the equipment (Project B).

- Project A requires an initial investment of [latex]\$300,000[/latex] in new equipment that will result in increased revenue of [latex]\$90,000[/latex] each year for five years.

- Project B requires an initial investment of [latex]\$125,000[/latex] to retrofit existing equipment that will result in increased revenue of [latex]\$30,000[/latex] each year for five years.

Calculate the internal rate of return for each project. Which project should the company select?

Solution

Project A:

| Year | Cash Inflows | Cash Outflows | Net Cash Flows |

| [latex]0[/latex] | [latex]0[/latex] | [latex]-300,000[/latex] | [latex]-300,000[/latex] |

| [latex]1[/latex] | [latex]90,000[/latex] | [latex]0[/latex] | [latex]90,000[/latex] |

| [latex]2[/latex] | [latex]90,000[/latex] | [latex]0[/latex] | [latex]90,000[/latex] |

| [latex]3[/latex] | [latex]90,000[/latex] | [latex]0[/latex] | [latex]90,000[/latex] |

| [latex]4[/latex] | [latex]90,000[/latex] | [latex]0[/latex] | [latex]90,000[/latex] |

| [latex]5[/latex] | [latex]90,000[/latex] | [latex]0[/latex] | [latex]90,000[/latex] |

| [latex]IRR[/latex] | [latex]15.24\%[/latex] |

Project B:

| Year | Cash Inflows | Cash Outflows | Net Cash Flows |

| [latex]0[/latex] | [latex]0[/latex] | [latex]-125,000[/latex] | [latex]-125,000[/latex] |

| [latex]1[/latex] | [latex]30,000[/latex] | [latex]0[/latex] | [latex]30,000[/latex] |

| [latex]2[/latex] | [latex]30,000[/latex] | [latex]0[/latex] | [latex]30,000[/latex] |

| [latex]3[/latex] | [latex]30,000[/latex] | [latex]0[/latex] | [latex]30,000[/latex] |

| [latex]4[/latex] | [latex]30,000[/latex] | [latex]0[/latex] | [latex]30,000[/latex] |

| [latex]5[/latex] | [latex]30,000[/latex] | [latex]0[/latex] | [latex]30,000[/latex] |

| [latex]IRR[/latex] | [latex]6.40\%[/latex] |

The company should select Project A because it has the higher [latex]IRR[/latex].

Paths to Success

Paths to Success

As mentioned above, the internal rate of return can be used to rank projects. However, a couple of things need to be considered about using the internal rate of return in this way.

- The Cost of Capital is Ignored. The internal rate of return does not factor in the cost of capital in its computations. Recall that the fundamental concept of time value of money requires all money to be on the same date using an appropriate rate of interest—the cost of capital—before any decision can be made. Therefore, if you have not factored in the cost of capital, then your analysis is incomplete.

- The Magnitude of the Decision is Ignored. It can easily happen that an alternative has a high [latex]IRR[/latex] but a low [latex]NPV[/latex]. For example, using a cost of capital of [latex]10\%[/latex] consider two alternatives. Alternative A invests [latex]\$1[/latex] and one year later returns [latex]\$1.50[/latex]. The [latex]IRR[/latex] is [latex]50\%[/latex], while the [latex]NPV[/latex] is [latex]\$0.36[/latex]. Alternative B invests [latex]\$1,000[/latex] and one year later returns [latex]\$1,250[/latex]. The [latex]IRR[/latex] is [latex]25\%[/latex], while the [latex]NPV[/latex] is [latex]\$136.36[/latex]. If choosing between these two options based on the [latex]IRR[/latex], you select Alternative A, resulting in a net present value that is [latex]\$136[/latex] lower than for Alternative B.

Section 5.2 Exercises

- A project requires an investment of [latex]\$225,000[/latex] today and is projected to have annual profits of [latex]\$34,000[/latex] for nine years. The capital assets can be sold at the end of the ninth year for [latex]\$23,500[/latex]. Calculate the IRR for this project. If capital could be acquired at a cost of [latex]12\%[/latex], should the project be pursued?

Solution

[latex]IRR=7.91\%[/latex]; do not pursue project

- A new diamond deposit has been found in northern Alberta. Your researchers have determined that it will cost [latex]\$4.5[/latex] million to purchase the land and prepare it for mining. Starting in the second year, the lode is expected to earn net profits of [latex]\$3[/latex] million, which will be sustained for three years before the deposit is depleted. Calculate the IRR on the diamond mine. If the cost of capital is [latex]21\%[/latex], should the deposit be acquired?

Solution

[latex]IRR=26.78\%[/latex]; pursue project

- Schick is considering launching only one of two new products to compete with the Gillette Fusion ProGlide Power razor.

- Product A requires a [latex]\$10[/latex] million research and development investment with forecasted profits are expected to be [latex]\$3[/latex] million in years two to four, [latex]\$1.5[/latex] million in years five to seven, and [latex]\$0.5[/latex] million in years eight to ten.

- Product B requires a [latex]\$6.5[/latex] million research and development investment with forecasted profits of [latex]\$2.75[/latex] million in years one to two, [latex]\$1[/latex] million in years three to five, and [latex]\$0.35[/latex] million in years six to ten.

Calculate the IRR for each product. Which product should Schick launch?

Solution

[latex]IRR\;\text{of Product A}=10.59\%[/latex]; [latex]IRR\;\text{of Product B}=16.89\%[/latex]; launch Product B

- The Dragons (from CBC's Dragon's Den) are considering a venture from an Albertan entrepreneur. His proposal requires the Dragons to invest [latex]\$500,000[/latex] immediately. Based on market conditions, the product is estimated to have year-end profits of [latex]\$100,000, \$200,000, \$300,000, \$200,000[/latex], and finally [latex]\$100,000[/latex]. The Dragons will invest only if the internal rate of return exceeds their cost of capital of [latex]20\%[/latex]. Should they invest?

Solution

[latex]IRR=22.78\%[/latex]; pursue project

- A Western Canadian producer is considering purchasing a five-year product licence from Sunkist Growers Inc. The product licence will cost [latex]\$1,500,000[/latex], and the required equipment will cost [latex]\$1[/latex] million. Equipment upgrades will be [latex]\$100,000[/latex] at the end of the second and fourth years. Expected profits are [latex]\$1[/latex] million in each of the first three years and [latex]\$750,000[/latex] in the last two years. The producer will purchase product licences only if the IRR is greater than [latex]25\%[/latex]. Should the product licence be purchased?

Solution

[latex]IRR=22.91\%[/latex]; do not pursue project

- Consider the following two projects, of which only one can be selected:

- Project A. Immediate investment of [latex]\$225,000[/latex], profits in years four to six of [latex]\$160,000[/latex].

- Project B. Immediate investment of [latex]\$112,500[/latex], profits in years one to three of [latex]\$55,000[/latex] followed by profits of [latex]\$20,000[/latex] in years four to six.

Calculate the IRR for each project. Which project should be selected?

Solution

[latex]IRR\;\text{of Project A}=16.54\%[/latex]; [latex]IRR\;\text{of Project B}=32\%[/latex]; select Project B

Attribution

"5.2 Internal Rate of Return" from Financial Math - Math 1175 by Margaret Dancy is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.