7.6. Contracts

Contract Types

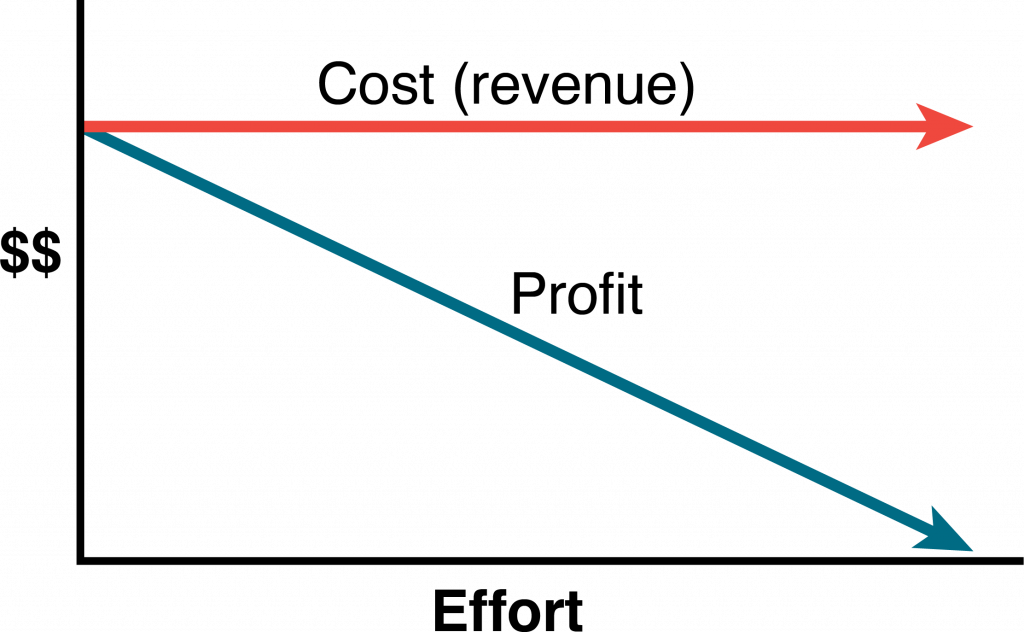

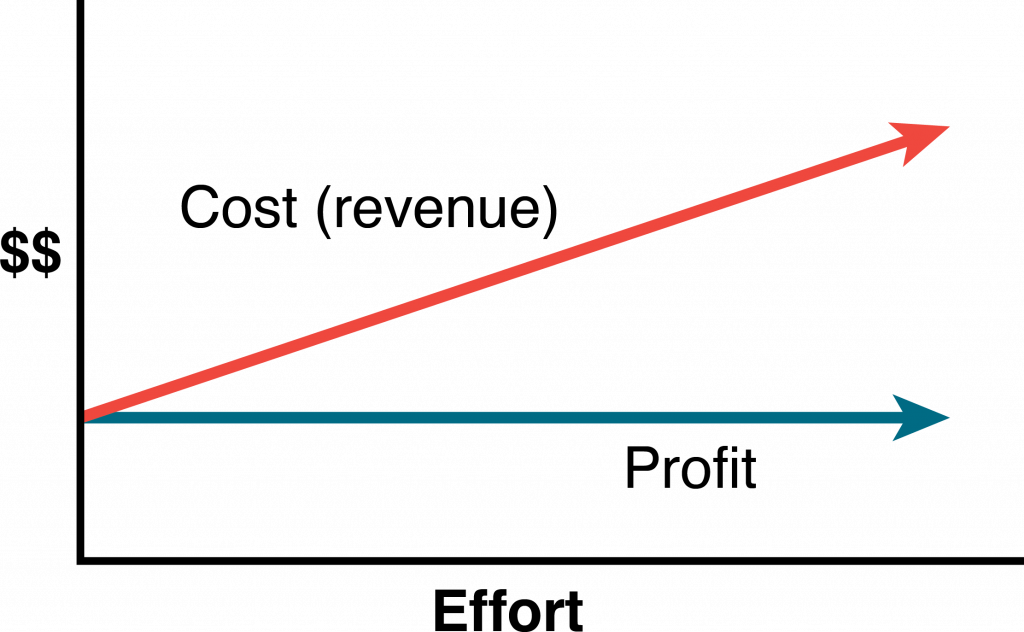

You should know a little bit about the major kinds of contracts available to you (the client) so that you choose the one that creates the most fair and workable deal for you and the contractor. Some contracts are fixed price: no matter how much time or effort goes into them, the client always pays the same. In Figure 7.1 the cost to the client stays the same, but as more effort is exerted the profit to the contractor goes down. Some are cost reimbursable also called cost plus. This is where the seller charges you for the cost of doing the work plus some fee or rate. Figure 7.2 illustrates this by showing that as efforts increase, costs to the client go up but the contractor’s profits stay the same. The third major kind of contract is time and materials. That’s where the client pays a rate for the time spent working on the project and also pays for all the materials used to do the work. Figure 7.3 shows that as costs to the client go up, so does the profit for the contractor.

Fixed-Price Contracts

The fixed-price contract is a legal agreement between the project organization and an entity (person or company) to provide goods or services to the project at an agreed-on price. The contract usually details the quality of the goods or services, the timing needed to support the project, and the price for delivering goods or services. There are several variations of the fixed-price contract. For commodities and goods and services where the scope of work is very clear and not likely to change, the fixed-price contract offers a predictable cost. The responsibility for managing the work to meet the needs of the project is focused on the contractor. The project team tracks the quality and schedule progress to ensure the contractors will meet the project needs. The risks associated with fixed-price contracts are the costs associated with project change. If a change occurs on a project that requires a change order from the contractor, the price of the change is typically very high. Even when the price for changes is included in the original contract, changes on a fixed-price contract will create higher total project costs than other forms of contracts because the majority of the cost risk is transferred to the contractor, and most contractors will add a contingency to the contract to cover their additional risk.

| Type | Known Scope | Share of Risk | Incentive for Meeting Milestones | Predictability of Cost |

|---|---|---|---|---|

| Fixed total cost | Very High | All contractor | Low | Very high |

| Fixed unit price | High | Mostly project | Low | High |

| Fixed price with an incentive fee | High | Mostly project | High | Medium-high |

| Fixed fee with price adjustment | High | Mostly project | Low | Medium |

Fixed-price contracts require the availability of at least two or more suppliers that have the qualifications and performance histories that ensure the needs of the project can be met. The other requirement is a scope of work that is most likely not going to change. Developing a clear scope of work based on good information, creating a list of highly qualified bidders, and developing a clear contract that reflects that scope of work are critical aspects of a good fixed-priced contract.

If the service provider is responsible for incorporating all costs, including profit, into the agreed-on price, it is a fixed-total-cost contract. The contractor assumes the risks for unexpected increases in labour and materials that are needed to provide the service or materials and, in the materials, and timeliness needed.

The Fixed-Price Contract with Price Adjustment is used for unusually long projects that span years. The most common use of this type of contract is the inflation-adjusted price. In some countries, the value of its local currency can vary greatly in a few months, which affects the cost of local materials and labour. In periods of high inflation, the client assumes the risk of higher costs due to inflation, and the contract price is adjusted based on an inflation index. The volatility of certain commodities can also be accounted for in a price-adjustment contract. For example, if the price of oil significantly affects the costs of the project, the client can accept the oil price volatility risk and include a provision in the contract that would allow the contract price adjustment based on a change in the price of oil.

The Fixed-Price Contract with Incentive Fee provides an incentive for performing the project above the established baseline in the contract. The contract might include an incentive for completing the work on an important milestone for the project. Often contracts have a penalty clause if the work is not performed according to the contract. For example, if the new software is not completed in time to support the implementation of the training, the contract might penalize the software company a daily amount of money for every day the software is late. This type of penalty is often used when the software is critical to the project and the delay will cost the project significant money.

If the service or materials can be measured in standard units, but the amount needed is not known accurately, the price per unit can be fixed—a fixed-unit-price contract. The project team assumes the responsibility of estimating the number of units used. If the estimate is not accurate, the contract does not need to be changed, but the project will exceed the budgeted cost.

Cost-Reimbursable Contracts

In a cost-reimbursable contract, the organization agrees to pay the contractor for the cost of performing the service or providing the goods. Cost-reimbursable contracts are also known as cost-plus contracts. Cost-reimbursable contracts are most often used when the scope of work or the costs for performing the work are not well known. The project uses a cost-reimbursable contract to pay the contractor for allowable expenses related to performing the work. Since the cost of the project is reimbursable, the contractor has much less risk associated with cost increases. When the costs of the work are not well known, a cost-reimbursable contract reduces the amount of money the bidders place in the bid to account for the risk associated with potential increases in costs. The contractor is also less motivated to find ways to reduce the cost of the project unless there are incentives for supporting the accomplishment of project goals.

Cost-reimbursable contracts require good documentation of the costs that occurred on the project to ensure that the contractor gets paid for all the work performed and that the organization is not paying for something that was not completed. The contractor is also paid an additional amount above the costs. There are several ways to compensate the contractor.

- A Cost-Reimbursable Contract with a Fixed Fee provides the contractor with a fee or profit amount, that is determined at the beginning of the contract and does not change.

- A Cost-Reimbursable Contract with a Percentage Fee pays the contractor for costs plus a percentage of the costs, such as 5% of total allowable costs. The contractor is reimbursed for allowable costs and is paid a fee.

- A Cost-Reimbursable Contract with an Incentive Fee is used to encourage performance in areas critical to the project. Often the contract attempts to motivate contractors to save or reduce project costs. The use of the cost reimbursable contract with an incentive fee is one way to motivate cost-reduction behaviours.

- A Cost-Reimbursable Contract with an Award Fee reimburses the contractor for all allowable costs plus a fee that is based on performance criteria. The fee is typically based on goals or objectives that are more subjective. An amount of money is set aside for the contractor to earn through excellent performance, and the decision on how much to pay the contractor is left to the judgment of the project team. The amount is sufficient to motivate excellent performance.

On small activities that have high uncertainty, the contractor might charge an hourly rate for labour, plus the cost of materials, plus a percentage of the total costs. This type of contract is called time and materials (T&M). Time is usually contracted on an hourly rate basis and the contractor usually submits time sheets and receipts for items purchased on the project. The project reimburses the contractor for the time spent based on the agreed-on rate and the actual cost of the materials. The fee is typically a percentage of the total cost.

“13. Procurement Management” from Project Management – 2nd Edition by Adrienne Watt; Merrie Barron; and Andrew Barron is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.